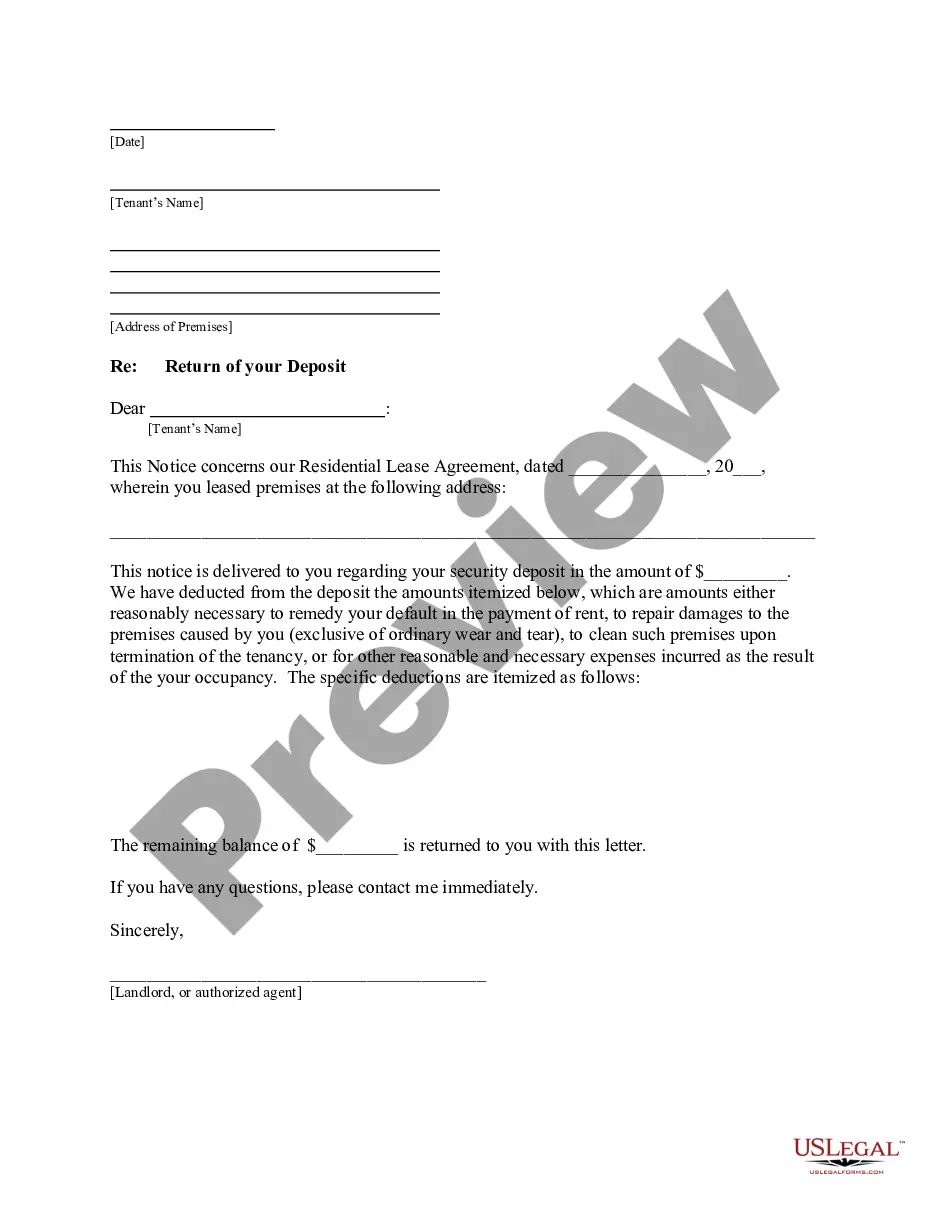

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: Omaha, Nebraska Letter from Landlord to Tenant Returning Security Deposit Less Deductions — Detailed Description Introduction: In Omaha, Nebraska, when a tenant vacates a rental property, it is common for landlords to return the security deposit after making any necessary deductions. This detailed description will provide valuable insights into the process and contents of an Omaha, Nebraska Letter from Landlord to Tenant Returning Security Deposit Less Deductions. Additionally, it will cover any other variations or types of such letters used in Omaha, Nebraska rental agreements. 1. Heading and Greeting: The letter should start with the landlord's name, address, and contact details on top, followed by the current date. The greeting should address the tenant by their full name, as well as any co-tenants if applicable. 2. Appreciation and Notice: Express appreciation for the tenant's residency and mention the purpose of the letter, which is to return the security deposit. State that this letter serves as a final account settlement. 3. Security Deposit Details: Clearly outline the specific amount of the security deposit initially paid by the tenant upon moving in. Provide supporting details such as the deposit amount, date of payment, and the rental property address. 4. Itemized Deductions: List any deductions made from the original security deposit explicitly and itemize them with supporting documentation. Deductions may include unpaid rent, damages beyond normal wear and tear, cleaning fees, unpaid utilities, or any outstanding charges mentioned in the lease agreement. 5. Calculation Method: Explain the method used to calculate the deductions, such as providing invoices, receipts, or repair estimates supporting each deduction. This ensures transparency and allows tenants to dispute any discrepancies if necessary. 6. Total Deductions: Summarize all deductions and provide a clear final calculation of the total deductions made from the original security deposit. Subtract this amount from the initial deposit to calculate the refundable balance. 7. Refundable Balance: If there is any balance remaining after deductions, mention this amount and confirm that it will be refunded to the tenant by a specified method (i.e., mailed check or direct deposit) within a reasonable timeframe, typically within 30 days as required by Nebraska law. 8. Dispute Resolution: Include information regarding the tenant's right to dispute deductions or request further clarification. Provide instructions on how to contact the landlord or property management if they wish to discuss or contest any deductions made. 9. Cleaning and Move-Out Expectations: Take the opportunity to remind the tenant of any specific cleaning requirements and procedures outlined in the lease agreement. Provide guidance on how to return any additional keys or remote controls, and indicate when the tenant needs to vacate the property completely. 10. Closing and Offer Help: Express gratitude for the tenancy and close the letter with a friendly conclusion. Offer assistance if the tenant requires any further information or assistance during the transition process. Types of Omaha, Nebraska Letters from Landlord to Tenant Returning Security Deposit Less Deductions: There aren't specific variations or types of such letters unique to Omaha, Nebraska. However, this description provides a comprehensive outline that landlords in Omaha often follow when returning security deposits with deductions. In conclusion, this detailed description of an Omaha, Nebraska Letter from Landlord to Tenant Returning Security Deposit Less Deductions serves as a helpful guide for landlords to draft accurate and transparent communication with their tenants.