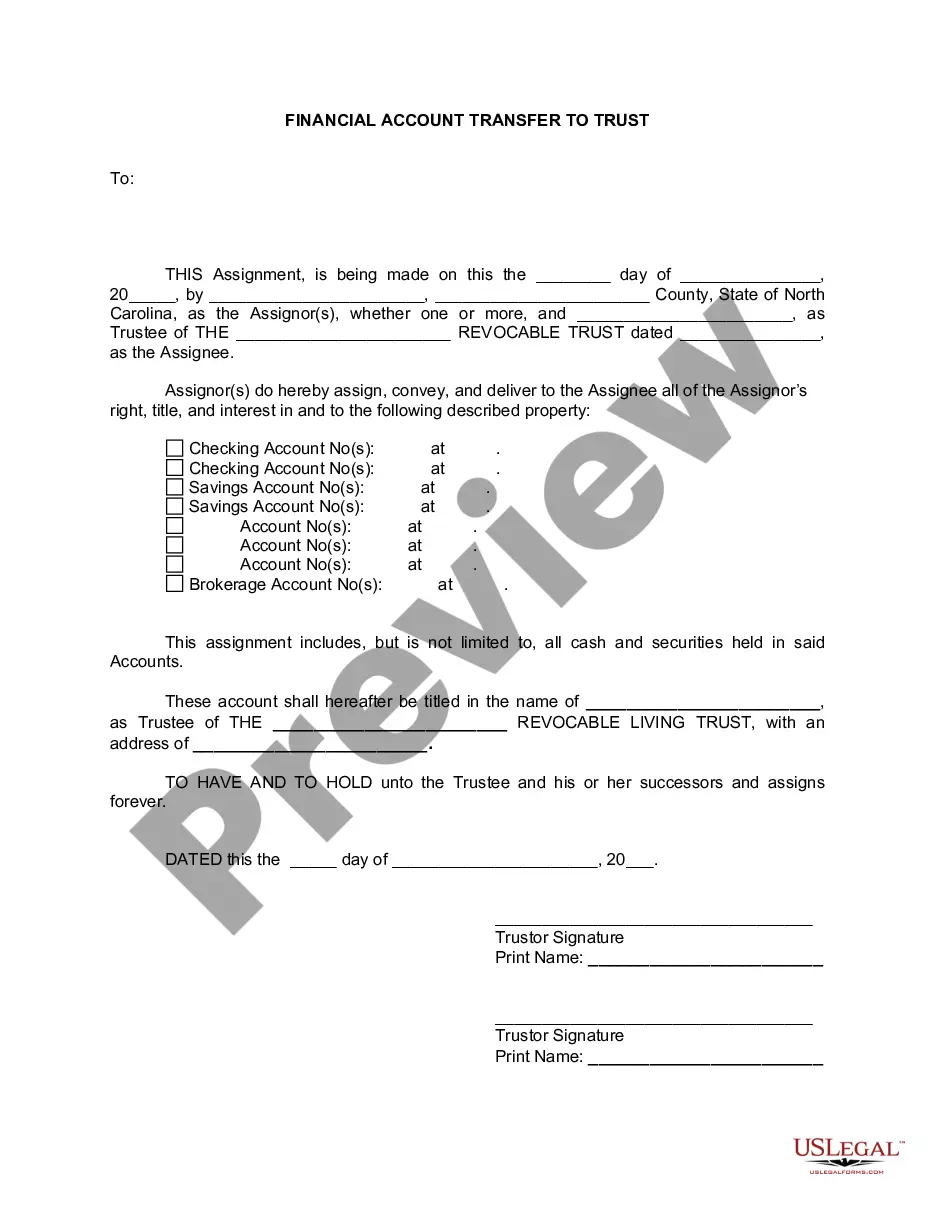

Greensboro North Carolina Financial Account Transfer to Living Trust

Description

How to fill out North Carolina Financial Account Transfer To Living Trust?

Regardless of societal or occupational standing, completing law-related documents is an unfortunate requirement in today's professional landscape.

Frequently, it's nearly impossible for someone lacking any legal background to create this type of paperwork from scratch, primarily due to the intricate language and legal subtleties they entail.

This is where US Legal Forms comes to the aid.

