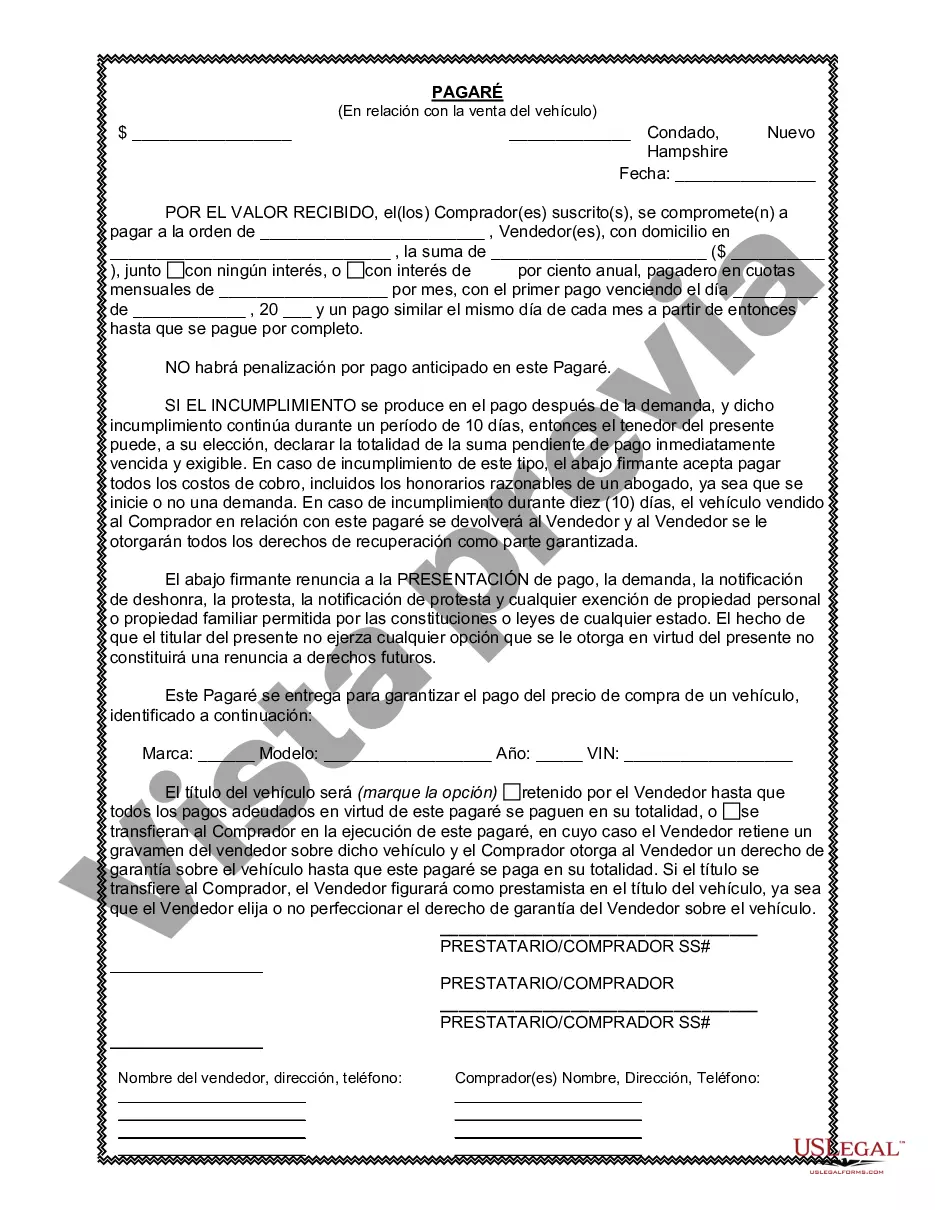

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

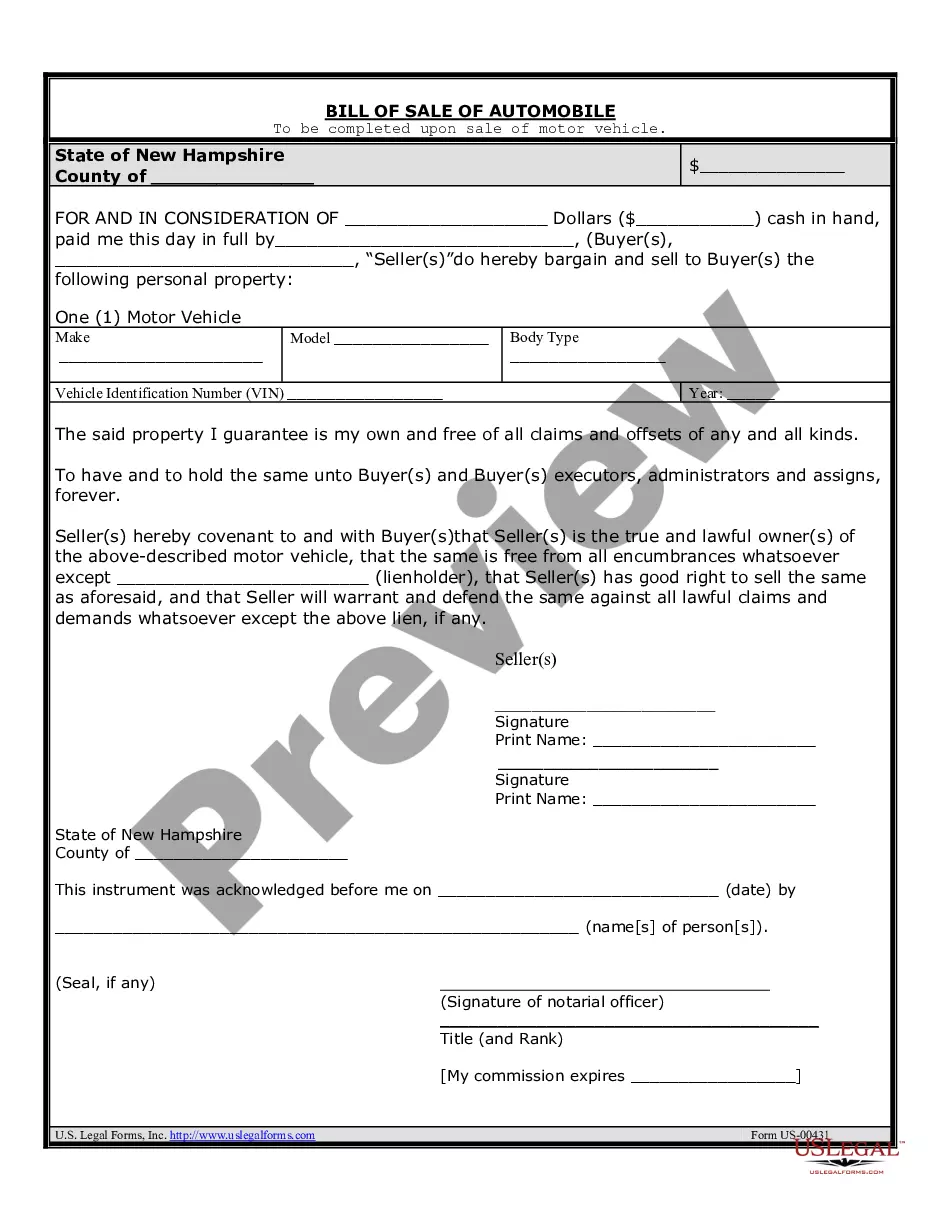

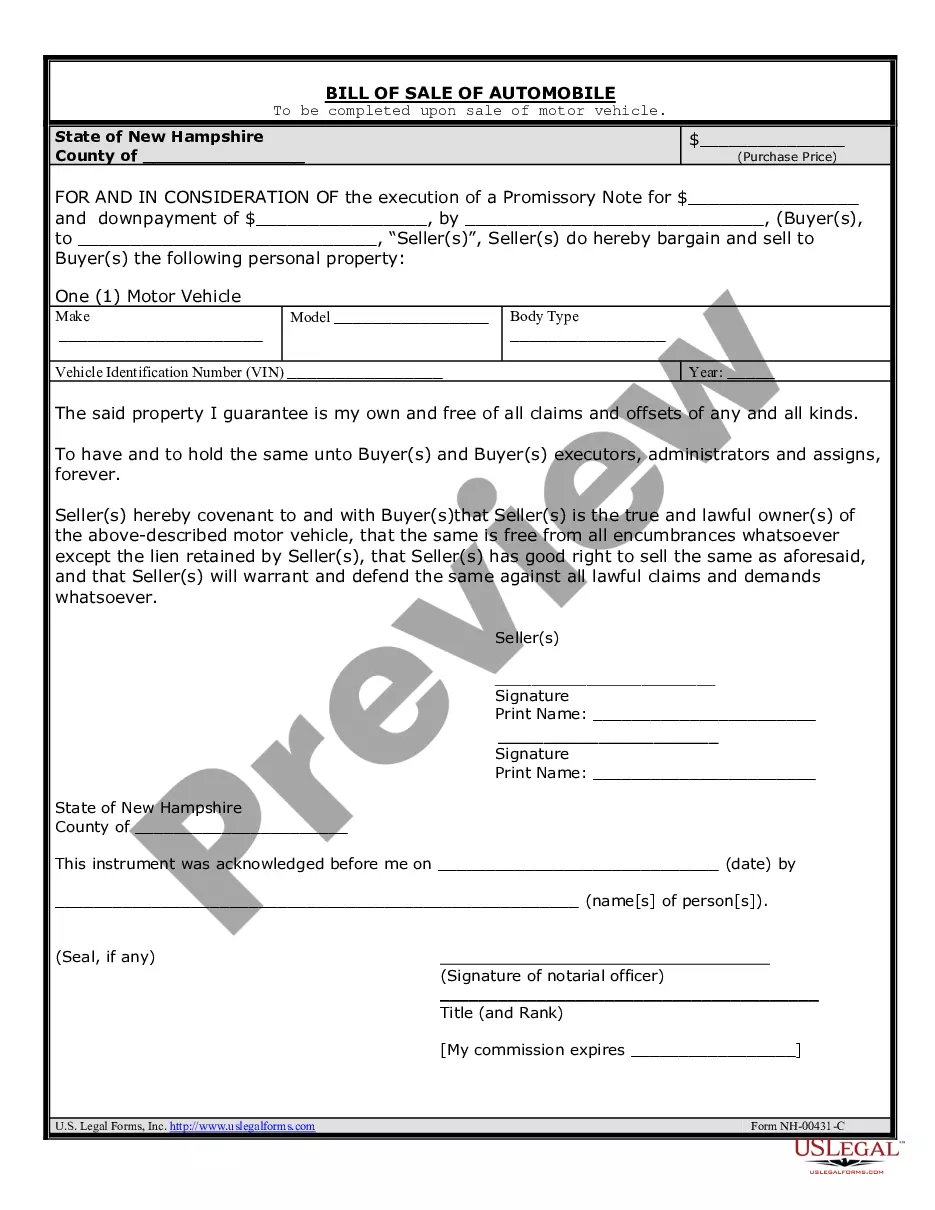

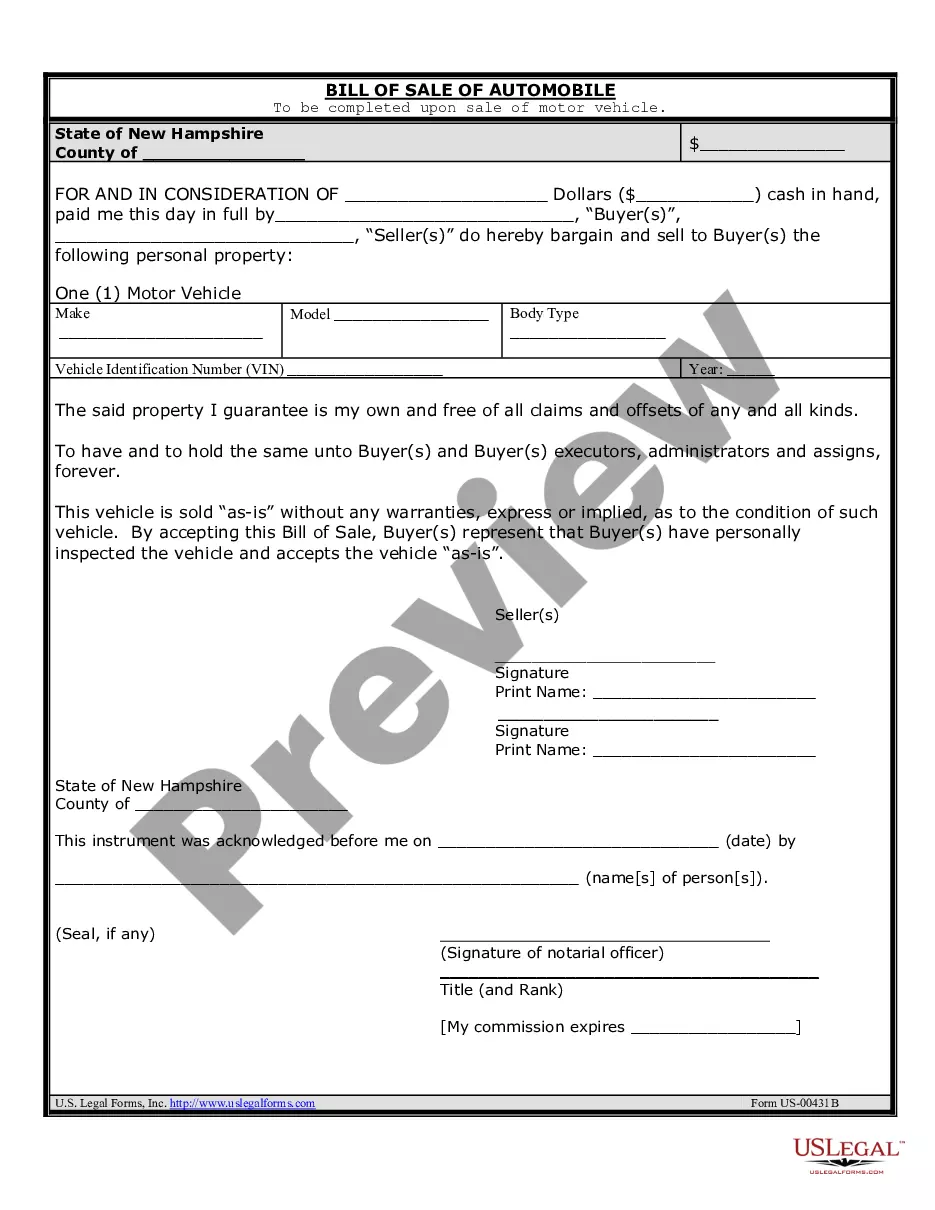

A Manchester New Hampshire Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. It serves as a written promise by the buyer to repay the seller for the vehicle purchase over a specified period of time. The Manchester New Hampshire Promissory Note typically includes essential details such as the names and addresses of both parties, the purchase price of the vehicle, a description of the vehicle being sold, and the terms of repayment. This document is essential for documenting the sale, protecting the interests of both parties involved, and ensuring a smooth transaction. In Manchester, New Hampshire, two common types of Promissory Notes in Connection with Sale of Vehicle or Automobile are: 1. Secured Promissory Note: This type of promissory note includes a