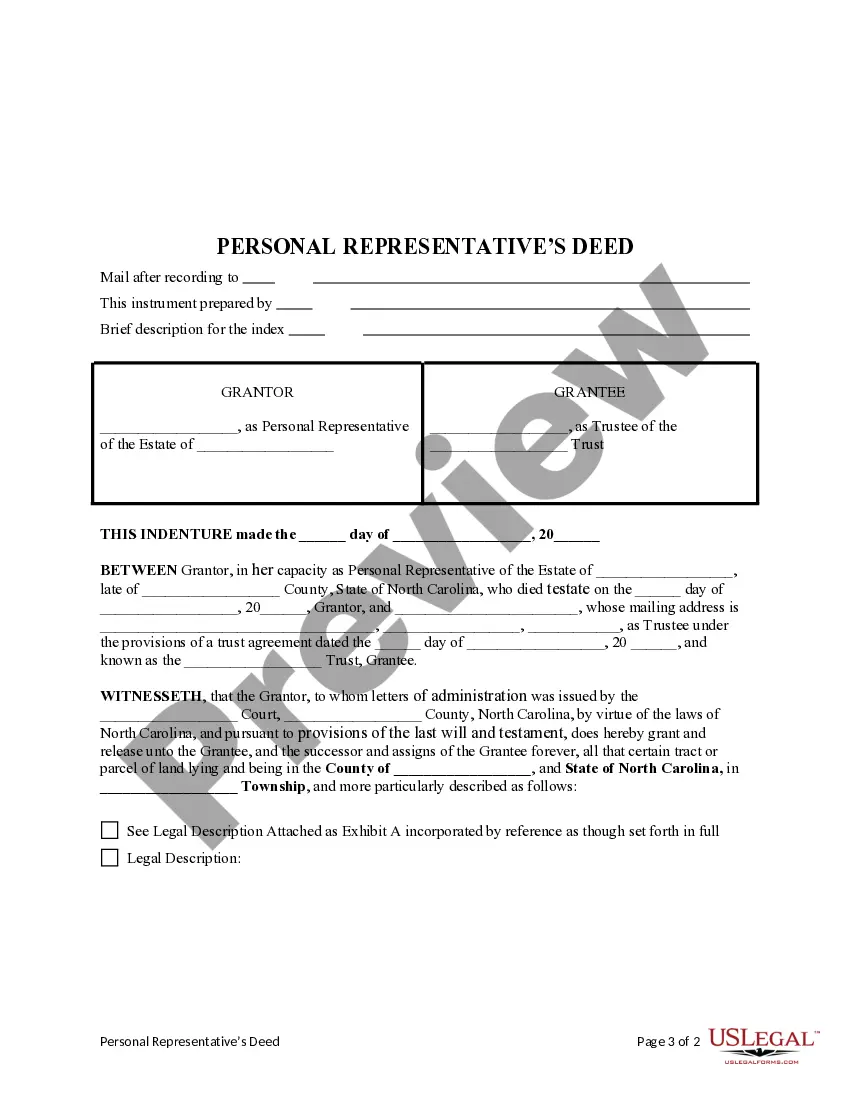

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

A Charlotte North Carolina Personal Representative's Deed to a Trust is a legal document that transfers property ownership from an estate to a trust, and it is commonly used in estate planning or probate processes. This deed is specifically executed by the personal representative of an estate who has been appointed by the court to administer the affairs of a deceased person. The purpose of this deed is to convey real estate, such as land or residential property, that was previously owned by the deceased person, known as the decedent, into a trust established by the decedent or for the beneficiaries of the estate. When drafting a Charlotte North Carolina Personal Representative's Deed to a Trust, several important details should be included. These include the full legal description of the property being transferred, the title of the personal representative that clearly identifies their authority, and specific references to the trust document that is being created or supplemented. The deed must also be prepared and executed in accordance with the laws and regulations of Charlotte, North Carolina. There are various types of Charlotte North Carolina Personal Representative's Deed to a Trust, depending on the specific circumstances and requirements of the estate and trust. These may include: 1. General Personal Representative's Deed to a Trust: This is the most common type of deed used when the personal representative is transferring property to a trust for the benefit of the estate's beneficiaries. It ensures that the estate's assets are properly distributed to the trust, protecting the interests of all parties involved. 2. Specific Personal Representative's Deed to a Trust: This type of deed is used when the personal representative is transferring a specific property or asset to a trust, rather than the entire estate. It is often employed when the decedent wants to distribute their assets unequally among beneficiaries or when specific conditions are attached to the transfer. 3. Personal Representative's Quitclaim Deed to a Trust: A quitclaim deed is used when the personal representative is transferring their interest in the property to the trust, without making any warranties or guarantees about the title. This type of deed is typically used when the personal representative is uncertain about the ownership or condition of the property and wants to avoid any potential liabilities. In conclusion, a Charlotte North Carolina Personal Representative's Deed to a Trust is a crucial legal instrument used in estate planning and probate processes. It allows for the transfer of property from a deceased person's estate to a trust, ensuring the efficient and effective management of the decedent's assets.A Charlotte North Carolina Personal Representative's Deed to a Trust is a legal document that transfers property ownership from an estate to a trust, and it is commonly used in estate planning or probate processes. This deed is specifically executed by the personal representative of an estate who has been appointed by the court to administer the affairs of a deceased person. The purpose of this deed is to convey real estate, such as land or residential property, that was previously owned by the deceased person, known as the decedent, into a trust established by the decedent or for the beneficiaries of the estate. When drafting a Charlotte North Carolina Personal Representative's Deed to a Trust, several important details should be included. These include the full legal description of the property being transferred, the title of the personal representative that clearly identifies their authority, and specific references to the trust document that is being created or supplemented. The deed must also be prepared and executed in accordance with the laws and regulations of Charlotte, North Carolina. There are various types of Charlotte North Carolina Personal Representative's Deed to a Trust, depending on the specific circumstances and requirements of the estate and trust. These may include: 1. General Personal Representative's Deed to a Trust: This is the most common type of deed used when the personal representative is transferring property to a trust for the benefit of the estate's beneficiaries. It ensures that the estate's assets are properly distributed to the trust, protecting the interests of all parties involved. 2. Specific Personal Representative's Deed to a Trust: This type of deed is used when the personal representative is transferring a specific property or asset to a trust, rather than the entire estate. It is often employed when the decedent wants to distribute their assets unequally among beneficiaries or when specific conditions are attached to the transfer. 3. Personal Representative's Quitclaim Deed to a Trust: A quitclaim deed is used when the personal representative is transferring their interest in the property to the trust, without making any warranties or guarantees about the title. This type of deed is typically used when the personal representative is uncertain about the ownership or condition of the property and wants to avoid any potential liabilities. In conclusion, a Charlotte North Carolina Personal Representative's Deed to a Trust is a crucial legal instrument used in estate planning and probate processes. It allows for the transfer of property from a deceased person's estate to a trust, ensuring the efficient and effective management of the decedent's assets.