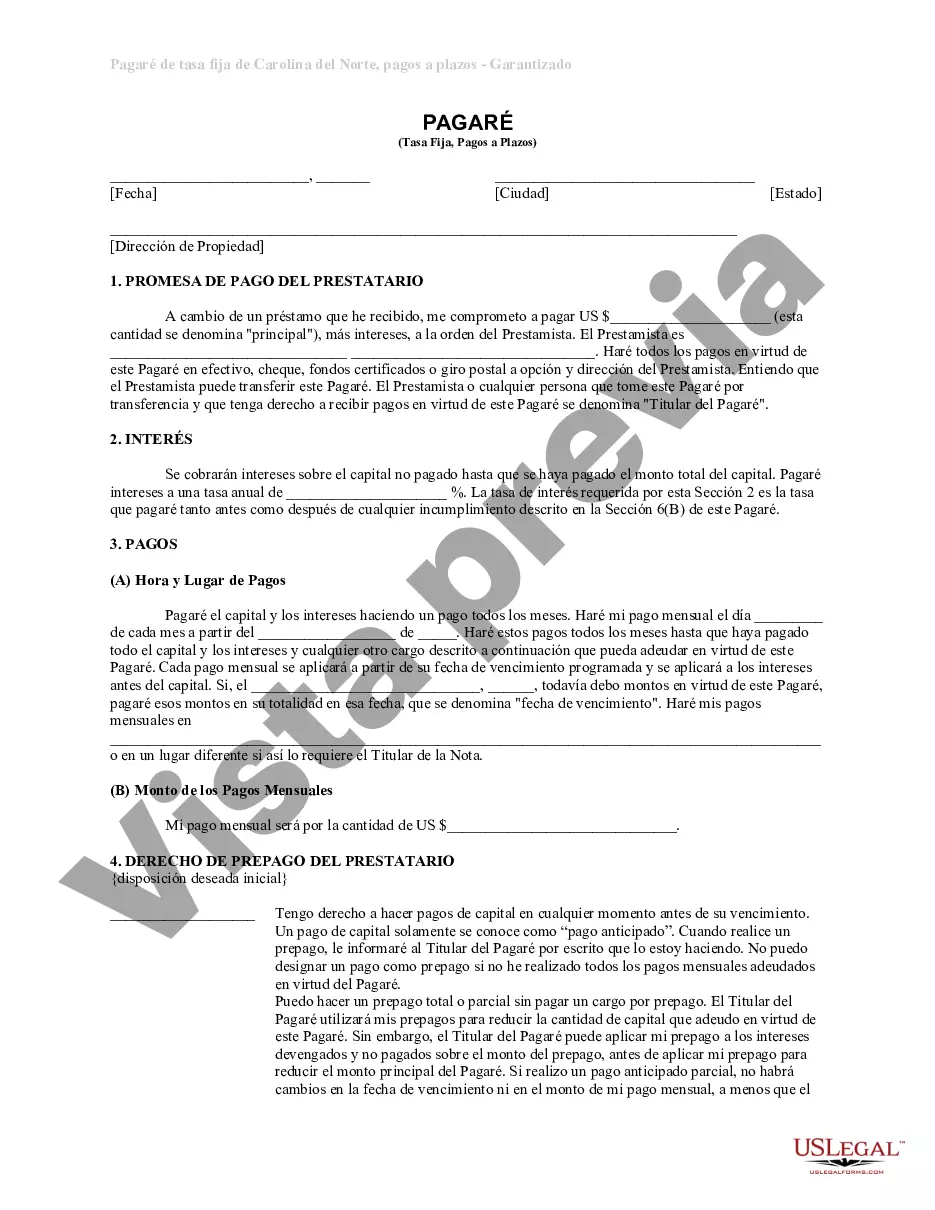

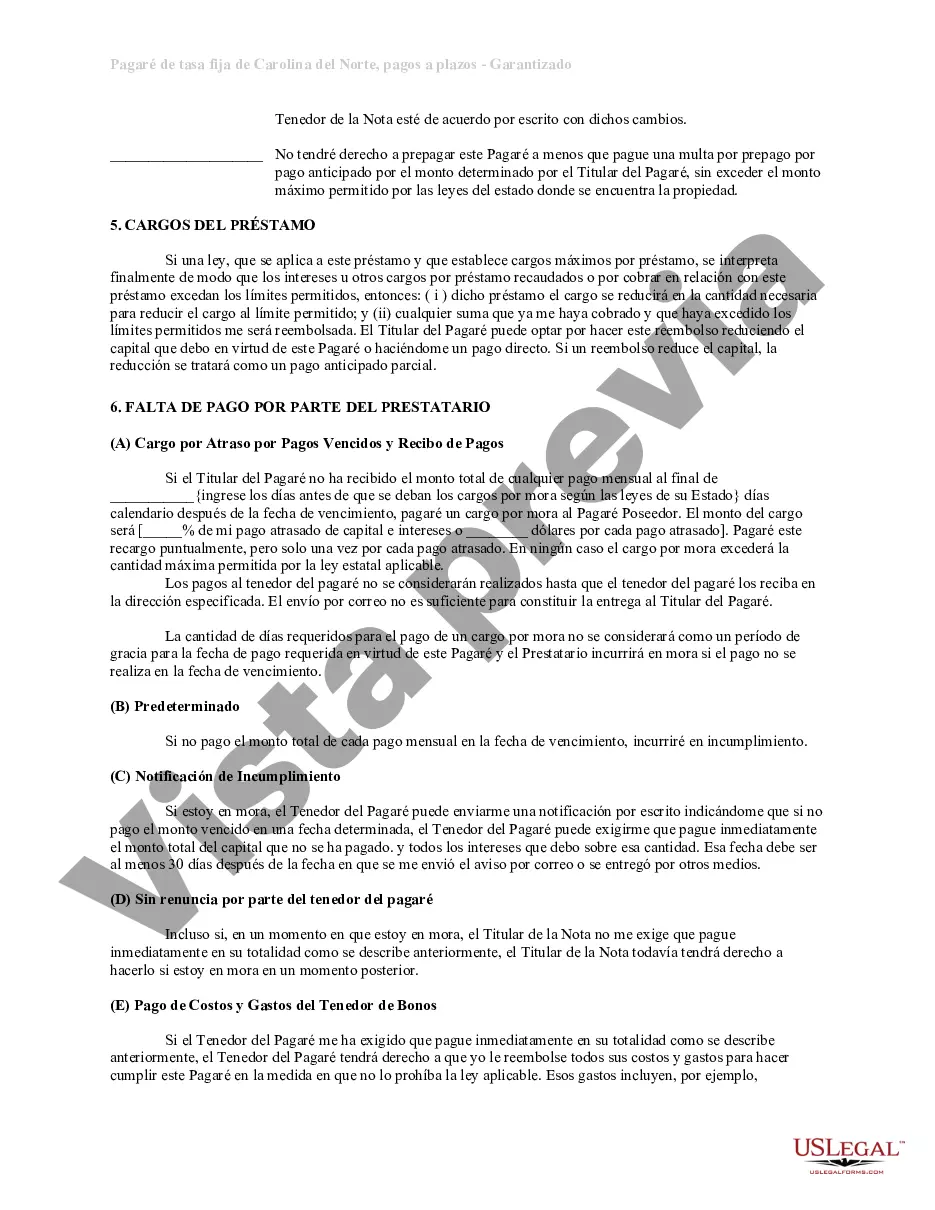

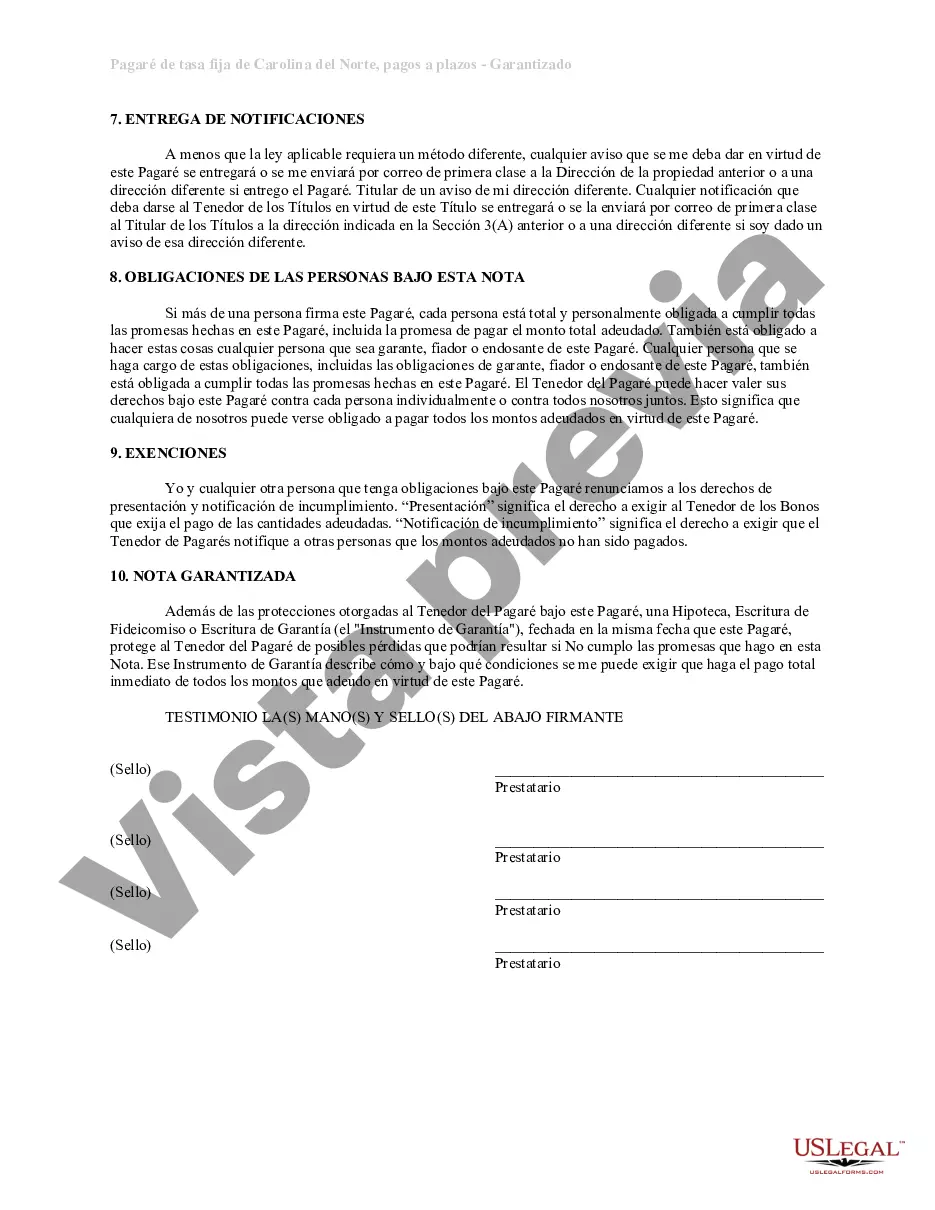

A Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower, where the loan is secured by residential real estate located in Charlotte, North Carolina. Keywords: Charlotte, North Carolina, installments fixed rate promissory note, secured, residential real estate. This type of promissory note is specifically designed for loans related to residential properties within the city of Charlotte in the state of North Carolina. It serves as evidence of the borrower's promise to repay the loan amount in fixed installments, along with a predetermined interest rate, over a specified period of time. The note is secured by the residential real estate property, meaning that in the event of default by the borrower, the lender has the right to seize and sell the property to recover the outstanding loan amount. There may be different types of Charlotte North Carolina Installments Fixed Rate Promissory Notes Secured by Residential Real Estate, depending on the specific terms and