Title: High Point, North Carolina Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In High Point, North Carolina, individuals have the option to transfer their financial accounts to a living trust, offering several benefits for estate planning and ensuring your assets are protected and managed efficiently. In this article, we discuss the process, benefits, and various types of financial account transfers to living trusts available in High Point, North Carolina. 1. Financial Accounts Eligible for Transfer: A financial account transfer to a living trust typically includes the following types of accounts: — Bank Accounts: Such as checking accounts, savings accounts, money market accounts, and certificates of deposit. — Investment Accounts: Including brokerage accounts, stocks, bonds, mutual funds, and other securities. — Retirement Accounts: IRAs, 401(k)s, and pension plans. — Insurance Policies: Cash value life insurance, annuities, and long-term care policies. 2. Benefits of Financial Account Transfer to Living Trust: 2.1 Avoiding Probate: By transferring your financial accounts to a living trust, you can bypass the probate process, saving your loved one's time and expenses. 2.2 Efficient Asset Distribution: Living trusts allow for seamless transfer of assets to beneficiaries, reducing delays and ensuring your wishes are carried out promptly. 2.3 Privacy: Unlike probate, living trusts offer increased privacy since they are not part of public record. 2.4 Incapacity Planning: Living trusts also provide a framework for managing your financial affairs in case of incapacity, with a designated successor trustee. 3. Process of Transferring Financial Accounts to a Living Trust: 3.1 Consultation with an Estate Planning Attorney: Seek guidance from a local High Point, North Carolina attorney with expertise in estate planning and living trusts. 3.2 Determine the Appropriate Living Trust: Working closely with your attorney, select the type of living trust that aligns with your financial goals and circumstances (e.g., revocable or irrevocable trust). 3.3 Draft and Fund the Trust: Your attorney prepares the necessary legal documents, and you transfer ownership of your financial accounts to the living trust by updating account titles and beneficiary designations. 3.4 Notify Financial Institutions: Inform your banks, brokerage firms, insurance providers, and retirement plan administrators about the living trust and provide the required documentation for account ownership transfer. 4. Different Types of High Point North Carolina Financial Account Transfers to Living Trust: 4.1 Revocable Living Trust: Offers flexibility as the trust creator (granter) retains the ability to modify or revoke the trust during their lifetime. 4.2 Irrevocable Living Trust: Once established, this type of trust cannot be modified or revoked, often used for advanced estate planning purposes, asset protection, or tax planning. 4.3 Testamentary Living Trust: Created through a person's last will and testament and becomes effective only upon the granter's death. Conclusion: Transferring financial accounts to a living trust is a prudent step towards effective estate planning and asset management in High Point, North Carolina. By avoiding probate, ensuring efficient asset distribution, maintaining privacy, and planning for incapacity, individuals can secure their financial future and provide for their loved ones seamlessly. Consultation with an experienced estate planning attorney is crucial to navigate the complexities of financial account transfers to a living trust in High Point, North Carolina.

