Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors

Description

How to fill out North Carolina Warranty Deed To Child Reserving A Life Estate In The Parents - Husband And Wife Grantors?

Regardless of the societal or occupational standing, preparing legal documents is an unfortunate obligation in modern society.

Frequently, it’s nearly impossible for an individual without legal experience to create such documents from scratch, largely due to the intricate language and legal nuances involved.

This is where US Legal Forms proves to be useful.

Ensure that the document you have found is appropriate for your area since the regulations of one state or county do not apply to another.

Review the form and read a brief description (if available) of the situations the document can be utilized in.

- Our site provides an extensive collection of over 85,000 state-specific templates that cater to nearly any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who desire to enhance their efficiency regarding time by utilizing our do-it-yourself forms.

- Whether you require the Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors or any other documentation that is suitable for your state or county, with US Legal Forms, everything is easily accessible.

- Here’s how you can swiftly obtain the Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors using our dependable platform.

- If you are currently a subscriber, you may proceed to Log In to your account to access the relevant form.

- However, if you are not acquainted with our platform, ensure to follow these instructions before obtaining the Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors.

Form popularity

FAQ

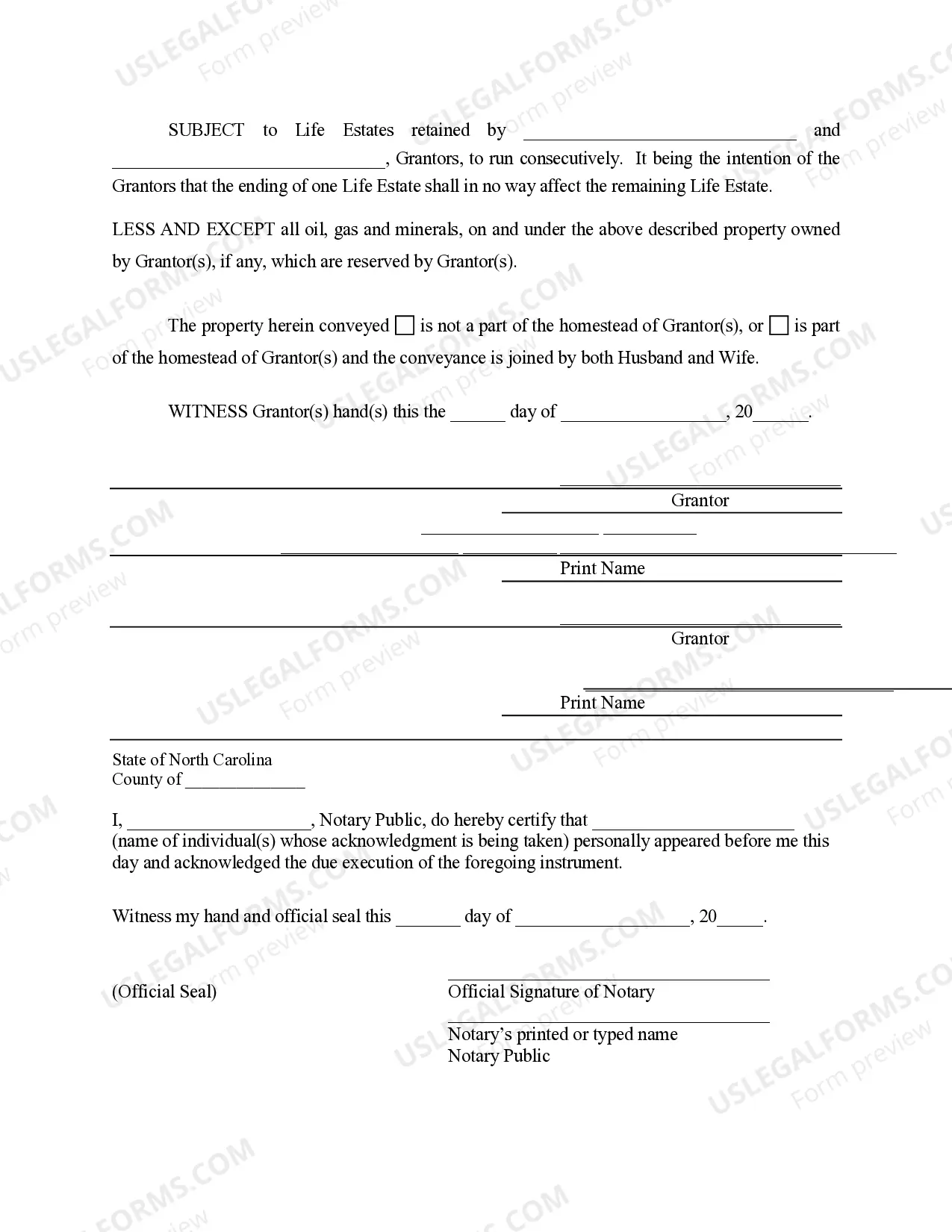

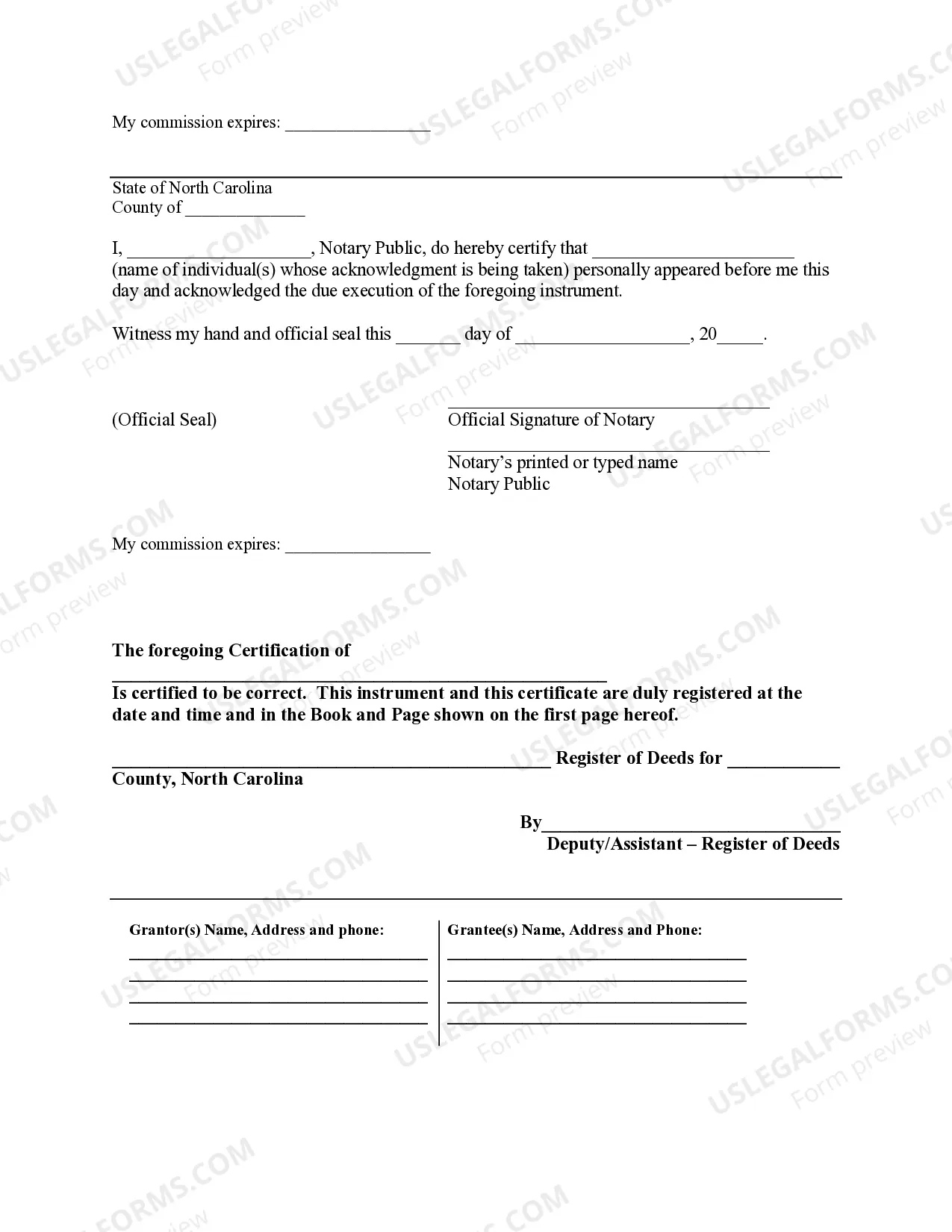

Filling out a warranty deed involves several steps to ensure the document is correct and legally binding. Begin with the names and addresses of the grantors and grantees, followed by a clear legal description of the property. If you're creating a Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents, make sure to specify the life estate clearly and ensure that both grantors sign in front of a notary for validation.

In a life estate in North Carolina, the parents, as the life tenants, retain ownership and control of the property during their lifetime. The child, as the remainderman, will acquire full ownership rights after the parents pass away. This arrangement, such as in a Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors, ensures that family members maintain ownership within the family lineage.

To fill out a warranty deed properly, begin by identifying the grantors and grantees clearly, including their full names and addresses. Next, include a thorough legal description of the property being transferred, and state any contingencies clearly, such as reserving a life estate for the parents. Lastly, ensure all necessary signatures are obtained and that the document is notarized, which is crucial for a Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents.

