Cary, North Carolina Financial Account Transfer to Living Trust Are you a resident of Cary, North Carolina, considering a financial account transfer to a living trust? This comprehensive guide will delve into the details of this process and provide you with relevant information to make informed decisions about your estate planning. We will also explore different types of financial account transfers to living trusts, ensuring you gain a complete understanding of your options. In Cary, North Carolina, a financial account transfer to a living trust refers to the act of transferring ownership of your financial accounts to a trust, which you have established during your lifetime. By doing so, you can enjoy the benefits of a living trust while ensuring the seamless management and distribution of your assets upon incapacitation or passing. What is a Living Trust? A living trust is a legal entity created during your lifetime to hold and distribute your assets. Unlike a will, a living trust becomes effective immediately and eliminates the need for probate court involvement upon your death. It also allows for efficient management of your affairs in case of incapacitation or disability, ensuring your finances are handled as per your wishes. Benefits of a Financial Account Transfer to Living Trust: 1. Avoiding Probate: Probate can be a lengthy and expensive process, during which your financial accounts could be tied up. A living trust bypasses probate, allowing for quicker distribution of assets to your beneficiaries. 2. Privacy: Unlike a will, which becomes public record upon probate, a living trust maintains your privacy as its contents remain confidential. 3. Incapacity Planning: A living trust provides a mechanism to manage your financial affairs if you become unable to do so due to illness, injury, or disability. 4. Flexible Asset Management: You retain complete control over your financial accounts during your lifetime and can make changes or amendments to the living trust as needed. 5. Potential Tax Benefits: A living trust may help with tax planning and may provide benefits for certain financial situations. Consult with a financial advisor or tax professional in Cary, North Carolina, to understand the specific advantages applicable to your circumstances. Different Types of Cary North Carolina Financial Account Transfers to Living Trusts: 1. Revocable Living Trust: The most common type of living trust, which allows you to retain control over your assets during your lifetime, make amendments, and revoke the trust if desired. 2. Irrevocable Living Trust: This type of trust cannot be altered or undone without the consent of the beneficiaries. It provides potential tax benefits but limits your control over the assets. 3. Testamentary Living Trust: Created through a will, this type of trust only becomes effective after your passing and must go through probate. It allows for flexibility while maintaining court oversight during administration. Before proceeding with a financial account transfer to a living trust in Cary, North Carolina, it is crucial to consult with an experienced estate planning attorney who can tailor the process to your specific needs and provide legal guidance. They will ensure that all necessary documentation is properly prepared and executed. In conclusion, a financial account transfer to a living trust in Cary, North Carolina, offers numerous benefits, including the avoidance of probate, efficient asset management, and privacy preservation. By choosing the appropriate living trust type, such as a revocable or irrevocable trust, you can customize your estate planning according to your unique requirements. Seek the assistance of a knowledgeable professional to navigate this process smoothly and ensure your assets are protected for future generations.

