Jersey City, New Jersey Civil Action Complaint in Rem Foreclosure is a legal process initiated by a lender or mortgage holder to reclaim a property when a borrower defaults on their mortgage payments. This method allows the lender to secure the outstanding debt by foreclosing the property, selling it, and using the proceeds to pay off the loan. A Civil Action Complaint in Rem Foreclosure is a lawsuit filed in the local court system to initiate the foreclosure proceedings. Keywords: Jersey City, New Jersey, Civil Action Complaint, in Rem Foreclosure, lender, mortgage holder, property, borrower, default, mortgage payments, outstanding debt, foreclosure proceedings. There are two primary types of Jersey City, New Jersey Civil Action Complaint in Rem Foreclosure: 1. Judicial Foreclosure: In this type of foreclosure, the lender files a Civil Action Complaint in Rem Foreclosure with the court. The court oversees the foreclosure process, ensures legal compliance, and decides upon the foreclosure sale. During this process, both the lender and the borrower have the opportunity to present their case before a judge. If the court rules in the lender's favor, the property is sold at auction, and the proceeds are used to repay the outstanding loan. Any surplus funds are returned to the borrower. 2. Non-Judicial Foreclosure: Unlike judicial foreclosure, this type of foreclosure does not involve a Civil Action Complaint in Rem Foreclosure filed with the court. Instead, if the mortgage agreement contains a power of sale clause, the lender can proceed with a non-judicial foreclosure. The lender follows a specific procedure outlined in the mortgage agreement and state laws to sell the property without court involvement. Non-judicial foreclosures are usually faster and require less court intervention. In summary, a Jersey City, New Jersey Civil Action Complaint in Rem Foreclosure is a legal process used by lenders to reclaim a property due to borrower default. There are two main types: judicial foreclosure, which involves court oversight, and non-judicial foreclosure, which occurs without court intervention. Both procedures aim to sell the property and use the proceeds to satisfy the outstanding debt.

Jersey City New Jersey Civil Action Complaint in Rem Foreclosure

Category:

State:

New Jersey

City:

Jersey City

Control #:

NJ-12110

Format:

Word;