Yes, you can prepare your own warranty deed, but it is advisable to do so with care, especially for the Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents. If you're not familiar with legal language or local requirements, using a service like uslegalforms can simplify the process. This platform provides templates and guidance, ensuring your warranty deed meets all legal standards.

The primary beneficiaries of a warranty deed are the grantees, who receive full ownership rights to the property with assurance against any future claims. In the context of a Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents, the child gains security in ownership while the parents retain their life estate. This arrangement offers peace of mind for both parties, ensuring the property remains in the family.

Filling out a North Carolina general warranty deed requires accurate information about both the grantor and the grantee. Start by entering the names and addresses of the Husband and Wife Grantors, followed by the legal description of the property. It's important to clearly state the purpose, which in this case is to create a Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents. Finally, both grantors should sign the document in front of a notary to make it legally binding.

The primary benefit of a life estate deed lies in its ability to facilitate the transfer of property while providing security for the life tenant. By using a Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors, parents can ensure their child inherits the property after their lifetime, all while retaining the right to live there. This arrangement often helps avoid probate and simplifies the transfer process.

For the remainderman, tax implications can arise from the transfer of property through the Wake North Carolina Warranty Deed to Child Reserving a Life Estate in the Parents - Husband and Wife Grantors. The remainderman typically does not owe taxes until they receive full ownership after the life tenant's death. Furthermore, it may benefit them to consult a tax professional about potential estate taxes and property taxes that could influence their financial decisions.

Several negatives accompany a life estate, particularly regarding control over the property. The life tenant cannot sell or mortgage the property without the consent of the remainderman. This arrangement can lead to conflicts if the expectations or desires of the parties involved differ, especially when it comes to future transactions like selling the inherited property.

A life estate deed, while beneficial, has certain disadvantages. One significant drawback is that it can complicate the process of selling or refinancing the home, as the life tenant has rights until their passing. Additionally, because property taxes and maintenance typically remain the responsibility of the life tenant, these costs could create financial burdens.