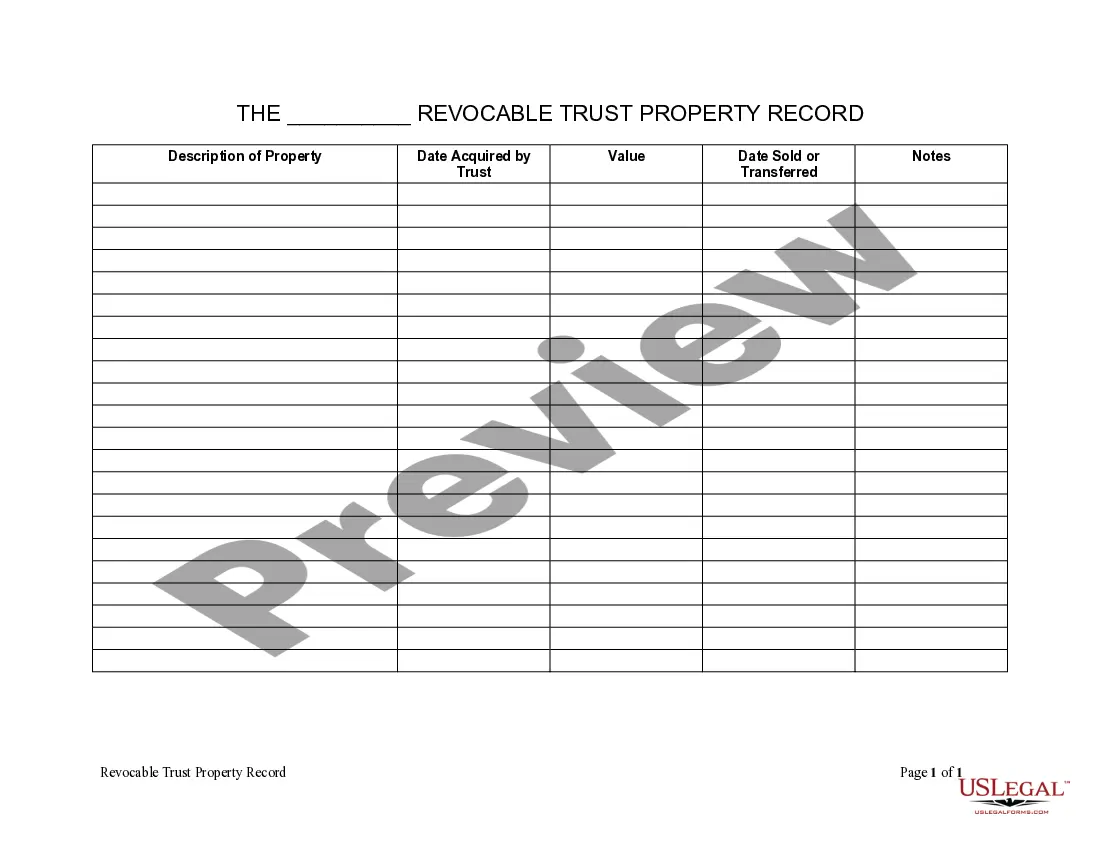

Cary North Carolina Living Trust Property Record

Description

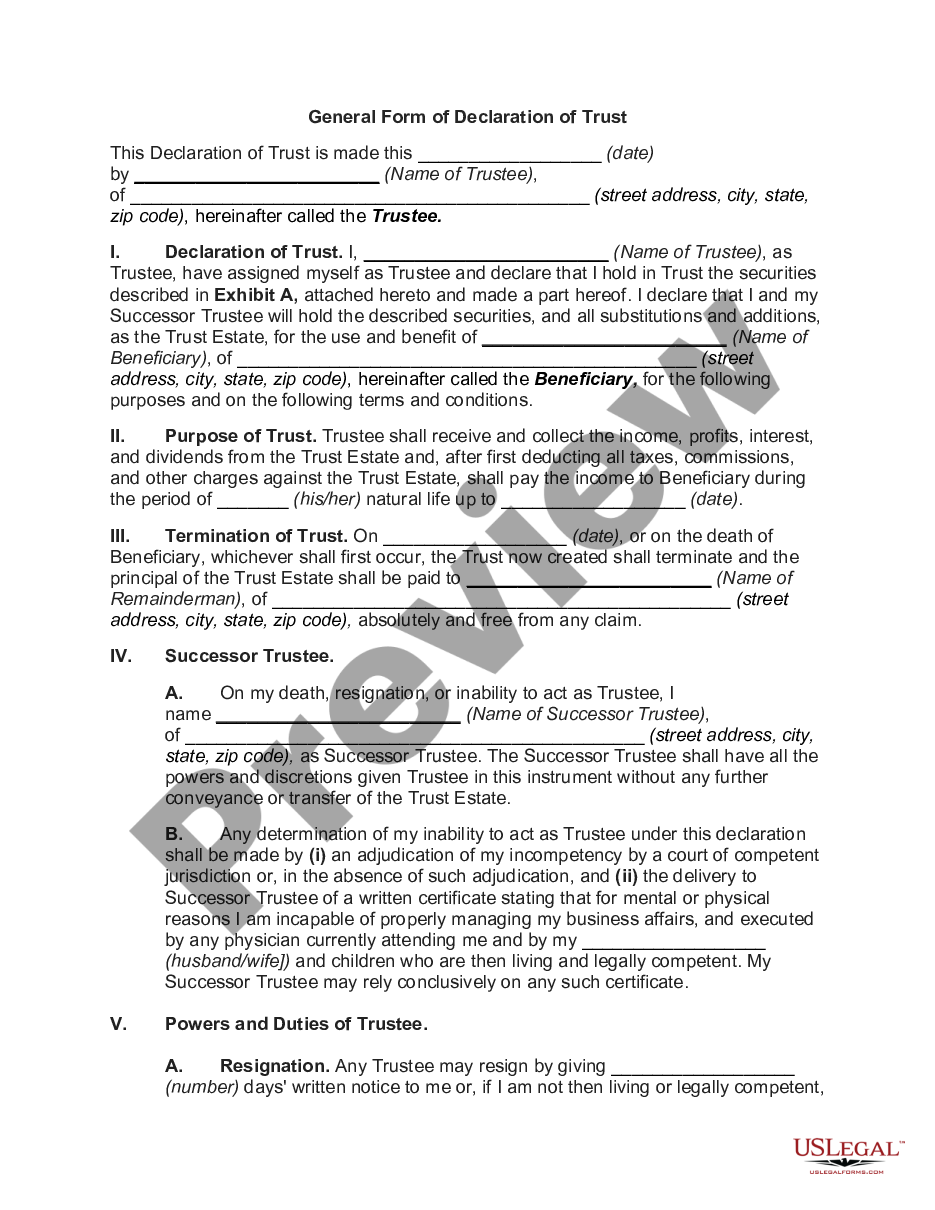

How to fill out North Carolina Living Trust Property Record?

Finding validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal forms catering to both personal and professional needs in various real-life scenarios.

All documents are systematically organized by usage area and jurisdiction, making the search for the Cary North Carolina Living Trust Property Record as simple as 1-2-3.

Provide your payment card information or utilize your PayPal account to finalize the transaction. Download the Cary North Carolina Living Trust Property Record and save the template on your device to fill it out, accessing it again anytime from the My documents menu in your profile. Keeping documents organized and compliant with legal standards holds great importance. Take advantage of the US Legal Forms library to always have essential document templates readily available for any requirements!

- Review the Preview mode and form overview.

- Ensure you’ve selected the appropriate one that fulfills your criteria and completely aligns with your local jurisdiction standards.

- Search for an alternative template if necessary.

- If you discover any discrepancies, utilize the Search tab above to locate the correct document. If it meets your requirements, proceed to the next step.

- Acquire the document. Click on the Buy Now button and choose your preferred subscription plan. You need to register for an account to access the library's materials.

Form popularity

FAQ

To look up property records in North Carolina, visit the county's Register of Deeds website or the North Carolina Department of Revenue's page. These platforms provide access to public records, including those relevant to a Cary North Carolina Living Trust Property Record. Using the online tools available, you can search by address, owner name, or parcel number, making the process efficient and user-friendly.

The property tax rate in Cary, North Carolina, typically fluctuates based on local government budgets and needs. As of the latest data, the rate is approximately $0.52 per $100 of assessed property value. Understanding this tax rate is crucial for anyone managing a Cary North Carolina Living Trust Property Record. You can always check with the local tax office for the most accurate and updated information.

In Cary, North Carolina, a trust does not typically need to be filed with the court. However, proper documentation and management of the trust and its associated assets are crucial. It helps ensure that your wishes are met and reduces potential disputes. Consider utilizing US Legal Forms for easy and effective asset management.

