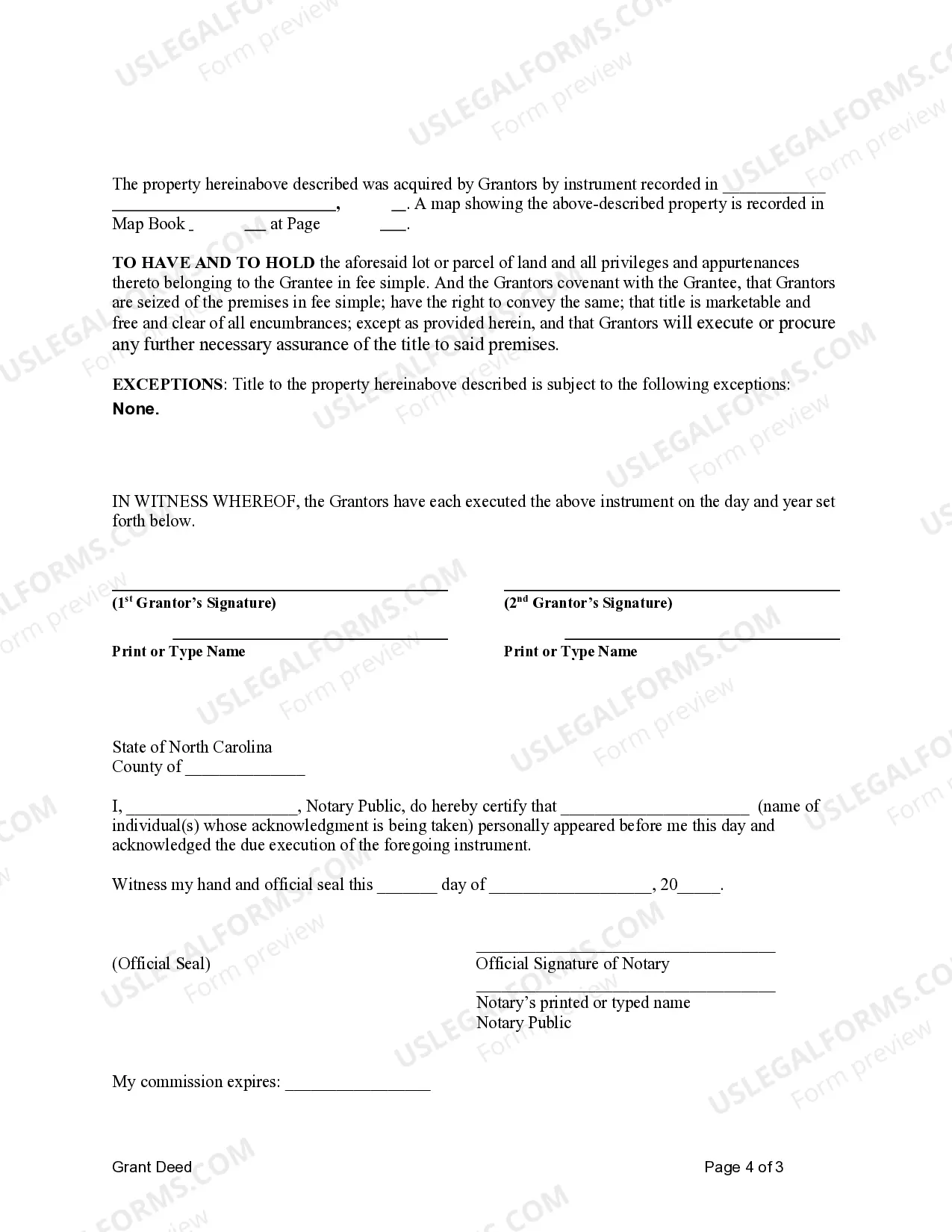

This form is a Grant Deed where the Grantors are husband and wife, or two individuals, and the Grantee is an LLC. Grantors convey the described property to the Grantee. This grant deed simply transfers the title of the property to the grantee. Included in the deed are statements verifying the property is not sold to other parties and all encumbrances on the property are known to the grantee. This deed complies with all state statutory laws.

A High Point North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company is a legal document that transfers ownership of a property from one or more individuals to a limited liability company (LLC) based in High Point, North Carolina. This deed serves as proof of the transaction and is filed with the appropriate county recorder's office. The granter(s), typically husband and wife or two individuals, are the current owners of the property. They grant and convey their ownership rights to the LLC, known as the grantee. This transfer ensures that the property is held under the LLC's name, providing protection and liability shield for the owners. Keywords: High Point North Carolina, Grant Deed, Husband, Wife, Two Individuals, Limited Liability Company, LLC, Property Ownership, County Recorder's Office, Transfer, Liability Shield. There are various types of High Point North Carolina Grant Deeds from Husband and Wife, or two Individuals, to a Limited Liability Company, depending on specific circumstances or conditions. These can include: 1. General Grant Deed: This is the most common type of grant deed used to transfer ownership. It assures that the granter(s) are transferring their interest in the property to the LLC without any undisclosed encumbrances or claims. 2. Special Warranty Deed: This type of grant deed guarantees that the granter(s) only warrants against any claims or encumbrances arising from their ownership of the property, but not against any previous issues. 3. Quitclaim Deed: A quitclaim deed is often used when the individuals transferring the property want to transfer any interest they may have, but they do not guarantee that they have any ownership rights. It is the least secure form of grant deed, as it provides no warranties of title. 4. Joint Tenancy Grant Deed: This grant deed is used when the property is owned by individuals as joint tenants. It transfers the ownership rights held by husband and wife or two individuals into the LLC, maintaining the joint tenancy status within the LLC. 5. Tenancy in Common Grant Deed: If the property is owned by individuals as tenants in common, this grant deed transfers the specific share, percentage, or interest held by the husband and wife or two individuals to the LLC. These various types of grant deeds ensure that the transfer of property ownership to a limited liability company in High Point, North Carolina, is conducted accurately and legally. It is always advisable to consult with a professional real estate attorney or experienced title company to guide you through the process and select the most appropriate grant deed for your specific situation.