Paterson New Jersey Business Credit Application is a crucial document that allows businesses within Paterson, New Jersey, to apply for credit from financial institutions or other lending entities. This application gathers pertinent information about a business, enabling lenders to assess creditworthiness and determine the level of credit that can be extended. The Paterson New Jersey Business Credit Application typically includes key details such as the legal name of the business, contact information, tax identification number, and nature of the business (sole proprietorship, partnership, corporation, etc.). It also requires information regarding the business owner(s) or principal(s), including their personal details, social security numbers, and equity interest in the business. Additionally, the Paterson New Jersey Business Credit Application requires to be detailed financial information to evaluate the business's ability to repay the credit. This section may ask for income statements, balance sheets, cash flow statements, personal and business tax returns, and bank statements. Lenders use these financial documents to assess the financial stability of the business and its ability to handle credit obligations. Furthermore, the application may inquire about the desired credit amount, the purpose of the credit, and the proposed collateral (if any) that the business is willing to offer to secure the credit. Collateral can range from real estate properties to inventory or accounts receivable. Providing collateral reduces the lender's risk, potentially increasing the chances of credit approval or obtaining more favorable terms. Different types of Paterson New Jersey Business Credit Applications may be available based on the specific lending institution or the type of credit being pursued. Some examples may include: 1. Small Business Loan Application: Catering to small businesses seeking financing for various purposes like expansion, working capital, or equipment purchase. 2. Business Line of Credit Application: Geared towards businesses requiring a revolving line of credit allowing them to draw funds as needed, typically used for short-term expenses or to cover seasonal fluctuations. 3. Commercial Mortgage Application: Designed for businesses looking to acquire or refinance commercial properties, such as offices, retail spaces, or warehouses. 4. Business Credit Card Application: Suited for businesses in need of a revolving credit option for day-to-day expenses, travel, and vendor payments. 5. Equipment Financing Application: Specifically for businesses seeking financing to acquire or lease specific equipment necessary for their operations. These are just a few examples, and the specific types of Paterson New Jersey Business Credit Applications may vary among lenders and financial institutions. It is essential for businesses to carefully review the requirements and determine the most suitable application based on their specific needs and credit goals.

Paterson New Jersey Business Credit Application

State:

New Jersey

City:

Paterson

Control #:

NJ-20-CR

Format:

Word;