Ensure the form you have selected is appropriate for your jurisdiction, as the regulations of one state or area do not apply to another.

Review the document and examine a brief overview (if available) of scenarios the paper can be utilized for.

- Our platform provides a vast array of over 85,000 ready-to-use state-specific forms that cater to almost any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors who seek to save time using our DIY documents.

- Whether you require the Greensboro North Carolina Financial Account Transfer to Living Trust or another form that will be applicable in your state or jurisdiction, with US Legal Forms, everything is readily available.

- Here's how to swiftly obtain the Greensboro North Carolina Financial Account Transfer to Living Trust using our reliable platform.

- If you are already a member, you can proceed to Log In to your account to download the required form.

- However, if you are not acquainted with our library, make sure to follow these steps before acquiring the Greensboro North Carolina Financial Account Transfer to Living Trust.

Form popularity

FAQ

A family trust can sometimes create tension among family members, particularly if the terms are not clearly communicated. There may also be costs associated with establishing and maintaining the trust, which can put a strain on family finances. In Greensboro North Carolina Financial Account Transfer to Living Trust, understanding these aspects before proceeding is crucial. Utilizing a platform like uslegalforms can assist in navigating these complexities.

If your parents have significant assets or wish to ensure their transfer according to their wishes, establishing a trust may be beneficial. In the context of Greensboro North Carolina Financial Account Transfer to Living Trust, this strategy can provide clarity and prevent disputes among heirs. It often offers protection from probate, saving time and costs. Professional guidance can help tailor the trust to their specific needs.

Putting assets in a trust can lead to possible loss of control over those assets. When you transfer property into a trust, you designate a trustee to manage it, which may limit your access. Furthermore, in Greensboro North Carolina Financial Account Transfer to Living Trust, it is vital to consider the fees involved, which can add up. Understanding these implications helps in making an informed decision about asset placement.

One potential downfall of having a trust is the complexity in setting it up. Greensboro North Carolina Financial Account Transfer to Living Trust may require specific legal guidance to ensure compliance with state laws. Additionally, there can be ongoing administrative duties, such as filing taxes for the trust. It is essential to weigh these factors against the benefits of asset protection and management.

To transfer your brokerage account to a living trust, begin by gathering the trust documentation and account information. Contact your brokerage firm and request their specific forms for account transfer to a trust. Fill out these forms accurately and provide the required documents, which will facilitate your Greensboro North Carolina Financial Account Transfer to Living Trust. This process ensures that your investments are managed according to your wishes within the trust framework.

When you transfer stock to a revocable trust, there are generally no immediate tax consequences. The Internal Revenue Service views the trust and the grantor as the same for tax purposes, so income generated by the stock remains yours. However, it's important to consider how this links to your overall Greensboro North Carolina Financial Account Transfer to Living Trust strategy, since future gains may have different implications. Consulting with a tax advisor can clarify any potential long-term effects.

To transfer property to a trust in North Carolina, you must prepare a deed that conveys the property to the trust. This deed should specify the name of the trust and be signed by the property owner. Once completed, you must record the deed with the appropriate county register of deeds. This process supports your overall Greensboro North Carolina Financial Account Transfer to Living Trust strategy, as it secures your assets in your estate plan.

The 5 year rule for trusts relates to the way assets are treated for tax purposes, particularly Medicaid qualifications. If assets are transferred to a trust within five years of applying for Medicaid, those assets may still be counted towards eligibility. For those considering a Greensboro North Carolina Financial Account Transfer to Living Trust, understanding this rule is crucial to avoid unexpected penalties. Consult a legal professional to effectively navigate this requirement.

To title a brokerage account to a trust, you need to contact your brokerage firm and provide them with the necessary trust documentation. This usually includes a copy of the trust agreement and the trust identification number. After submitting these documents, the brokerage will help you change the title of the account to reflect the Greensboro North Carolina Financial Account Transfer to Living Trust. This ensures that the account is managed according to the terms of your trust.

To transfer your checking account to a trust, you will need to visit your bank with your trust documents. Most banks will ask for the trust's name and tax identification number as part of their verification process. Completing this Greensboro North Carolina Financial Account Transfer to Living Trust ensures your financial assets are managed per your wishes and can simplify handling them for your beneficiaries.