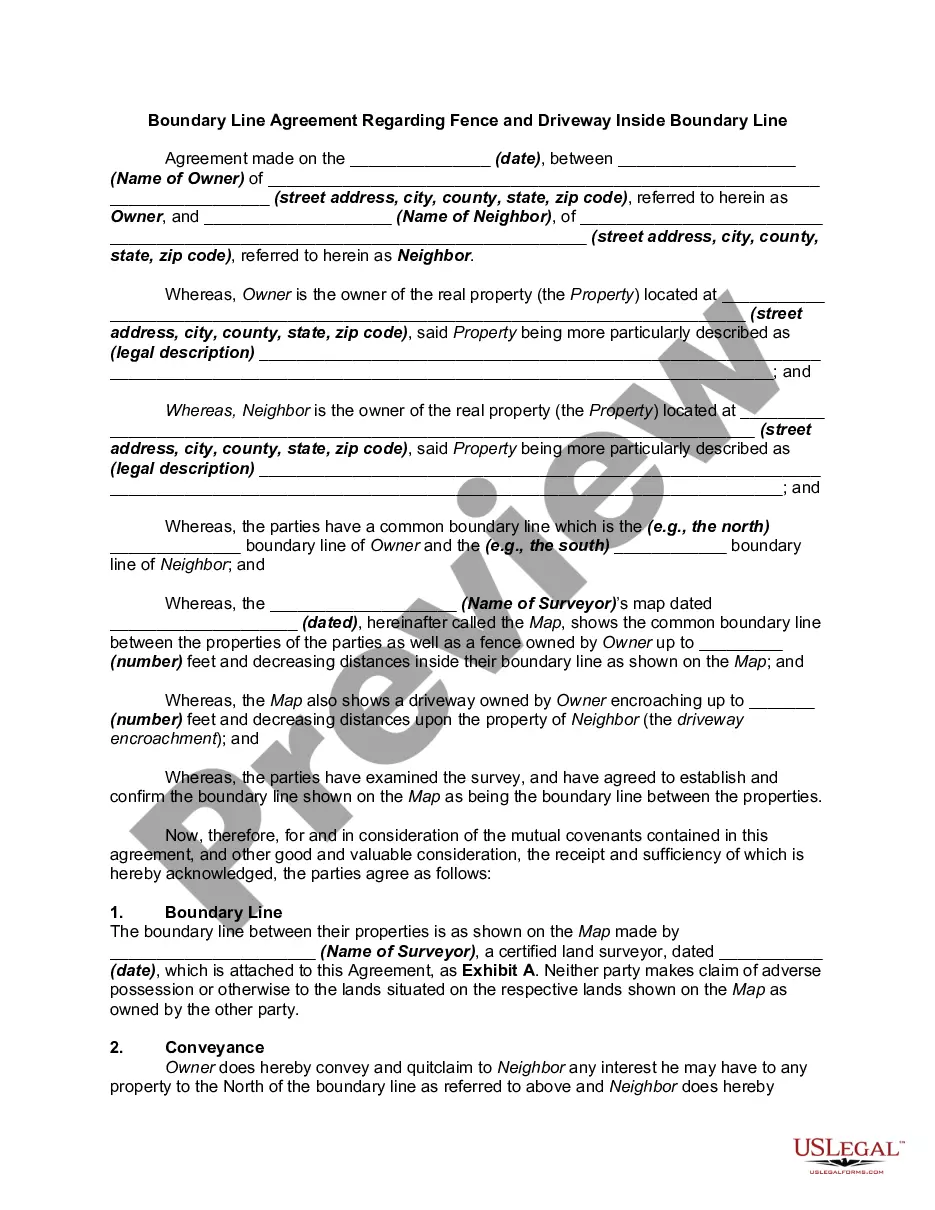

The Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children is a legal document that allows individuals residing in Wilmington, North Carolina, who are married and have no children, to outline their wishes for the distribution of their assets and the management of their affairs after their death. This document ensures that your estate is distributed according to your preferences and eliminates potential disputes among family members. In Wilmington, there are several types of Last Will and Testament forms available for married individuals with no children. These include: 1. Simple Last Will and Testament: This form is suitable for individuals who have a straightforward estate and want to specify their intentions clearly. It typically involves naming the spouse as the primary beneficiary and designating alternate beneficiaries in case the spouse predeceases the testator (the person creating the will). 2. Mutual Last Will and Testament: This form is often utilized by spouses who wish to create a single will document that reflects both of their wishes for the distribution of assets. With a mutual will, both spouses will outline their shared intentions, ensuring consistency and avoiding any misunderstandings after one spouse's passing. 3. Living Will: Although not specific to married individuals with no children, a living will is an essential document to consider alongside a Last Will and Testament. A living will outlines your healthcare preferences should you become unable to communicate them, ensuring that your wishes regarding medical treatments and end-of-life decisions are honored. Within the Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children, you can expect to include the following key details: 1. Identification: Begin the document with your full legal name, as well as your spouse's name, address, and contact information. 2. Executor nomination: Name an executor, who will be responsible for administering your estate according to the instructions outlined in the will. 3. Beneficiary designation: Clearly specify how you want your assets to be distributed upon your death. Identify your spouse as the primary beneficiary, and decide on alternate beneficiaries if necessary. 4. Asset distribution: Provide specific instructions on how various assets, such as property, bank accounts, investments, and personal belongings, should be distributed among beneficiaries. 5. Appointment of a guardian: Although not relevant for married persons with no children, individuals with dependents should include provisions for naming a guardian for their minor children. 6. Residual clause: Include a residual clause to assign any remaining assets or property that might not have been explicitly addressed in other sections of the will. 7. Signatures: Sign and date the document in the presence of witnesses, adhering to the legal requirements of Wilmington, North Carolina. Remember, it is crucial to consult with a qualified attorney to ensure that your Last Will and Testament is legally valid and meets all the specific requirements of Wilmington, North Carolina's jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wilmington North Carolina Formulario de última voluntad y testamento legal para una persona casada sin hijos - North Carolina Last Will and Testament for a Married Person with No Children

Description

How to fill out Wilmington North Carolina Formulario De última Voluntad Y Testamento Legal Para Una Persona Casada Sin Hijos?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of specific state and county.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Start the search over if the template isn’t good for your specific situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children in any provided format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online once and for all.