A Cary North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines the terms of a loan agreement between a lender and a borrower in Cary, North Carolina. The promissory note serves as a written promise from the borrower to repay a specific amount of money (principal) with interest to the lender within a designated time frame. The key features of a Cary North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property include the following: 1. Loan Terms: The promissory note clearly specifies the loan amount, interest rate, repayment schedule, and duration of the loan. It may also outline any additional fees or penalties associated with late payments or defaults. 2. Personal Property Collateral: This type of promissory note is secured by personal property offered by the borrower as collateral. Personal property may include vehicles, real estate, jewelry, electronics, or any valuable assets that can be transferred to the lender in case of default or non-repayment. 3. Installment Payments: The borrower agrees to make regular fixed-rate installment payments, typically on a monthly basis, towards the loan balance. Each payment consists of both principal and interest, allowing for a gradual reduction of the debt over time. 4. Interest Rate: The promissory note establishes a fixed interest rate, ensuring the borrower's monthly payments remain consistent throughout the loan term. The interest rate is determined based on several factors, such as the borrower's creditworthiness, prevailing market rates, and the nature of the personal property securing the loan. Different types of Cary North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property include: 1. Auto Loan Promissory Note: This type of promissory note pertains specifically to loans secured by personal vehicles. It outlines the terms and conditions unique to auto loans, such as relevant vehicle information, insurance requirements, and provisions for repossession in case of default. 2. Jewelry Loan Promissory Note: If the personal property used as collateral is valuable jewelry, a specialized promissory note may be used. It may contain additional provisions related to the appraisal, maintenance, and insurance of the jewelry. 3. Electronics Loan Promissory Note: For loans secured by personal electronic devices like laptops, smartphones, or gaming consoles, a specific promissory note can be employed. This note might outline the model and condition of the electronics, as well as any necessary authentication or verification processes. In Cary, North Carolina, a Cary North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property is a vital legal document that protects the rights of both the lender and borrower. It ensures transparent communication and sets clear expectations regarding the loan terms, repayment schedule, and collateral requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cary North Carolina Pagaré de tasa fija a plazos de Carolina del Norte garantizado por propiedad personal - North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property

Category:

State:

North Carolina

City:

Cary

Control #:

NC-NOTESEC2

Format:

Word

Instant download

Description

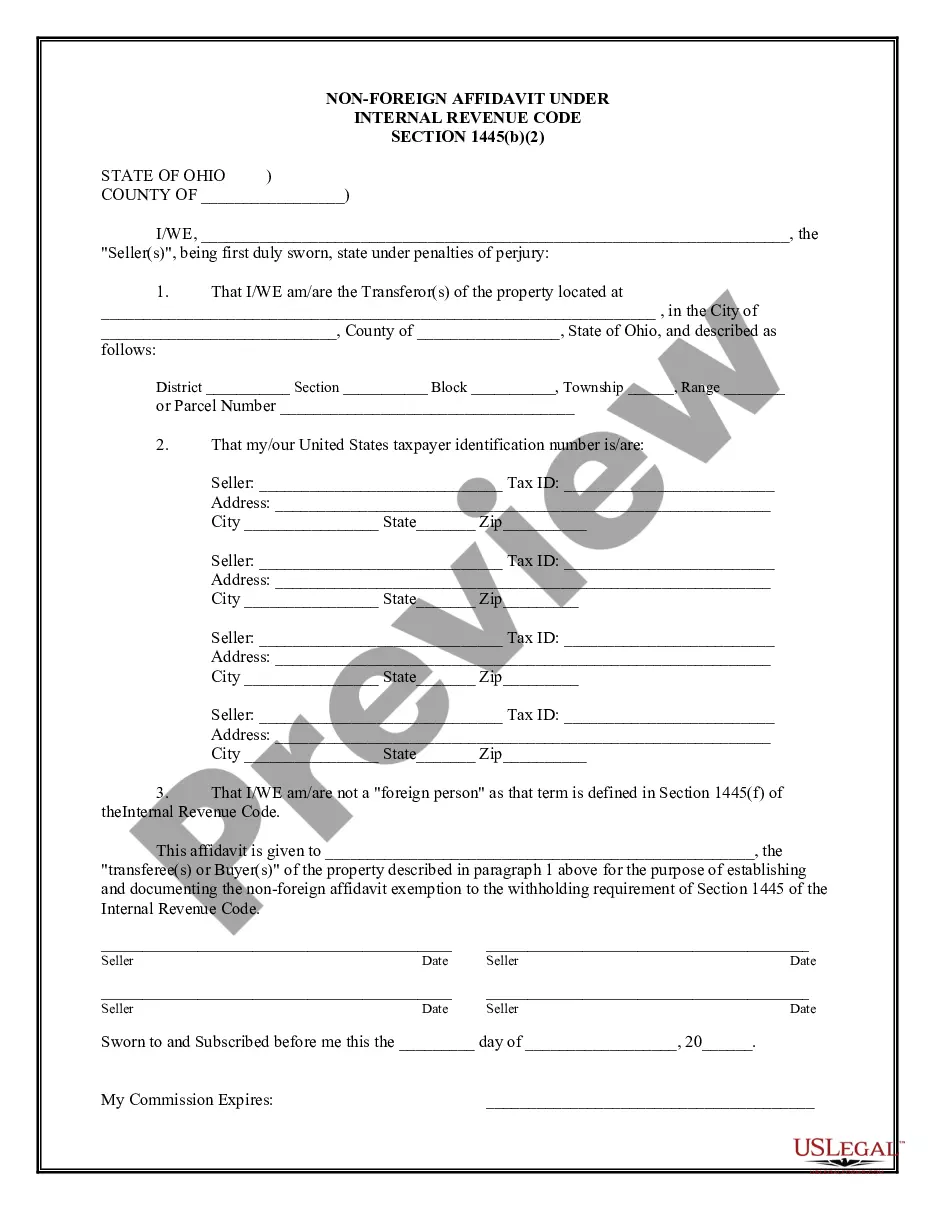

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Free preview

How to fill out Cary North Carolina Pagaré De Tasa Fija A Plazos De Carolina Del Norte Garantizado Por Propiedad Personal?

If you’ve previously utilized our service, Log In to your account and download the Cary North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property onto your device by clicking the Download button. Ensure your subscription is active. If it has expired, renew it based on your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You can access every document you have purchased regularly: it can be found in your profile within the My documents section whenever you need to reuse it. Use the US Legal Forms service to easily find and save any template for your personal or professional requirements!

- Confirm you’ve selected the correct document. Review the description and use the Preview feature, if available, to see if it aligns with your needs. If it doesn’t fit your criteria, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and make a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Cary North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property. Select the document format and save it to your device.

- Complete your sample. Print it out or benefit from professional online editors to fill it out and electronically sign it.

Form popularity

Interesting Questions

More info

Adjusted Entry, An entry made in the general journal at the end of an accounting period to bring certain accounts up to date. Whether, and how much, you will charge for interest or interest payments.Property Tax Rates-Direct and Overlapping Governments, Last Ten Fiscal Years . Interest in the Mortgaged Property and anticipates such subordination to be in place prior to the issuance of the 2021A Bonds. Financial Statements. Sign a promissory note (and if you are an entity, all your owners must sign the note) and give us a security interest in the assets of your Waxing Studio.