Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed

Description

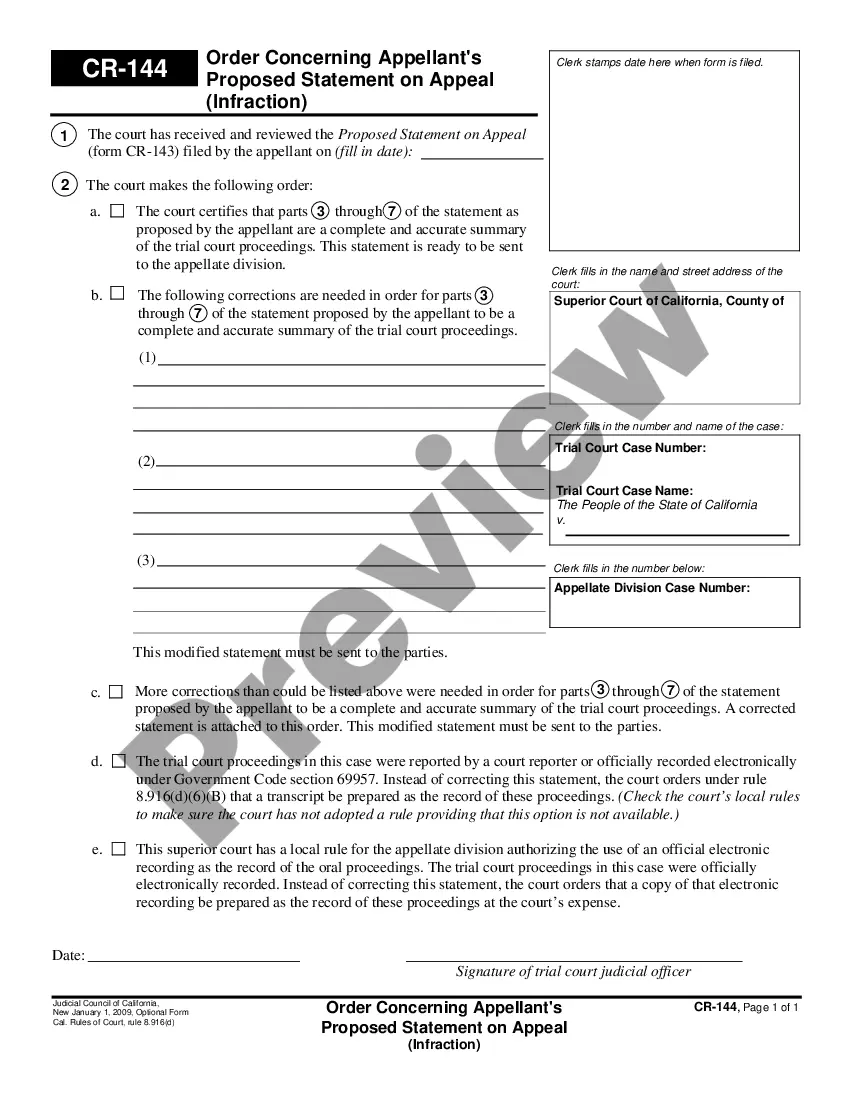

How to fill out New Jersey Notice Of Default For Past Due Payments In Connection With Contract For Deed?

We consistently endeavor to mitigate or avert legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek legal assistance that is typically quite costly.

However, not all legal situations are similarly intricate.

The majority can be managed independently.

Utilize US Legal Forms whenever you need to locate and download the Jersey City New Jersey Notice of Default for Past Due Payments related to Contract for Deed or any other document with ease and security. Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it from within the My documents section. The procedure is equally simple if you’re new to the platform! You can set up your account in a matter of minutes. Ensure to verify if the Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed adheres to the laws and statutes of your state and region. Additionally, it’s crucial that you review the form’s description (if present), and if you identify any inconsistencies with your initial requirements, search for an alternative form. Once you’ve confirmed that the Jersey City New Jersey Notice of Default for Past Due Payments in relation to Contract for Deed is suitable for your situation, you can select a subscription plan and proceed with payment. Following this, you can download the form in any available file format. For over 24 years, we’ve assisted millions by offering customizable and up-to-date legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our library empowers you to take control of your affairs without relying on an attorney's services.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

