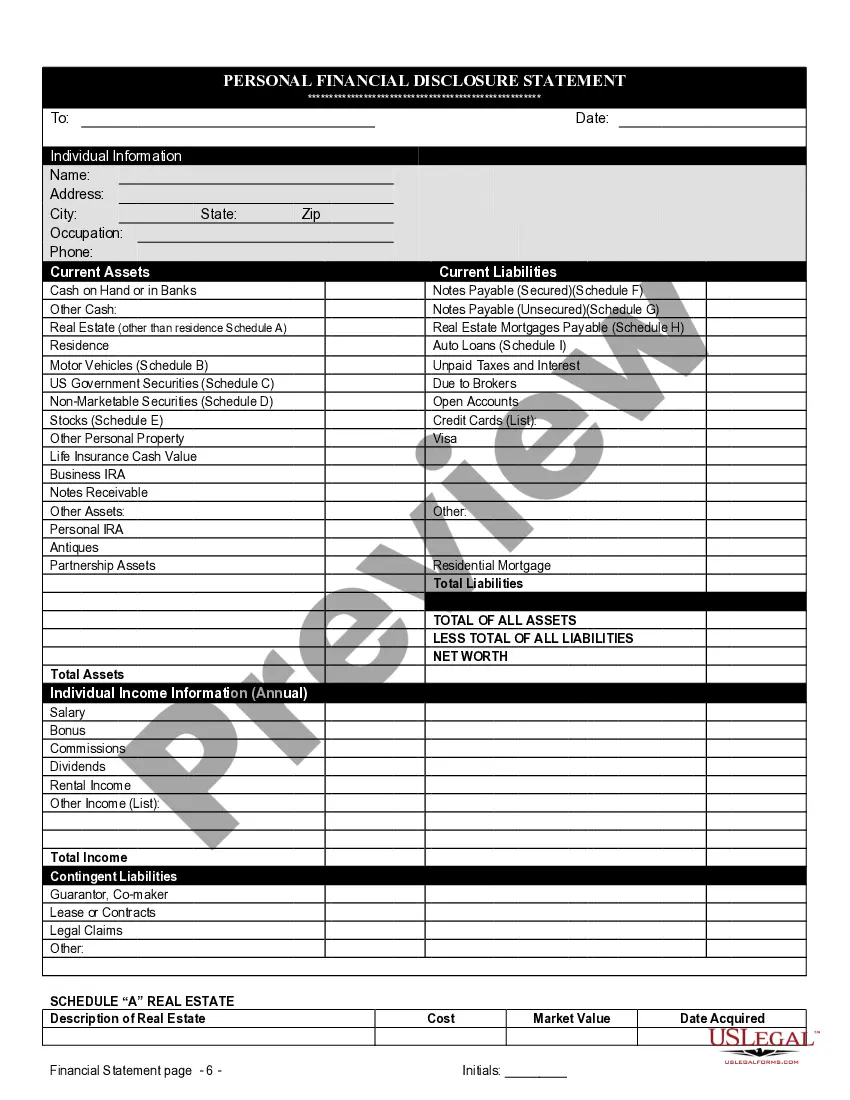

Raleigh North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out North Carolina Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Are you seeking a reliable and affordable legal forms provider to obtain the Raleigh North Carolina Financial Statements solely related to Prenuptial Premarital Agreement? US Legal Forms is your ideal choice.

Whether you need a basic agreement to establish rules for living with your partner or a collection of documents to facilitate your divorce in court, we have you covered. Our platform features over 85,000 current legal document templates for personal and business purposes. All templates we provide are not one-size-fits-all and are tailored to meet the needs of specific states and counties.

To acquire the form, you must Log In to your account, find the necessary form, and click on the Download button next to it. Please remember that you can download any previously purchased form templates at any time from the My documents section.

Are you a newcomer to our site? No problem. You can easily set up an account, but before doing so, ensure that you: Check if the Raleigh North Carolina Financial Statements solely related to Prenuptial Premarital Agreement adheres to the laws of your state and locality. Review the form’s particulars (if available) to understand who can use the form and for what purpose. If the form isn’t appropriate for your legal situation, start the search again.

Acquiring current legal documents has never been more straightforward. Try US Legal Forms today and stop wasting your precious time trying to learn about legal papers online once and for all.

- Now you can create your account.

- Then choose the subscription plan and proceed with payment.

- Once the payment is finalized, download the Raleigh North Carolina Financial Statements solely related to Prenuptial Premarital Agreement in any of the available file formats.

- You can return to the website anytime and redownload the form at no additional cost.

Form popularity

FAQ

Prenups last, usually by their terms, for the entire length of the marriage. However, prenups sometimes include provisions that expire. The most common one might be an agreement that there's going to be no spousal support unless they are married for at least 10 years.

Your prenup remains valid even if you draft the agreement in one state and get married in another state. A prenuptial agreement is a contractual agreement. Like other contracts, there is usually a choice of law provision that says which state's law applies when enforcing the agreement.

Based on ContractsCounsel's marketplace data, the average cost of a prenuptial agreement is $550 .

As we mentioned earlier, North Carolina law says you can only sign a prenuptial agreement before you get married. However, if you're looking for ways to protect your assets after you've already gotten married, a postnuptial agreement is a good option.

North Carolina formally recognizes the validity of prenuptial agreements according to a statute called the Uniform Premarital Agreement Act.

Typically, prenups cost around $2,500, but can cost more if you spend a while haggling out various issues.

In theory, you could write your own prenuptial agreement ? or, you could use a form from a Do-It-Yourself (DIY) service. As with any legal document, if you take either of those approaches, you run substantial risks that your agreement or some of its provisions may not be enforceable under North Carolina law.

52B MOS Army Power Generation Equipment Operator/Mechanic.

You should consider a prenuptial agreement if any of the following applies: You have children from a previous marriage. You own your own business or are involved in a family business. You have significant assets that you want to keep separate.