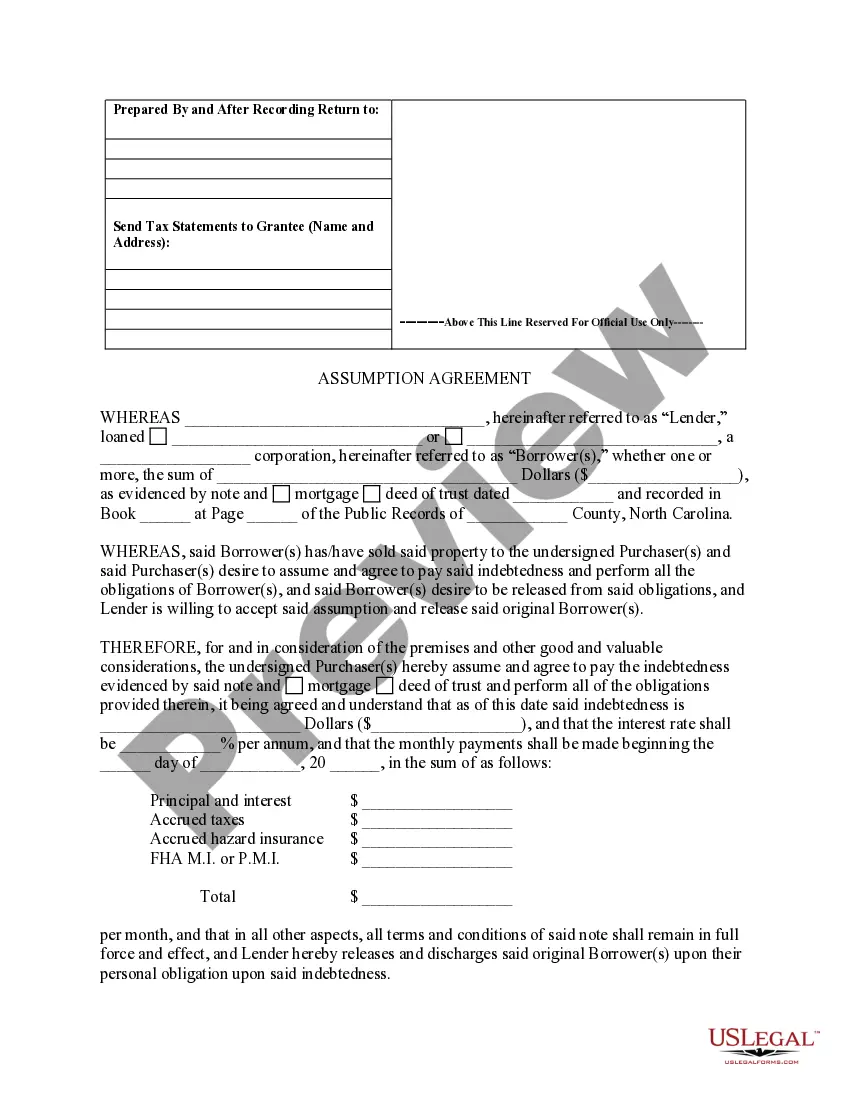

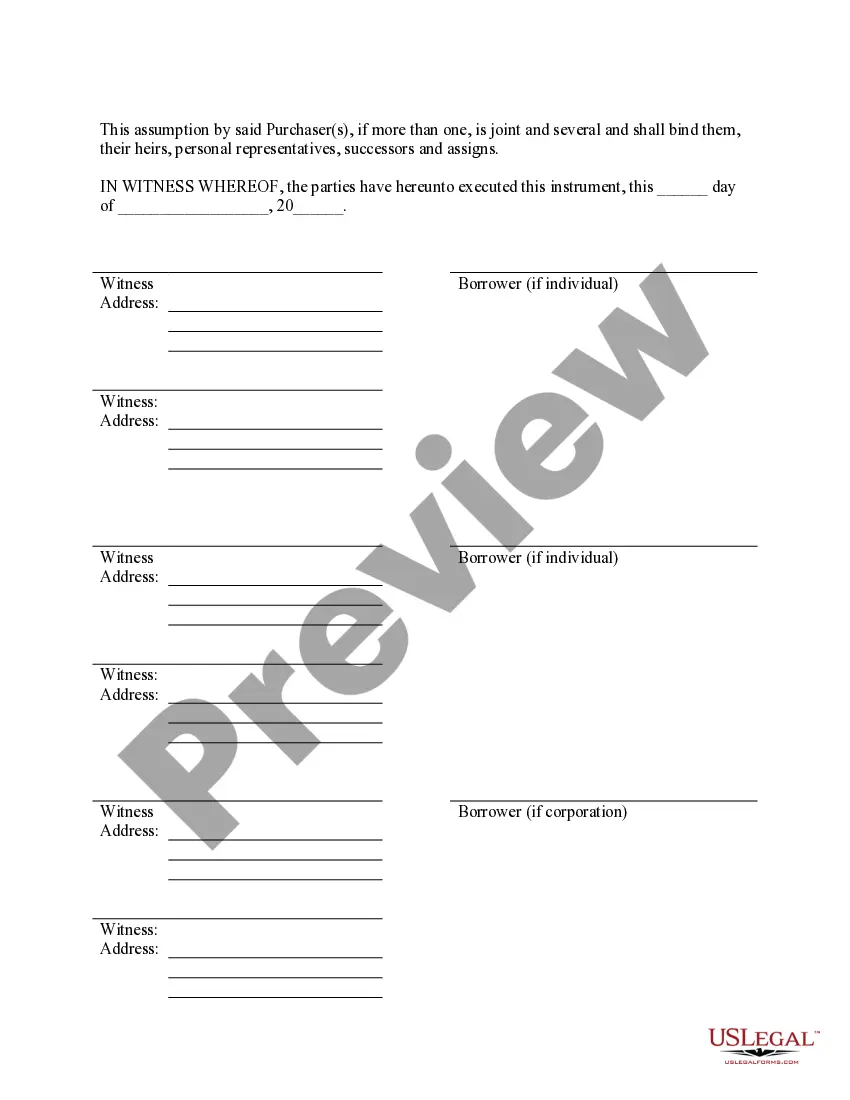

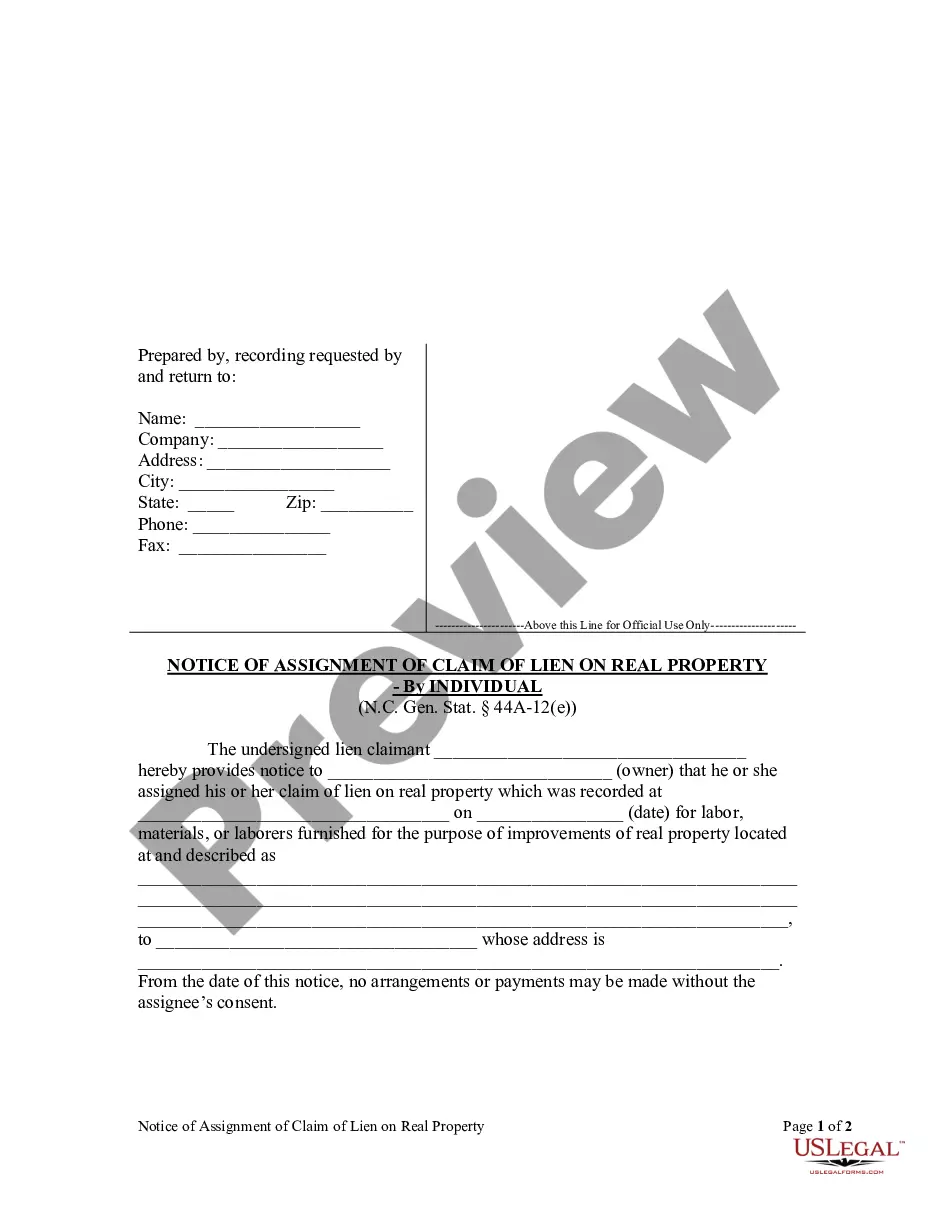

The Cary, North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a property's mortgage from the original borrowers (mortgagors) to a new borrower. This agreement allows the new borrower to assume the existing mortgage and take over the responsibility for making mortgage payments. The assumption agreement typically includes relevant information such as the names and contact details of all parties involved, the original mortgage amount, the interest rate, and the remaining balance on the mortgage. It also specifies the terms and conditions under which the assumption is executed, including any additional fees or costs involved. In Cary, North Carolina, there may be different types of assumption agreements depending on the specific circumstances. For instance: 1. Full Assumption: This type of assumption agreement allows the new borrower to assume all aspects of the original mortgage, including the remaining balance, interest rate, and repayment schedule. The original mortgagors are released from all obligations associated with the mortgage. 2. Partial Assumption: In this scenario, the new borrower assumes part of the original mortgage while the original mortgagors remain liable for the remaining portion. This could occur when there is the need for additional financing or when the parties reach a mutually agreed-upon arrangement. 