Newark New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed

Description

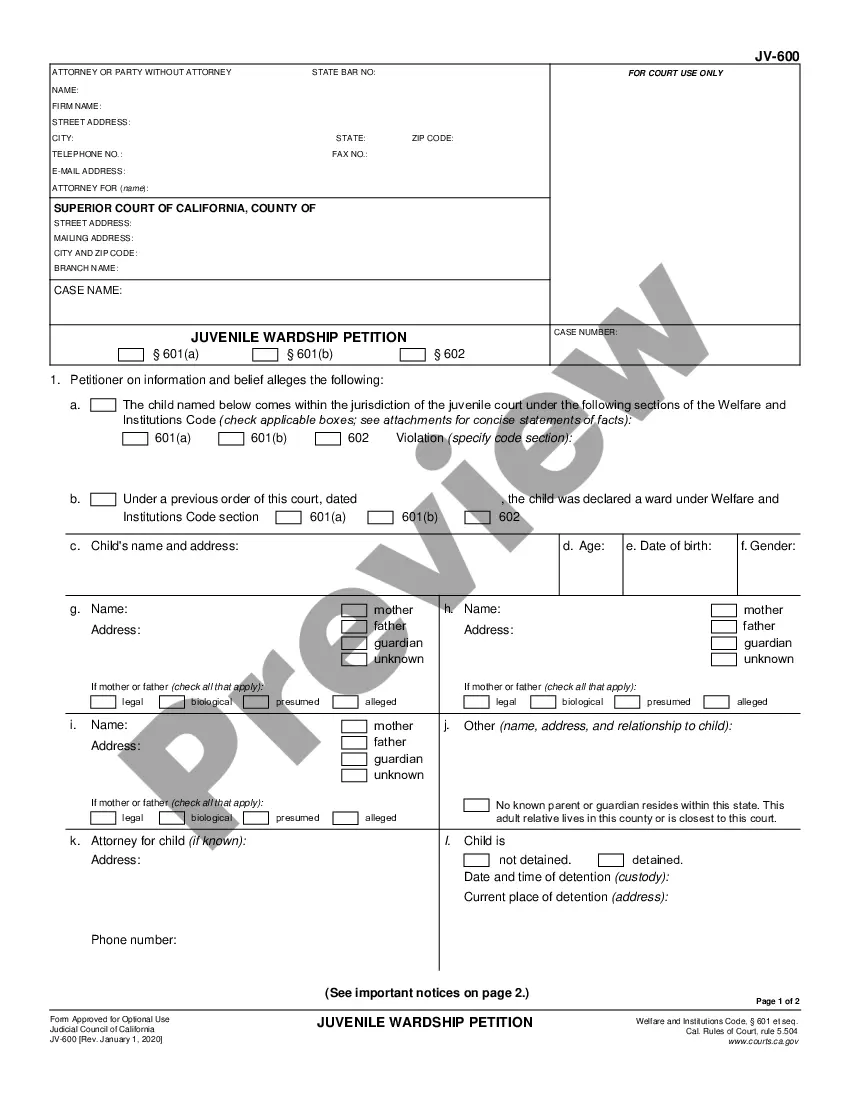

How to fill out New Jersey Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you’ve previously utilized our service, Log In to your account and store the Newark New Jersey Notice of Default for Past Due Payments related to Contract for Deed on your device by selecting the Download button. Ensure your subscription is active. If it isn't, renew it as per your payment plan.

If this is your initial interaction with our service, adhere to these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents menu whenever you wish to reuse it. Leverage the US Legal Forms service to swiftly locate and download any template for your personal or business requirements!

- Confirm you’ve located an appropriate document. Review the description and utilize the Preview feature, if accessible, to verify if it satisfies your requirements. If it doesn't suit you, employ the Search tab above to discover the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or select the PayPal option to finalize the transaction.

- Receive your Newark New Jersey Notice of Default for Past Due Payments related to Contract for Deed. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

