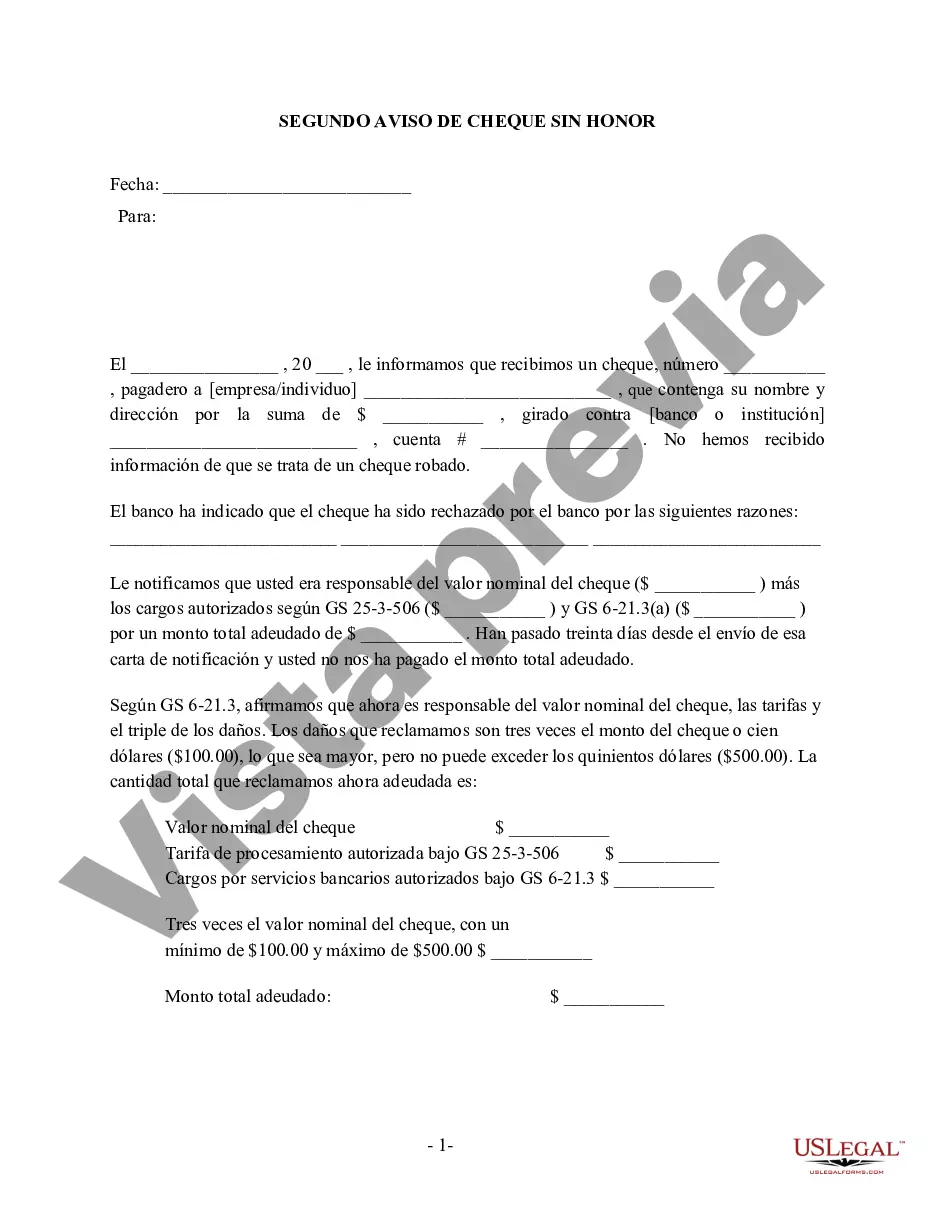

Title: Understanding the Winston-Salemem North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice Introduction: The Winston-Salem North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is an essential legal instrument used when a check has been returned due to insufficient funds in the account or other reasons. This article will provide a detailed description of this notice, explain its significance, and explore the different types of dishonored checks. Keywords: bad check, bounced check. 1. What is a Notice of Dishonored Check? A Notice of Dishonored Check is a formal written notification issued to the check issuer to inform them that the check they have issued has been returned unpaid. This notice serves as an important legal document to draw the issuer's attention to their financial obligation and potential consequences. 2. Purpose of the Notice: The primary objective of the Winston-Salem North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is to notify the check issuer that their check has been dishonored or bounced. This notice is typically sent when the issuer fails to resolve the issue even after a previous notice was sent. 3. Legal Implications: When an individual writes a bad check, it can have serious legal consequences. The notice serves as a warning to the check issuer that if they do not resolve the issue promptly, they may face legal action, hefty fines, or even criminal charges in some cases. 4. Types of Dishonored Checks: a) Insufficient Funds: The most common reason for a check to be dishonored is insufficient funds. This occurs when the issuer writes a check without having enough money in their account to cover the transaction. b) Closed Account: If the check issuer closes their account before the recipient deposits the check, the check will be dishonored. c) Irregular Signature: If the signature on the check does not match the account holder's authorized signature, the bank may dishonor the check. d) Post-Dated Check: A post-dated check, which is a check with a future date, may be dishonored if it is deposited before the specified date. e) Stolen or Forgery: If a check is reported as stolen or forged, the bank may dishonor the check. Conclusion: The Winston-Salem North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is a legal document used to notify check issuers about dishonored checks. Understanding the significance of this notice and its implications is crucial for check issuers to take prompt action to resolve the issue. Avoiding writing bad checks and maintaining adequate funds in the account are essential to prevent such notices and potential legal consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Winston–Salem North Carolina Notificación de cheque sin fondos - Civil - 2da notificación - Palabras clave: cheque sin fondos, cheque sin fondos - North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description

How to fill out Winston–Salem North Carolina Notificación De Cheque Sin Fondos - Civil - 2da Notificación - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Do you need a trustworthy and inexpensive legal forms provider to get the Winston–Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check? US Legal Forms is your go-to option.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed based on the requirements of specific state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Winston–Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Restart the search in case the template isn’t good for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Winston–Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check in any provided format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal paperwork online once and for all.