A living trust is a legal arrangement in Charlotte, North Carolina, that allows individuals to transfer their assets into a trust while they are still alive. This specific type of living trust is designed for husbands and wives with no children. It provides various benefits such as asset protection, privacy, and avoiding probate. One type of Charlotte North Carolina Living Trust for Husband and Wife with No Children is a revocable living trust. This type of living trust allows the individuals to maintain control and ownership of their assets during their lifetime. They can make changes or revoke the trust if necessary. With a revocable living trust, the assets are transferred into the trust and are managed by the trustees who are typically the husband and wife themselves. Another type is an irrevocable living trust. Unlike a revocable trust, once assets are transferred into an irrevocable trust, they cannot be modified or revoked by the individuals. However, this type of trust offers additional advantages such as potential tax benefits and asset protection from creditors. In a living trust for husband and wife with no children, the assets owned by the couple, such as real estate, bank accounts, investments, and personal property, are transferred into the trust. By doing so, they no longer belong to the individuals but instead are owned by the trust. This provides protection against potential probate issues that may arise upon the death of either spouse. A living trust can also include provisions for the management and distribution of assets in case of incapacity or death. This means that if one spouse becomes incapacitated, the other spouse or a designated successor trustee can step in as the trustee and manage the trust for the benefit of the incapacitated spouse. In the event of death, the trust can outline how the assets will be distributed to beneficiaries, such as other family members or charitable organizations. Having a living trust for husband and wife with no children in Charlotte, North Carolina, enables the couple to maintain control over their assets, protect them from probate, and potentially reduce estate taxes. It is essential to consult an estate planning attorney to determine the type of living trust that best suits your specific circumstances and to ensure all legal requirements are met.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Charlotte North Carolina Fideicomiso en vida para esposo y esposa sin hijos - North Carolina Living Trust for Husband and Wife with No Children

Description

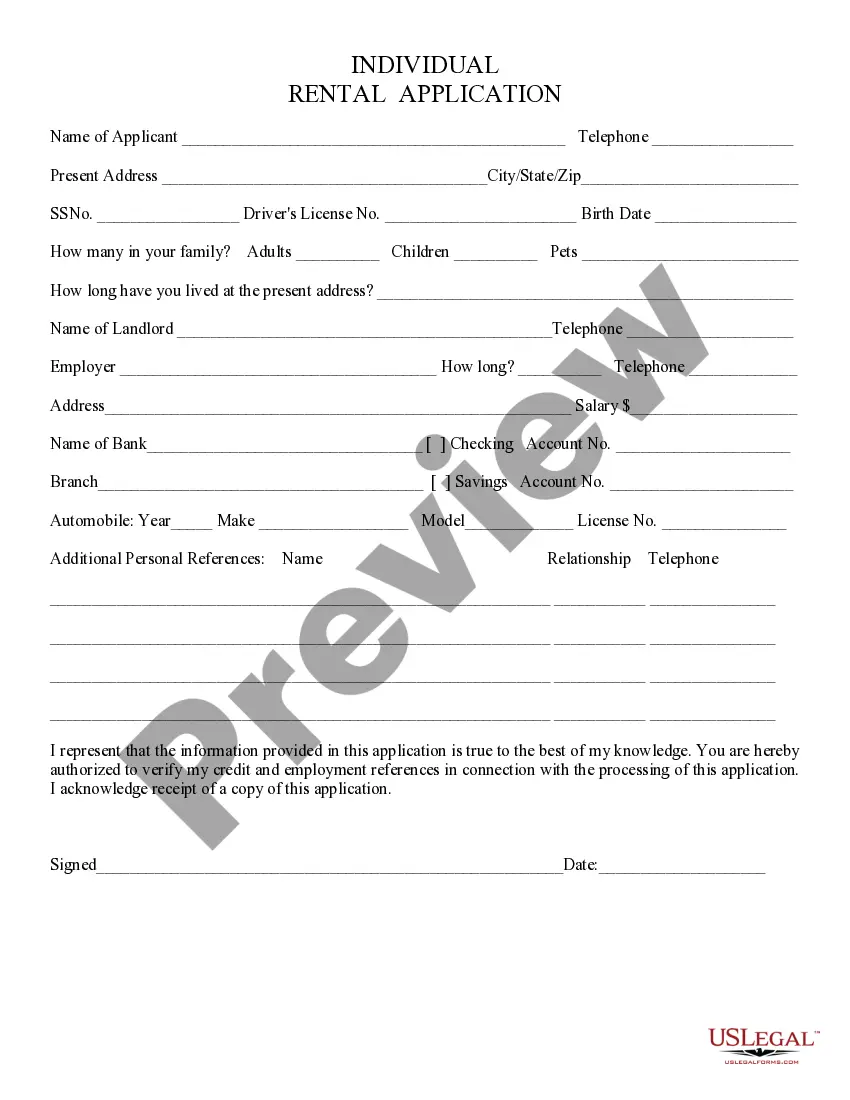

How to fill out Charlotte North Carolina Fideicomiso En Vida Para Esposo Y Esposa Sin Hijos?

If you are looking for a valid form, it’s extremely hard to choose a better place than the US Legal Forms site – one of the most comprehensive libraries on the web. With this library, you can get a large number of templates for organization and individual purposes by types and states, or key phrases. With our high-quality search option, discovering the latest Charlotte North Carolina Living Trust for Husband and Wife with No Children is as easy as 1-2-3. In addition, the relevance of each file is confirmed by a team of professional attorneys that regularly review the templates on our website and update them based on the latest state and county requirements.

If you already know about our system and have an account, all you should do to receive the Charlotte North Carolina Living Trust for Husband and Wife with No Children is to log in to your account and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have found the form you need. Check its information and make use of the Preview function (if available) to explore its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to find the proper record.

- Affirm your choice. Choose the Buy now button. Following that, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the form. Select the file format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the received Charlotte North Carolina Living Trust for Husband and Wife with No Children.

Every form you add to your account does not have an expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to get an additional duplicate for editing or printing, you may come back and download it once again anytime.

Take advantage of the US Legal Forms extensive collection to get access to the Charlotte North Carolina Living Trust for Husband and Wife with No Children you were seeking and a large number of other professional and state-specific templates on one platform!