Rich Text

Instant download

Description

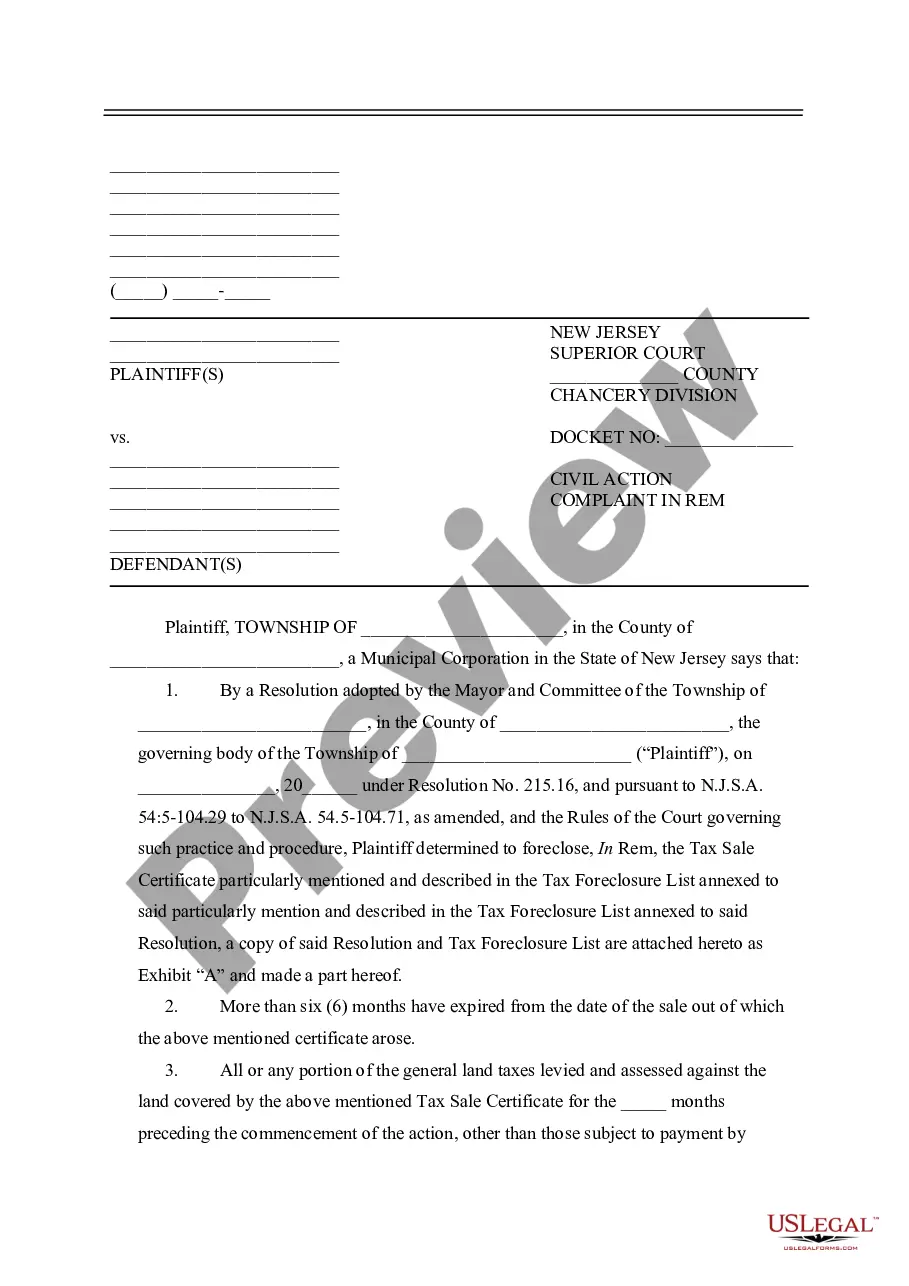

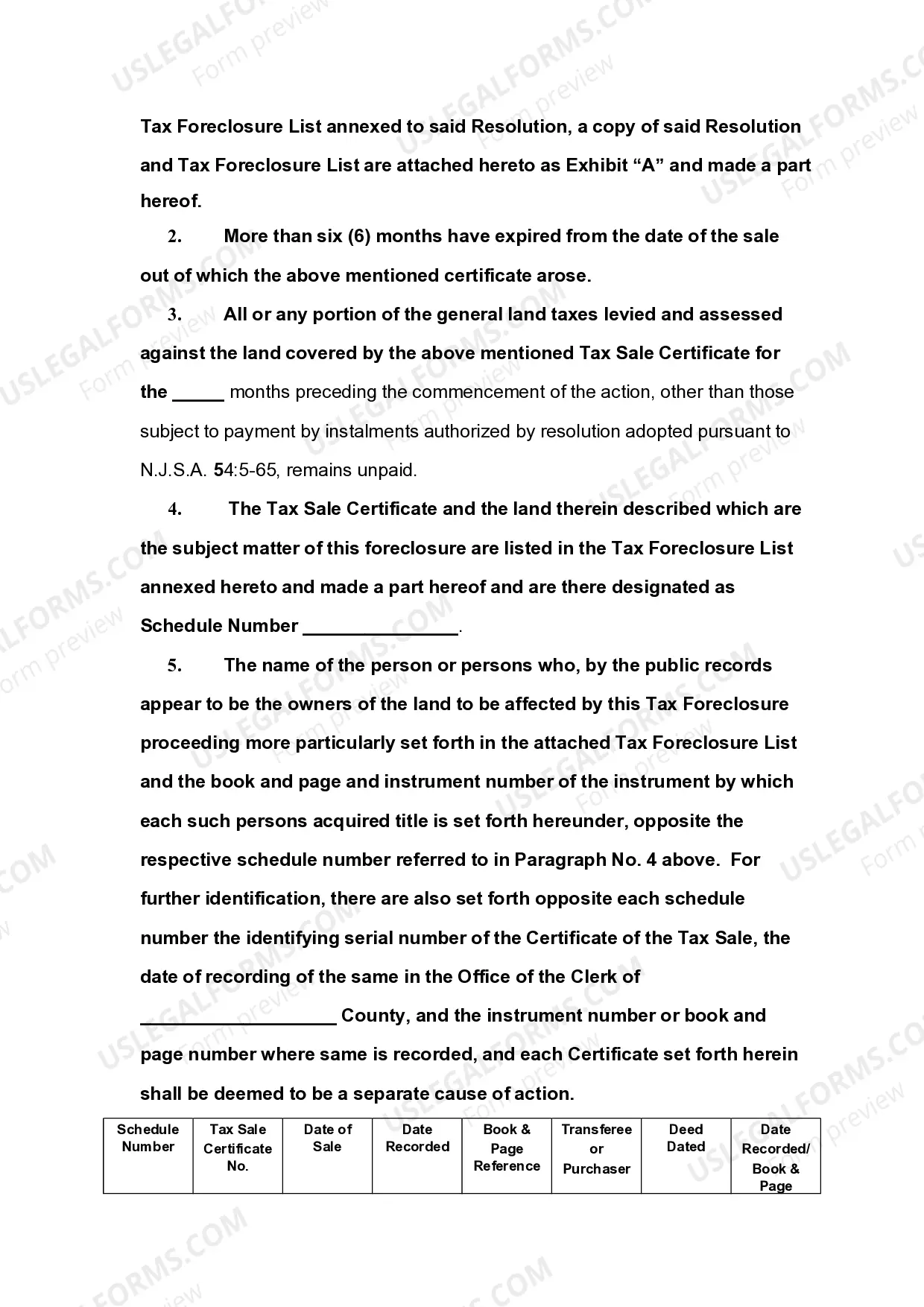

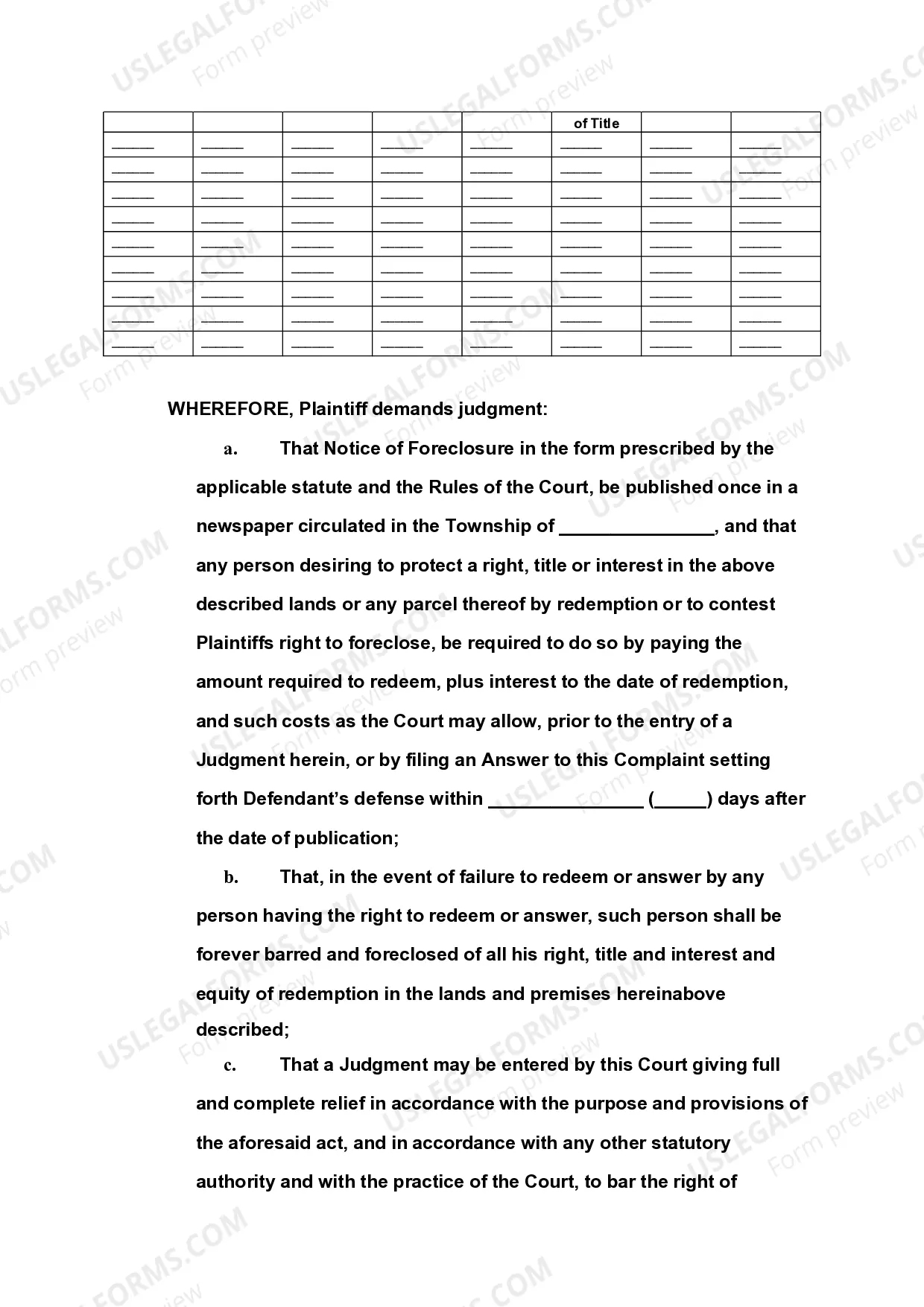

This complaint filed b a municipality seeks foreclosure as a result of unpaid taxes and seeks possession of the property.

Jersey City, New Jersey Civil Action Complaint in Rem Foreclosure is a legal process initiated by a lender or mortgage holder to reclaim a property when a borrower defaults on their mortgage payments. This method allows the lender to secure the outstanding debt by foreclosing the property, selling it, and using the proceeds to pay off the loan. A Civil Action Complaint in Rem Foreclosure is a lawsuit filed in the local court system to initiate the foreclosure proceedings. Keywords: Jersey City, New Jersey, Civil Action Complaint, in Rem