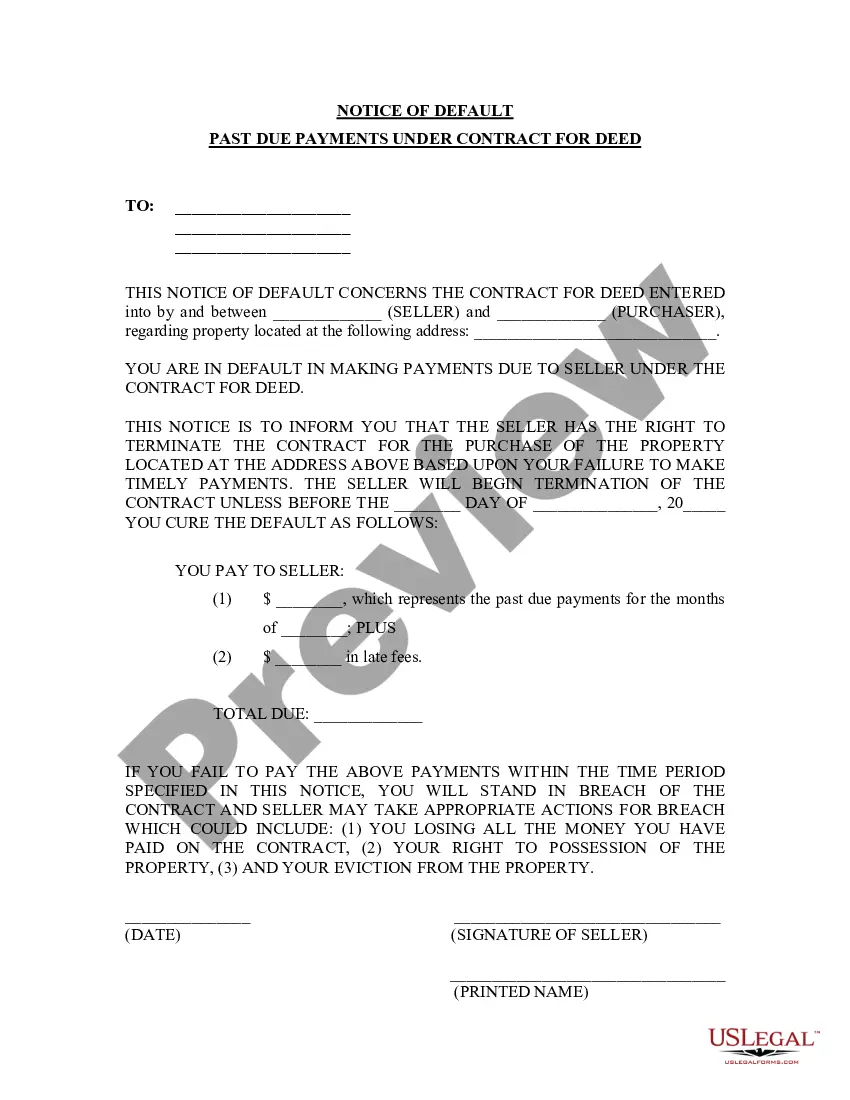

Receiving a default notice is a critical alert indicating that payments on a property are overdue. It is essential to respond promptly, as this notice typically indicates the beginning of more serious actions if the situation is not addressed. Homeowners should review their options for remedying the default and could benefit from legal guidance. If you are facing a Newark New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed, consider consulting resources like USLegalForms to understand your options.

A request for notice of default indicates that a party seeks to be notified when a default occurs on a property. This request is essential for investors and lenders who want to keep track of potential issues that may affect their financial stakes. Being proactive about such notices can help mitigate risks. Understanding the Newark New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed can empower you to make informed decisions.

A request for notice of default allows interested parties, such as buyers or investors, to receive formal notifications if a default notice is issued on a property. This request can help individuals stay informed about potential risks associated with their investments. By having this knowledge, they can act accordingly to protect their interests. If you're working with a Newark New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed, submitting this request could be beneficial.

A default notice serves as a formal communication to inform the property owner that they are behind on payments. This notice outlines the amount owed and often provides a timeframe for the homeowner to rectify the situation. It aims to encourage prompt payment and prevent further legal actions. For those dealing with a Newark New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed, receiving this notice is an important step in addressing payment issues quickly.

When a property enters default, the owner has failed to meet the payment obligations specified in their Contract for Deed. This situation can lead to serious consequences, including potential foreclosure. The lender or seller may initiate proceedings to recover the owed amount. Understanding the Newark New Jersey Notice of Default for Past Due Payments in connection with Contract for Deed is crucial for homeowners to protect their rights.

Defendant(s) must file an answer to the complaint along with the appropriate filing fee within 35 days after service of the complaint. After the complaint is served and an answer is filed, the discovery period begins.

Judgments in New Jersey remain in effect for 20 years and may be renewed for an additional 20 years by filing a motion in the Superior Court, Law Division, Civil Part and/or in the Special Civil Part if the Special Civil Part case was assigned a DJ or J docket number.

Default judgments happen when you don't respond to a lawsuit ? often from a debt collector ? and a judge resolves the case without hearing your side. In effect, you're found guilty because you never entered a defense. Default judgments are sometimes called automatic judgments because of how fast they can happen.

This a result of the person suing you in small claims court and you failed to appear at the hearing. You cannot appeal this kind of judgment and have a new trial until you ?vacate the default judgment?, that is, until you have the judgment removed or erased.

Generally, a default allows you to obtain an earlier final hearing to finish your case. Once the default is signed by the clerk, you can request a trial or final hearing in your case. To obtain a default, you will need to complete Motion for Default, Florida Supreme Court Approved Family Law Form 12.922(a).