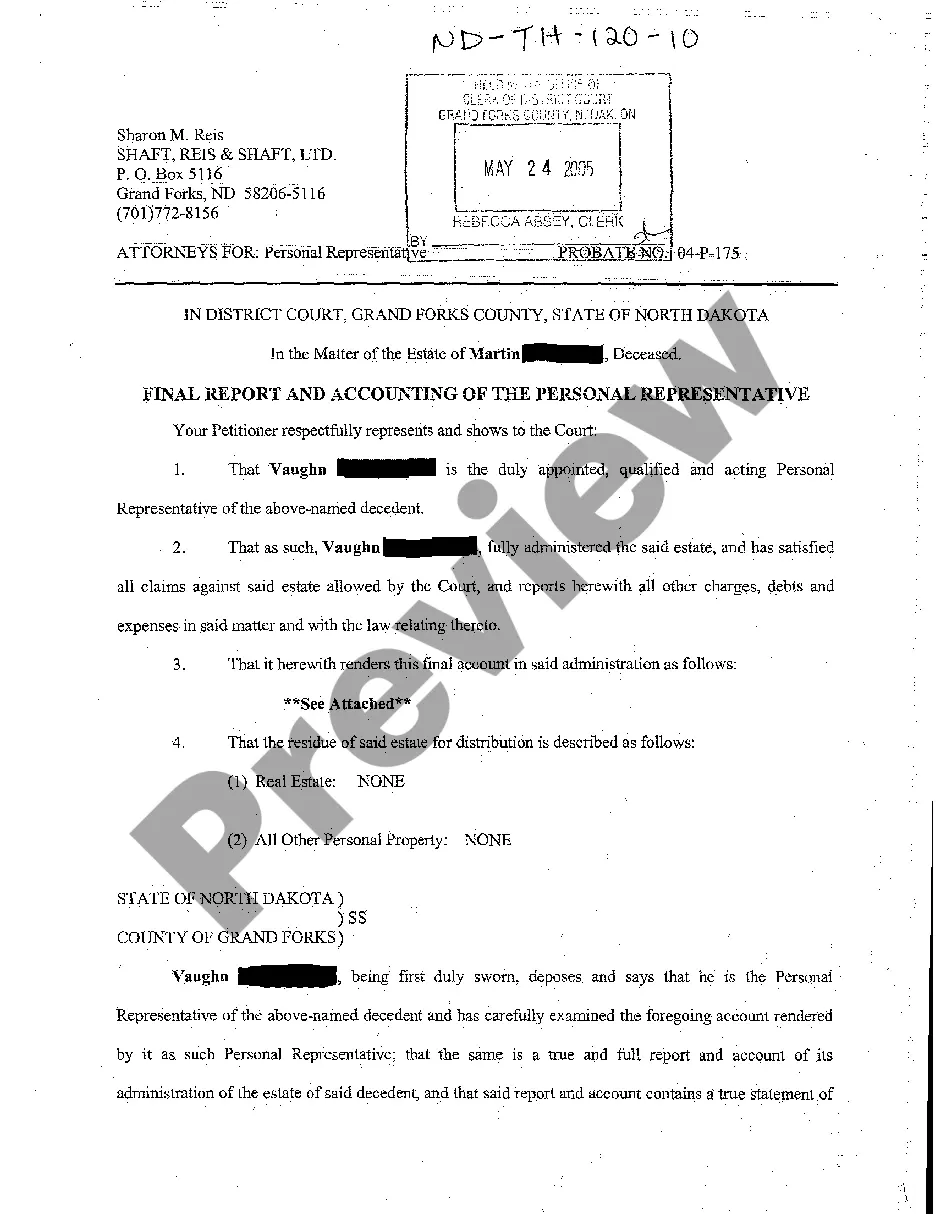

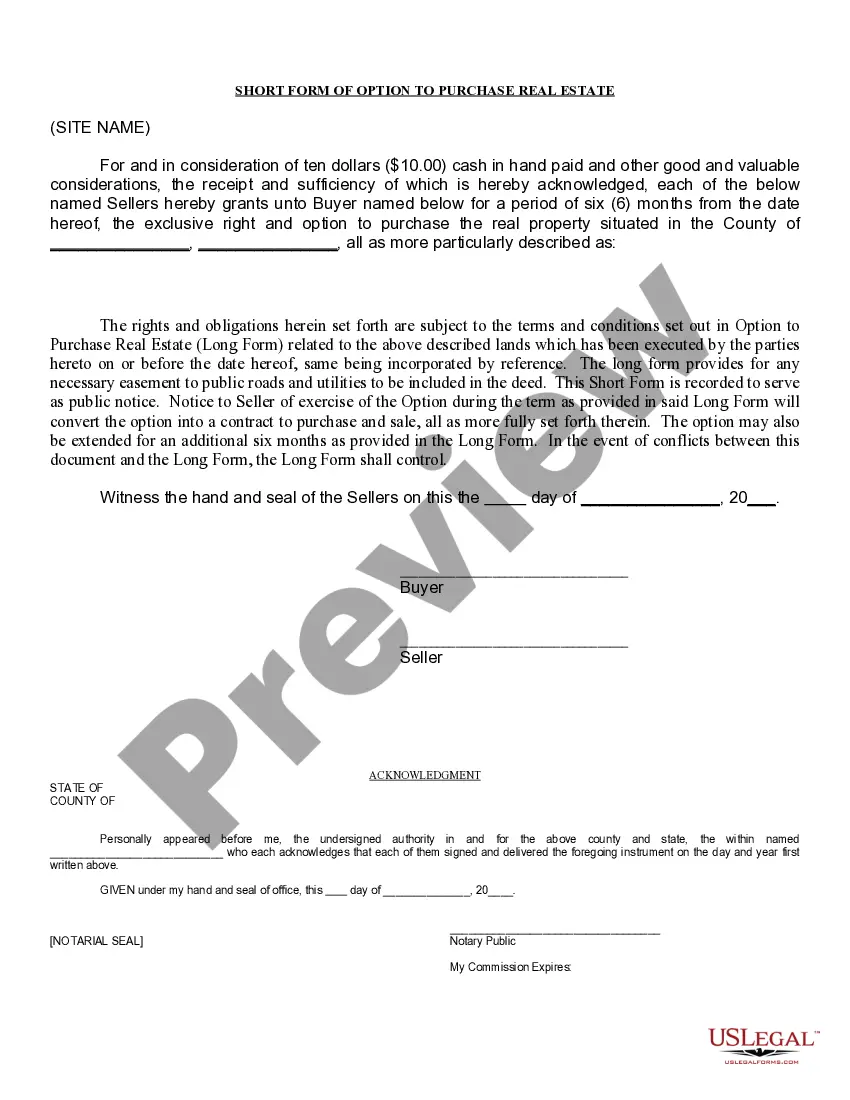

Title: Fargo North Dakota Final Report and Accounting of the Personal Representative: Comprehensive Overview and Types Introduction: In Fargo, North Dakota, the Final Report and Accounting of the Personal Representative play a crucial role in the probate process. This report provides a detailed overview of the personal representative's activities and financial transactions, ensuring transparency and accountability. In this article, we will delve into the specifics of the Fargo North Dakota Final Report and Accounting, explore its purpose, and outline the different types within this context. 1. What is Fargo North Dakota Final Report and Accounting of the Personal Representative? The Fargo North Dakota Final Report and Accounting of the Personal Representative is a document filed with the probate court at the conclusion of the estate administration process. This report serves as a comprehensive breakdown of the personal representative's activities, financial decisions, distributions, and management of the decedent's estate assets. Its main aim is to provide beneficiaries and interested parties with clear insight into the estate's financial affairs and ensure adherence to legal obligations. 2. Purpose and Importance of the Fargo North Dakota Final Report: The primary purpose of the Fargo North Dakota Final Report and Accounting is to facilitate transparency and provide assurance to the probate court, beneficiaries, and interested parties. It serves several essential objectives: a. Financial Transparency: The report offers a detailed summary of all financial activities, including income, expenses, distributions, and changes in the estate's value. This transparency ensures that the personal representative has correctly managed the estate, safeguarding the beneficiaries' interests. b. Confirmation of Compliance: By reviewing the final report, the court can verify whether the personal representative abided by the legal obligations, followed the proper distribution procedures, and obtained necessary approvals. This step helps prevent any fraudulent or unauthorized actions. c. Beneficiary Protection: The Final Report and Accounting allow beneficiaries to understand how the estate was handled, verify their inheritances, and detect any potential errors or discrepancies that may require further investigation or action. 3. Types of Fargo North Dakota Final Report and Accounting of the Personal Representative: Although the core purpose remains the same, there can be several types of Final Reports and Accounting, depending on the specific circumstances. Some common variations include: a. Formal Account: This type of report is provided when the estate administration is more complex, involving detailed financial transactions such as sales of properties, investments, or significant litigation. It offers an in-depth breakdown of financial activities and justifies all expenses made on behalf of the estate. b. Informal Account: In cases where the estate administration is relatively straightforward and