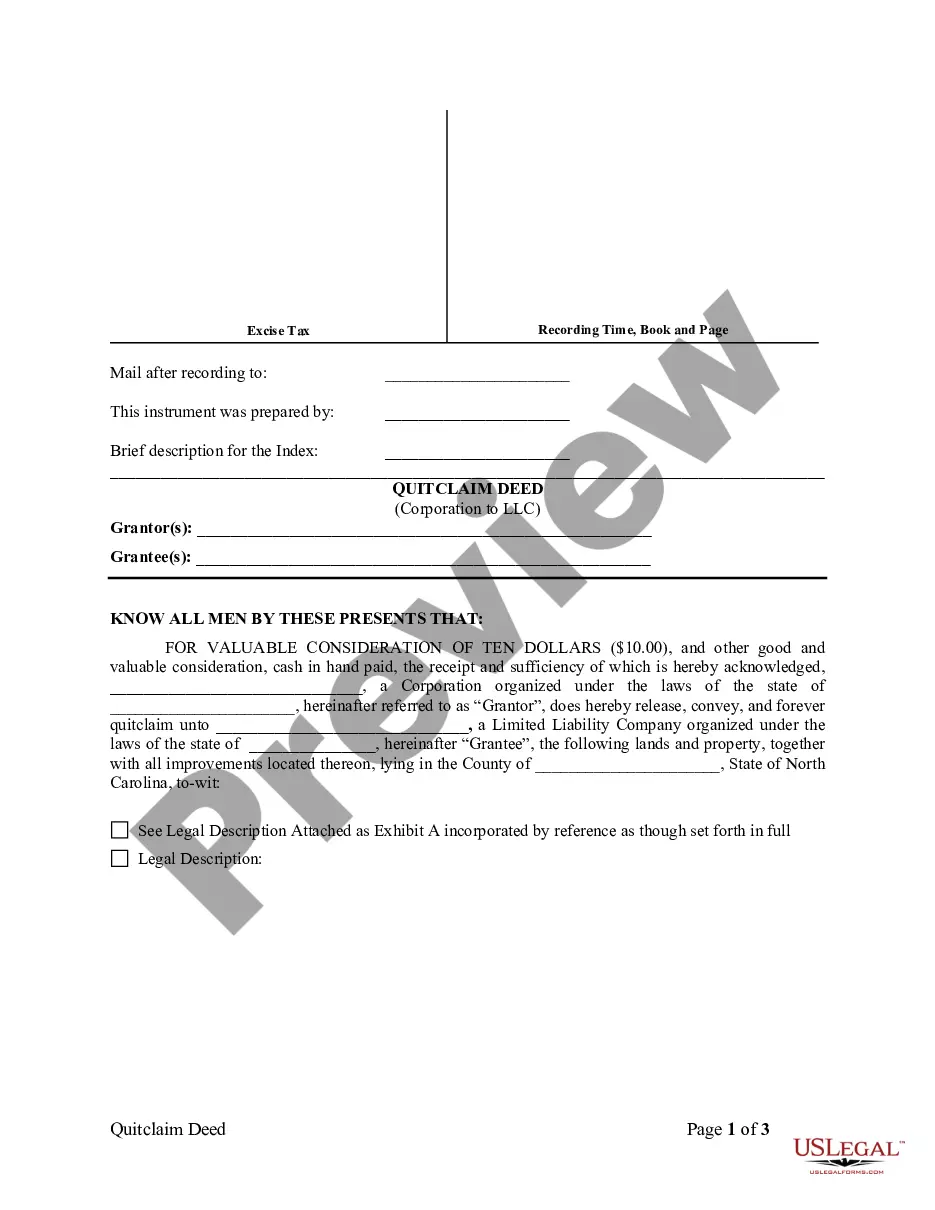

A quitclaim deed is a legal document used to transfer ownership or interest in a property from one party to another. In the case of High Point, North Carolina, there are various types of quitclaim deeds from a corporation to an LLC that can occur. Here, we will provide a detailed description of what a High Point North Carolina Quitclaim Deed from Corporation to LLC entails and discuss a few common variations. A High Point North Carolina Quitclaim Deed from Corporation to LLC is a legal instrument commonly employed when a corporation wishes to transfer its property rights to a limited liability company (LLC). This type of deed is utilized to convey the interests, titles, and rights that the corporation possesses in a specific property to the LLC. The goal is to establish the LLC as the new legal owner of the property, ensuring a smooth and legal transition while maintaining the property's integrity. A corporation opting to use a quitclaim deed to transfer property to an LLC chooses this method for several reasons. One factor is the simplicity and efficiency offered by a quitclaim deed, allowing for a straightforward transfer process. Unlike a warranty deed, a quitclaim deed does not provide guarantees or warranties regarding the property's title, making it suitable for transfer within affiliated entities. In High Point, North Carolina, there are a few notable types of quitclaim deeds from a corporation to an LLC that individuals encounter. These variations are important to consider, as they can impact the specific terms and conditions of the property transfer. Consequently, it's advisable to consult with a legal professional to determine the most appropriate quitclaim deed for the particular situation. Here are some common types: 1. Simple Quitclaim Deed: This is the most basic form of a quitclaim deed, transferring all the corporation's interest in the property to the LLC. It simply extinguishes the corporation's claims, without offering any warranties or representations. 2. Special Warranty Quitclaim Deed: In this variation, the corporation assures the LLC that it has not encumbered or subjected the property to any legal liabilities or claims during its ownership. However, it does not guarantee against potential issues arising from before its ownership. 3. Partial Quitclaim Deed: This type of deed is employed when the corporation intends to transfer only a portion of its interest in the property to the LLC. The specific portion must be explicitly defined in the deed, outlining the exact rights and responsibilities being transferred. 4. Reverse Quitclaim Deed: Although less common, a reverse quitclaim deed allows the LLC to transfer its interest in the property back to the corporation. This can occur when the LLC no longer wishes to hold ownership and wants the corporation to regain full control. In High Point, North Carolina, a quitclaim deed from a corporation to an LLC serves as a useful tool for property transfers, providing straightforward and efficient means of conveying ownership rights. It is crucial to engage legal professionals well-versed in North Carolina real estate laws to ensure compliance, accuracy, and to tailor the deed to the specific circumstances of the transfer.

High Point North Carolina Quitclaim Deed from Corporation to LLC

Description

How to fill out High Point North Carolina Quitclaim Deed From Corporation To LLC?

Are you looking for a trustworthy and affordable legal forms provider to get the High Point North Carolina Quitclaim Deed from Corporation to LLC? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of particular state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the High Point North Carolina Quitclaim Deed from Corporation to LLC conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is intended for.

- Start the search over if the template isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the High Point North Carolina Quitclaim Deed from Corporation to LLC in any provided file format. You can get back to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal papers online once and for all.