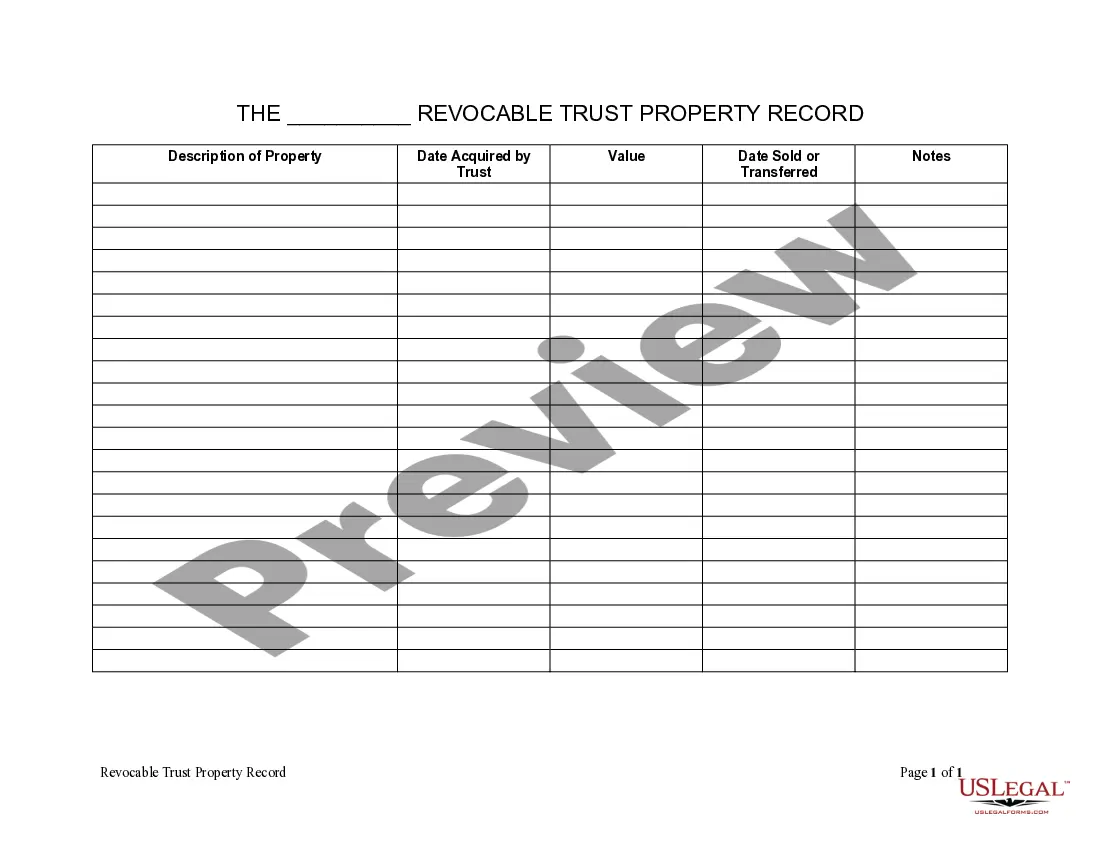

Charlotte North Carolina Living Trust Property Record

Description

How to fill out North Carolina Living Trust Property Record?

Take advantage of the US Legal Forms and gain instant access to any form template you desire.

Our helpful platform with a wide array of document templates streamlines the process of locating and obtaining nearly any document sample you need.

You can save, complete, and sign the Charlotte North Carolina Living Trust Property Record in just a few minutes instead of spending hours online trying to locate the correct template.

Utilizing our collection is an excellent approach to enhancing the security of your document submissions. Our experienced attorneys routinely review all the records to ensure that the forms are applicable for a particular area and in compliance with current laws and regulations.

If you do not have an account yet, follow the instructions provided below.

