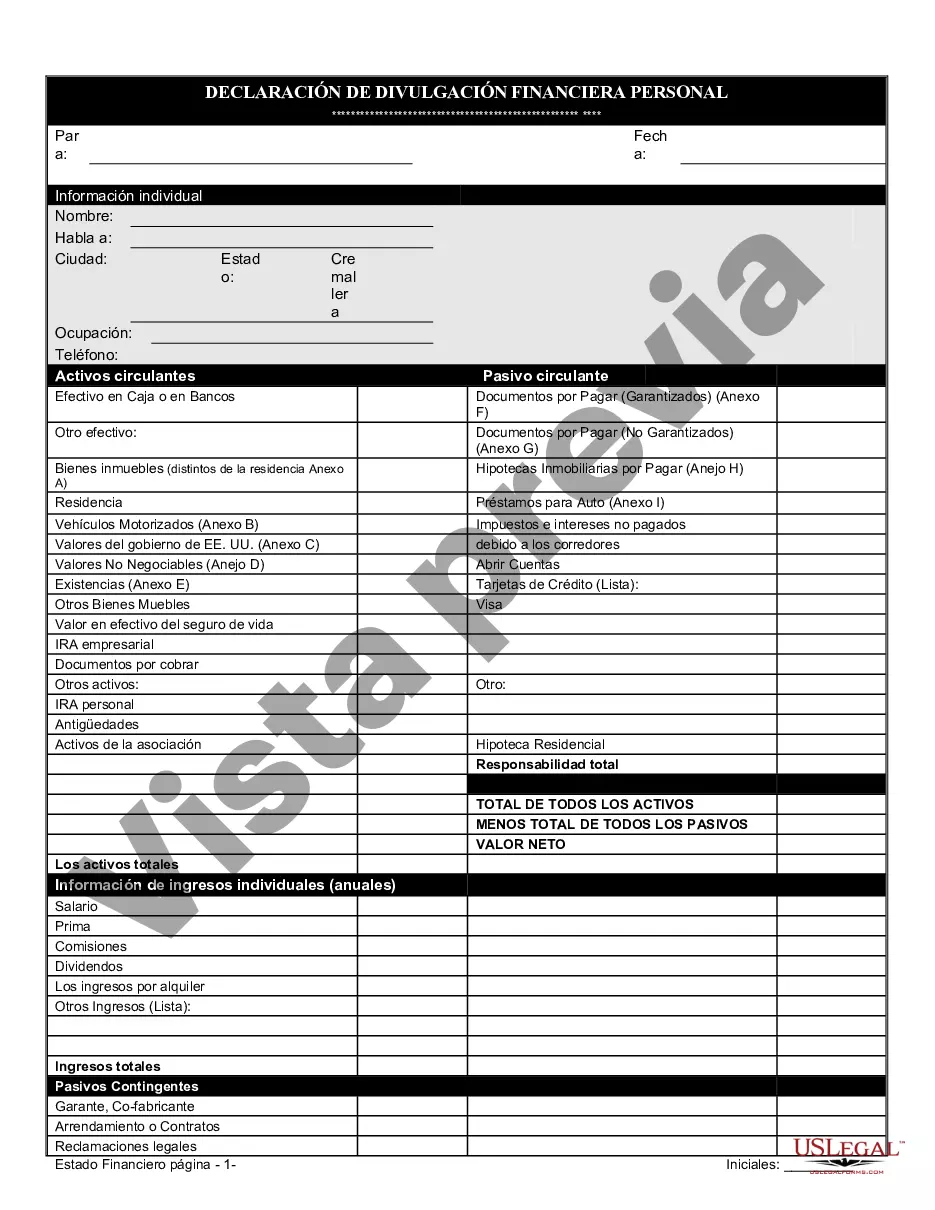

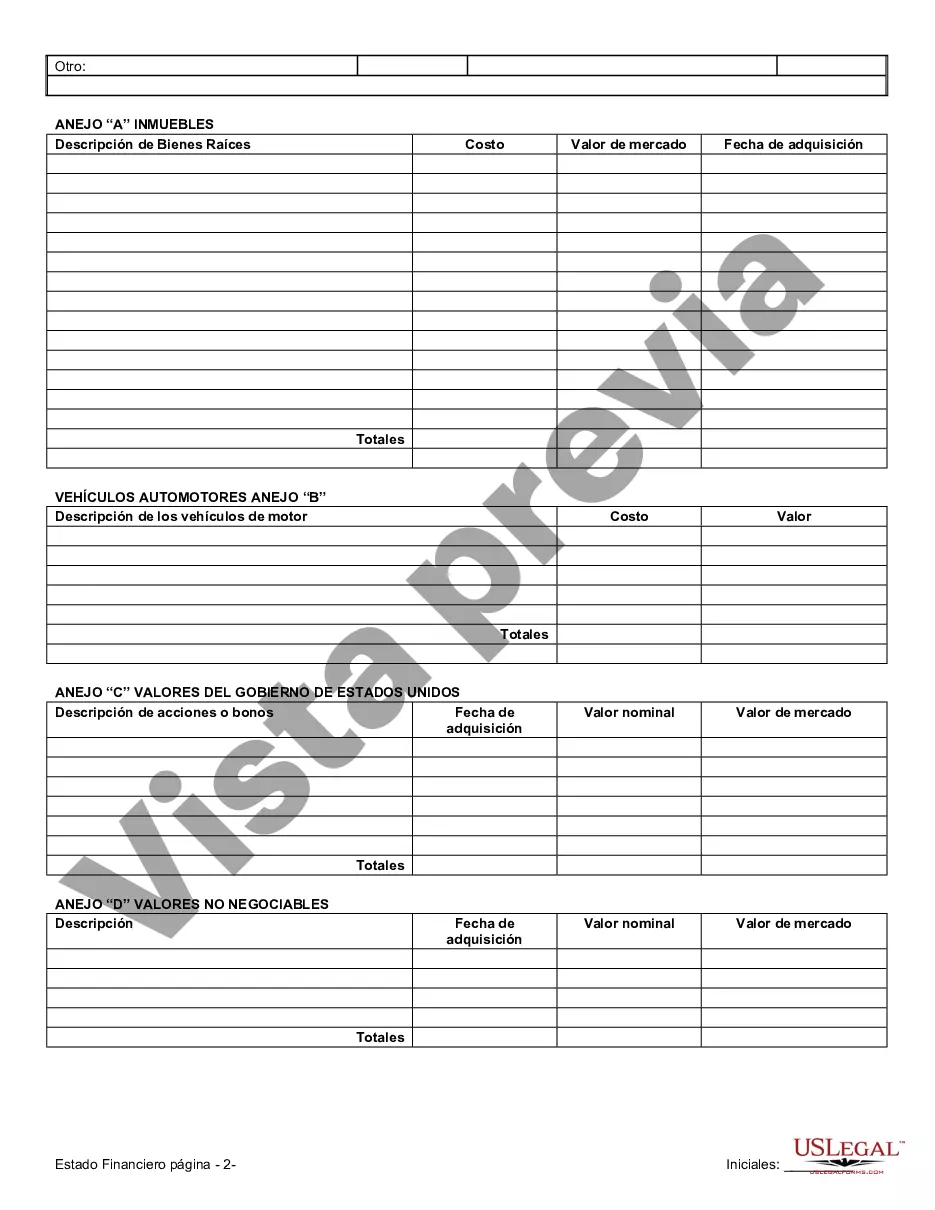

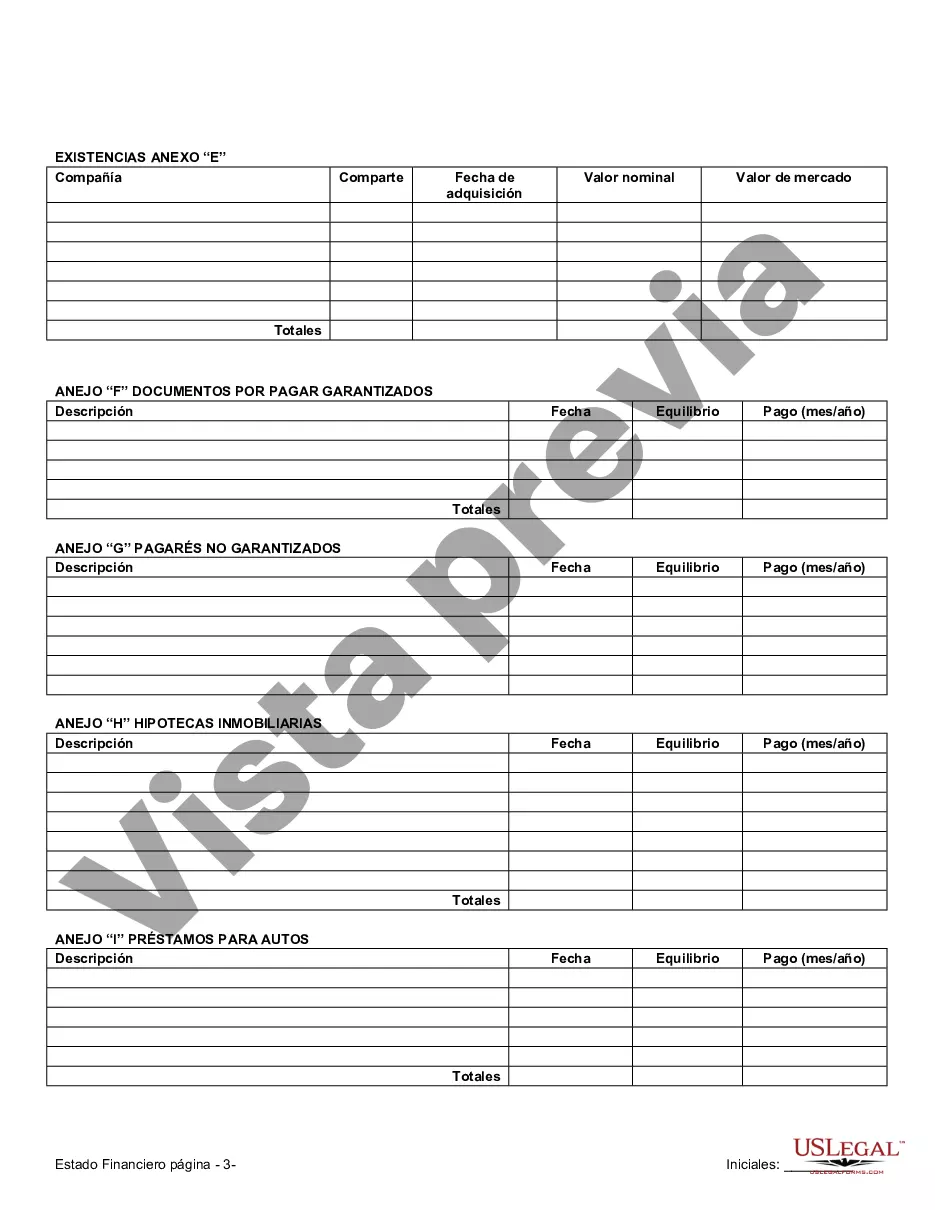

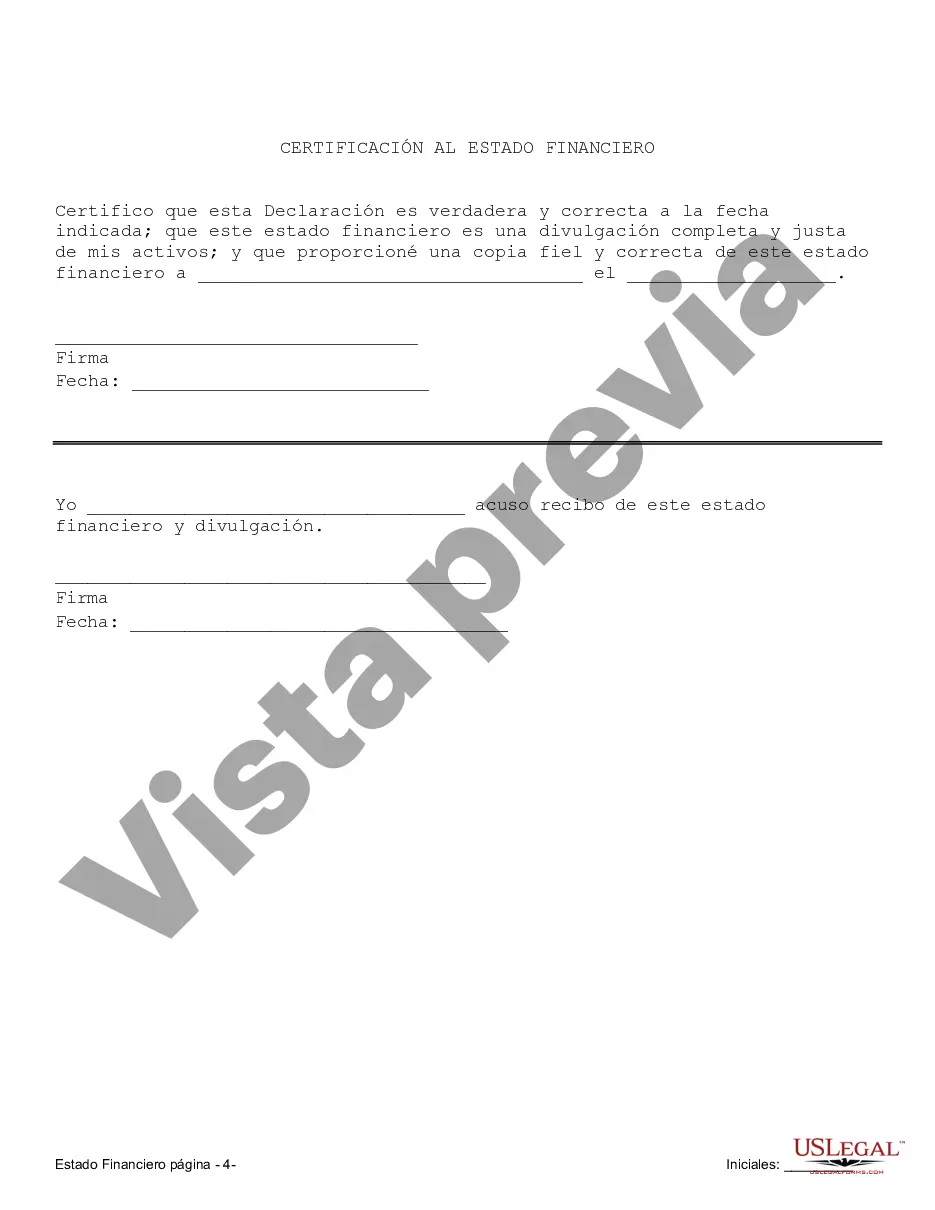

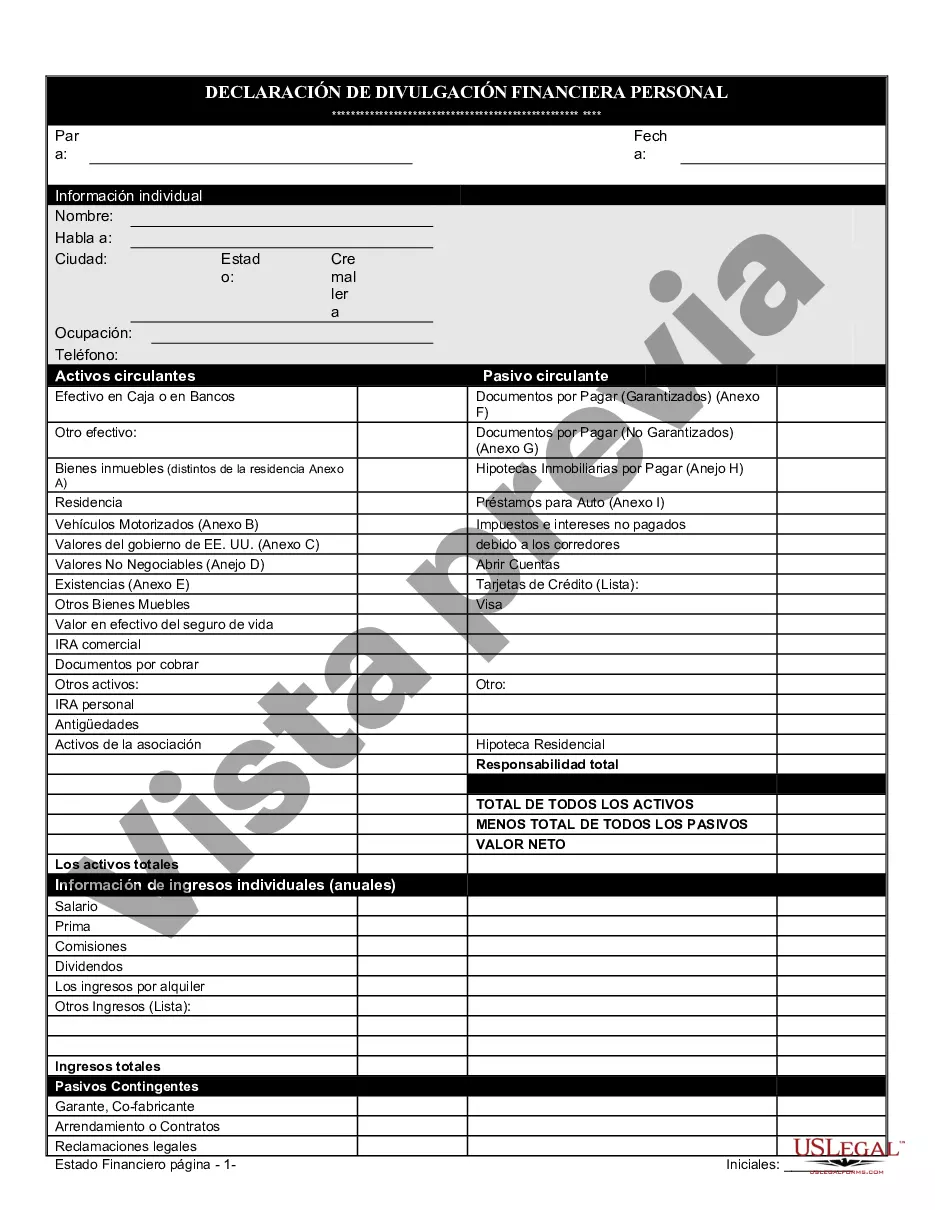

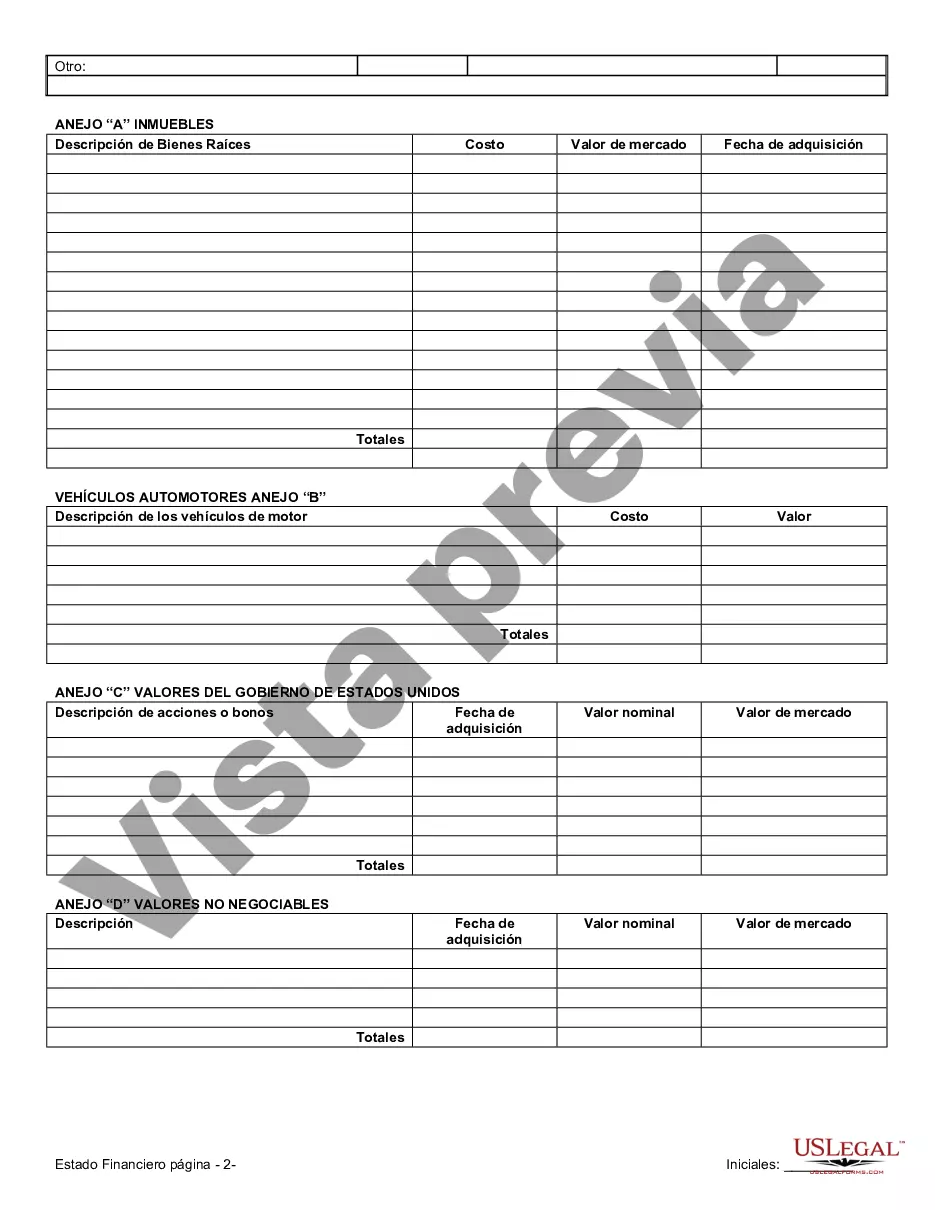

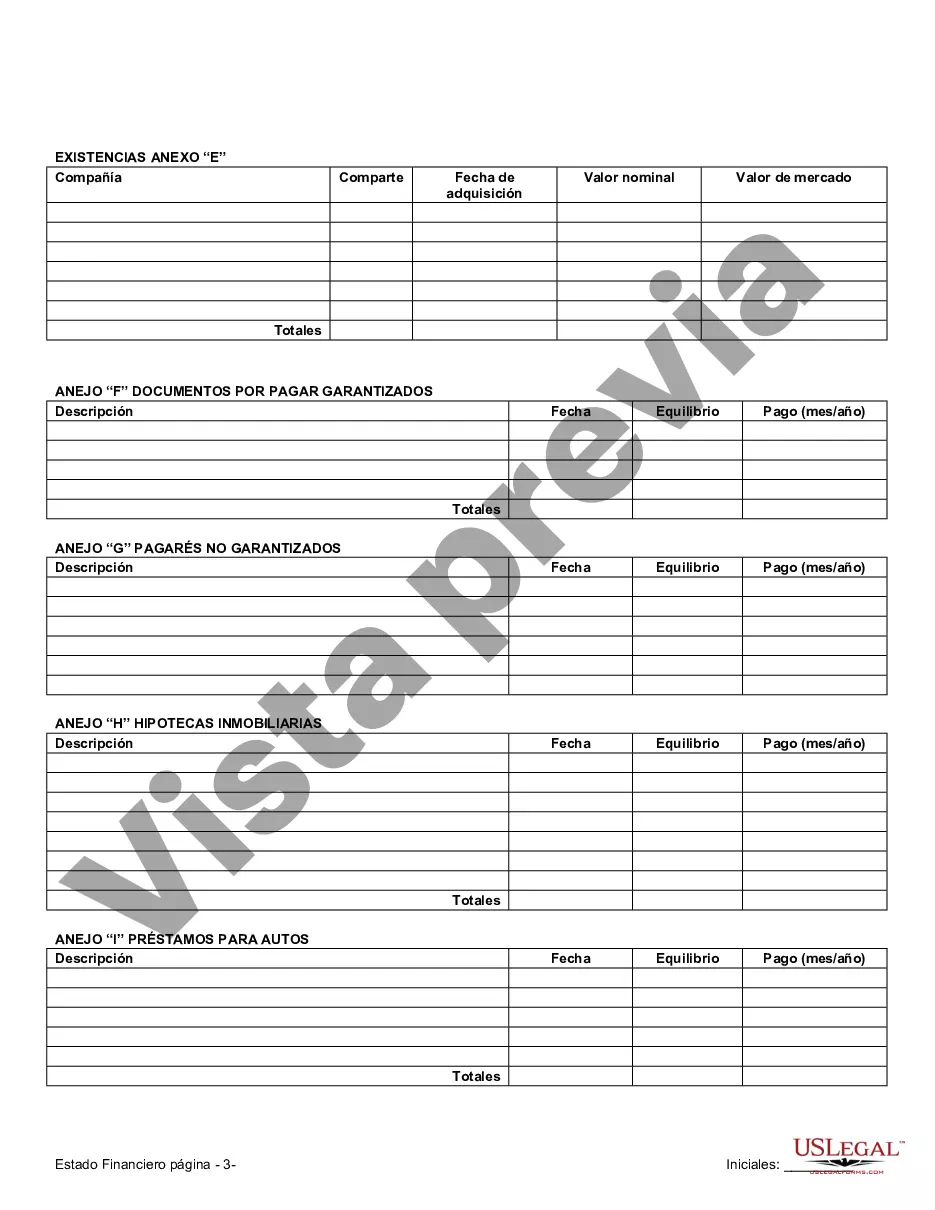

A prenuptial or premarital agreement is a legal document that couples sign before getting married or entering into a civil partnership. It outlines how assets, debts, and other financial matters will be divided