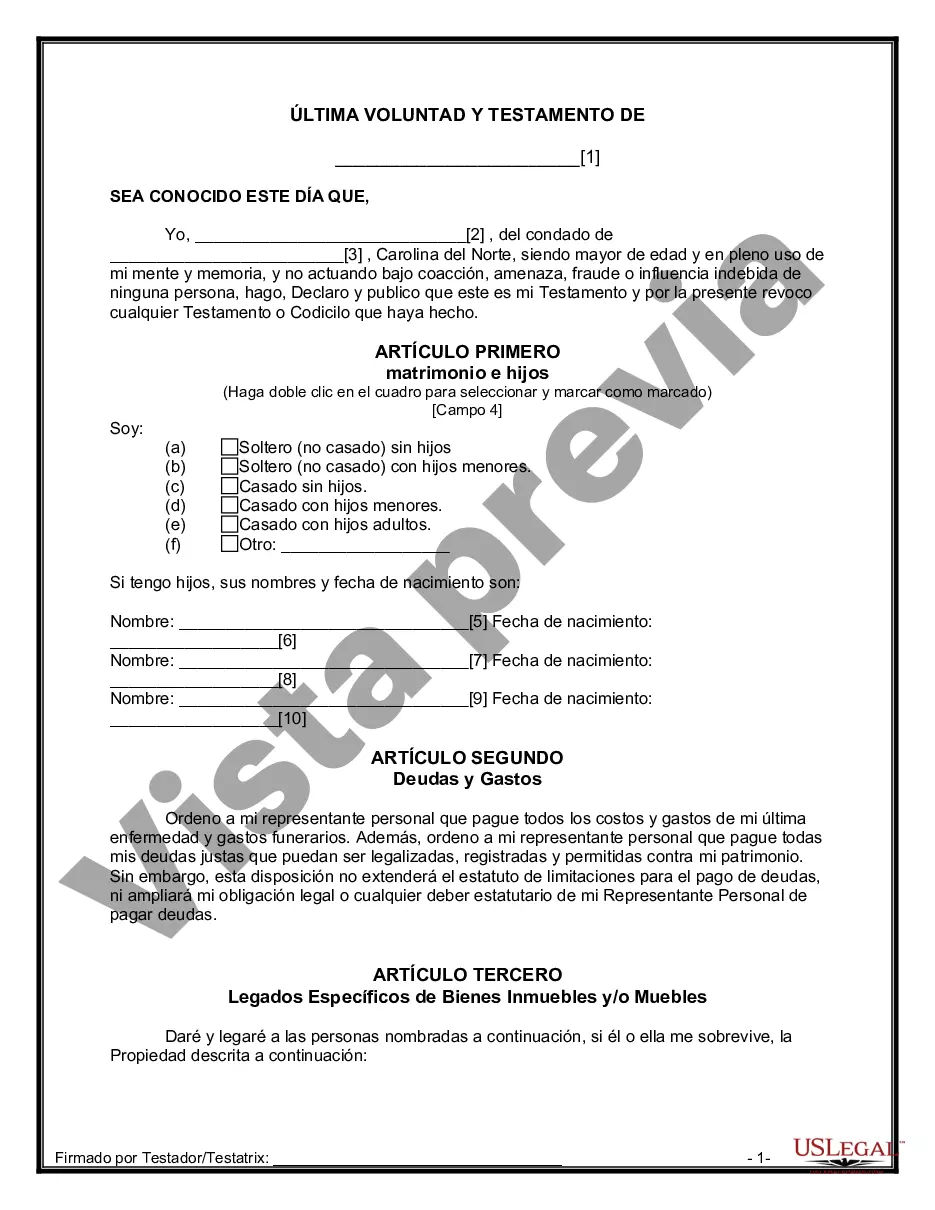

Mecklenburg County, located in North Carolina, has specific laws and regulations regarding Last Will and Testaments for individuals who reside within its jurisdiction. A Last Will and Testament is a legal document that allows individuals to outline their final wishes and appoint executors to handle their estate after their passing. It ensures that their assets are distributed according to their desires and provides clarity and direction to loved ones. In Mecklenburg County, there are different types of Last Will and Testaments available to suit different needs and circumstances. These variations include: 1. Simple Will: A Simple Will is a basic document that outlines how an individual's assets should be distributed after their death. It typically covers assets such as bank accounts, properties, personal belongings, and investments. 2. Pour-Over Will: A Pour-Over Will is used in conjunction with a living trust. It directs any assets not already transferred to the trust during the individual's lifetime to be "poured over" or transferred to the trust after their death. 3. Living Will: Though not a traditional Last Will and Testament, a Living Will is an essential legal document that outlines an individual's medical preferences and desires in the event they become incapacitated and unable to make decisions for themselves. It allows them to specify their wishes regarding life-sustaining treatments, organ donations, and more. 4. Joint Will: A Joint Will is a document created by couples in Mecklenburg County who wish to have a unified plan for the distribution of their assets upon their deaths. This type of Will typically states that when one spouse passes away, the surviving spouse inherits all the assets, and upon the death of the second spouse, the assets are distributed according to the outlined wishes. Regardless of the type of Last Will and Testament, certain key elements should be included in the document. These elements provide clarity and validity to the Will: 1. Identification: The individual creating the Will should be identified by their full legal name and must be of sound mind and over the age of 18. 2. Executors: The Will should name one or more persons who will be responsible for carrying out the terms of the Will. Executors can be family members, trusted friends, or professionals. 3. Beneficiaries: The Will should clearly identify the beneficiaries who will receive the assets or property after the individual's death. Beneficiaries can be family members, friends, charitable organizations, or even pets. 4. Assets Distribution: The Will should outline how the assets should be distributed among the beneficiaries. This can be done in percentages, specific bequests, or by establishing trusts for certain beneficiaries. 5. Witnesses and Signatures: Mecklenburg County requires a Last Will and Testament to be signed by the testator (the person creating the Will) in the presence of at least two competent witnesses. The witnesses should also sign the document to validate its authenticity. It is important to consult with an attorney experienced in estate planning to ensure your Last Will and Testament complies with Mecklenburg County laws and meets your specific needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Última voluntad y testamento para otras personas - North Carolina Last Will and Testament for other Persons

Description

How to fill out Mecklenburg North Carolina Última Voluntad Y Testamento Para Otras Personas?

Make use of the US Legal Forms and have instant access to any form you want. Our beneficial website with a huge number of templates allows you to find and obtain virtually any document sample you need. You are able to save, complete, and sign the Mecklenburg North Carolina Last Will and Testament for other Persons in a matter of minutes instead of surfing the Net for many hours looking for the right template.

Utilizing our collection is a wonderful way to raise the safety of your form filing. Our professional attorneys regularly check all the records to make sure that the forms are relevant for a particular state and compliant with new laws and polices.

How do you obtain the Mecklenburg North Carolina Last Will and Testament for other Persons? If you have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Find the template you require. Make sure that it is the template you were looking for: examine its name and description, and make use of the Preview function if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Save the document. Indicate the format to get the Mecklenburg North Carolina Last Will and Testament for other Persons and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable form libraries on the internet. We are always happy to help you in any legal case, even if it is just downloading the Mecklenburg North Carolina Last Will and Testament for other Persons.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!