Raleigh Annual Minutes for a North Carolina Professional Corporation

Description

How to fill out Annual Minutes For A North Carolina Professional Corporation?

Utilize the US Legal Forms to gain immediate access to any form template you need.

Our user-friendly website, featuring a vast array of templates, streamlines the process of locating and acquiring nearly any document sample you seek.

You can download, complete, and authorize the Raleigh Annual Minutes for a North Carolina Professional Corporation within moments, instead of spending hours scouring the Internet for the perfect template.

Using our catalog is an excellent method to enhance the security of your document filing.

If you do not yet have an account, adhere to the steps outlined below.

Locate the form you need. Ensure it is the form you were looking for: review its title and description, and use the Preview feature if available. If not, use the Search bar to find the correct one.

- Our skilled legal experts routinely review all the documents to ensure that the templates are suitable for a specific jurisdiction and adhere to updated laws and regulations.

- How can you acquire the Raleigh Annual Minutes for a North Carolina Professional Corporation.

- If you already possess a subscription, simply Log In to your account. The Download option will be visible on all the samples you preview.

- Moreover, you can access all previously saved documents through the My documents section.

Form popularity

FAQ

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

Annual and Quarterly Reports SEC rules require your company to file annual reports on Form 10-K and quarterly reports on Form 10-Q with the SEC on an ongoing basis.

