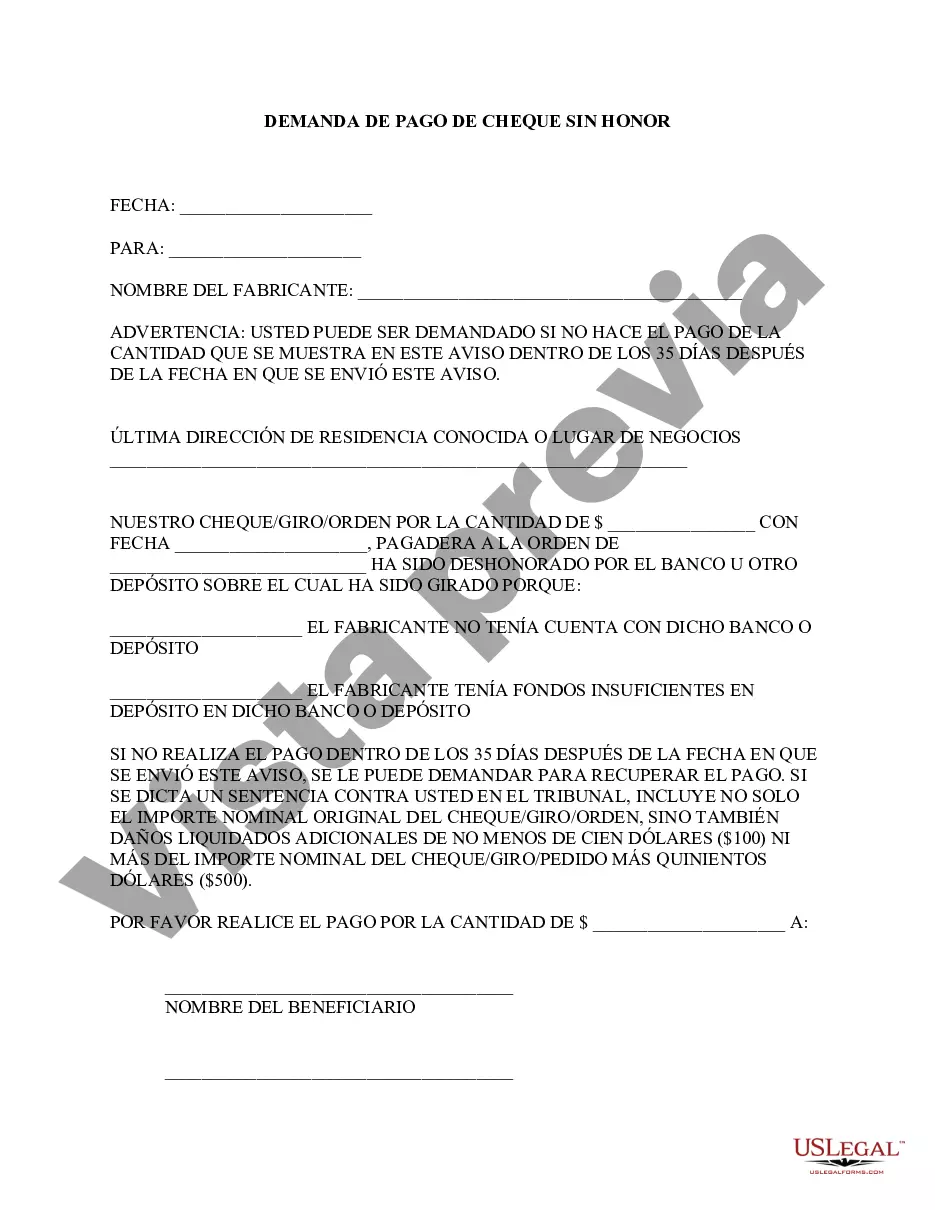

Jersey City New Jersey Demand for Payment of Dishonored Check — A Comprehensive Overview Keywords: Jersey City New Jersey, demand for payment, dishonored check, legal process, penalties, financial obligations Introduction: In the bustling city of Jersey City, New Jersey, businesses and individuals frequently utilize checks as a form of payment. However, on occasion, checks may be dishonored or returned due to insufficient funds or other reasons. In such cases, a demand for payment of the dishonored check is a legal document designed to ensure that the check issuer fulfills their financial obligations. Jersey City has specific processes and requirements in place to address this matter smoothly, protecting the rights and interests of both parties involved. Types of Jersey City New Jersey Demand for Payment of Dishonored Check: 1. Formal Demand Letter: A formal demand letter is the initial step in the process of retrieving payment for a dishonored check. This written correspondence is sent by the payee (the recipient of the check) to the drawer (the check issuer). The demand letter usually notifies the drawer of the dishonored check, states the outstanding amount owed, and requests prompt payment within a specified timeframe. 2. Statutory Demand: If the drawer fails to respond to the formal demand letter or does not settle the outstanding payment, the payee may initiate legal proceedings by filing a statutory demand. This is a more formal and legally binding document that demands payment within a specific timeframe, usually 20 days. The statutory demand serves as a final opportunity for the drawer to resolve the issue before further legal actions are pursued. 