in the event of a divorce or separation. In Wake, North Carolina, certain financial statements are required to be included in connection with a prenuptial or premarital agreement to ensure transparency and address any potential disputes. Here are the types of Wake North Carolina financial statements that may be relevant in this context: 1. Individual Financial Statements: Each party involved in the prenuptial or premarital agreement must submit an individual financial statement. This statement provides a comprehensive overview of their personal financial situation, including income, assets, debts, and liabilities. It helps establish a clear understanding of their individual financial standing before entering into the agreement. 2. Schedule of Assets and Liabilities: This statement is a detailed breakdown of all the assets and liabilities that each party possesses individually or jointly. It includes real estate, investments, bank accounts, vehicles, personal property, credit cards, mortgages, outstanding loans, and any other form of financial obligation. The schedule provides a snapshot of the couple's financial health and assists in the division of assets and debts if the relationship ends. 3. Income and Expense Statement: The income and expense statement highlights the individual's monthly income, including salary, dividends, rental income, alimony, and any other sources of regular earnings. It also accounts for monthly expenses, including housing costs, utilities, insurance, transportation, education, and discretionary spending. This statement aids in determining spousal support or maintenance arrangements if the agreement allows for it. 4. Business Financial Statements: If either party owns a business or has a stake in one, business financial statements are necessary. These documents provide an overview of the company's financial health, including its balance sheet, income statement, cash flow statement, equity position, and any other relevant financial information. It helps ensure that the business's value and potential future earnings are considered when structuring the prenuptial or premarital agreement. 5. Retirement Account Statements: If either party has retirement accounts, such as Individual Retirement Accounts (IRAs), 401(k)s, pensions, or other forms of retirement savings, account statements should be included. These records showcase the total value of the retirement accounts and assist in establishing how these assets will be divided in the event of a divorce or separation. In summary, Wake North Carolina financial statements, such as individual financial statements, schedules of assets and liabilities, income and expense statements, business financial statements, and retirement account statements, are crucial in connection with prenuptial or premarital agreements. These documents help promote clarity, fairness, and informed decision-making, ensuring that both parties have a complete understanding of their financial situation when entering into the agreement.