uncontested, an informal account may be employed. This report provides a concise overview of transactions, distributions, and any pertinent financial details. c. Supplemental Account: A supplemental report is filed when there are significant changes or updates to the estate's financial status, usually due to subsequent findings, litigation outcomes, or newly discovered assets. It ensures that all developments are accurately reflected in the final report. Conclusion: The Fargo North Dakota Final Report and Accounting of the Personal Representative serve as an integral part of the probate process for ensuring transparency, accountability, and protection of beneficiaries' rights. By providing a comprehensive breakdown of financial activities, this report assures all involved parties that the estate administration was carried out in accordance with legal requirements. Whether it's a formal, informal, or supplemental account, the Fargo North Dakota Final Report plays a crucial role in preserving the integrity of the probate process.

Fargo North Dakota Final Report and Accounting of the Personal Representative

Description

How to fill out Fargo North Dakota Final Report And Accounting Of The Personal Representative?

If you are searching for a relevant form template, it’s difficult to find a better service than the US Legal Forms website – one of the most extensive online libraries. Here you can get a huge number of form samples for business and individual purposes by categories and states, or keywords. With the high-quality search feature, getting the newest Fargo North Dakota Final Report and Accounting of the Personal Representative is as easy as 1-2-3. Moreover, the relevance of each file is confirmed by a group of professional attorneys that on a regular basis check the templates on our platform and update them according to the most recent state and county demands.

If you already know about our platform and have an account, all you should do to receive the Fargo North Dakota Final Report and Accounting of the Personal Representative is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have opened the form you require. Check its explanation and use the Preview function to see its content. If it doesn’t meet your needs, use the Search field near the top of the screen to find the needed file.

- Confirm your choice. Click the Buy now button. After that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Select the format and save it to your system.

- Make adjustments. Fill out, modify, print, and sign the received Fargo North Dakota Final Report and Accounting of the Personal Representative.

Every template you add to your profile has no expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you need to have an additional copy for editing or creating a hard copy, you can come back and export it again whenever you want.

Take advantage of the US Legal Forms professional collection to gain access to the Fargo North Dakota Final Report and Accounting of the Personal Representative you were looking for and a huge number of other professional and state-specific samples in one place!