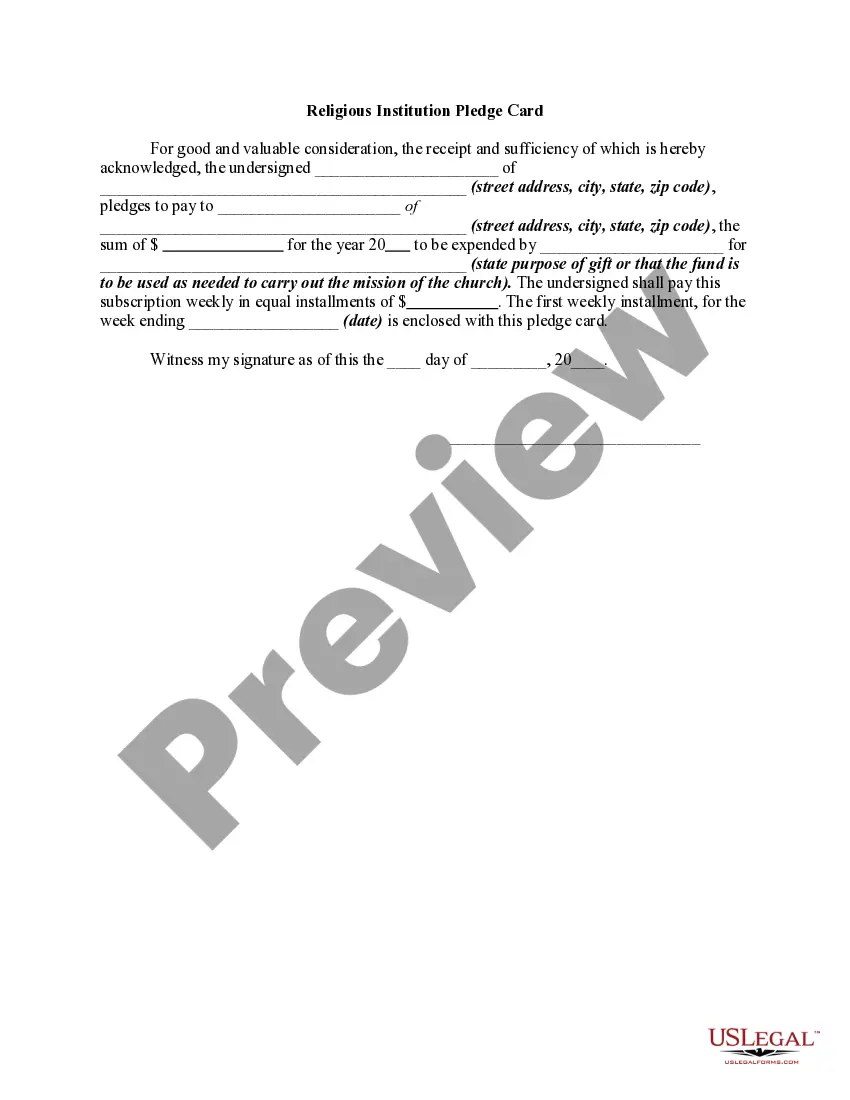

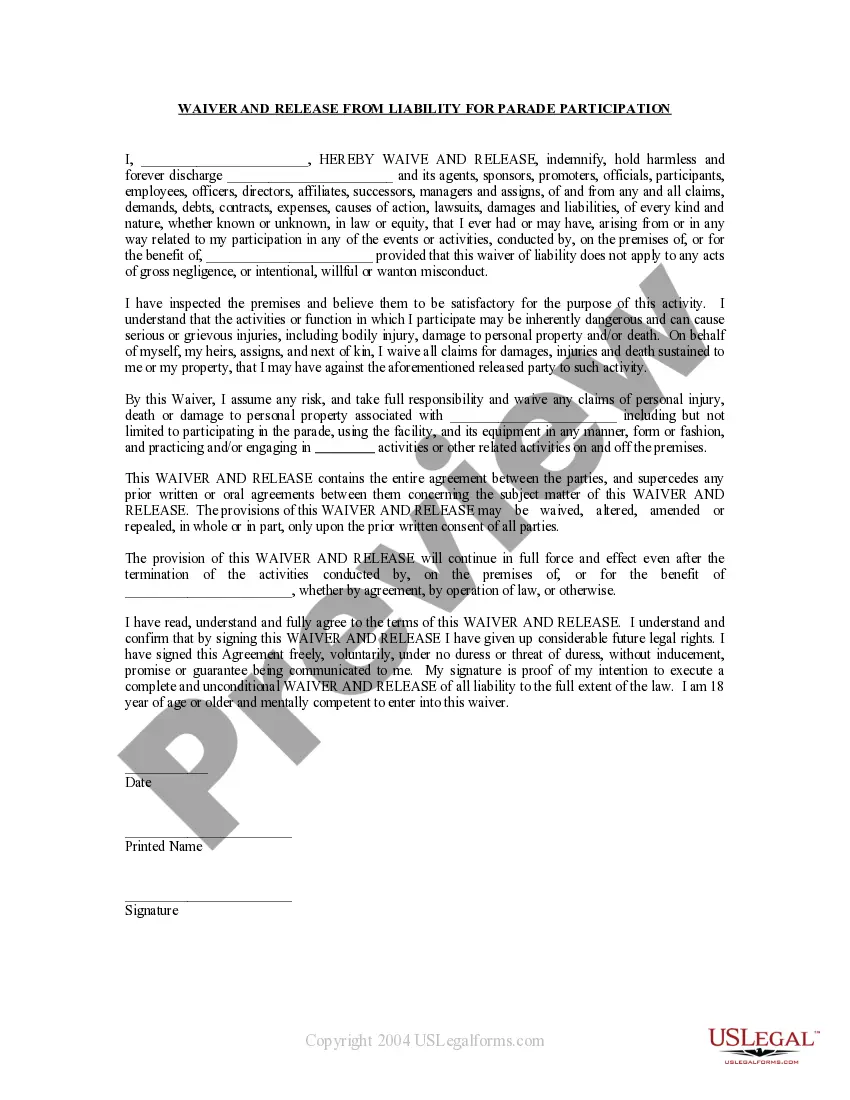

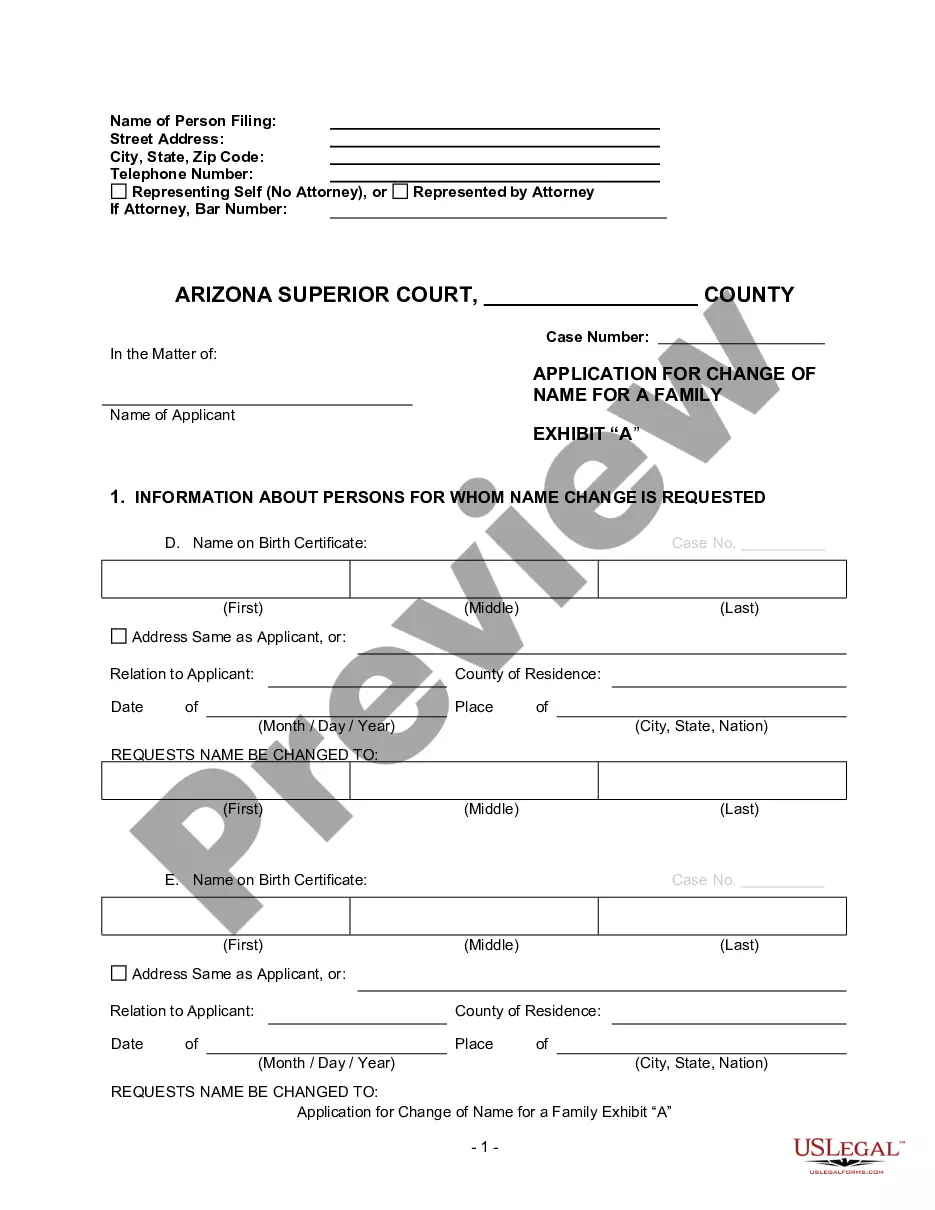

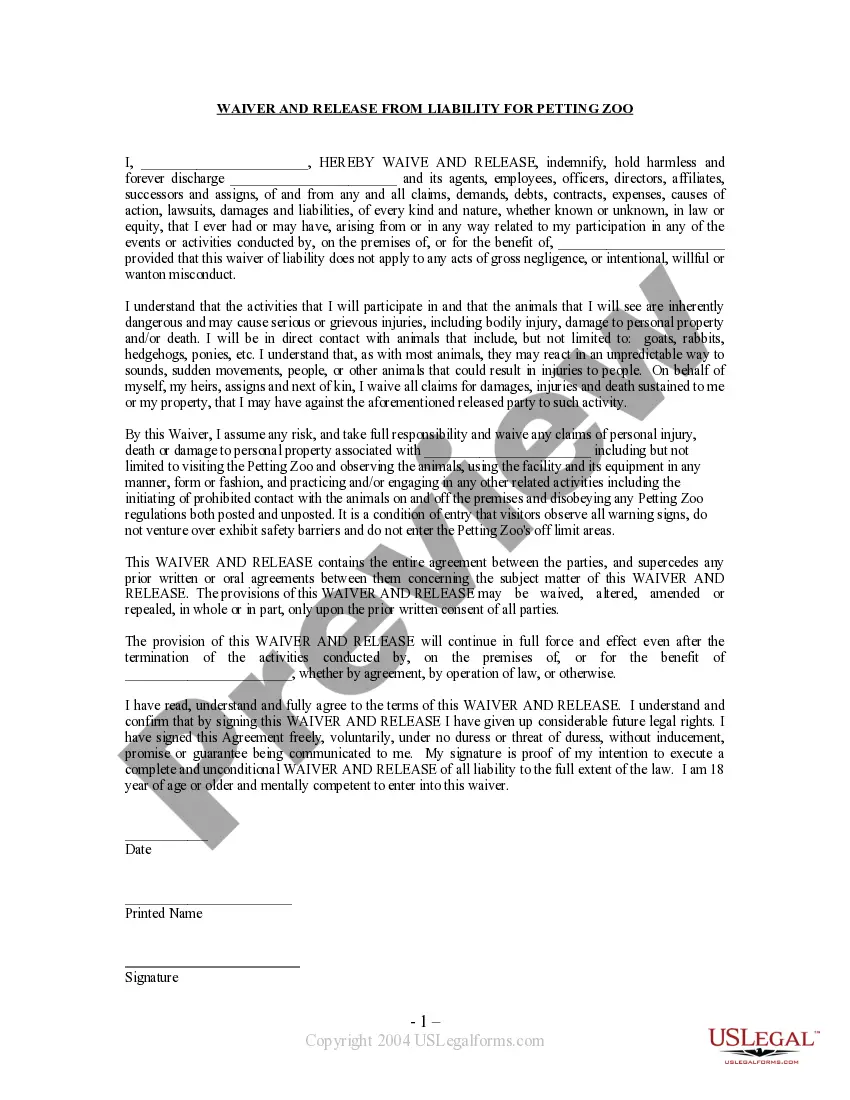

Locate the template you require. Ensure it is the template you anticipated: verify its title and description, and take advantage of the Preview option if it is accessible. Otherwise, use the Search field to find the desired document.

- How can you acquire the Charlotte North Carolina Living Trust Property Record.

- If you already possess an account, simply Log In to your profile. The Download button will be available on all the samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

Another reason to use a trust is that it creates a veil of privacy for you and your family. Wills become part of the public record when they go through probate. Your trust will never become public record and no one needs to know what assets are in it, who your beneficiaries are, or how assets are being distributed.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

The cost of forming a living trust will depend on how you go about setting it up. If you use an online program to draw up the trust document yourself, you will pay a few hundred dollars or less. You can also choose to hire an attorney, which could end up costing more than $1,000.

One advantage for using a trust is that trusts can be used to begin distributing property before death, at death or even sometime afterwards. That isn't helpful or important in all cases, but it provides a level of flexibility that a will simply can't.

A will distributes assets immediately after probate ends. A trust lets you keep assets in the trust if you wish and pass them on at later dates, such as beneficiaries' significant birthdays. Your revocable living trust protects you should you become mentally incapacitated.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

Likewise, North Carolina law provides that all current trust beneficiaries have a right to receive a copy of the trust document, and a right to financial accountings and trust management records at ?reasonable intervals.? It is a good idea for a trustee to be proactive, and responsive, in providing these items to

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

The bottom line is that a trust provides far more potential asset protection than an outright inheritance. Depending upon the needs of your family, an estate planning attorney can create a trust for you that protects assets and preserves them for your beneficiaries.