A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

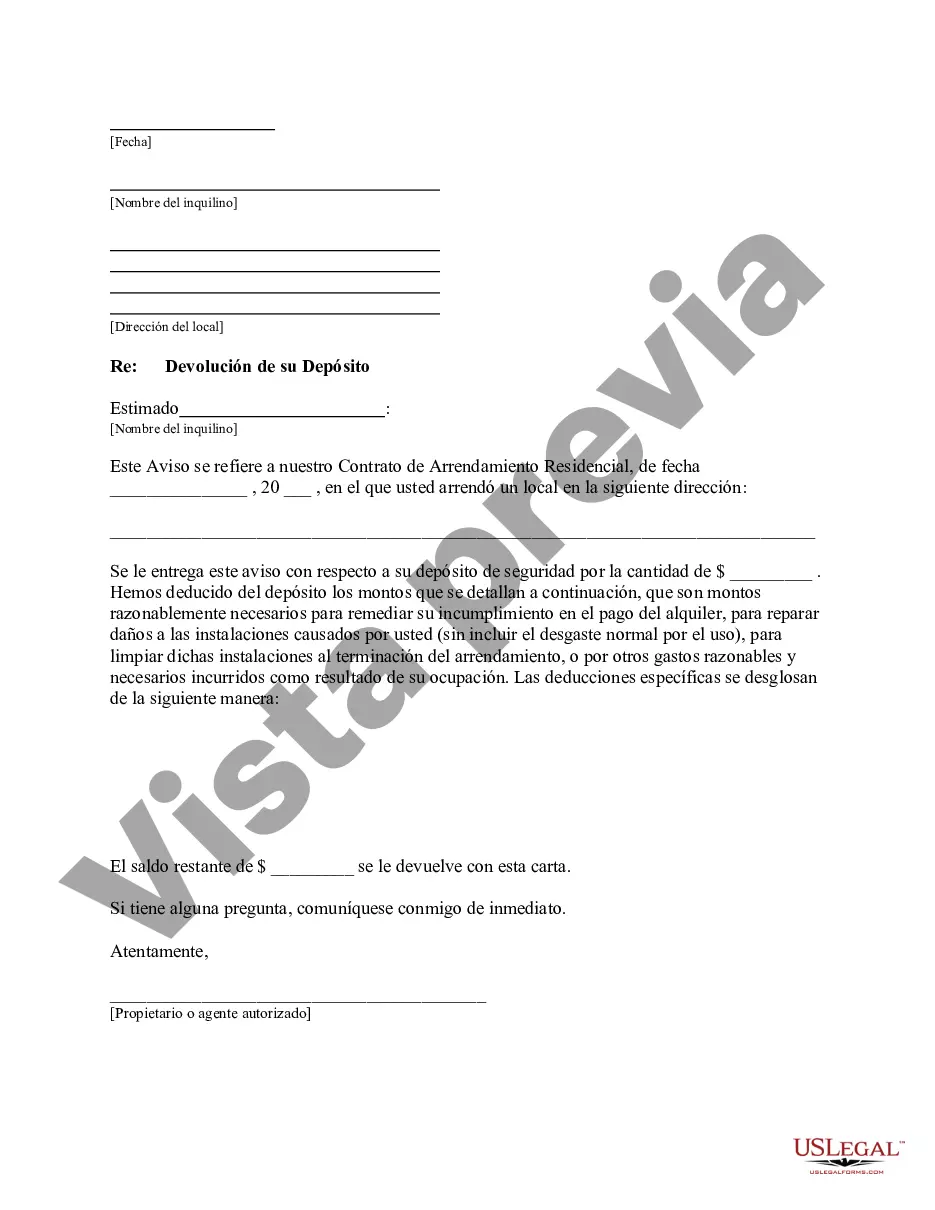

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: Newark, New Jersey Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Detailed Description Introduction: In Newark, New Jersey, a letter from a landlord to a tenant returning a security deposit less deductions is an essential communication. This formal document outlines the deductions made from the tenant's upfront deposit and specifies the remaining amount being returned. Whether it's for damages, unpaid rent, or unpaid utilities, a landlord must provide a thorough and comprehensive breakdown of the deductions to maintain transparency and ensure adherence to rental regulations. This article aims to guide landlords through crafting an effective Newark New Jersey letter and provide insights into different types of deductions they may encounter. Key Elements of a Newark, New Jersey Letter: 1. Date: Begin the letter by including the date when the letter is being drafted to establish a timeline of communication. 2. Tenant's Information: Mention the tenant's full name, address, and the period of tenancy for quick identification. 3. Security Deposit Amount: State the original security deposit amount and reiterate its purpose as protection against potential damages. 4. Deductions Made: Outline the valid deductions made from the security deposit. Use clear and concise language to specify each deduction, including their respective amounts. 5. Description of Deductions: Provide detailed explanations for each deduction, mentioning specifics such as damaged items, unpaid rent, or outstanding utility bills. Attach supporting documents or invoices for transparency. 6. Itemized Deduction Summary: Summarize the total deductions made and present a final amount. Subtract this sum from the original security deposit amount to calculate the refundable amount. 7. Security Deposit Refund Details: Clearly state the remaining amount to be refunded to the tenant, which may include interest depending on local regulations. Specify the manner of refund (check, direct deposit, etc.) and the expected timeframe. 8. Contact Information: Include the landlord's name, address, email, and phone number to facilitate further communication or inquiries. Different Types of Newark, New Jersey Letters: 1. Deductions for Property Damages: This letter highlights deductions from the security deposit concerning damage caused intentionally or accidentally to the property beyond normal wear and tear. 2. Unpaid Rent Deductions: This letter focuses on deductions made to cover unpaid rent or late fees accrued during the tenancy period. 3. Utility Bill Deductions: This letter accounts for deductions made to settle any outstanding utility bills, such as gas, electricity, or water bills, if the tenant failed to pay them during the lease term. 4. Combinations of Deductions: In some cases, a landlord may need to create a comprehensive letter incorporating deductions from multiple categories if applicable. Conclusion: Crafting a well-structured Newark, New Jersey letter from a landlord to a tenant returning a security deposit less deductions is crucial for maintaining professionalism and transparency. By adhering to the instructions outlined in this article, landlords can efficiently communicate deductions made and refund the remaining deposit in accordance with local regulations. Remember to customize the letter as per the specific circumstances and keep open lines of communication to address any concerns raised by the tenant.

