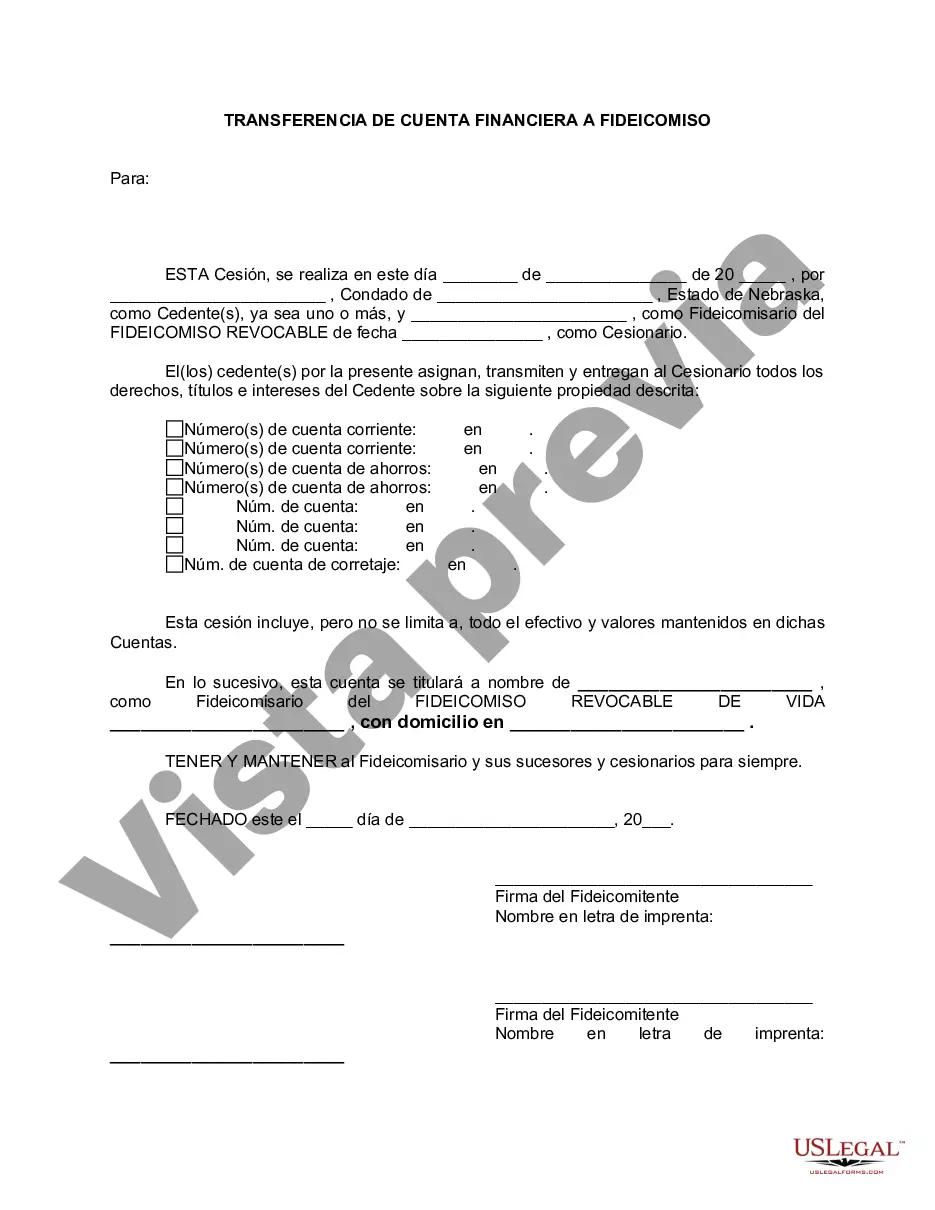

Omaha Nebraska Financial Account Transfer to Living Trust: A Comprehensive Guide In Omaha, Nebraska, Financial Account Transfer to Living Trust involves a legal and seamless process of transferring ownership of various financial accounts, assets, and investments into a designated living trust structure. This strategy ensures a streamlined and efficient transition of assets upon the account holder's incapacity or demise, eliminating the need for probate. 1. Living Trust: Also known as a revocable trust or inter vivos trust, a living trust is a legal entity created by an individual (the granter) to hold, manage, and distribute their assets during their lifetime and after their passing. This trust structure allows for the seamless transfer of accounts to designated beneficiaries, while providing flexibility to modify or revoke it as per the granter's wishes. 2. Financial Accounts: Financial accounts that can be transferred to a living trust include bank accounts, certificates of deposit (CDs), retirement accounts (e.g., IRAs, 401(k)s), brokerage accounts, stocks, bonds, mutual funds, and even real estate properties. 3. Avoiding Probate: The primary benefit of transferring financial accounts to a living trust in Omaha, Nebraska, is bypassing the probate process. Probate can be time-consuming, costly, and subject to public scrutiny. By utilizing a living trust, assets are transferred directly to beneficiaries, avoiding probate and ensuring a smoother transfer process. 4. Privacy and Asset Protection: Transferring accounts to a living trust offers enhanced privacy, as the trust agreement is not publicly filed, unlike a will. Moreover, a living trust can provide asset protection from creditors or potential lawsuits, safeguarding the granter's wealth for the benefit of their beneficiaries. 5. Revocable vs. Irrevocable Trust: While a revocable living trust is the most common type, allowing the granter to modify or revoke it at any time, an irrevocable living trust can also be established. An irrevocable trust, once created, cannot be easily modified or revoked but offers additional protection against estate taxes and potential creditors. 6. Transfer Process: To transfer financial accounts to a living trust, the account holder (granter) must consult with an estate planning attorney to create the trust agreement. Once established, the granter needs to update the account ownership information, designating the trust as the new owner. This typically involves submitting the necessary forms and documentation to each financial institution. The attorney will guide the process to ensure all legal requirements are met and the transfer is executed accurately. In summary, Omaha, Nebraska Financial Account Transfer to Living Trust is a strategic estate planning approach designed to facilitate the efficient transfer of financial accounts, assets, and investments to a living trust structure. By avoiding probate, ensuring privacy, and potentially protecting assets, this practice offers individuals and families a comprehensive and seamless solution to secure their financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Omaha Nebraska Transferencia de cuenta financiera a fideicomiso en vida - Nebraska Financial Account Transfer to Living Trust

Description

How to fill out Omaha Nebraska Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Take advantage of the US Legal Forms and obtain instant access to any form template you want. Our beneficial website with a huge number of document templates simplifies the way to find and get almost any document sample you want. You can export, fill, and sign the Omaha Nebraska Financial Account Transfer to Living Trust in a matter of minutes instead of browsing the web for several hours trying to find the right template.

Utilizing our library is an excellent way to improve the safety of your form filing. Our experienced attorneys regularly review all the documents to make sure that the templates are relevant for a particular state and compliant with new acts and polices.

How can you obtain the Omaha Nebraska Financial Account Transfer to Living Trust? If you already have a profile, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Find the form you require. Make sure that it is the template you were seeking: check its title and description, and take take advantage of the Preview function if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the document. Choose the format to get the Omaha Nebraska Financial Account Transfer to Living Trust and revise and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable document libraries on the internet. We are always ready to help you in virtually any legal process, even if it is just downloading the Omaha Nebraska Financial Account Transfer to Living Trust.

Feel free to benefit from our platform and make your document experience as straightforward as possible!