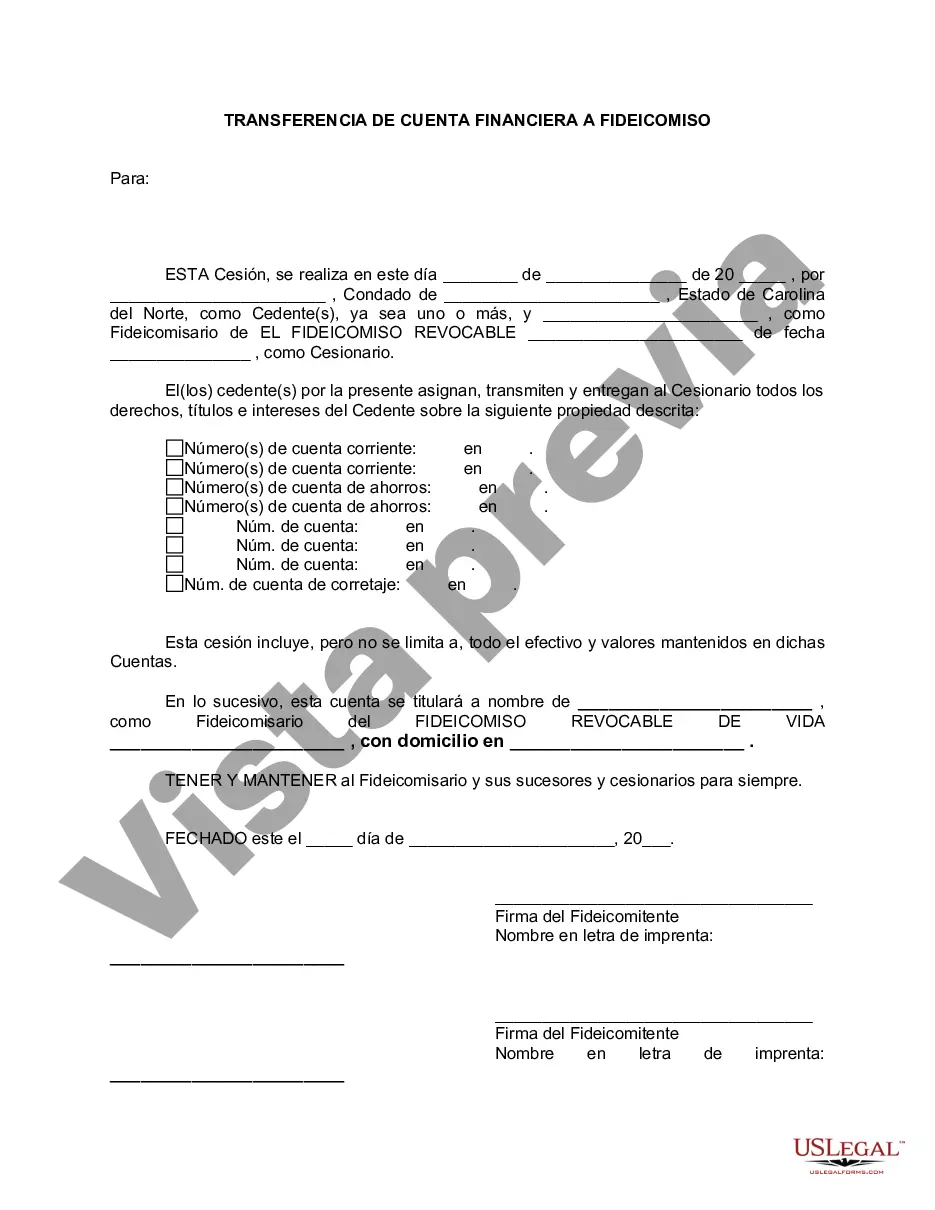

Wake North Carolina Financial Account Transfer to Living Trust is a legal process that involves transferring financial accounts to a living trust located in Wake County, North Carolina. This type of transfer allows individuals to protect their assets, plan for the future, and ensure a smooth transition of their financial accounts after they pass away. The Wake North Carolina Financial Account Transfer to Living Trust provides several benefits to individuals who choose this option. By transferring their financial accounts to a living trust, individuals can avoid the probate process, which can be time-consuming, costly, and may lack privacy. Additionally, the living trust allows the account holder to maintain control over their assets while they are alive and allows for a seamless transfer of ownership to their designated beneficiaries upon their death. There are different types of Wake North Carolina Financial Account Transfer to Living Trust, including: 1. Revocable Living Trust: This type of living trust allows the account holder to have complete control over their assets during their lifetime. They can make changes, add or remove assets, or revoke the trust entirely if they choose. 2. Irrevocable Living Trust: With this type of living trust, the account holder relinquishes control over the assets placed in the trust. Once the assets are transferred, they become the property of the trust, and the account holder cannot make changes or revoke the trust. 3. Testamentary Living Trust: This living trust is created through a will and goes into effect only upon the account holder's death. It allows the assets to be transferred to the trust and distributed according to the account holder's wishes outlined in the will. 4. Special Needs Trust: This type of living trust is designed to provide ongoing financial support and care for a loved one with special needs. It ensures that the funds placed in the trust are managed and distributed in a way that doesn't jeopardize the individual's eligibility for government benefits. 5. Charitable Remainder Trust: This living trust allows the account holder to donate their assets to a charitable organization while receiving income from the trust during their lifetime. Upon the account holder's death, the remaining assets are transferred to the designated charity. In Wake North Carolina, individuals interested in a Financial Account Transfer to Living Trust should consult with an experienced estate planning attorney who specializes in North Carolina law. The attorney will guide them through the legal process, help them understand the different types of living trusts available, and ensure that their financial accounts are transferred correctly and in accordance with their wishes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Transferencia de cuenta financiera a fideicomiso en vida - North Carolina Financial Account Transfer to Living Trust

Description

