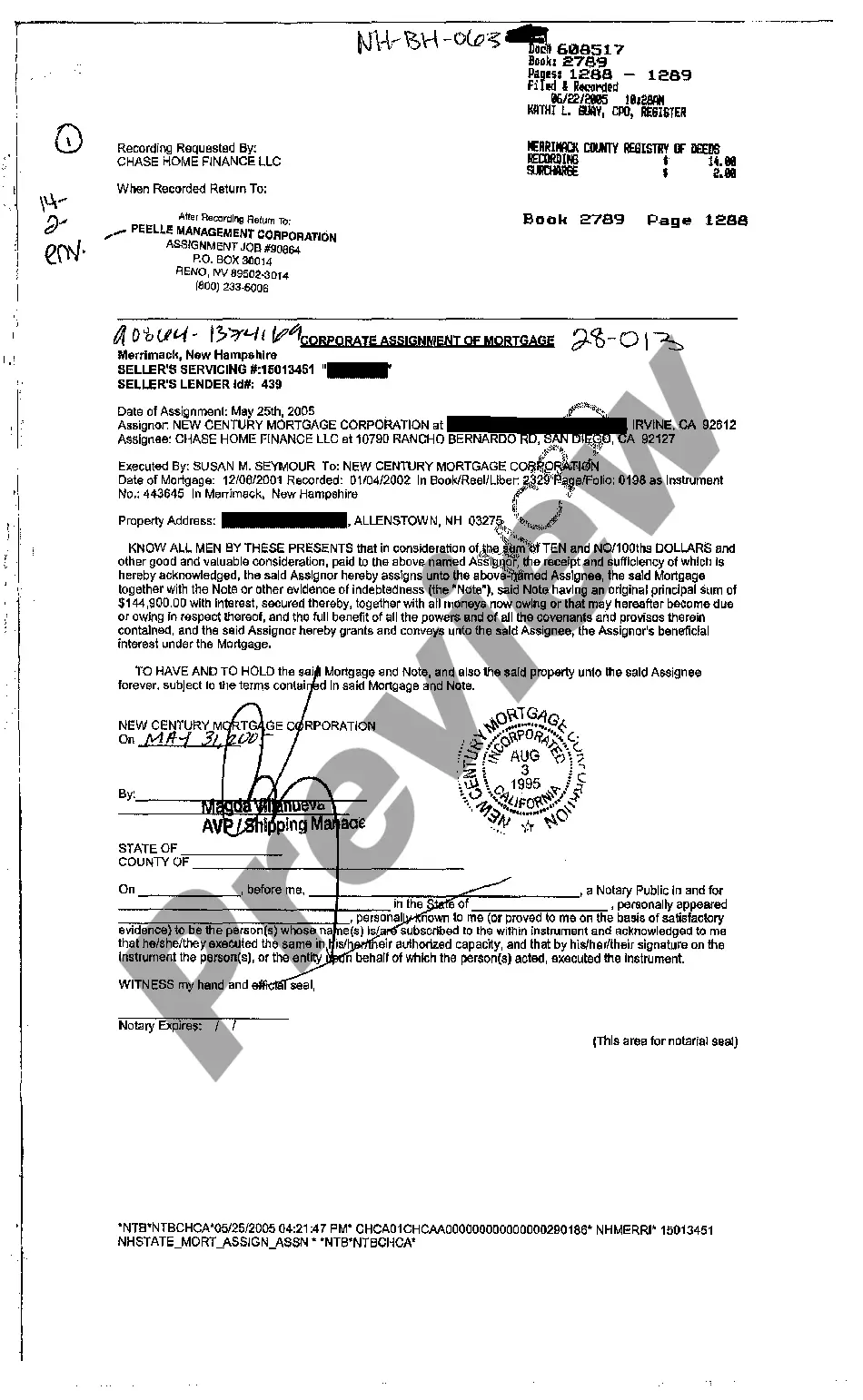

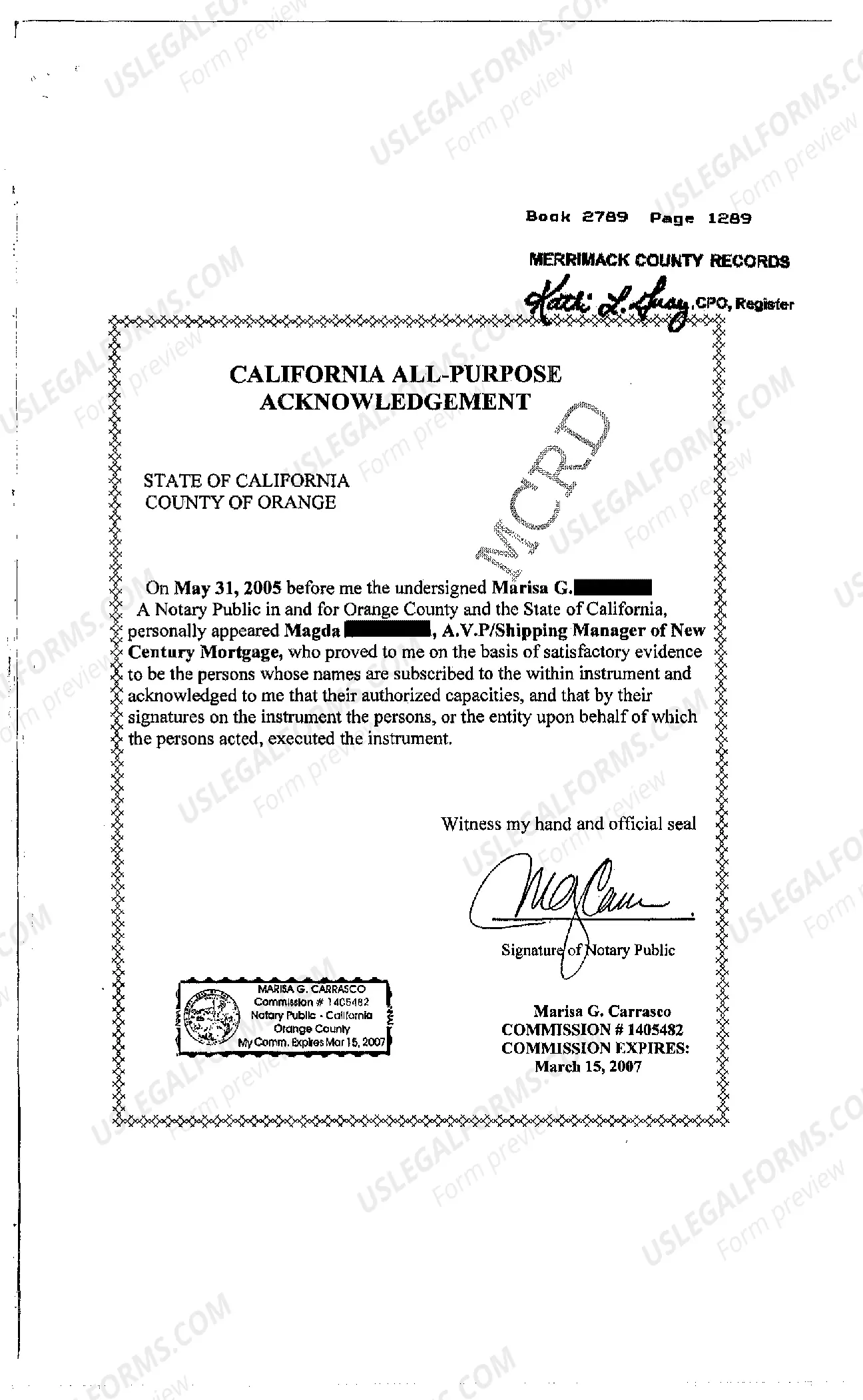

The Manchester New Hampshire Corporate Assignment of Mortgage is a legal document that involves the transfer of a mortgage from one entity to another within the corporate structure. This assignment typically occurs when a mortgage is sold or transferred between affiliated companies or subsidiaries. Keywords: Manchester New Hampshire, Corporate Assignment of Mortgage, legal document, transfer, mortgage, entity, corporate structure, sold, transferred, affiliated companies, subsidiaries. There are various types or variations of the Manchester New Hampshire Corporate Assignment of Mortgage, such as: 1. Intra-corporate Assignment of Mortgage: This type of assignment happens when a mortgage is transferred between two entities within the same corporate structure, usually affiliated companies or subsidiaries. The transfer can include the transfer of both the mortgage debt and the accompanying rights and responsibilities. 2. Inter-corporate Assignment of Mortgage: This refers to the transfer of a mortgage from one corporate entity to another that is not within the same corporate structure or affiliation. It could involve the sale of a mortgage from one company to another or the transfer of a mortgage as part of a business transaction. 3. Partial Assignment of Mortgage: In this type of assignment, only a portion of the mortgage debt is transferred from the assigning entity to the assignee. This can occur when a mortgage is divided or shared between different corporate entities, often based on a negotiated agreement or contractual arrangement. 4. Full Assignment of Mortgage: This type of assignment involves the complete transfer of a mortgage from the assigning entity to the assignee. It involves transferring both the mortgage debt and associated rights, such as the right to collect mortgage payments, foreclose the property in case of default, and any other obligations associated with the mortgage. 