Title: Newark, New Jersey Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Detailed Description Introduction: In Newark, New Jersey, a letter from a landlord to a tenant returning a security deposit less deductions is an essential communication. This formal document outlines the deductions made from the tenant's upfront deposit and specifies the remaining amount being returned. Whether it's for damages, unpaid rent, or unpaid utilities, a landlord must provide a thorough and comprehensive breakdown of the deductions to maintain transparency and ensure adherence to rental regulations. This article aims to guide landlords through crafting an effective Newark New Jersey letter and provide insights into different types of deductions they may encounter. Key Elements of a Newark, New Jersey Letter: 1. Date: Begin the letter by including the date when the letter is being drafted to establish a timeline of communication. 2. Tenant's Information: Mention the tenant's full name, address, and the period of tenancy for quick identification. 3. Security Deposit Amount: State the original security deposit amount and reiterate its purpose as protection against potential damages. 4. Deductions Made: Outline the valid deductions made from the security deposit. Use clear and concise language to specify each deduction, including their respective amounts. 5. Description of Deductions: Provide detailed explanations for each deduction, mentioning specifics such as damaged items, unpaid rent, or outstanding utility bills. Attach supporting documents or invoices for transparency. 6. Itemized Deduction Summary: Summarize the total deductions made and present a final amount. Subtract this sum from the original security deposit amount to calculate the refundable amount. 7. Security Deposit Refund Details: Clearly state the remaining amount to be refunded to the tenant, which may include interest depending on local regulations. Specify the manner of refund (check, direct deposit, etc.) and the expected timeframe. 8. Contact Information: Include the landlord's name, address, email, and phone number to facilitate further communication or inquiries. Different Types of Newark, New Jersey Letters: 1. Deductions for Property Damages: This letter highlights deductions from the security deposit concerning damage caused intentionally or accidentally to the property beyond normal wear and tear. 2. Unpaid Rent Deductions: This letter focuses on deductions made to cover unpaid rent or late fees accrued during the tenancy period. 3. Utility Bill Deductions: This letter accounts for deductions made to settle any outstanding utility bills, such as gas, electricity, or water bills, if the tenant failed to pay them during the lease term. 4. Combinations of Deductions: In some cases, a landlord may need to create a comprehensive letter incorporating deductions from multiple categories if applicable. Conclusion: Crafting a well-structured Newark, New Jersey letter from a landlord to a tenant returning a security deposit less deductions is crucial for maintaining professionalism and transparency. By adhering to the instructions outlined in this article, landlords can efficiently communicate deductions made and refund the remaining deposit in accordance with local regulations. Remember to customize the letter as per the specific circumstances and keep open lines of communication to address any concerns raised by the tenant.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.