Cary North Carolina Business Credit Application is a comprehensive and straightforward document that allows businesses in Cary, North Carolina, to apply for credit services. This application is designed for businesses, both large and small, operating in the Cary area and seeking financial assistance or credit options to support their ventures. The Cary North Carolina Business Credit Application requests relevant information from applicants to assess their creditworthiness and determine the amount of credit they are eligible to receive. By providing a detailed overview of the business's financial history and current situation, including revenue, assets, and liabilities, the application helps lenders or creditors evaluate the applicant's ability to repay the credit. Keywords: Cary North Carolina, Business Credit Application, credit services, businesses, financial assistance, credit options, creditworthiness, lenders, creditors, repay, financial history, revenue, assets, liabilities. Different types of Cary North Carolina Business Credit Application may include: 1. Small Business Credit Application: Specifically designed for small businesses operating in Cary, North Carolina, this application considers the unique financial aspects and challenges faced by small-scale enterprises. 2. Corporate Credit Application: Tailored for larger corporations and companies in Cary, North Carolina, this application takes into account the complex financial structures and multiple stakeholders involved in corporate entities. 3. Start-up Credit Application: Specifically crafted for newly established businesses or entrepreneurs starting their ventures in Cary, North Carolina. This application may focus on alternative evaluation methods to assess credit eligibility for businesses without extensive financial histories. 4. Line of Credit Application: Geared towards businesses looking for a revolving line of credit, allowing them to access funds on an as-needed basis. This type of application facilitates a flexible borrowing framework for businesses operating in Cary. 5. Working Capital Credit Application: Aimed at businesses seeking additional financial support to cover operational expenses, inventory, or other short-term financial needs. This application helps evaluate a business's ability to manage cash flow effectively. Keywords: Small Business Credit Application, Corporate Credit Application, Start-up Credit Application, Line of Credit Application, Working Capital Credit Application, financial aspects, challenges, small-scale enterprises, complex financial structures, multiple stakeholders, evaluation methods, revolving line of credit, flexible borrowing framework, operational expenses, cash flow.

Cary North Carolina Business Credit Application

Description

How to fill out Cary North Carolina Business Credit Application?

If you are looking for a relevant form, it’s impossible to find a better service than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can find a huge number of templates for company and personal purposes by categories and states, or keywords. Using our advanced search feature, discovering the newest Cary North Carolina Business Credit Application is as easy as 1-2-3. Furthermore, the relevance of each document is confirmed by a group of professional lawyers that regularly check the templates on our website and revise them in accordance with the newest state and county demands.

If you already know about our system and have a registered account, all you need to get the Cary North Carolina Business Credit Application is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have discovered the form you want. Check its information and use the Preview function to see its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to discover the needed document.

- Affirm your decision. Choose the Buy now button. Next, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the template. Indicate the format and save it to your system.

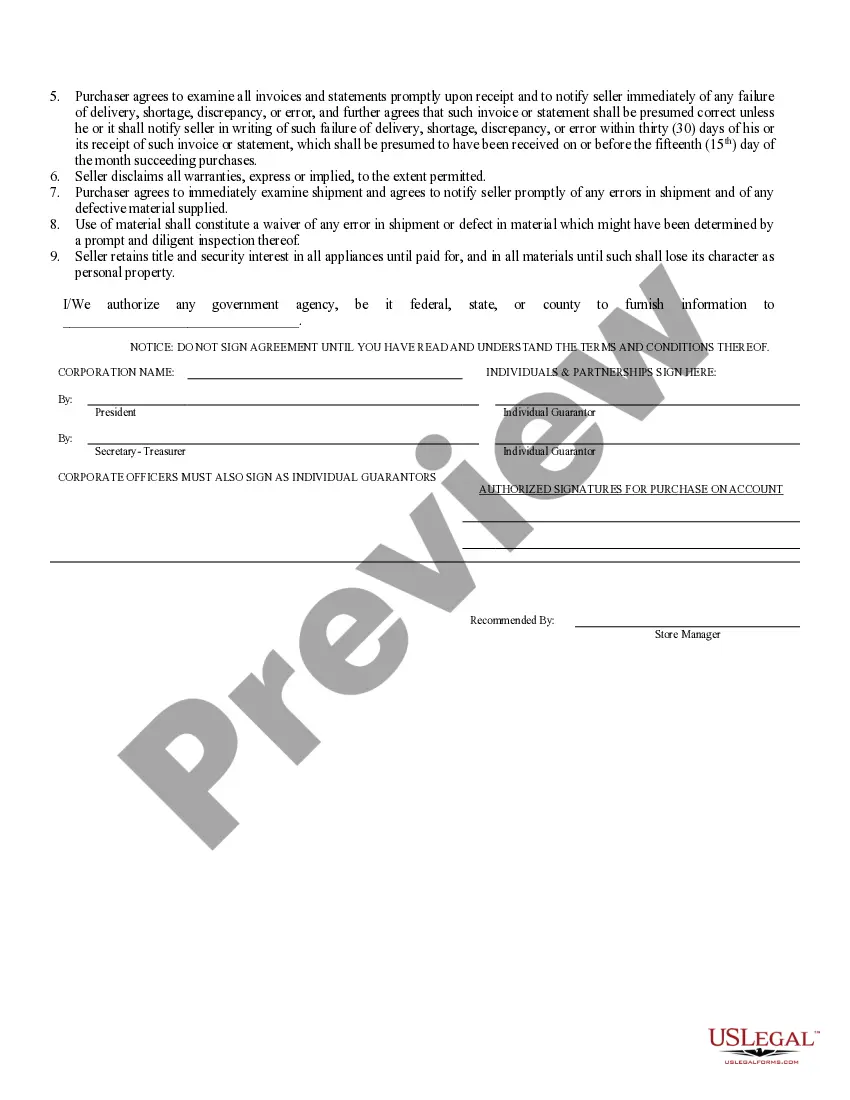

- Make adjustments. Fill out, edit, print, and sign the acquired Cary North Carolina Business Credit Application.

Each template you save in your user profile does not have an expiry date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you need to get an additional duplicate for modifying or creating a hard copy, feel free to return and save it again anytime.

Make use of the US Legal Forms professional library to get access to the Cary North Carolina Business Credit Application you were looking for and a huge number of other professional and state-specific samples in a single place!