Rich Text

Instant download

Description

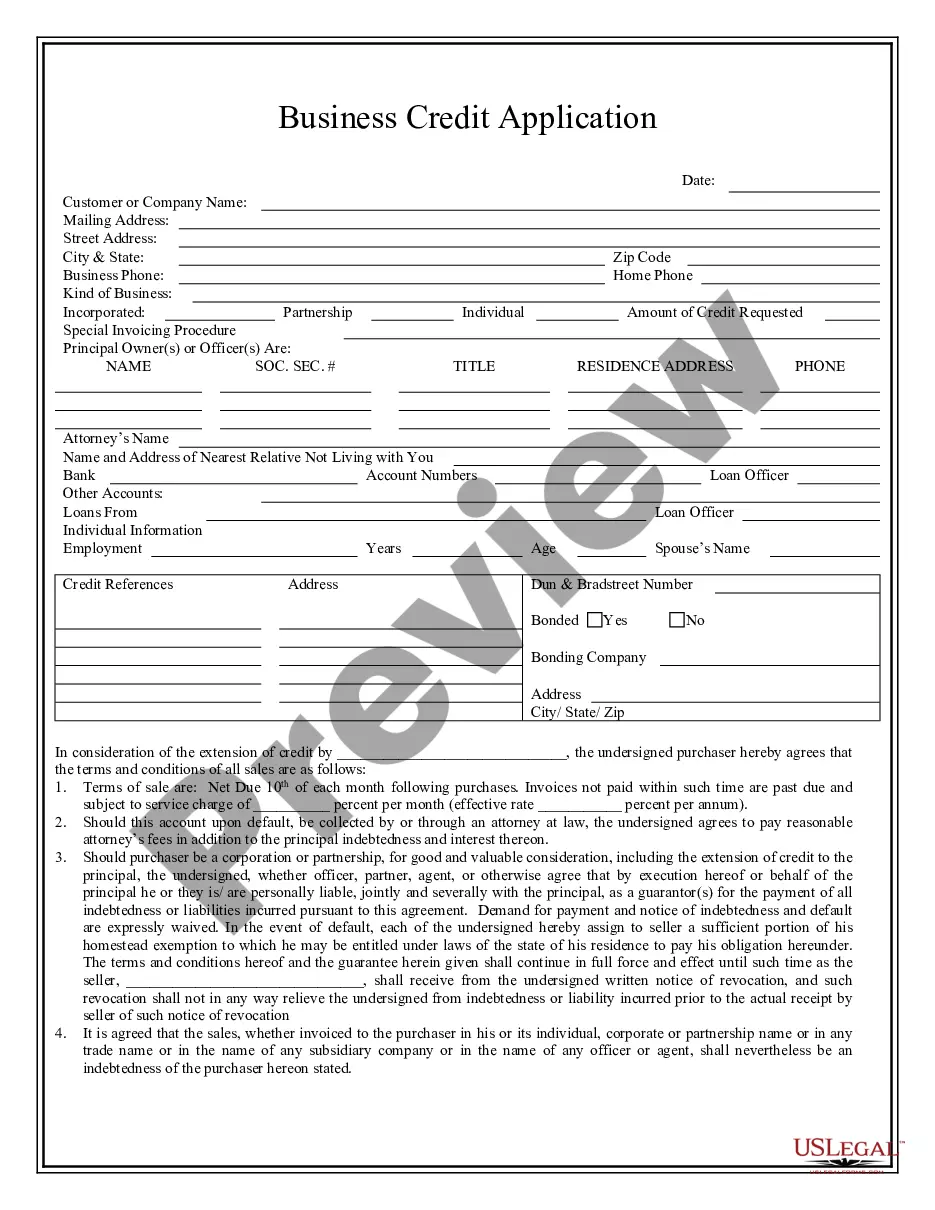

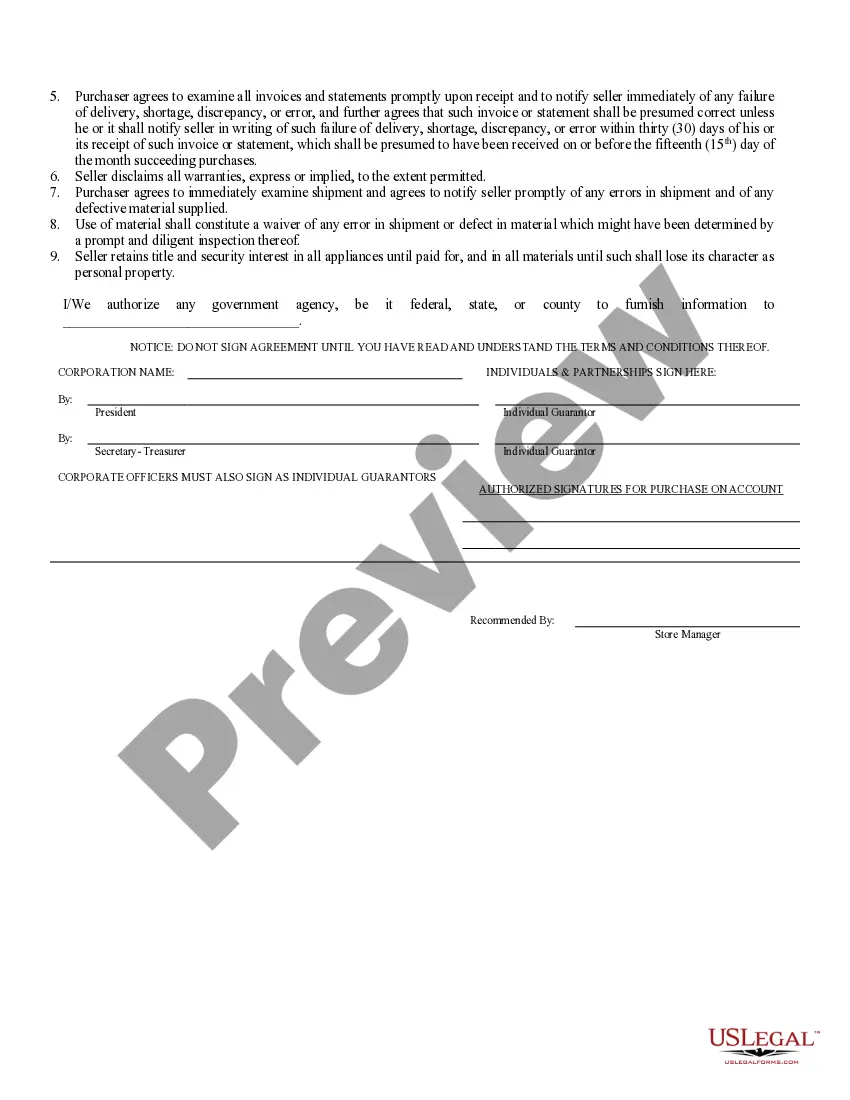

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Paterson New Jersey Business Credit Application is a crucial document that allows businesses within Paterson, New Jersey, to apply for credit from financial institutions or other lending entities. This application gathers pertinent information about a business, enabling lenders to assess creditworthiness and determine the level of credit that can be extended. The Paterson New Jersey Business Credit Application typically includes key details such as the legal name of the business, contact information, tax identification number, and nature of the business (sole proprietorship, partnership, corporation, etc.). It also requires information regarding the business owner(s) or principal(s), including their personal details, social security numbers, and equity interest in the business. Additionally, the Paterson New Jersey Business Credit Application requires to be detailed financial information to evaluate the business's ability to repay the credit. This section may ask for income statements, balance sheets, cash flow statements, personal and business tax returns, and bank statements. Lenders use these financial documents to assess the financial stability of the business and its ability to handle credit obligations. Furthermore, the application may inquire about the desired credit amount, the purpose of the credit, and the proposed collateral (if any) that the business is willing to offer to secure the credit. Collateral can range from real estate properties to inventory or accounts receivable. Providing collateral reduces the lender's risk, potentially increasing the chances of credit approval or obtaining more favorable terms. Different types of Paterson New Jersey Business Credit Applications may be available based on the specific lending institution or the type of credit being pursued. Some examples may include: 1. Small Business Loan Application: Catering to small businesses seeking financing for various purposes like expansion, working capital, or equipment purchase. 2. Business Line of Credit Application: Geared towards businesses requiring a revolving line of credit allowing them to draw funds as needed, typically used for short-term expenses or to cover seasonal fluctuations. 3. Commercial Mortgage Application: Designed for businesses looking to acquire or refinance commercial properties, such as offices, retail spaces, or warehouses. 4. Business Credit Card Application: Suited for businesses in need of a revolving credit option for day-to-day expenses, travel, and vendor payments. 5. Equipment Financing Application: Specifically for businesses seeking financing to acquire or lease specific equipment necessary for their operations. These are just a few examples, and the specific types of Paterson New Jersey Business Credit Applications may vary among lenders and financial institutions. It is essential for businesses to carefully review the requirements and determine the most suitable application based on their specific needs and credit goals.

Free preview

How to fill out Paterson New Jersey Business Credit Application?

If you’ve already utilized our service before, log in to your account and save the Paterson New Jersey Business Credit Application on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Paterson New Jersey Business Credit Application. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!