3. Litigation: If both the formal demand letter and statutory demand fail to produce the desired outcome, the payee may proceed with legal action by filing a lawsuit against the drawer. This course of action involves the courts and requires the assistance of an attorney. Filing a lawsuit aims to obtain a judgment against the drawer, which typically includes the dishonored amount, legal fees, and other associated costs. Process and Penalties in Jersey City New Jersey: 1. Notice of Dishonored Check: As per New Jersey law, within 30 days of receiving a dishonored check, the payee must provide written notice to the drawer. The notice should include details regarding the check, such as the date, amount, and reason for dishonor. It should also demand payment for the check plus any applicable fees, typically a fee determined by the amount of the check. 2. Right to Cure: Upon receiving the notice of dishonored check, the drawer has 10 days to "cure" the dishonor by making full payment. If the drawer fails to fulfill their financial obligation within this period, the payee may proceed with further legal actions. 3. Penalties and Damages: New Jersey law stipulates that if a drawer fails to pay within the prescribed period, the payee may be entitled to damages, including the amount of the dishonored check, prejudgment interest, reasonable attorney's fees, and court costs. Additionally, the drawer may face additional penalties imposed by the court. Conclusion: The demand for payment of a dishonored check in Jersey City, New Jersey is a crucial step to ensure fair financial practices and protect payees from losses. It also provides an opportunity for check issuers to rectify their mistakes promptly. Understanding the various types of demands, the legal process, and the potential penalties involved is essential for both payees and drawers, ensuring a fair resolution for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Doculivery Abm - New Jersey Demand For Payment of Dishonored Check

