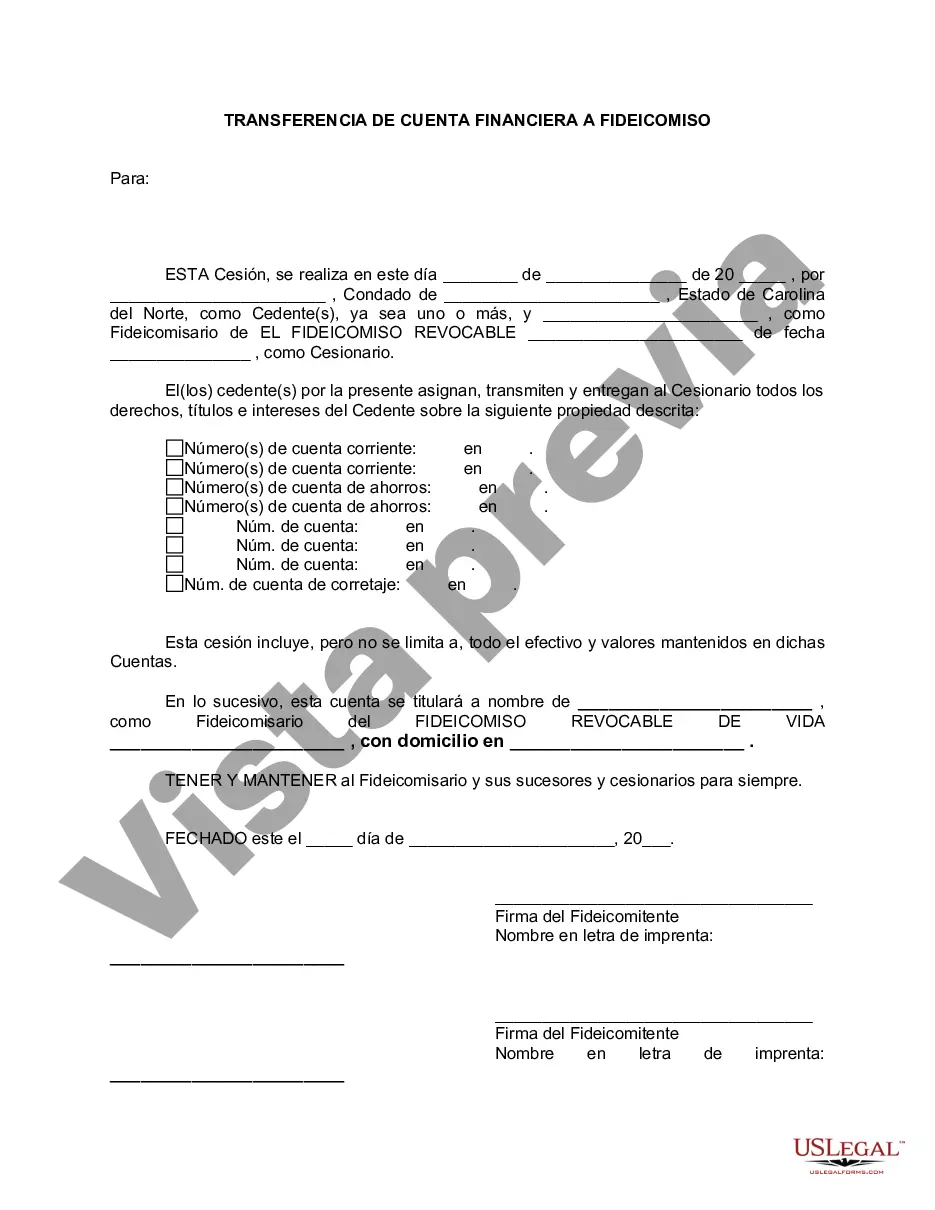

A Charlotte North Carolina Financial Account Transfer to Living Trust is a legal process wherein an individual's financial accounts, such as bank accounts, investment portfolios, and retirement funds, are transferred to their living trust. This transfer occurs in order to ensure seamless management and distribution of these assets upon the individual's incapacitation or death. Living trusts, also known as revocable trusts, are estate planning tools that allow individuals to maintain control over their assets while providing a framework for their efficient administration. By transferring financial accounts to a living trust, individuals can take advantage of various benefits, including avoiding probate, maintaining privacy, minimizing estate taxes, and ensuring a smooth transition of assets to beneficiaries. There are various types of Charlotte North Carolina Financial Account Transfer to Living Trust, including: 1. Bank Account Transfer: This involves transferring personal bank accounts, such as checking and savings accounts, to the living trust. This can be done by contacting the bank and providing the necessary documentation, including the trust agreement. 2. Investment Account Transfer: Individuals can transfer their investment accounts, such as brokerage accounts, stocks, bonds, and mutual funds, into their living trust. This transfer may require completing specific forms provided by the respective financial institution or brokerage firm. 3. Retirement Account Transfer: It is possible to transfer retirement accounts, such as individual retirement accounts (IRAs), 401(k)s, or pensions, to a living trust. However, there are certain rules and restrictions imposed by the Internal Revenue Service (IRS) that need to be followed, including potential tax consequences. 4. Estate Account Transfer: If an individual has an estate account specifically set up for managing their estate's financial matters, this account can also be transferred to the living trust. This account often serves as a centralized hub for managing and distributing assets during the probate process. When pursuing a Charlotte North Carolina Financial Account Transfer to Living Trust, it is essential to seek professional legal advice from an estate planning attorney familiar with the laws and regulations of North Carolina. They can provide guidance tailored to individual circumstances, prepare the necessary legal documents, and ensure a proper and legally binding transfer of financial accounts to the living trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Charlotte North Carolina Transferencia de cuenta financiera a fideicomiso en vida - North Carolina Financial Account Transfer to Living Trust

Description

How to fill out Charlotte North Carolina Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are searching for a pertinent form, you won’t find a superior platform than the US Legal Forms site – quite possibly the most comprehensive libraries available online.

With this collection, you can access thousands of templates for organizational and personal uses by categories and regions, or keywords.

