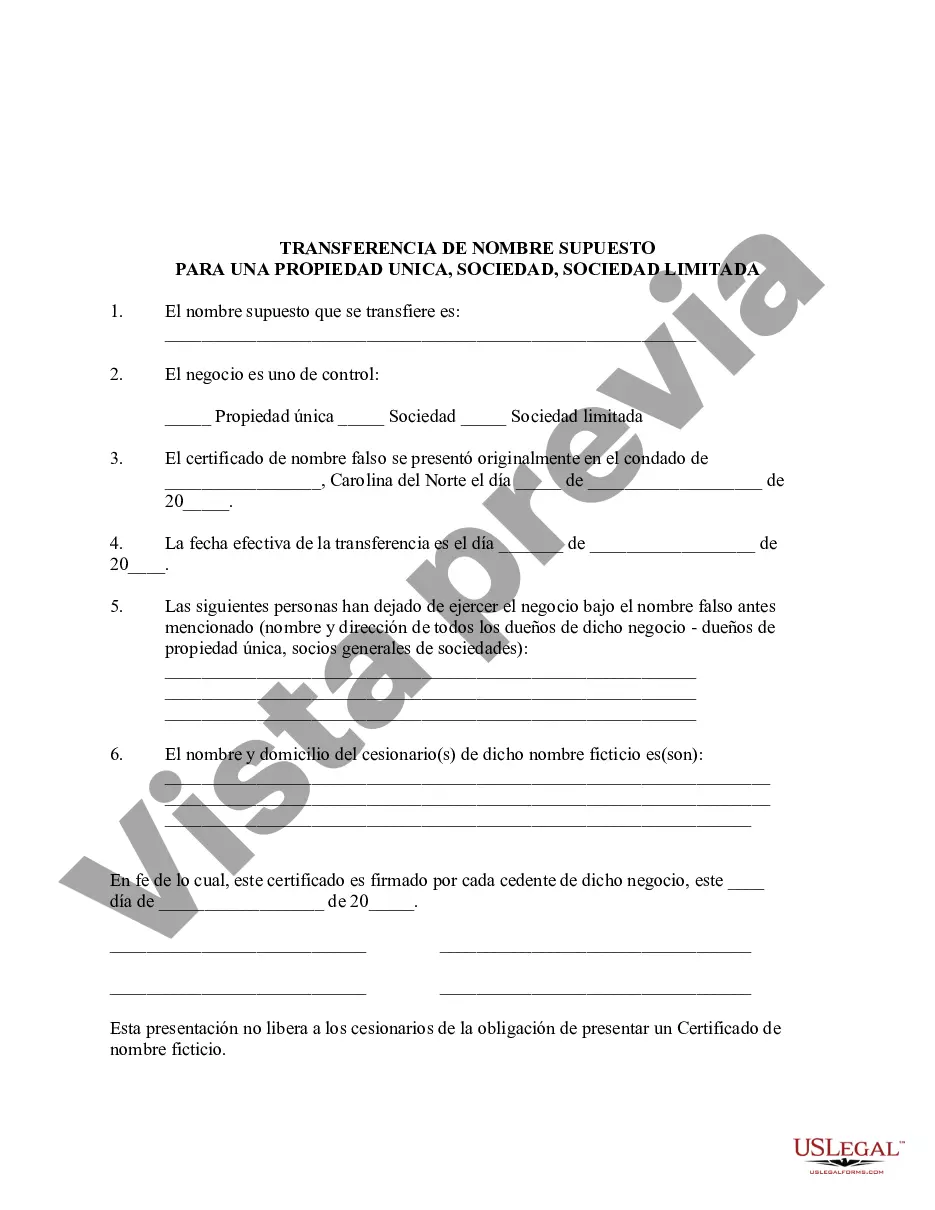

The Transfer of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership in Charlotte, North Carolina refers to the process of transferring the rights and responsibilities associated with a business's assumed name to another entity. This is typically done when there is a change in ownership or when a business is being dissolved. Keywords: Charlotte, North Carolina, transfer, assumed name, partnership, sole proprietorship, limited partnership. There are three main types of transfers that can occur for these business entities: 1. Transfer of Assumed Name for Partnership: In the case of a partnership, where two or more individuals operate a business together, the transfer of assumed name involves transferring the rights to use the assumed name from one partner to another. This may occur when one partner leaves the partnership or in the event of a buyout. 2. Transfer of Assumed Name for Sole Proprietorship: A sole proprietorship is a business owned and operated by a single individual. When a sole proprietorship is being transferred to a new owner, the assumed name associated with the business must also be transferred. This is often done when the owner sells the business or transitions it to a family member. 3. Transfer of Assumed Name for Limited Partnership: A limited partnership is a business structure that consists of both general partners, who manage the business, and limited partners, who contribute to the business but do not have control over day-to-day operations. In the event of a transfer of assumed name for a limited partnership, it typically involves the transfer of the general partner's rights and responsibilities to a new party. The process of transferring the assumed name for partnership, sole proprietorship, or limited partnership in Charlotte, North Carolina generally requires several steps. Firstly, the current owner or partners must draft a transfer agreement that outlines the terms of the transfer, including the rights and responsibilities being transferred and any financial arrangements. Once the transfer agreement is prepared, it needs to be signed by all parties involved and notarized. It is important to ensure that all legal requirements are met to ensure the validity of the transfer. Next, the transferor must notify the North Carolina Secretary of State's office of the transfer. This can be done by filing the appropriate forms and paying any required fees. The Secretary of State will then update their records to reflect the new ownership or partnership structure. Additionally, it is advisable to update any relevant tax registrations, licenses, permits, and contracts associated with the assumed name transfer. This ensures that the new owner or partners have all the necessary legal documentation to operate the business under the assumed name. In summary, the Transfer of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership in Charlotte, North Carolina involves transferring the rights and responsibilities associated with a business's assumed name to another entity. This process varies depending on the type of business entity involved — partnership, sole proprietorship, or limited partnership — and requires drafting a transfer agreement, notifying the Secretary of State's office, and updating relevant tax registrations and licenses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Charlotte North Carolina Transferencia del nombre ficticio para sociedad, empresa unipersonal o sociedad limitada - North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership

Description

How to fill out Charlotte North Carolina Transferencia Del Nombre Ficticio Para Sociedad, Empresa Unipersonal O Sociedad Limitada?

Make use of the US Legal Forms and have immediate access to any form sample you want. Our helpful platform with thousands of document templates simplifies the way to find and get virtually any document sample you need. You can download, fill, and certify the Charlotte North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership in just a few minutes instead of surfing the Net for hours attempting to find an appropriate template.

Using our library is a superb way to raise the safety of your document filing. Our experienced lawyers on a regular basis review all the records to make sure that the templates are relevant for a particular state and compliant with new laws and regulations.

How do you get the Charlotte North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership? If you have a profile, just log in to the account. The Download option will appear on all the samples you view. Additionally, you can get all the earlier saved files in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Open the page with the template you require. Ensure that it is the template you were looking for: check its name and description, and take take advantage of the Preview option if it is available. Otherwise, use the Search field to look for the needed one.

- Launch the downloading procedure. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the file. Pick the format to get the Charlotte North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership and revise and fill, or sign it for your needs.

US Legal Forms is probably the most significant and reliable document libraries on the internet. We are always ready to assist you in any legal procedure, even if it is just downloading the Charlotte North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership.

Feel free to make the most of our service and make your document experience as efficient as possible!