security agreement where the vehicle itself serves as collateral for the loan. In case the buyer defaults on the payments, the seller has the right to repossess the vehicle. 2. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not involve collateral. In this case, the buyer's promise to repay the loan rests solely on their creditworthiness and personal integrity. It is crucial to include specific conditions in the promissory note, such as the interest rate or finance charges (if any), the repayment schedule (monthly, bi-weekly, or weekly), any late payment penalties, and the consequences of default. Both parties must carefully review and agree upon these terms before signing the document. In conclusion, a Manchester New Hampshire Promissory Note in Connection with Sale of Vehicle or Automobile is an important legal agreement that protects the rights and obligations of both the buyer and the seller during the purchase of a vehicle. It ensures clarity and transparency in the transaction, minimizes potential disputes, and provides a framework for smooth repayment.A Manchester New Hampshire Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. It serves as a written promise by the buyer to repay the seller for the vehicle purchase over a specified period of time. The Manchester New Hampshire Promissory Note typically includes essential details such as the names and addresses of both parties, the purchase price of the vehicle, a description of the vehicle being sold, and the terms of repayment. This document is essential for documenting the sale, protecting the interests of both parties involved, and ensuring a smooth transaction. In Manchester, New Hampshire, two common types of Promissory Notes in Connection with Sale of Vehicle or Automobile are: 1. Secured Promissory Note: This type of promissory note includes a security agreement where the vehicle itself serves as collateral for the loan. In case the buyer defaults on the payments, the seller has the right to repossess the vehicle. 2. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not involve collateral. In this case, the buyer's promise to repay the loan rests solely on their creditworthiness and personal integrity. It is crucial to include specific conditions in the promissory note, such as the interest rate or finance charges (if any), the repayment schedule (monthly, bi-weekly, or weekly), any late payment penalties, and the consequences of default. Both parties must carefully review and agree upon these terms before signing the document. In conclusion, a Manchester New Hampshire Promissory Note in Connection with Sale of Vehicle or Automobile is an important legal agreement that protects the rights and obligations of both the buyer and the seller during the purchase of a vehicle. It ensures clarity and transparency in the transaction, minimizes potential disputes, and provides a framework for smooth repayment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.