Cary North Carolina Revocation of Living Trust

Description

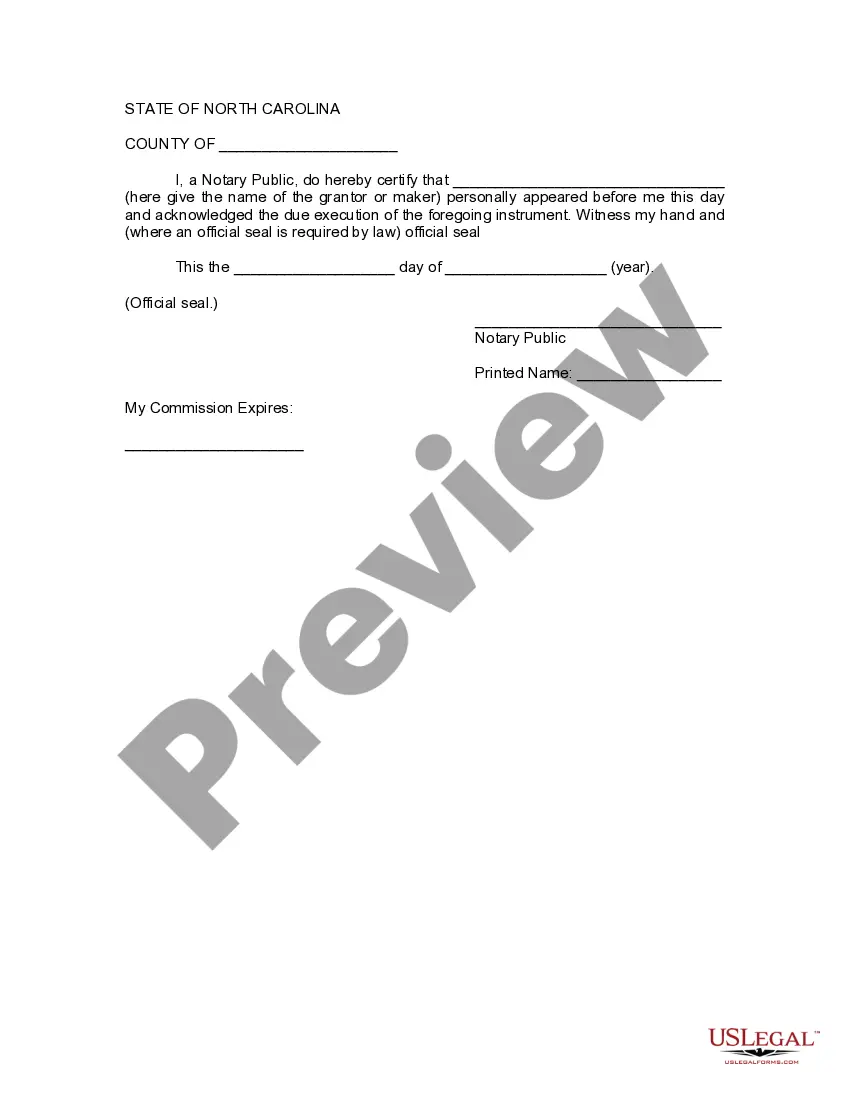

How to fill out North Carolina Revocation Of Living Trust?

We consistently endeavor to reduce or evade legal repercussions when managing intricate legal or financial issues.

To achieve this, we enlist legal remedies that are typically very costly.

However, not all legal challenges are as straightforward.

Many of these can be handled independently.

Utilize US Legal Forms whenever you need to obtain and download the Cary North Carolina Revocation of Living Trust or any other form efficiently and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform allows you to manage your own affairs without the necessity of legal representation.

- We provide access to legal form templates that are not always readily available to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

To shut down a trust, you need to follow a formal process of revocation. In Cary, North Carolina, the Revocation of Living Trust typically involves creating a written document that clearly states your intention to dissolve the trust. It's important to ensure that all assets within the trust are returned to you or redistributed according to your wishes. Utilizing the resources available on the uslegalforms platform can help simplify this process, ensuring that each step aligns with the legal requirements in your area.

Revoking a revocable trust is generally easy and manageable. In Cary, North Carolina, you usually need to sign a written document declaring your intention to revoke the trust. Once this is done, you should also remove any assets held in the trust to ensure your wishes are clear. To navigate the Cary North Carolina Revocation of Living Trust smoothly, US Legal Forms can provide the necessary tools and templates.

Yes, you can remove yourself from a revocable trust in Cary, North Carolina. This process is straightforward since a revocable trust allows you to change or revoke it at any time while you are alive. To formally remove yourself, you may need to document the changes and possibly create a new trust. If you need assistance with the Cary North Carolina Revocation of Living Trust process, consider using the US Legal Forms platform for helpful resources.

The main difference between a revocable trust and an irrevocable trust lies in control and flexibility. A revocable trust allows you to change or revoke the terms anytime during your lifetime while an irrevocable trust typically cannot be altered once established. Understanding the implications of each type is crucial, especially in considerations for Cary North Carolina Revocation of Living Trust.

A trust can be terminated in three primary ways: by the grantor's instruction, when its purpose has been fulfilled, or through a court ruling. Each method has its own considerations, especially regarding Cary North Carolina Revocation of Living Trust. Proper legal guidance can ensure that you're following all necessary steps to terminate a trust correctly.

A revocable trust can be revoked at any time by following the specific procedures outlined in the trust document. Generally, you must provide written notice of revocation and follow any stipulations stated within the trust. If you need guidance in navigating the process, legal platforms like uslegalforms can be helpful resources.

One effective method to protect your assets from nursing homes is by establishing an irrevocable trust. By placing your assets in an irrevocable trust, you can ensure they are no longer considered part of your estate for Medicaid eligibility. However, always explore your options for Cary North Carolina Revocation of Living Trusts to find the optimal solution for your situation.

Yes, an irrevocable trust can be subject to the 5 year rule when it comes to Medicaid eligibility for nursing home costs. This rule states that any assets transferred into an irrevocable trust are viewed as gifts, impacting your eligibility if done within five years of receiving Medicaid. It’s wise to consult a professional regarding Cary North Carolina Revocation of Living Trusts to navigate these complexities.

Yes, nursing homes can potentially access assets in a revocable trust when determining financial eligibility for care. When formulating your plan, take into account that assets held in a revocable trust may be counted in your resources. To preserve your estate, consider taking steps to protect your assets before entering long-term care.

A revocable trust, including those related to Cary North Carolina Revocation of Living Trust, does not offer asset protection. Since you can change or dissolve the trust at any time, creditors can access these assets. It's important to understand that while revocable trusts afford flexibility, they are not shields against legal claims or estate taxes.