Foreclosure, lender, mortgage holder, property, borrower, default, mortgage payments, outstanding debt, foreclosure proceedings. There are two primary types of Jersey City, New Jersey Civil Action Complaint in Rem Foreclosure: 1. Judicial Foreclosure: In this type of foreclosure, the lender files a Civil Action Complaint in Rem Foreclosure with the court. The court oversees the foreclosure process, ensures legal compliance, and decides upon the foreclosure sale. During this process, both the lender and the borrower have the opportunity to present their case before a judge. If the court rules in the lender's favor, the property is sold at auction, and the proceeds are used to repay the outstanding loan. Any surplus funds are returned to the borrower. 2. Non-Judicial Foreclosure: Unlike judicial foreclosure, this type of foreclosure does not involve a Civil Action Complaint in Rem Foreclosure filed with the court. Instead, if the mortgage agreement contains a power of sale clause, the lender can proceed with a non-judicial foreclosure. The lender follows a specific procedure outlined in the mortgage agreement and state laws to sell the property without court involvement. Non-judicial foreclosures are usually faster and require less court intervention. In summary, a Jersey City, New Jersey Civil Action Complaint in Rem Foreclosure is a legal process used by lenders to reclaim a property due to borrower default. There are two main types: judicial foreclosure, which involves court oversight, and non-judicial foreclosure, which occurs without court intervention. Both procedures aim to sell the property and use the proceeds to satisfy the outstanding debt.