With the premium search feature, locating the latest Charlotte North Carolina Financial Account Transfer to Living Trust is as simple as 1-2-3.

Acquire the form. Select the format and download it onto your device.

Make modifications. Fill out, amend, print, and sign the acquired Charlotte North Carolina Financial Account Transfer to Living Trust.

- If you are already familiar with our platform and possess an account, all you need to obtain the Charlotte North Carolina Financial Account Transfer to Living Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have selected the template you need. Review its description and utilize the Preview option (if available) to view its content. If it doesn't fulfill your requirements, use the Search feature at the top of the page to find the suitable document.

- Validate your selection. Click the Buy now button. Then, choose your desired subscription plan and provide details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Trusts can hold many different types of assets, including cash, stocks, bonds, mutual funds, real estate and other property. Once the account is opened, you can transfer assets into the trust.

What Type of Assets Go into a Trust? Bonds and stock certificates. Shareholders stock from closely held corporations. Non-retirement brokerage and mutual fund accounts. Money market accounts, cash, checking and savings accounts. Annuities. Certificates of deposit (CD) Safe deposit boxes.

The cost of forming a living trust will depend on how you go about setting it up. If you use an online program to draw up the trust document yourself, you will pay a few hundred dollars or less. You can also choose to hire an attorney, which could end up costing more than $1,000.

You cannot put your individual retirement account (IRA) in a trust while you are living. You can, however, name a trust as the beneficiary of your IRA and dictate how the assets are to be handled after your death. This applies to all types of IRAs, including traditional, Roth, SEP, and SIMPLE IRAs.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Using a revocable trust can help you avoid probate Assets that don't pass directly to heirs (such as a bank account, brokerage account, home, etc.) will go through probate before being distributed according to your will (if you had one) or at the court's discretion. Probate is an expensive, time-consuming process.

Retirement plans themselves cannot be transferred into a trust; those assets must be distributed from the plan first, which triggers income tax on the distribution. If you are older than 72 when you die, money generally must come out of your retirement plan according to the schedule that was required before your death.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Pertaining to the types of asset you put in a living trust: generally speaking, all of your assets should be transferred into your trust. However, there are some assets that you may not want or cannot be transferred into the trust. You cannot put a 401(k) in a living trust or other tax-deferred plans, for that matter.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.