5. Servicing Assignment of Mortgage: This assignment occurs when the assignment is related to the transfer of servicing rights for a mortgage. In this case, the assigning entity transfers the responsibility for collecting mortgage payments and managing the loan to the assignee, while the ownership of the mortgage may or may not change. 6. Secondary Market Assignment of Mortgage: This type of assignment involves the transfer of a mortgage from the original lender to a secondary market participant, such as a mortgage-backed securities investor or another financial institution. This allows the lender to generate liquidity by selling the mortgage to another entity. Manchester New Hampshire Corporate Assignment of Mortgage refers to the process of transferring a mortgage from one corporate entity to another within the Manchester area, ensuring compliance with legal requirements and establishing the new entity as the official mortgage holder. It involves detailed documentation and the appropriate filing with relevant authorities to ensure a smooth and legally valid transfer. In conclusion, the Manchester New Hampshire Corporate Assignment of Mortgage is a critical legal process that enables the transfer of mortgages between corporate entities within the Manchester area. The variations and types of assignments include intra-corporate, inter-corporate, partial, full, servicing, and secondary market assignments. These assignments facilitate the smooth transfer of mortgage ownership and responsibilities, while ensuring compliance with legal regulations.

Manchester New Hampshire Corporate Assignment of Mortgage

Description

How to fill out Manchester New Hampshire Corporate Assignment Of Mortgage?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney services that, as a rule, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Manchester New Hampshire Corporate Assignment of Mortgage or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Manchester New Hampshire Corporate Assignment of Mortgage adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Manchester New Hampshire Corporate Assignment of Mortgage is proper for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!