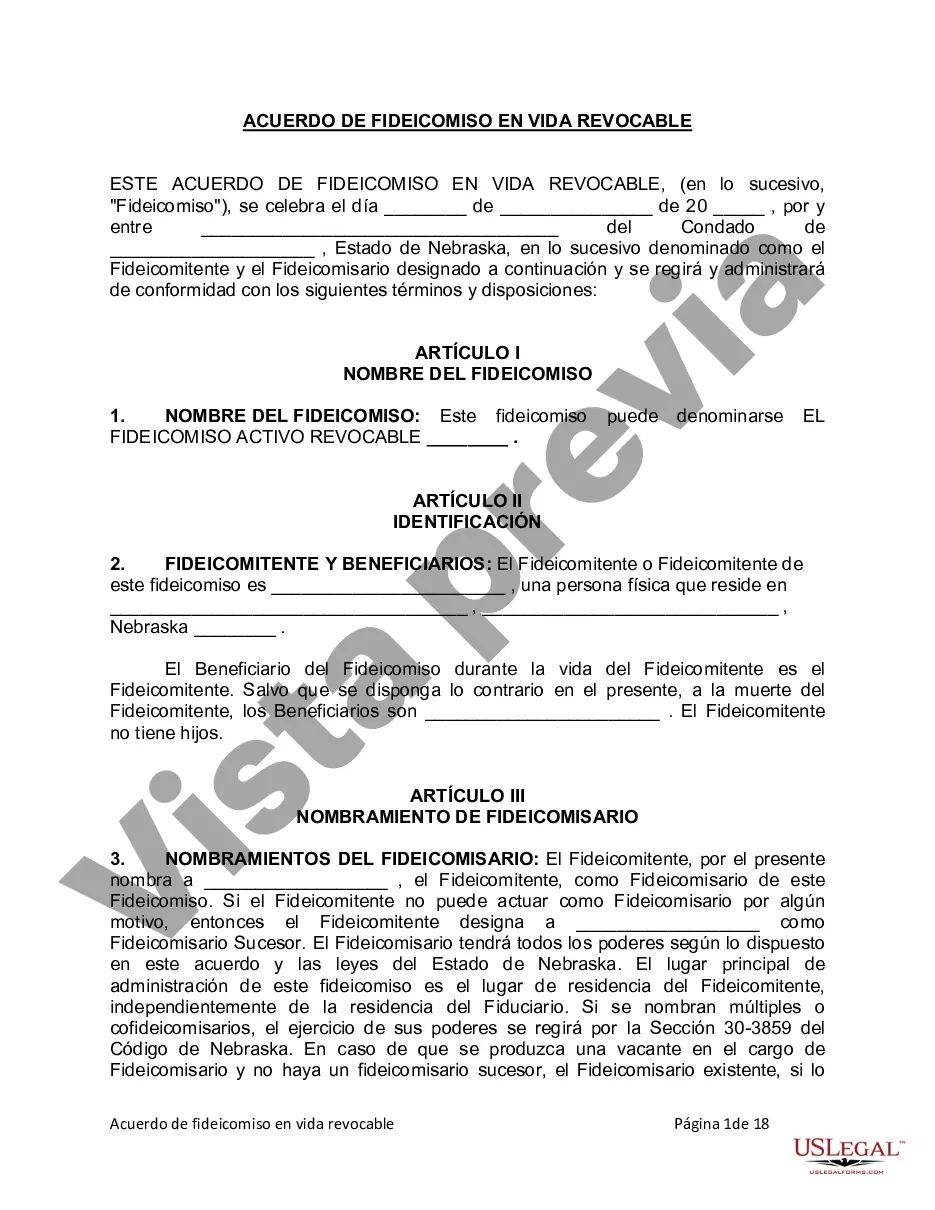

Omaha Nebraska Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children If you are a single, divorced, widow, or widower with no children residing in Omaha, Nebraska, it is essential to consider estate planning options that suit your unique circumstances. One such option is establishing a Living Trust, a legal instrument that allows you to maintain control over your assets during your lifetime while ensuring a smooth transfer of these assets upon your passing. Here, we will explore the different types of Living Trusts available for individuals in Omaha, Nebraska, who are single, divorced, widowed, or widowers with no children. 1. Revocable Living Trust: A revocable living trust enables you to have complete control over your assets and make revisions or terminate the trust whenever you wish. This type of trust provides flexibility, allowing you to manage and allocate your assets as per your preferences. In the event of your demise, the assets held in the trust can be seamlessly transferred to the designated beneficiaries without going through probate court. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or terminated without the consent of the designated beneficiaries. By creating an irrevocable living trust, you can protect your assets from potential creditors, lawsuits, and probate expenses, ensuring their secure transfer to your chosen beneficiaries when the time comes. 3. Testamentary Trust: A testamentary trust is established through your will and takes effect only upon your death. It allows you to specify how your assets will be managed and distributed after your passing. This trust is ideal for individuals with no heirs, as it enables you to leave your estate to charities, friends, or other organization of your choice. 4. Dynasty Trust: A dynasty trust is designed to protect and preserve your wealth for multiple generations. By creating a dynasty trust, you can ensure that your assets remain untouched by estate taxes, creditors, and divorces, creating a lasting legacy for your chosen beneficiaries. This type of trust could be particularly appealing for individuals without direct descendants. Whichever type of Living Trust you choose, it is crucial to consult with an experienced estate planning attorney in Omaha, Nebraska, who can guide you through the process and tailor it to your specific needs. By establishing a Living Trust, you can protect your assets, maintain privacy, and dictate how your estate will be distributed, assuring that your wishes are fulfilled while minimizing the burden on your loved ones during a challenging time.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Omaha Nebraska Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos o Viudos sin Hijos - Nebraska Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

How to fill out Omaha Nebraska Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos O Viudos Sin Hijos?

If you are searching for a valid form, it’s difficult to choose a more convenient service than the US Legal Forms site – probably the most extensive libraries on the web. Here you can get thousands of templates for organization and personal purposes by types and regions, or key phrases. With our high-quality search function, getting the newest Omaha Nebraska Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is as easy as 1-2-3. In addition, the relevance of every record is verified by a group of professional lawyers that regularly check the templates on our website and update them based on the most recent state and county requirements.

If you already know about our platform and have an account, all you need to receive the Omaha Nebraska Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the form you need. Check its information and utilize the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to find the proper document.

- Confirm your selection. Choose the Buy now button. Next, select your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the form. Choose the file format and save it to your system.

- Make adjustments. Fill out, modify, print, and sign the received Omaha Nebraska Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children.

Each and every form you save in your account has no expiry date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you need to receive an extra version for editing or creating a hard copy, feel free to return and download it again anytime.

Make use of the US Legal Forms professional collection to get access to the Omaha Nebraska Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children you were looking for and thousands of other professional and state-specific samples in a single place!