3. Subject to Assumption: This type of assumption agreement allows the new borrower to assume the existing mortgage while acknowledging that they are not personally liable for the debt. In this case, the original mortgagors remain legally responsible for the mortgage, and any default would affect their creditworthiness. It is crucial for all parties involved to thoroughly review the assumption agreement and consult with legal professionals to ensure compliance with local laws and regulations. Mortgage assumption agreements may have specific requirements and procedures that vary from state to state, and Cary, North Carolina is no exception. In conclusion, the Cary, North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors enables a smooth transfer of mortgage responsibility from the original borrowers to a new borrower. Whether it is a full, partial, or subject to assumption agreement, it is important to understand the terms, obligations, and potential legal implications before entering into such an arrangement.

Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Cary North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Benefit from the US Legal Forms and have immediate access to any form sample you need. Our beneficial platform with a huge number of document templates simplifies the way to find and get virtually any document sample you require. You can download, complete, and certify the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors in just a few minutes instead of surfing the Net for many hours searching for a proper template.

Using our library is a superb way to improve the safety of your document submissions. Our experienced legal professionals regularly review all the documents to make sure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors? If you already have a profile, just log in to the account. The Download option will appear on all the documents you look at. Additionally, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction listed below:

- Open the page with the form you need. Make certain that it is the template you were looking for: examine its headline and description, and utilize the Preview feature when it is available. Otherwise, use the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Indicate the format to get the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors and revise and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and trustworthy template libraries on the web. We are always happy to help you in virtually any legal case, even if it is just downloading the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Feel free to make the most of our platform and make your document experience as efficient as possible!