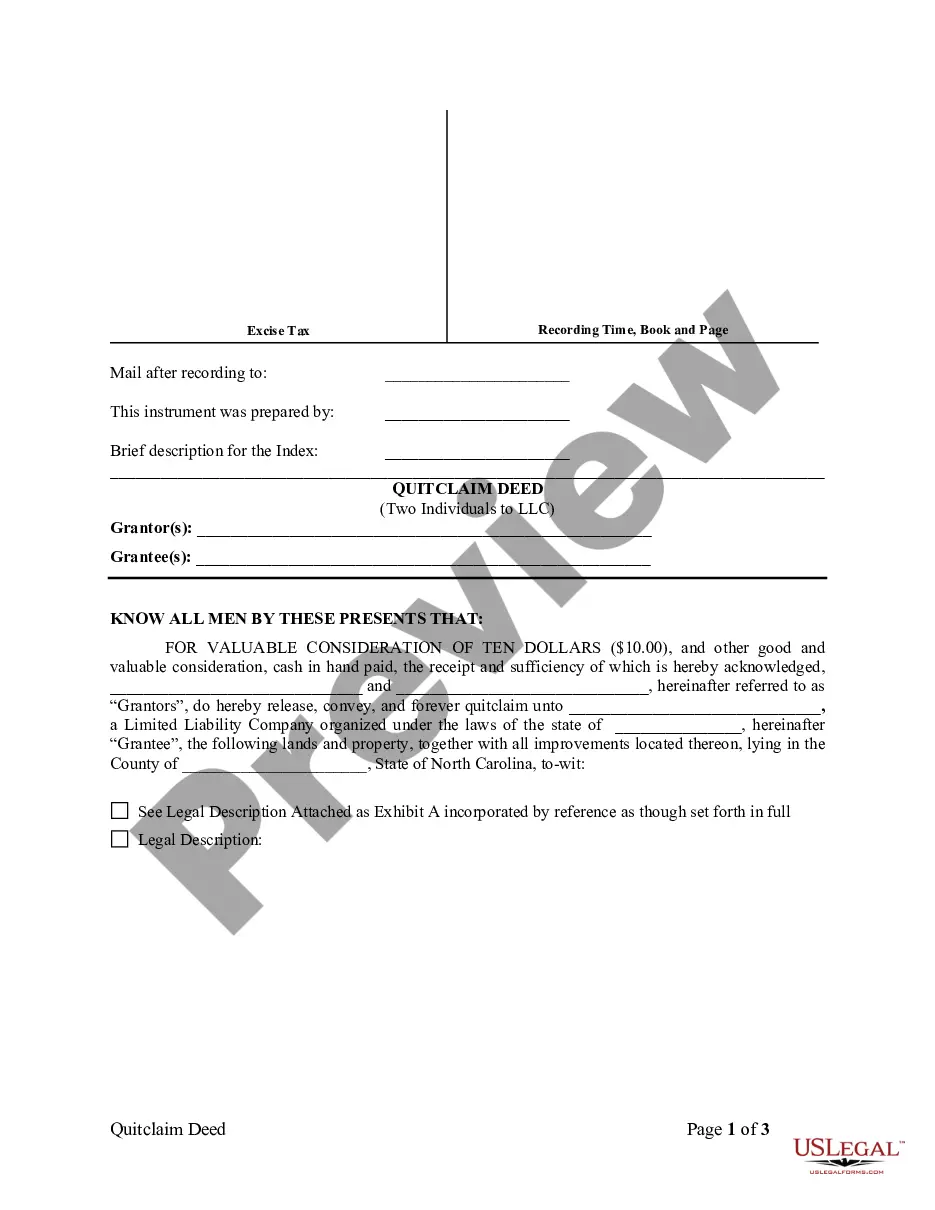

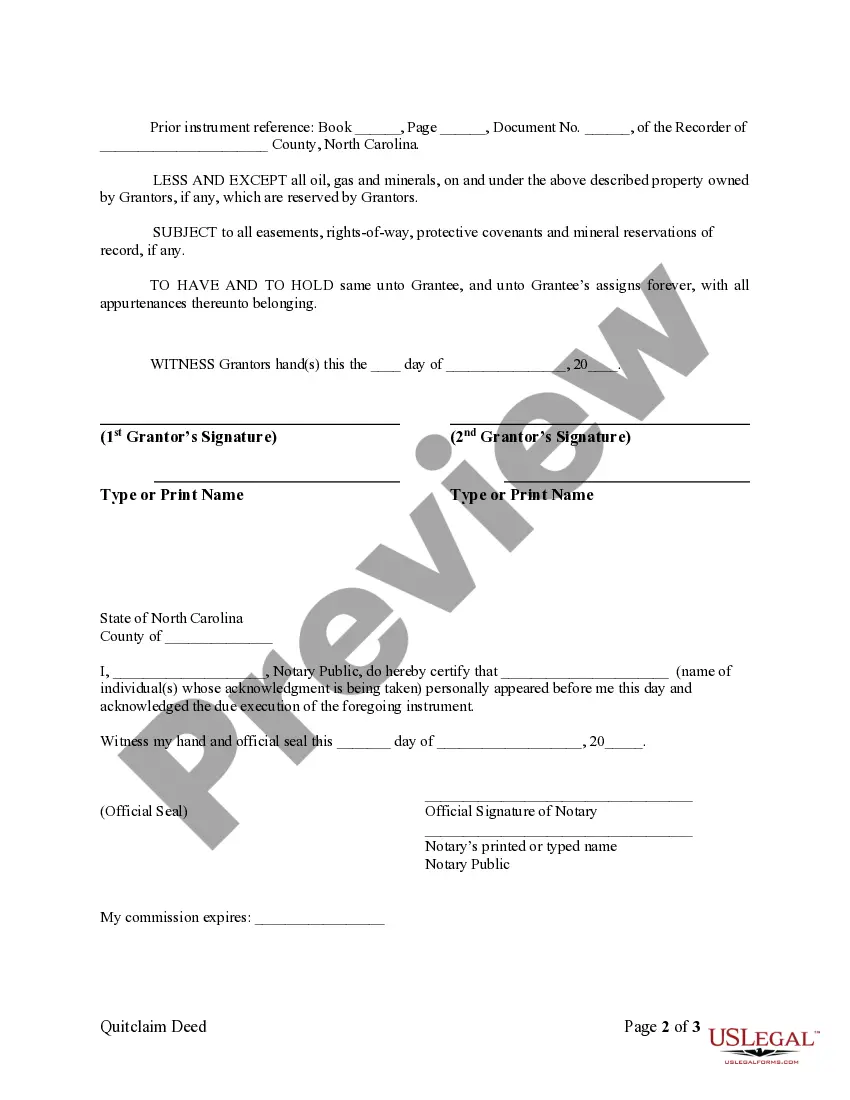

A Cary North Carolina Quitclaim Deed by Two Individuals to LLC is a legal document that transfers ownership of a property from two individuals to a limited liability company (LLC) through the use of a quitclaim deed. This type of transfer is common when individuals wish to contribute their property to an LLC for various reasons, such as asset protection, tax benefits, or business structuring. Keywords: Cary North Carolina, Quitclaim Deed, Two Individuals, LLC, property transfer, ownership, legal document, limited liability company, quitclaim deed, asset protection, tax benefits, business structuring. Cary, North Carolina, is a vibrant city known for its robust economy, excellent education system, and high quality of life. It is no wonder that individuals often choose to establish an LLC in Cary and opt for a Quitclaim Deed to transfer the property ownership to their newly formed business entity. A Quitclaim Deed is a legal instrument used to convey the rights and interests in a property from the granters (the two individuals) to the grantee (the LLC). It is important to note that this type of deed does not provide any guarantee or warranty regarding the title's validity or clear ownership. Instead, it simply transfers the rights that the granters possess at the time of the transfer. The decision to execute a Quitclaim Deed to transfer ownership of a property to an LLC in Cary, North Carolina, can be motivated by several factors. One common reason is asset protection. By transferring the property to an LLC, individuals can separate their personal assets from potential liabilities associated with the property. This arrangement helps shield personal assets from business-related risks. Another benefit is the potential tax advantages provided by an LLC structure. Depending on the individual's circumstances, transferring property ownership to an LLC can offer tax incentives such as favorable depreciation deductions, pass-through taxation, or the ability to offset rental income with business expenses. Additionally, using a Quitclaim Deed to transfer property to an LLC facilitates business structuring. It allows for a clear separation between personal and business assets, enabling individuals to manage their investment properties or real estate holdings more efficiently. This separation can also streamline the process of securing financing or engaging in real estate transactions specific to the LLC. It is worth noting that different types of Quitclaim Deeds may be used in Cary, North Carolina, depending on the specific circumstances and intentions involved. Some variations include: 1. Individual-to-LLC Quitclaim Deed: This type of deed involves the transfer of property ownership from one individual to an LLC. It is commonly used when a sole property owner wishes to contribute their personal property to an LLC they own or intend to establish. 