Filing a trust in North Carolina generally involves creating the trust document and ensuring that it complies with state laws. You also need to retitle any assets or property under the trust's name in Cary. While you don't file the trust itself, keeping a thorough record is essential, and US Legal Forms can help you through each step.

Recording a living trust is not mandatory, but it can offer benefits such as clarity and protection of assets in Cary, North Carolina. It's wise to record any property titles associated with the trust to avoid potential legal issues down the line. US Legal Forms can assist in guiding you through this beneficial recording process.

Deciding whether to record a living trust depends on your unique situation. While the trust document itself does not need to be filed, any property titles should reflect the trust's ownership in Cary, North Carolina. This ensures proper asset management and clarity for beneficiaries. Using US Legal Forms can help streamline this process.

In North Carolina, trusts themselves are not typically recorded with county offices. However, property held in the trust, such as real estate, must be reported in the Cary North Carolina Living Trust Property Record. Recording helps establish clear ownership and can prevent future disputes. Consider using US Legal Forms to ensure proper property documentation.

One common mistake parents make is not clearly communicating their intentions for the trust. This lack of clarity can lead to misunderstandings among heirs. Additionally, neglecting to review and update the trust can leave it outdated. Resources from US Legal Forms can guide you in setting up a clear and effective Cary North Carolina Living Trust Property Record.

In Cary, North Carolina, there is typically no legal requirement for a trust to undergo an audit. However, many beneficiaries may request transparency. It's smart to keep detailed records to avoid confusion and maintain trust among family members. Utilizing tools from US Legal Forms can simplify record-keeping.

Filling out a living trust involves several straightforward steps. Start by gathering all relevant documents regarding your assets, such as property deeds and bank statements. Clearly outline your beneficiaries and specify how you want your assets distributed. Using uslegalforms can streamline the process, ensuring your Cary North Carolina Living Trust Property Record is completed correctly and efficiently.