Title: Understanding the Fayetteville North Carolina Notice of Dishonored Check Civilvi— - 1st Notice Introduction: The Fayetteville North Carolina Notice of Dishonored Check Civilvi— - 1st Notice is an essential document that serves to inform individuals or businesses about a bad check that has been bounced or dishonored by a financial institution within the state. This notice plays a crucial role in informing the check issuer about the dishonored check, its consequences, and the necessary steps to rectify the situation. In this article, we will delve into the details of the notice, its significance, and the potential repercussions of issuing a bad or bounced check. Types of Fayetteville North Carolina Notice of Dishonored Check Civilvi— - 1st Notice: 1. Bad Check Notice: The Bad Check Notice, also referred to as the Notice of Dishonored Check, is issued by the recipient of a bad check when it fails to clear due to insufficient funds, closed accounts, or other invalid reasons. This notice serves as an initial warning, giving the check issuer an opportunity to rectify the situation before facing legal action. 2. Bounced Check Notice: A Bounced Check Notice is similar to the Bad Check Notice, both in purpose and consequences. It is sent by the payee or the financial institution where the check was deposited, informing the check issuer about the dishonored check. This notice typically includes details regarding the bounced check, such as the check's date, amount, and the financial institution's reason for dishonoring it. Significance of the Fayetteville North Carolina Notice of Dishonored Check Civilvi— - 1st Notice: The Notice of Dishonored Check holds great significance for both parties involved. It aims to resolve the situation amicably by giving the issuer the opportunity to rectify the issue promptly, thus preventing potential legal or financial consequences. By sending this notice, the payee or financial institution also demonstrates their intent to pursue legal action if the situation remains unresolved. Consequences of issuing a bad or bounced check: 1. Legal Ramifications: The recipient of a bad check has the right to take legal action against the issuer. Depending on the circumstances, the issuer may face civil penalties, fines, or even criminal charges. Repeat offenders may face more severe consequences. 2. Damaged Reputation: Issuing a bad check can tarnish the issuer's reputation, both personally and professionally. This can lead to strained relationships, loss of credibility, and potential difficulties in obtaining credit or loans in the future. 3. Financial Consequences: A bounced check can result in additional fees, such as bank charges or administrative fees imposed by the recipient. Additionally, the issuer may be required to reimburse the payee for any expenses incurred due to the dishonored check. Conclusion: The Fayetteville North Carolina Notice of Dishonored Check Civilvi— - 1st Notice plays a vital role in informing check issuers about their dishonored checks. Understanding the implications of issuing a bad or bounced check is essential for individuals and businesses alike. It is crucial to promptly address the situation, rectify any erroneous checks, and take necessary steps to maintain financial integrity and good standing within the community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fayetteville North Carolina Aviso de cheque sin fondos - Civil - 1er aviso - Palabras clave: cheque sin fondos, cheque sin fondos - North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check

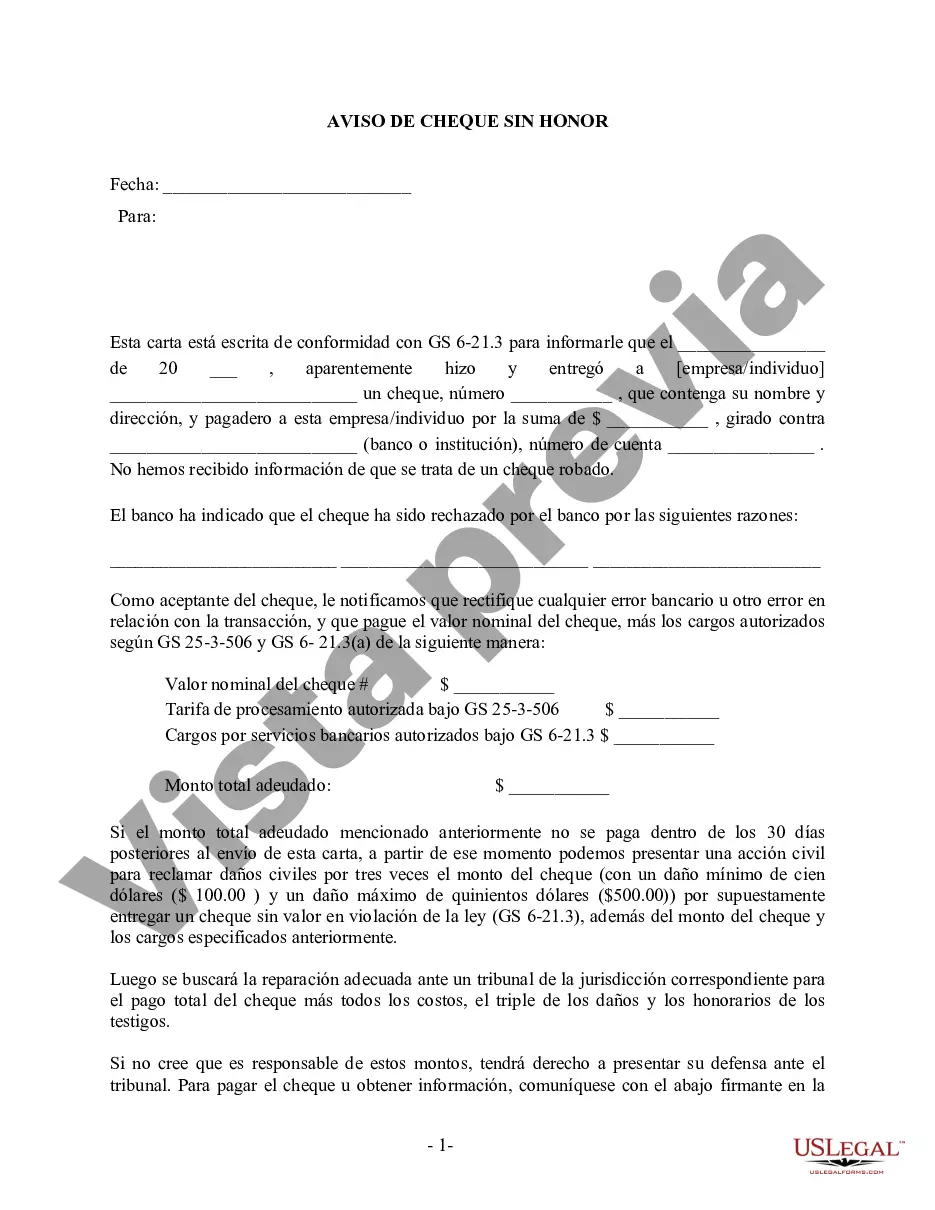

Description

How to fill out Fayetteville North Carolina Aviso De Cheque Sin Fondos - Civil - 1er Aviso - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no law education to draft this sort of paperwork from scratch, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our platform offers a huge catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you want the Fayetteville North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Fayetteville North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check quickly employing our trustworthy platform. In case you are presently a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps before downloading the Fayetteville North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check:

- Ensure the template you have chosen is good for your area because the regulations of one state or county do not work for another state or county.

- Preview the document and read a brief description (if provided) of cases the paper can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and look for the needed form.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Fayetteville North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check once the payment is through.

You’re good to go! Now you can proceed to print the document or complete it online. Should you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.