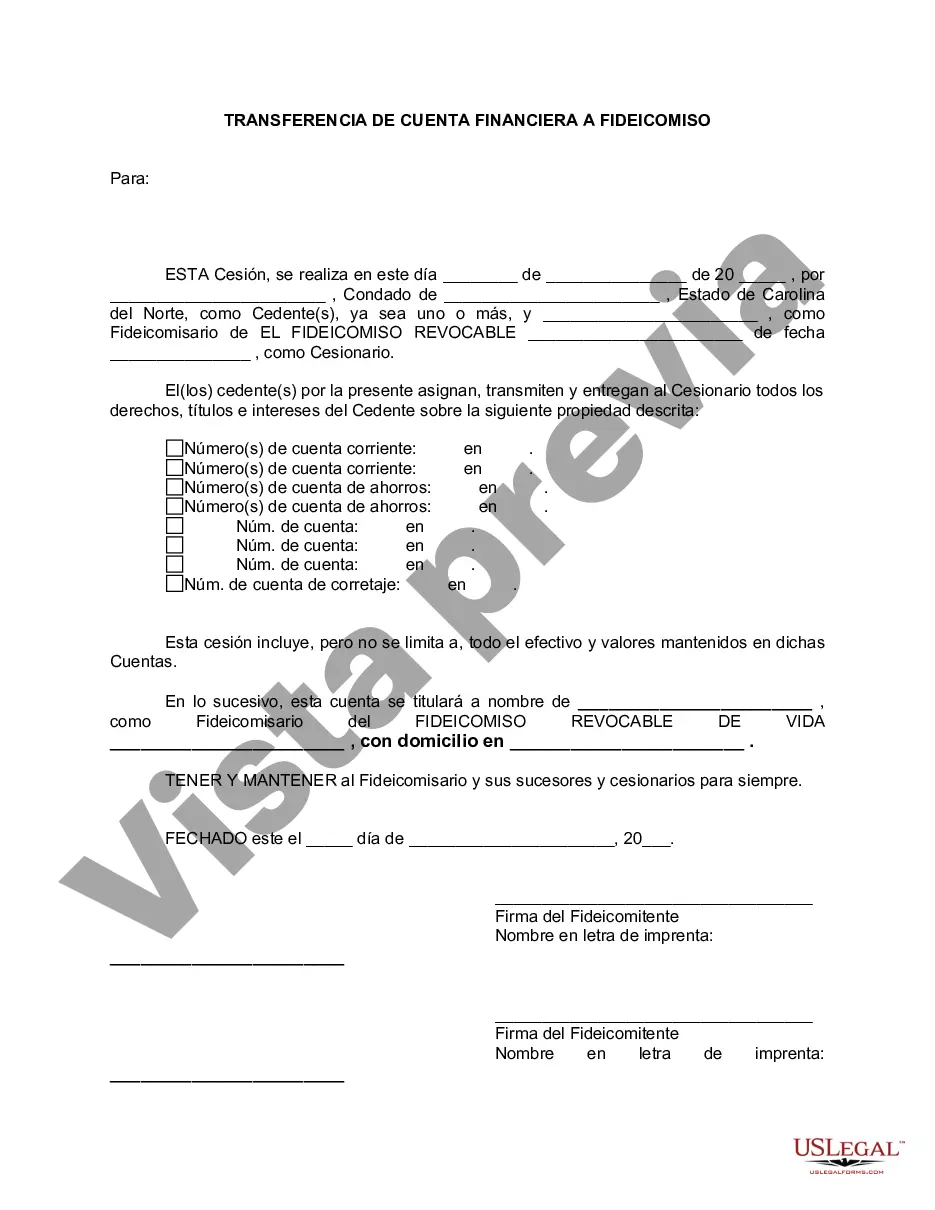

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.High Point North Carolina Transferencia de cuenta financiera a fideicomiso en vida - North Carolina Financial Account Transfer to Living Trust

State:

North Carolina

City:

High Point

Control #:

NC-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Title: High Point, North Carolina Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In High Point, North Carolina, individuals have the option to transfer their financial accounts to a living trust, offering several benefits for estate planning and ensuring your assets are protected and managed efficiently. In this article, we discuss the process, benefits, and various types of financial account transfers to living trusts available in High Point, North Carolina. 1. Financial Accounts Eligible for Transfer: A financial account transfer to a living trust typically includes the following types of accounts: — Bank Accounts: Such as checking accounts, savings accounts, money market accounts, and certificates of deposit. — Investment Accounts: Including brokerage accounts, stocks, bonds, mutual funds, and other securities. — Retirement Accounts: IRAs, 401(k)s, and pension plans. — Insurance Policies: Cash value life insurance, annuities, and long-term care policies. 2. Benefits of Financial Account Transfer to Living Trust: 2.1 Avoiding Probate: By transferring your financial accounts to a living trust, you can bypass the probate process, saving your loved one's time and expenses. 2.2 Efficient Asset Distribution: Living trusts allow for seamless transfer of assets to beneficiaries, reducing delays and ensuring your wishes are carried out promptly. 2.3 Privacy: Unlike probate, living trusts offer increased privacy since they are not part of public record. 2.4 Incapacity Planning: Living trusts also provide a framework for managing your financial affairs in case of incapacity, with a designated successor trustee. 3. Process of Transferring Financial Accounts to a Living Trust: 3.1 Consultation with an Estate Planning Attorney: Seek guidance from a local High Point, North Carolina attorney with expertise in estate planning and living trusts. 3.2 Determine the Appropriate Living Trust: Working closely with your attorney, select the type of living trust that aligns with your financial goals and circumstances (e.g., revocable or irrevocable trust). 3.3 Draft and Fund the Trust: Your attorney prepares the necessary legal documents, and you transfer ownership of your financial accounts to the living trust by updating account titles and beneficiary designations. 3.4 Notify Financial Institutions: Inform your banks, brokerage firms, insurance providers, and retirement plan administrators about the living trust and provide the required documentation for account ownership transfer. 4. Different Types of High Point North Carolina Financial Account Transfers to Living Trust: 4.1 Revocable Living Trust: Offers flexibility as the trust creator (granter) retains the ability to modify or revoke the trust during their lifetime. 4.2 Irrevocable Living Trust: Once established, this type of trust cannot be modified or revoked, often used for advanced estate planning purposes, asset protection, or tax planning. 4.3 Testamentary Living Trust: Created through a person's last will and testament and becomes effective only upon the granter's death. Conclusion: Transferring financial accounts to a living trust is a prudent step towards effective estate planning and asset management in High Point, North Carolina. By avoiding probate, ensuring efficient asset distribution, maintaining privacy, and planning for incapacity, individuals can secure their financial future and provide for their loved ones seamlessly. Consultation with an experienced estate planning attorney is crucial to navigate the complexities of financial account transfers to a living trust in High Point, North Carolina.

Free preview

How to fill out High Point North Carolina Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you’ve already utilized our service before, log in to your account and download the High Point North Carolina Financial Account Transfer to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your High Point North Carolina Financial Account Transfer to Living Trust. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!