Cary North Carolina Financial Account Transfer to Living Trust

Description

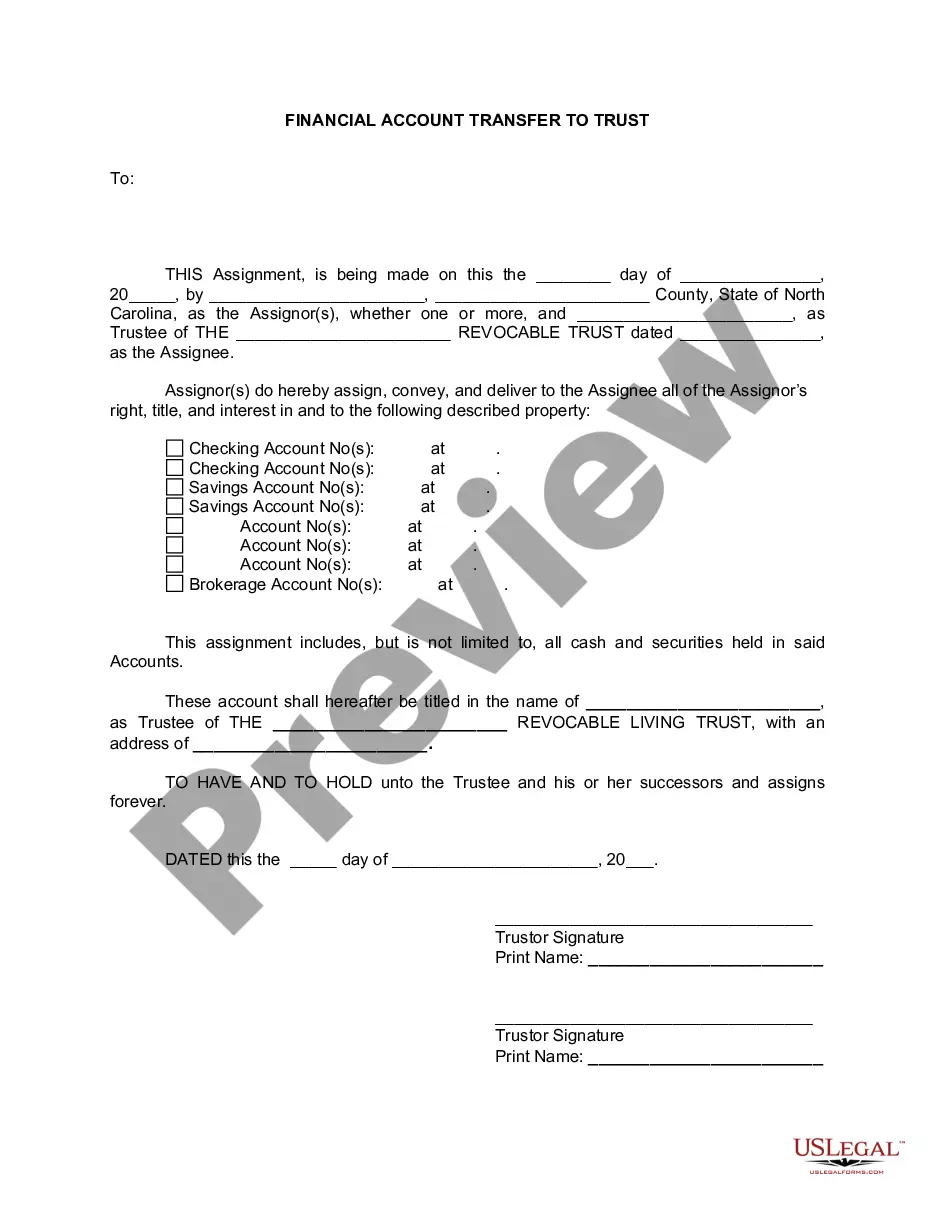

How to fill out North Carolina Financial Account Transfer To Living Trust?

If you are looking for an official document, it’s incredibly challenging to locate a more suitable site than the US Legal Forms platform – likely the most extensive online collections.

With this collection, you can discover a vast array of document examples for business and personal uses categorized by types and jurisdictions, or keywords.

Utilizing our sophisticated search function, locating the most recent Cary North Carolina Financial Account Transfer to Living Trust is as simple as 1-2-3.

Verify your choice. Choose the Buy now option. Afterward, select your desired subscription plan and provide the necessary information to register for an account.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the accuracy of each document is validated by a group of qualified attorneys who regularly examine the templates on our platform and update them in accordance with the latest state and county laws.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Cary North Carolina Financial Account Transfer to Living Trust is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have located the document you require. Review its description and use the Preview feature (if available) to assess its content.

- If it doesn’t fulfill your needs, use the Search option located at the top of the screen to find the suitable document.

Form popularity

FAQ

To transfer your checking account to a trust in Cary, North Carolina, you need to follow a few essential steps. First, establish your living trust by drafting the necessary legal documents, which define the trust's terms and beneficiaries. Next, contact your bank to obtain their specific requirements for transferring the account. Typically, you will need to provide the bank with a copy of your trust agreement and complete some forms, ensuring a smooth Cary North Carolina financial account transfer to living trust.

To transfer your brokerage account to a living trust, begin by reviewing the requirements set forth by your brokerage firm regarding a Cary North Carolina Financial Account Transfer to Living Trust. You will generally need to complete a transfer form and provide a copy of the living trust document. After submitting these documents, your brokerage will process the transfer, ensuring the account is properly titled in the name of the trust. Double-check that all documentation is accurate to ensure a smooth transition.

When you transfer stock to a revocable trust as part of a Cary North Carolina Financial Account Transfer to Living Trust, there are typically no immediate tax consequences. This is because revocable trusts allow you to maintain control over assets during your lifetime. However, once you pass away, tax consequences may arise based on the stock’s appreciated value and the trust's terms. It is wise to consult a financial advisor to assess your situation.

To transfer a brokerage account to a trust, start by notifying your brokerage firm about your intent to perform a Cary North Carolina Financial Account Transfer to Living Trust. They will guide you through the necessary paperwork, which typically includes providing a copy of the trust document and completing specific forms. Once approved, the brokerage will change the account registration to reflect the trust's ownership. Ensure you verify the new account details to avoid any confusion.

Transferring assets to a trust, such as during a Cary North Carolina Financial Account Transfer to Living Trust, is generally not a taxable event. This is because trusts are often treated as pass-through entities for tax purposes. However, it is important to consider any potential implications, such as capital gains or property taxes, based on the type of asset being transferred. Consulting with a tax professional can help clarify any specific concerns you may have.

To transfer your checking account to your living trust, you must contact your bank and request their specific process for this transaction. Typically, you will fill out forms and provide a copy of your trust document. This step ensures your finances align with your estate planning strategy, making the Cary North Carolina Financial Account Transfer to Living Trust even more seamless.

Transferring assets into a trust generally involves changing the title of the asset to reflect the trust as the new owner. This can include real estate, bank accounts, and investments. Proper documentation and legal guidance can simplify the process and ensure compliance with the law, especially when considering the Cary North Carolina Financial Account Transfer to Living Trust.

Deciding whether to place your house in a trust in North Carolina depends on your individual circumstances. A trust can help avoid probate and facilitate a smoother transition of assets upon your passing. However, it's essential to assess your financial situation and future plans. Consulting with experts in the Cary North Carolina Financial Account Transfer to Living Trust can provide invaluable insights tailored to your needs.

While placing your house in a trust can offer benefits, there are potential drawbacks to consider as well. For example, establishing and maintaining a living trust may involve legal fees and ongoing management responsibilities. Additionally, transferring your home to a trust might impact your eligibility for certain government benefits. Evaluating these aspects carefully is crucial before initiating the Cary North Carolina Financial Account Transfer to Living Trust.

Transferring property to a trust in North Carolina involves several steps. You must execute a deed that names the trust as the new owner and file it with the county register of deeds. This process ensures that your assets align with your estate planning goals, particularly when considering the Cary North Carolina Financial Account Transfer to Living Trust.