2. Joint Tenants-to-LLC Quitclaim Deed: When two or more individuals co-own a property as joint tenants, they may choose to transfer their ownership interests to an LLC using this type of deed. In doing so, they convert their joint tenancy into a business entity owned by the LLC. 3. Tenants-in-Common-to-LLC Quitclaim Deed: If multiple individuals own a property as tenants in common, they can transfer their respective interests to an LLC through this type of deed. It allows for the consolidation of ownership under the LLC's umbrella, simplifying management and facilitating decision-making processes. In conclusion, a Cary North Carolina Quitclaim Deed by Two Individuals to LLC is a legal instrument used to transfer property ownership to a limited liability company. It provides benefits such as asset protection, potential tax advantages, and improved business structuring. Understanding the different types of Quitclaim Deeds available can help individuals choose the most appropriate method for transferring their property to an LLC in Cary.

Cary North Carolina Quitclaim Deed by Two Individuals to LLC

Description

How to fill out Cary North Carolina Quitclaim Deed By Two Individuals To LLC?

If you are looking for a valid form, it’s impossible to choose a better service than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can find a large number of templates for company and individual purposes by categories and regions, or key phrases. With our high-quality search feature, discovering the most up-to-date Cary North Carolina Quitclaim Deed by Two Individuals to LLC is as elementary as 1-2-3. Furthermore, the relevance of each document is confirmed by a team of expert lawyers that on a regular basis review the templates on our website and update them in accordance with the newest state and county demands.

If you already know about our platform and have a registered account, all you need to get the Cary North Carolina Quitclaim Deed by Two Individuals to LLC is to log in to your user profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have opened the form you want. Look at its description and make use of the Preview feature to explore its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to get the appropriate document.

- Confirm your choice. Click the Buy now button. Following that, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Select the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Cary North Carolina Quitclaim Deed by Two Individuals to LLC.

Every single template you save in your user profile does not have an expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to have an additional copy for enhancing or printing, you can return and export it once again at any time.

Make use of the US Legal Forms professional library to gain access to the Cary North Carolina Quitclaim Deed by Two Individuals to LLC you were looking for and a large number of other professional and state-specific templates in one place!