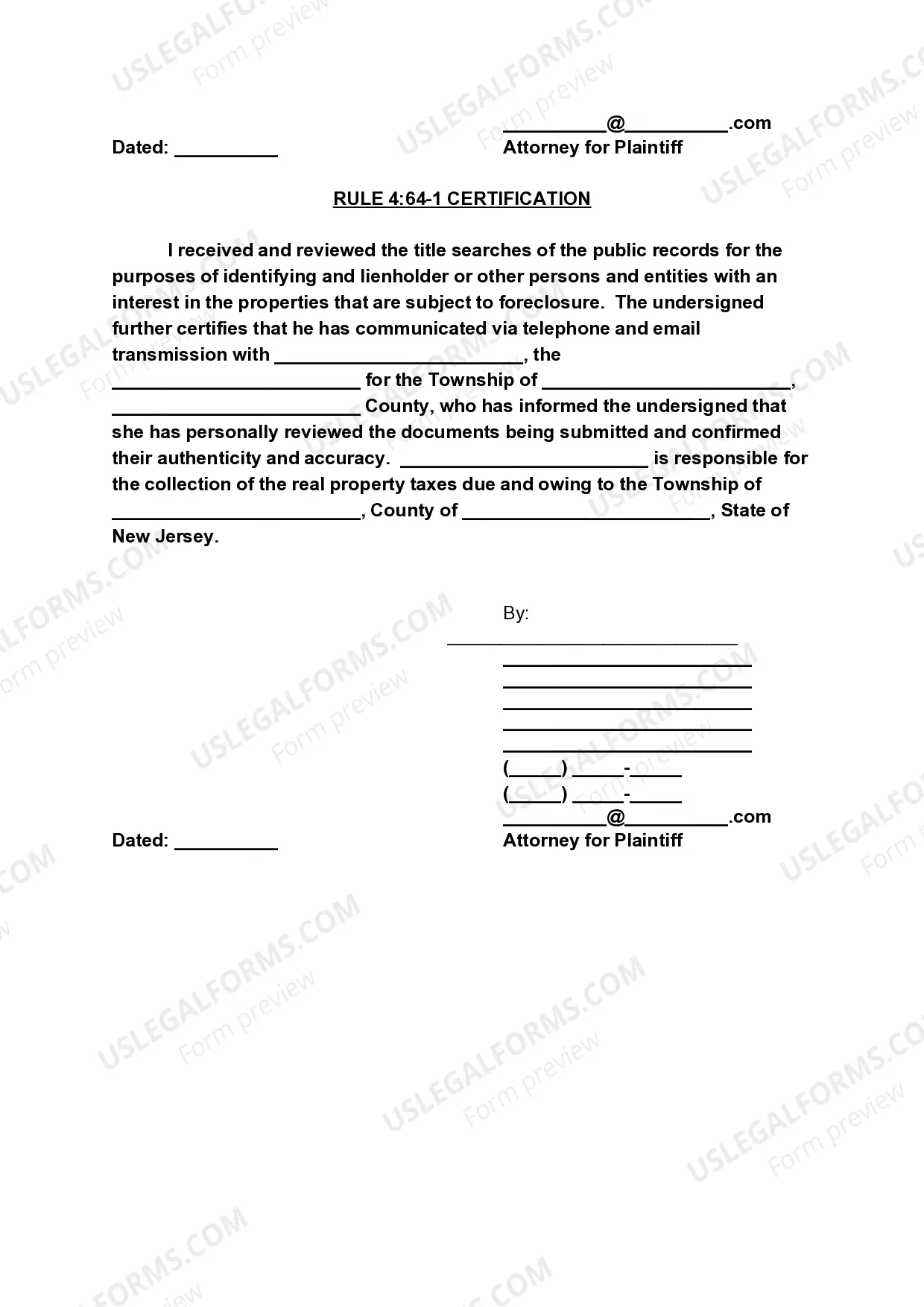

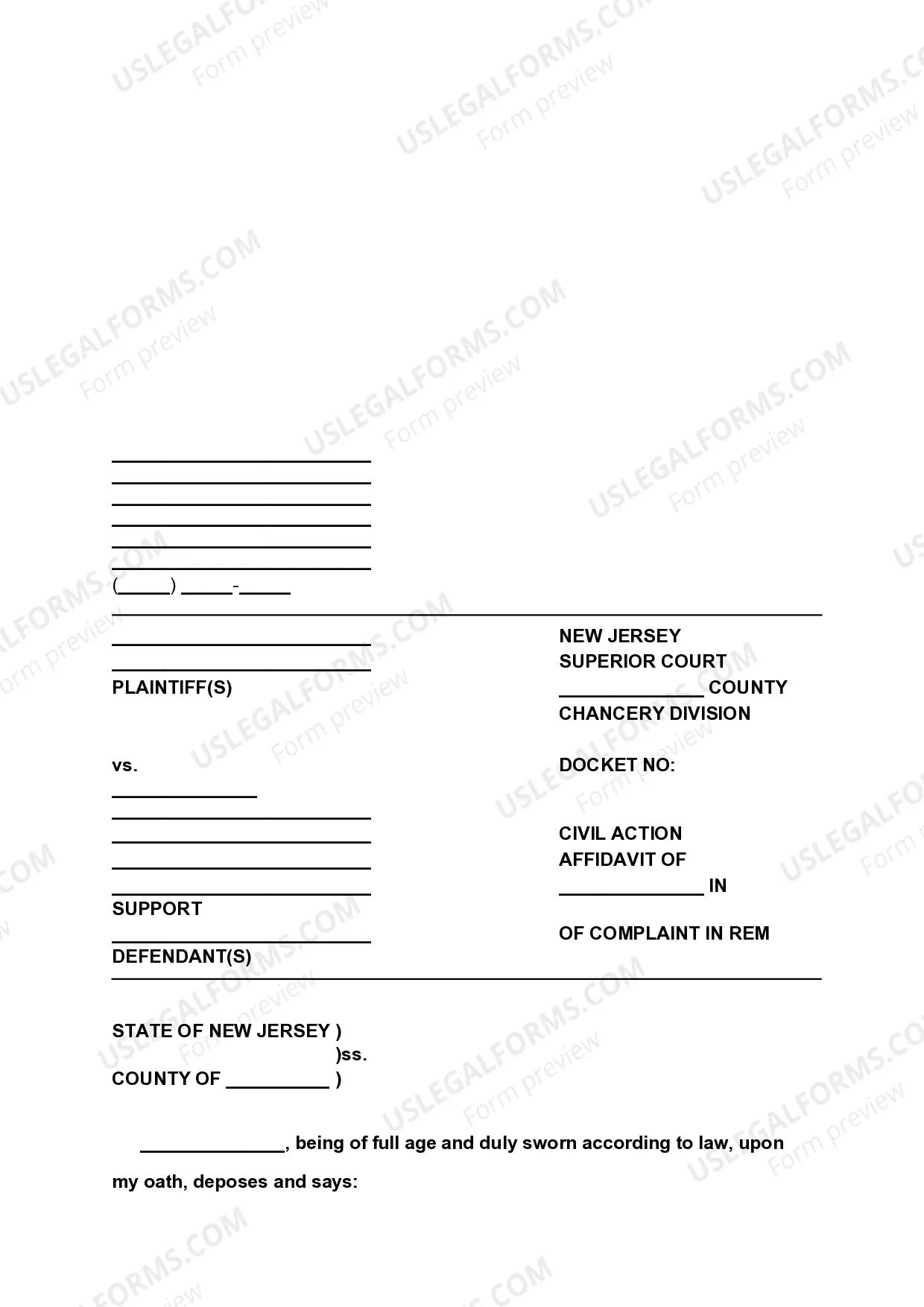

Free preview

How to fill out Jersey City New Jersey Civil Action Complaint In Rem Foreclosure?

If you’ve already utilized our service before, log in to your account and download the Jersey City New Jersey Civil Action Complaint in Rem Foreclosure on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Jersey City New Jersey Civil Action Complaint in Rem Foreclosure. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!