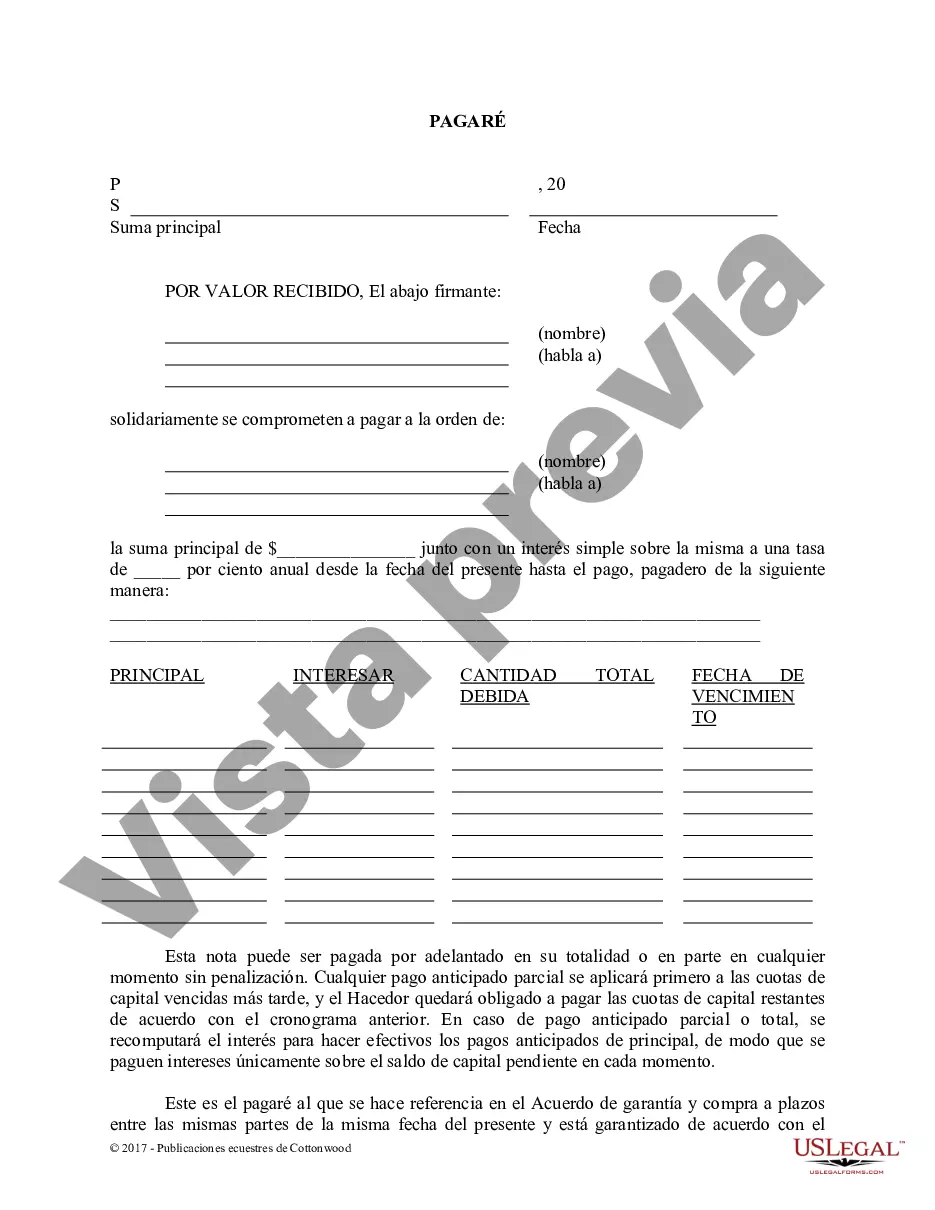

A Charlotte North Carolina Promissory Note — Horse Equine Form is a legal document used to formalize a loan agreement between parties involved in the horse or equine industry. It serves as a written promise to repay a specific amount of money borrowed for a specific purpose related to horses or equines. The Promissory Note ensures that all essential aspects of the loan are clearly defined and agreed upon by both the lender and the borrower. It outlines important details such as the loan amount, interest rate, repayment terms, default consequences, and other relevant conditions. There are several types of Charlotte North Carolina Promissory Note — Horse Equine Forms, including: 1. Simple Promissory Note: This is the most basic type of Promissory Note, documenting a simple loan agreement without any additional clauses or special conditions. It is commonly used for straightforward transactions. 2. Secured Promissory Note: This form includes provisions for collateral to secure the loan. If the borrower fails to repay the loan, the lender can take possession of the specified collateral, which may be a horse, equipment, or any other valuable asset agreed upon by both parties. 3. Installment Promissory Note: This type of Promissory Note divides the loan repayments into equal periodic installments. It specifies the amount to be paid at each interval and the duration of the repayment period, providing a structured approach to loan repayment. 4. Balloon Promissory Note: In a Balloon Promissory Note, the borrower is required to make smaller regular payments during the loan term. However, a significant lump sum payment, often referred to as the 'balloon payment,' is due at the end of the loan term. This type of Promissory Note is often used when the borrower expects to receive a large sum of money before the end of the term. 5. Interest-Only Promissory Note: This form allows the borrower to pay only the accrued interest for a specified period, typically at the beginning of the loan term. Only after this interest-only period ends, the borrower will start making payments towards the principal loan amount along with the interest. It is crucial to carefully review and understand the specific terms and conditions outlined in any Promissory Note before entering into a horse equine-related loan agreement. Seeking legal advice or consulting an attorney experienced in equine law is recommended to ensure compliance with all applicable laws and protect the interests of both the lender and borrower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Charlotte North Carolina Pagaré - Caballo Equino Formas - North Carolina Promissory Note - Horse Equine Forms

Description

How to fill out Charlotte North Carolina Pagaré - Caballo Equino Formas?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Charlotte North Carolina Promissory Note - Horse Equine Forms becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Charlotte North Carolina Promissory Note - Horse Equine Forms takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Charlotte North Carolina Promissory Note - Horse Equine Forms. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!