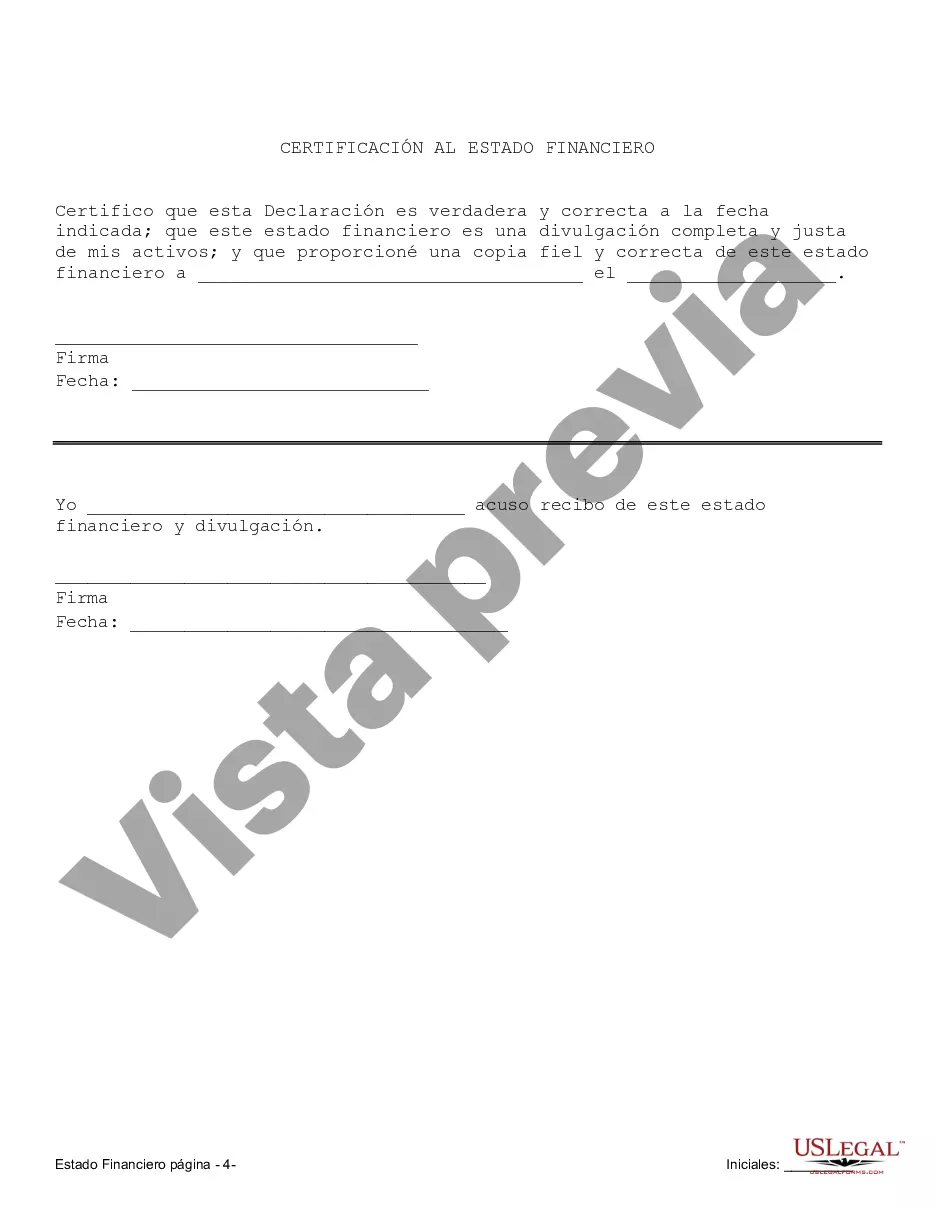

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Wake North Carolina Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you are searching for a valid form, it’s difficult to find a better platform than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can get a huge number of document samples for organization and individual purposes by categories and states, or key phrases. With the high-quality search feature, finding the most up-to-date Wake North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement is as easy as 1-2-3. In addition, the relevance of each document is verified by a group of expert attorneys that regularly review the templates on our website and update them according to the most recent state and county regulations.

If you already know about our system and have a registered account, all you should do to receive the Wake North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have found the form you need. Read its information and make use of the Preview function to explore its content. If it doesn’t meet your needs, use the Search option near the top of the screen to find the proper record.

- Affirm your choice. Select the Buy now button. Following that, pick your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Select the file format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the acquired Wake North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement.

Each and every template you add to your user profile does not have an expiry date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you want to get an extra version for modifying or creating a hard copy, you may return and save it once again anytime.

Take advantage of the US Legal Forms professional catalogue to gain access to the Wake North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement you were looking for and a huge number of other professional and state-specific templates on one platform!