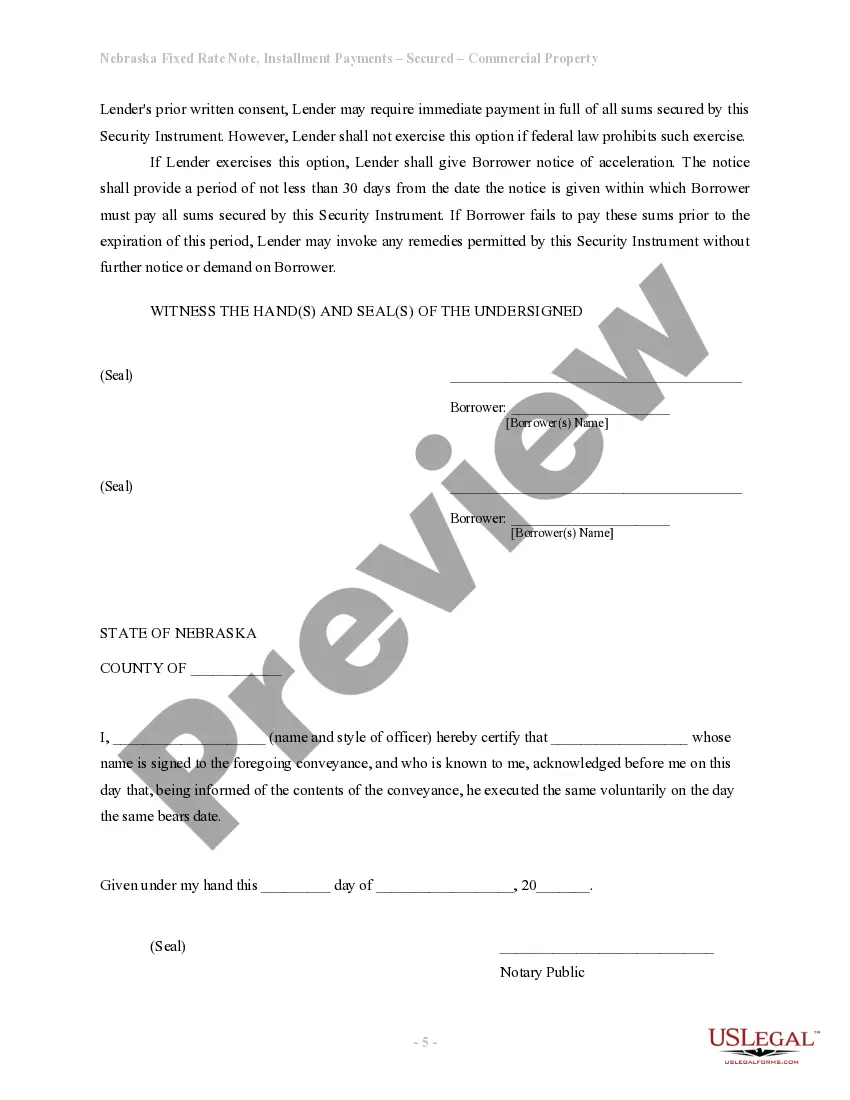

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Omaha Nebraska Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Nebraska Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Locating verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

It is an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the files are appropriately categorized by usage area and jurisdictional regions, making it as simple and quick as ABC to find the Omaha Nebraska Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

Maintaining paperwork organized and compliant with legal requirements is crucial. Take advantage of the US Legal Forms library to have vital document templates readily available for any of your needs!

- For those who are already familiar with our service and have previously used it, acquiring the Omaha Nebraska Installments Fixed Rate Promissory Note Secured by Commercial Real Estate involves just a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device.

- This process will require just a couple more steps for new users.

- Follow the instructions below to begin with the largest online form catalog.

- Review the Preview mode and document description. Ensure you have selected the correct one that fulfills your needs and fully complies with your local jurisdiction regulations.

Form popularity

FAQ

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

What's included in a promissory note? Borrower name and contact information. Lender details and contact info. Principal loan amount. Interest rate and how it's been calculated. Date first payment is required. Loan maturity date. Date and place of issuance. Fees and charges.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory Note Requires acceptance.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note refers to a written document stating that a certain amount of money will be paid to someone by a specified date. Generally, it is not necessary for the note to be recorded officially. The borrower is required to sign the note, but the lender may choose not to sign it.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.