conditions agreed upon by the parties involved. These variations can include the loan amount, interest rate, repayment period, and any additional provisions or clauses that may be added to meet the needs of the lender and borrower. Other common types of Charlotte North Carolina Installments Fixed Rate Promissory Notes Secured by Residential Real Estate may include: 1. Residential mortgage promissory note: This type of promissory note is commonly used for financing the purchase or refinancing of a residential property in Charlotte, North Carolina. It outlines the terms of the loan and contains provisions specific to mortgage loans, such as escrow accounts for taxes and insurance. 2. Home equity promissory note: This type of promissory note is used when the borrower has built up equity in their residential property and seeks a loan or line of credit based on that equity. It outlines the terms of the loan, including the interest rate and repayment schedule, while using the property's equity as collateral. 3. Construction loan promissory note: This type of promissory note is utilized when the borrower seeks financing for the construction of a residential property in Charlotte, North Carolina. It outlines the terms of the loan, including disbursement schedules, draw procedures, and other provisions specific to construction loans. In summary, a Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions for a loan agreement related to residential properties in Charlotte, North Carolina. These notes may come in different variations depending on the specific requirements of the lender and borrower, such as residential mortgage promissory notes, home equity promissory notes, and construction loan promissory notes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Charlotte North Carolina Pagaré de tasa fija a plazos de Carolina del Norte garantizado por bienes raíces residenciales - North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Charlotte North Carolina Pagaré De Tasa Fija A Plazos De Carolina Del Norte Garantizado Por Bienes Raíces Residenciales?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Charlotte North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!