How to fill out Wake North Carolina Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are searching for a relevant form template, it’s difficult to find a more convenient place than the US Legal Forms site – probably the most considerable libraries on the web. With this library, you can get a huge number of document samples for organization and individual purposes by types and states, or key phrases. With the high-quality search option, finding the newest Wake North Carolina Financial Account Transfer to Living Trust is as easy as 1-2-3. In addition, the relevance of every document is proved by a team of professional lawyers that on a regular basis review the templates on our platform and revise them according to the newest state and county regulations.

If you already know about our system and have a registered account, all you need to get the Wake North Carolina Financial Account Transfer to Living Trust is to log in to your account and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the sample you want. Check its description and use the Preview feature to check its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to discover the proper record.

- Affirm your selection. Click the Buy now button. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Choose the format and download it to your system.

- Make changes. Fill out, revise, print, and sign the received Wake North Carolina Financial Account Transfer to Living Trust.

Every single template you save in your account does not have an expiration date and is yours forever. You always have the ability to access them via the My Forms menu, so if you need to receive an additional copy for enhancing or creating a hard copy, feel free to come back and export it once again at any time.

Make use of the US Legal Forms professional collection to gain access to the Wake North Carolina Financial Account Transfer to Living Trust you were seeking and a huge number of other professional and state-specific samples in one place!

Form popularity

FAQ

Para establecer un fideicomiso, cualquiera de los bancos en Mexico cobrara una cuota anual por mantener el fideicomiso, un promedio de $450 a $550 USD por ano.

Cuando se habla del fideicomiso, es necesario distinguir al menos las tres partes principales que componen esta figura mercantil: el fiduciante, el fiduciario y el fideicomisario. Fiduciante.Fiduciario.Fideicomisario.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

En nuestro actual sistema legal se requiere la intervencion de por lo menos tres partes: el Fiduciante, fideicomitente o constituyente: es el propietario del bien que se trasmite en fideicomiso y es quien instruye al fiduciario acerca del encargo que debe cumplir, este ultimo es quien asume la propiedad fiduciaria y la

Los fideicomisos pueden ayudarte a administrar tus activos, pero tambien los puedes usar para asegurarte de que tu patrimonio se distribuya cuando ya no estes, de acuerdo con tus deseos, para entregar seguridad a tus seres queridos, permitiendo que ahorren dinero y tiempo en papeleo y tramites.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

Cuando se habla del fideicomiso, es necesario distinguir al menos las tres partes principales que componen esta figura mercantil: el fiduciante, el fiduciario y el fideicomisario. Fiduciante.Fiduciario.Fideicomisario.

Los fideicomisos le permiten al otorgante controlar las propiedades, aun despues de su muerte. Los fideicomisos proporcionan privacidadson contratos discretos entre dos partes que raramente son partes del registro publico. Los fideicomisos pueden funcionar para eliminar la necesidad de tutores.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.