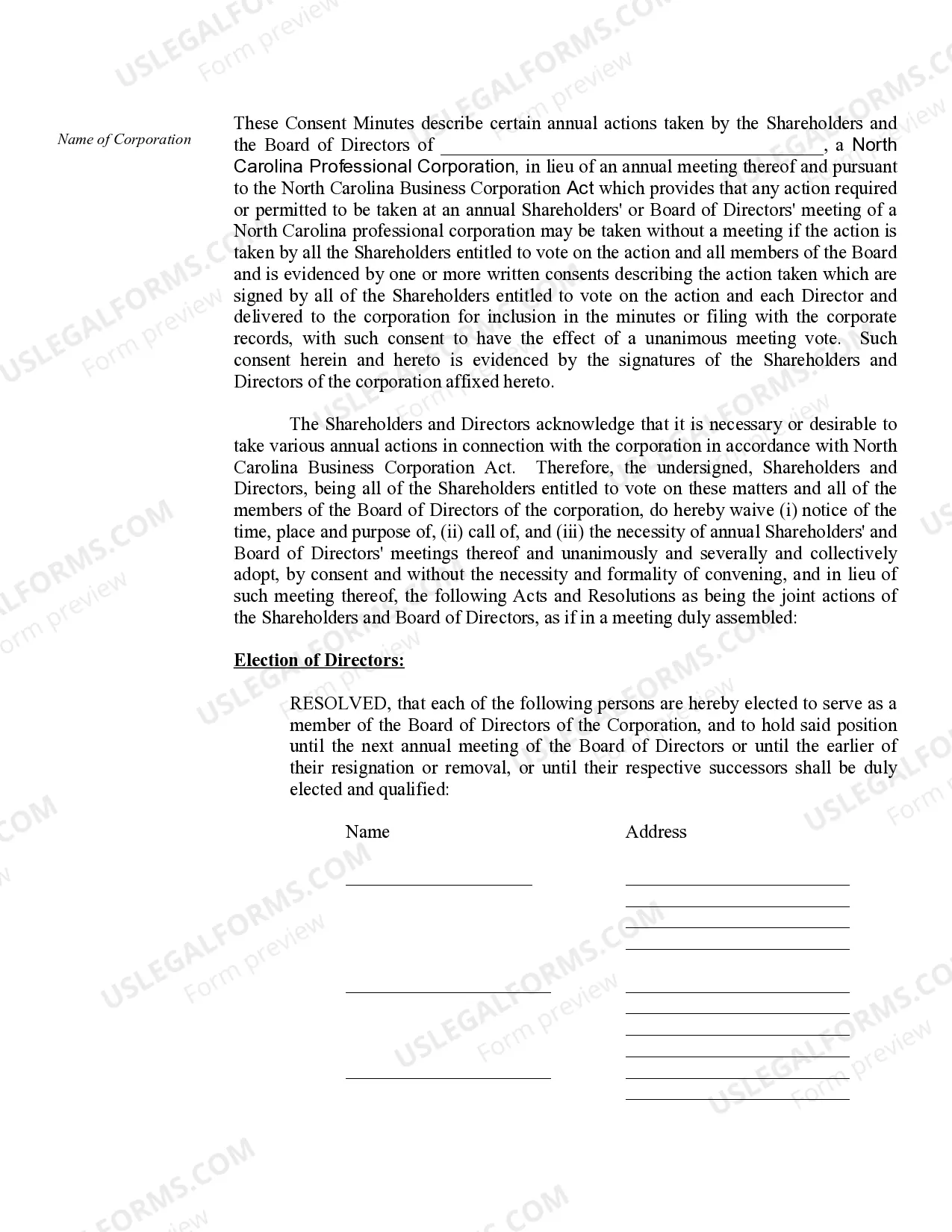

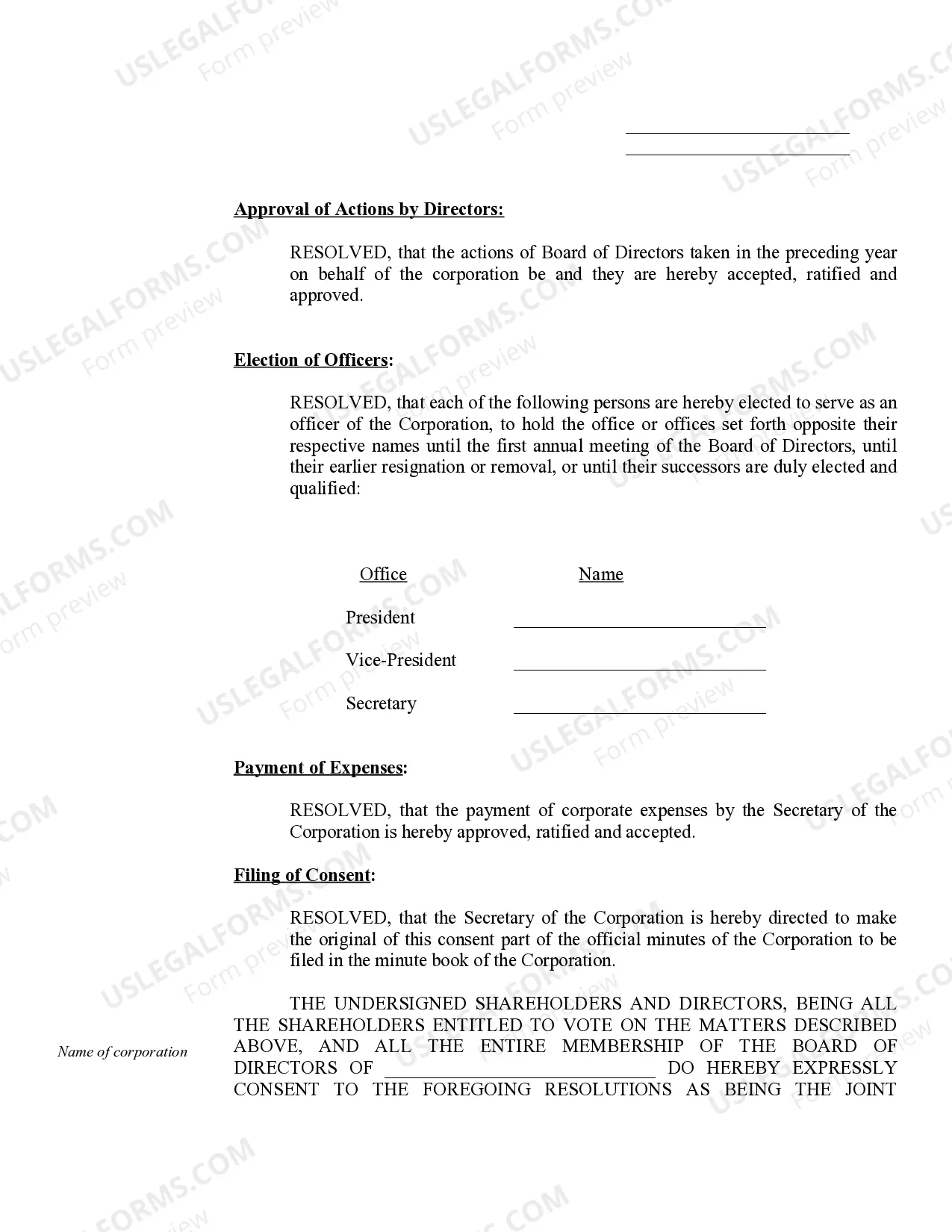

In order to qualify as a Professional Corporation the ownership of the company must meet N.C.G.S. 55B-6 and 55B-4(3), which requires at least 2/3 ownership by licensees and at least one North Carolina licensee for each profession that will be offered who is an officer, director and shareholder in the corporation.

The annual report fee for a limited liability company is $200.00. If filed electronically, there is a $3.00 transaction fee. An annual report filed electronically with the Secretary of State is due by the fifteenth (15th) day of the fourth month following the close of the LLP's fiscal year.

Professional corporations, professional LLCs, and nonprofit corporations do not have to file annual reports in North Carolina.

(5) ?Professional corporation? means a corporation which is engaged in rendering the professional services as herein specified and defined, pursuant to a certificate of registration issued by the Licensing Board regulating the profession or practice, and which has as its shareholders only those individuals permitted by

A company that fails to file an annual report will be administratively dissolved or revoked. To reinstate, an administratively dissolved company must file ALL overdue annual reports as well as an Application for Reinstatement, which carries a $100 fee.

Each Business Corporation, Limited Liability Company, Limited Liability Partnership and Limited Liability Limited Partnership is required to file an annual report with the Secretary of State.

Pretty much anyone can form a regular corporation. Professional corporations, however, are more limited, as only certain professional groups can form one. Which professions qualify varies from one state to the next, but typical professions include doctors, attorneys, chiropractors, accountants, and similar trades.