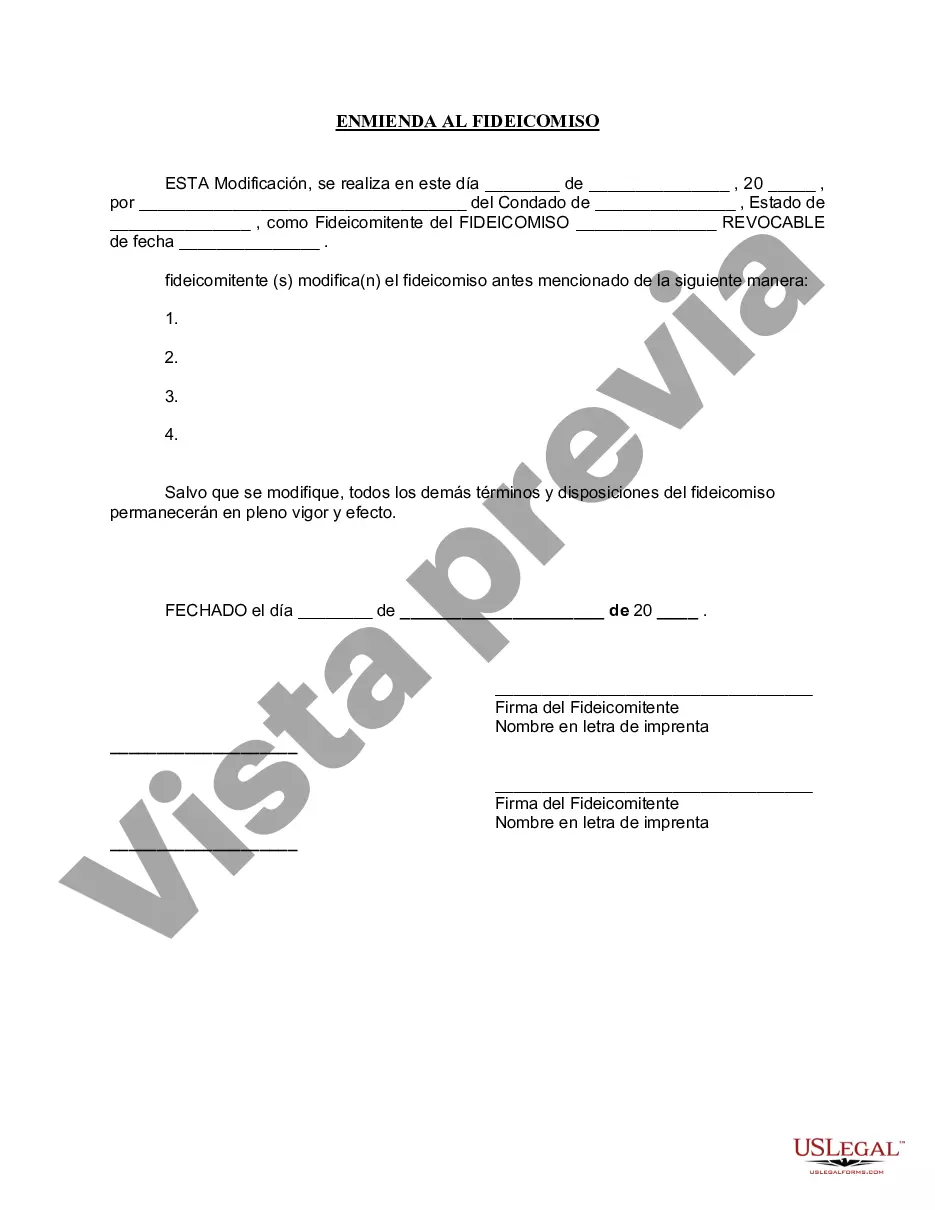

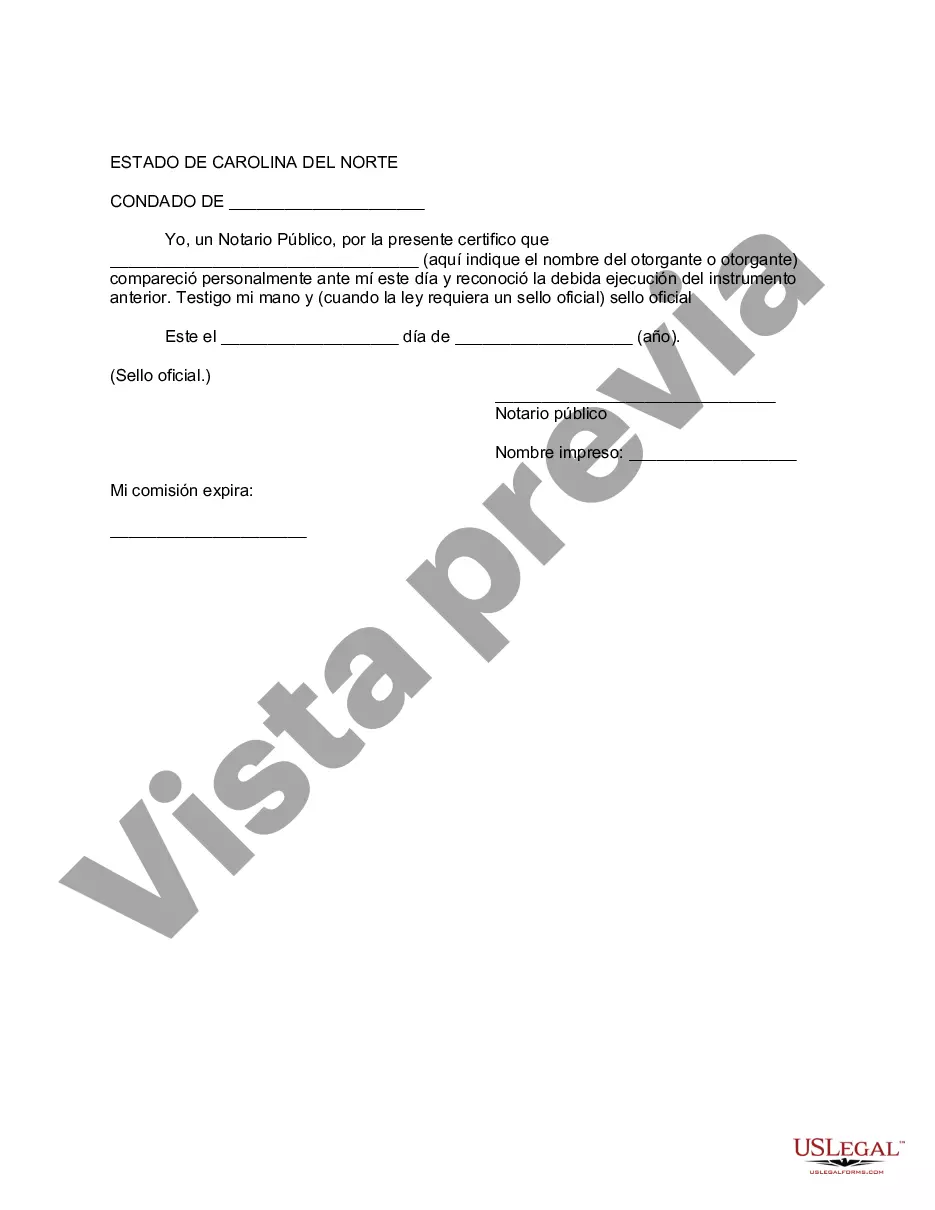

Wilmington North Carolina Enmienda al fideicomiso en vida - North Carolina Amendment to Living Trust

Description

How to fill out North Carolina Enmienda Al Fideicomiso En Vida?

Do you require a reliable and economical supplier of legal documents to procure the Wilmington North Carolina Amendment to Living Trust? US Legal Forms is your ideal option.

Whether you need a basic agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the judiciary, we have everything you need. Our site offers over 85,000 current legal document templates for both personal and business needs.

All templates we provide are not generic; they are tailored based on the specifications of individual states and counties.

To download the document, you must Log In to your account, find the necessary form, and click the Download button beside it. Keep in mind that you can download your previously acquired document templates anytime from the My documents section.

You can now create your account. Then choose the subscription plan and proceed with the payment. Once the payment is finalized, download the Wilmington North Carolina Amendment to Living Trust in any available file format. You can revisit the website at any time and redownload the document at no cost.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time scouring the web for legal paperwork once and for all.

- Are you visiting our website for the first time? No problem.

- You can set up an account in just a few minutes, but before that, make sure to do the following.

- Check if the Wilmington North Carolina Amendment to Living Trust adheres to the legal requirements of your state and locality.

- Examine the form’s description (if available) to understand who and what the form is meant for.

- Restart your search if the form does not suit your particular situation.