Description

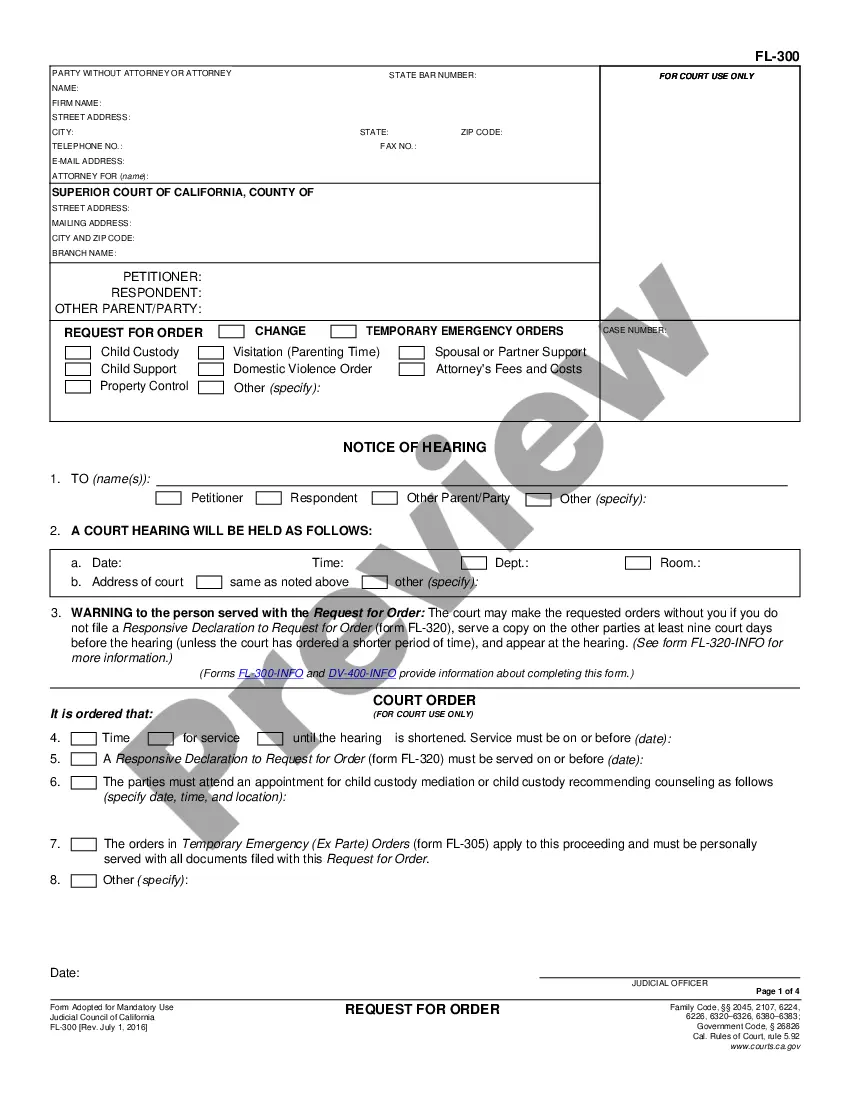

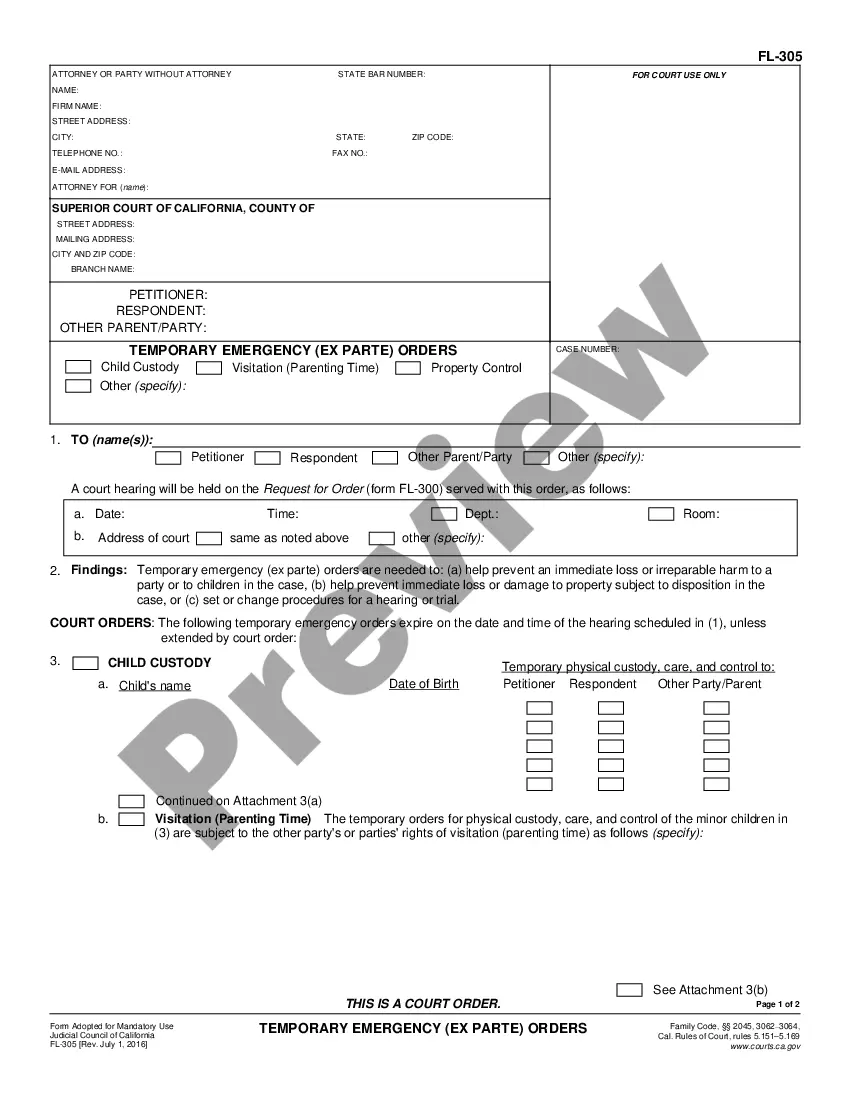

How to fill out Jersey City New Jersey Demanda De Pago De Cheque Sin Fondos?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Jersey City New Jersey Demand For Payment of Dishonored Check becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Jersey City New Jersey Demand For Payment of Dishonored Check takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Jersey City New Jersey Demand For Payment of Dishonored Check. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!