Form popularity

FAQ

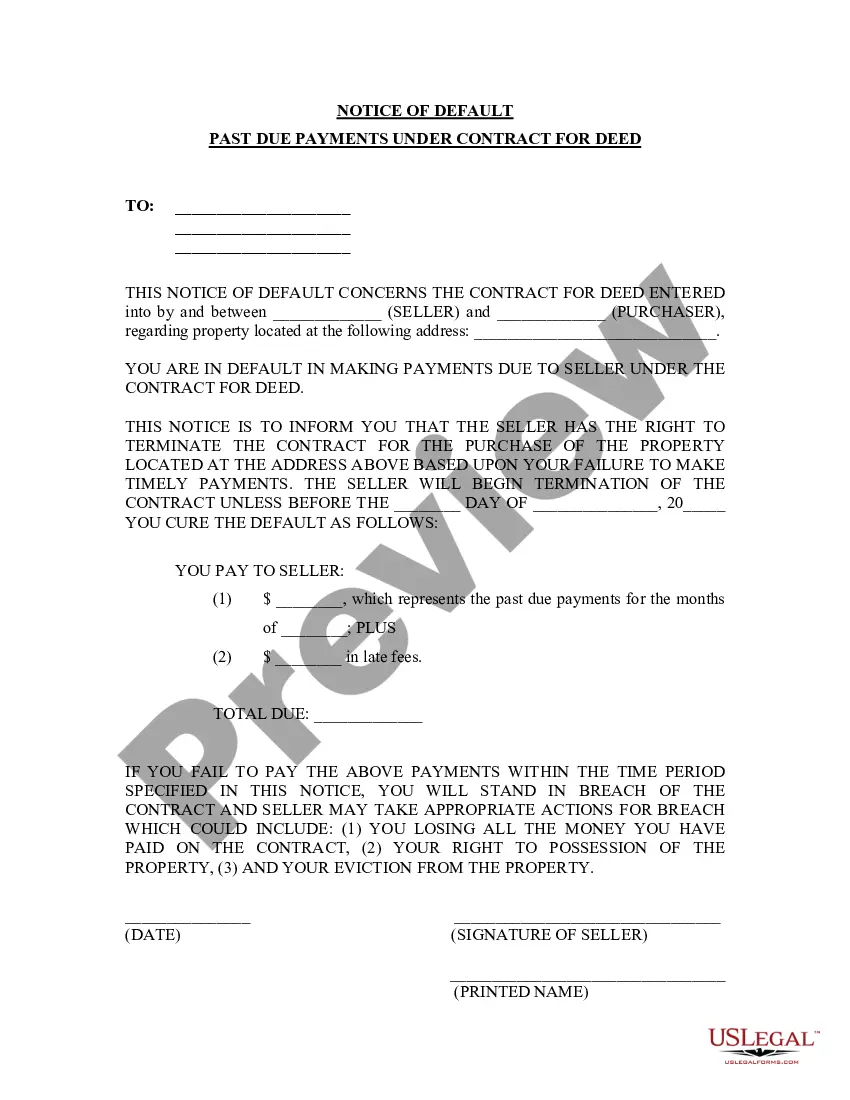

If someone defaults on a land contract, it means they have failed to adhere to the payment terms specified in the agreement, as reflected in the Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed. This can lead to severe ramifications, including loss of the property and legal action from the seller. It is advisable to communicate with the seller to discuss potential resolutions before the situation escalates. The US Legal Forms platform offers various resources to navigate these challenges with confidence.

A notice of default on a house is a legal document highlighting that a borrower has not met their payment obligations, specifically noted in the Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed. This document initiates the pathway to foreclosure, signaling to the borrower that immediate action is required. It is important to assess your financial situation and seek solutions quickly. Utilizing resources, such as the US Legal Forms platform, can guide you through the process effectively.

Receiving a default notice means you are on the brink of losing your property due to missed payments outlined in your Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed. This notification typically includes a timeframe within which you must rectify the payment issue. If you do not act promptly, the lender can pursue legal steps that may lead to foreclosure. Thus, understanding your options and responding timely is vital to protecting your investment.

When you receive a Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed, it signifies that you have fallen behind on your payments. This notice acts as a formal alert, informing you of the overdue amount and the potential consequences. It is crucial to respond quickly, as this may impact your ownership rights and the agreement terms. By addressing the issue early, you may avoid further actions such as foreclosure.

A notice of default in New Jersey is a formal communication issued when a party fails to meet their payment obligations. This notice alerts the borrower about the default status and outlines the required actions to remedy the situation. In the context of a contract for deed, receiving a Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed emphasizes the importance of timely payments. Understanding this process can mitigate financial risks and preserve property interests.

Typically, parties involved in a contract for deed can draft the document themselves or seek assistance from a real estate professional or attorney. This flexibility allows buyers and sellers in Jersey City to tailor the contract to their specific needs. However, utilizing resources like uslegalforms can ensure that you have a compliant and robust document. This can help safeguard against issues that may lead to a Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed.

In most cases, a contract for deed does not require notarization, but having it notarized adds an extra layer of security. This practice ensures that both parties acknowledge the agreement willingly. Furthermore, if the contract leads to disputes, a notarized document may carry more weight in court. For those in Jersey City, New Jersey, understanding the legal implications can help avoid issues related to a Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed.

If a buyer defaults on payments under a land contract, the seller may issue a Jersey City New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed. This notice alerts the buyer of their missed payments and provides a timeframe to rectify the situation. Failure to comply may lead to foreclosure or loss of the property. Buyers should be aware of these consequences and maintain open communication with their sellers.

The state of New Jersey's Prompt Payment Act aims to promote fairness in payment practices across various sectors. It specifies the terms under which payments must occur and outlines consequences for late payments. In cases related to a Jersey City New Jersey Notice of Default for Past Due Payments in connection with a Contract for Deed, this act provides a legal basis for seeking timely compensation.

The New Jersey Prompt Payment Act, specifically PL 1987 Chapter 184, serves as a regulatory framework for timely payments. This law mandates that payments be made promptly, and it details the procedures to follow if payments are delayed. Knowing the provisions of this act is important for anyone issuing or receiving a Jersey City New Jersey Notice of Default for Past Due Payments in connection with a Contract for Deed.