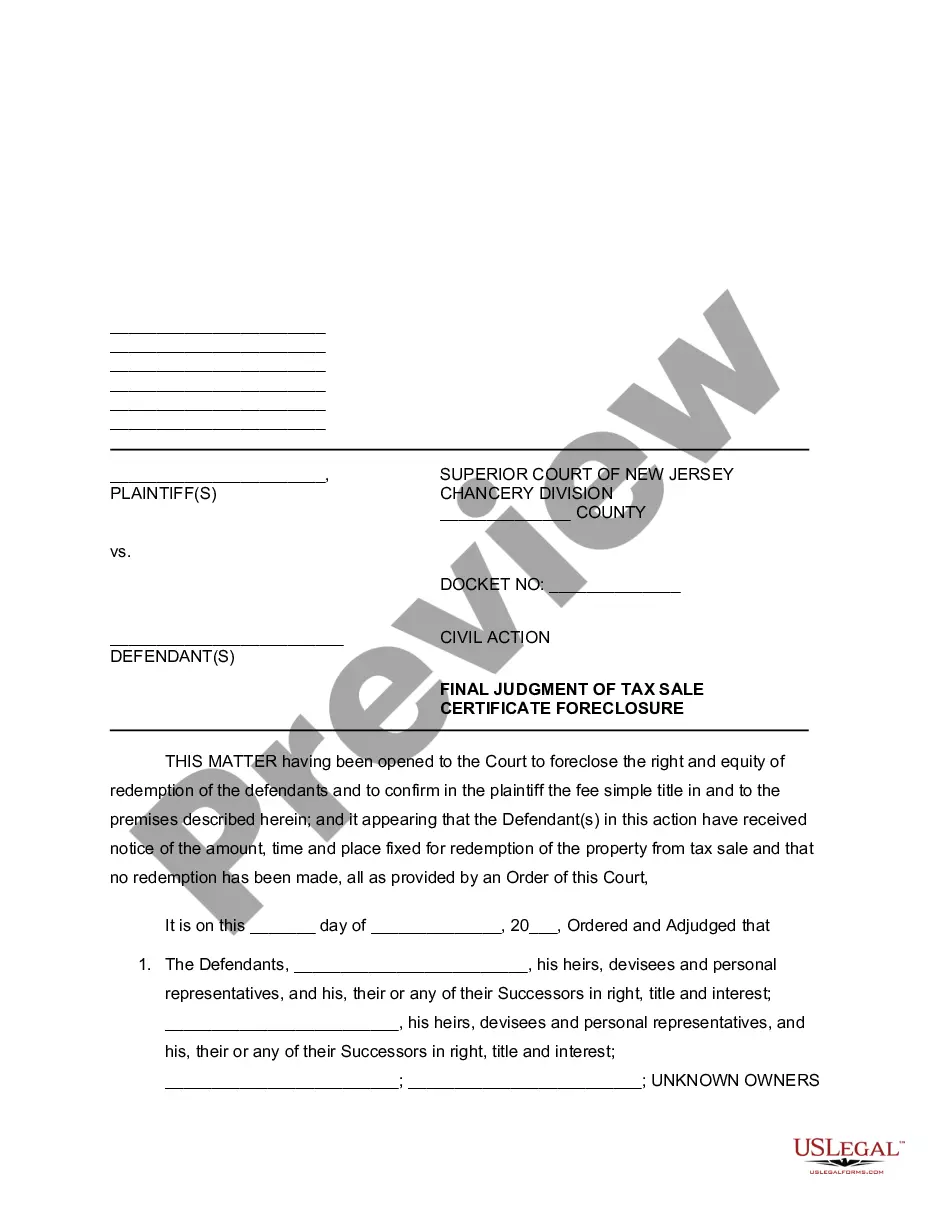

Jersey City, New Jersey Final Judgment of Tax Sale Certificate Foreclosure is a legal process whereby the ownership rights of a property are transferred to a buyer after the homeowner fails to pay their property taxes. This type of foreclosure is initiated when the property owner fails to repay their outstanding property taxes despite receiving several notices and warnings from the city. In Jersey City, New Jersey, there are mainly two types of Final Judgment of Tax Sale Certificate Foreclosures: In Rem and In Personal. 1. In Rem Foreclosure: In this type of foreclosure, the legal action is taken against the property itself rather than the property owner. The city files a lawsuit against the property, seeking a judgment and the sale of the property to recover the unpaid tax amount. The proceeds from the sale are then used to satisfy the outstanding tax debt. 2. In Personal Foreclosure: In this type of foreclosure, the legal action is taken against the property owner directly. The city files a lawsuit against the property owner, seeking a judgment and potentially seizing other assets of the property owner to satisfy the unpaid tax amount. If the property owner still fails to repay their taxes, the property may also be sold at a tax sale. The final judgment of a tax sale certificate foreclosure is typically issued by a court once all legal requirements have been met. It establishes that the property will be sold at a public auction to the highest bidder. The date and time of the auction are announced publicly, giving interested parties an opportunity to bid on the property. It is important to note that a Final Judgment of Tax Sale Certificate Foreclosure can have significant consequences for property owners. The successful bidder at the auction becomes the new owner of the property, and the previous owner loses all rights and interests in the property. Additionally, any outstanding liens or mortgages on the property may also be extinguished through this process. In conclusion, the Jersey City, New Jersey Final Judgment of Tax Sale Certificate Foreclosure is a legal process used to recover unpaid property taxes. It can be initiated through In Rem or In Personal foreclosure, and it ultimately results in the sale of the property to settle the outstanding tax debt.

Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure

Category:

State:

New Jersey

City:

Jersey City

Control #:

NJ-29337

Format:

Word;

Rich Text

Instant download

Description

The court finalizes a foreclosure based upon unpaid taxes and grants title and possessio of the property to the Plaintiff.

Jersey City, New Jersey Final Judgment of Tax Sale Certificate Foreclosure is a legal process whereby the ownership rights of a property are transferred to a buyer after the homeowner fails to pay their property taxes. This type of foreclosure is initiated when the property owner fails to repay their outstanding property taxes despite receiving several notices and warnings from the city. In Jersey City, New Jersey, there are mainly two types of Final Judgment of Tax Sale Certificate Foreclosures: In Rem and In Personal. 1. In Rem Foreclosure: In this type of foreclosure, the legal action is taken against the property itself rather than the property owner. The city files a lawsuit against the property, seeking a judgment and the sale of the property to recover the unpaid tax amount. The proceeds from the sale are then used to satisfy the outstanding tax debt. 2. In Personal Foreclosure: In this type of foreclosure, the legal action is taken against the property owner directly. The city files a lawsuit against the property owner, seeking a judgment and potentially seizing other assets of the property owner to satisfy the unpaid tax amount. If the property owner still fails to repay their taxes, the property may also be sold at a tax sale. The final judgment of a tax sale certificate foreclosure is typically issued by a court once all legal requirements have been met. It establishes that the property will be sold at a public auction to the highest bidder. The date and time of the auction are announced publicly, giving interested parties an opportunity to bid on the property. It is important to note that a Final Judgment of Tax Sale Certificate Foreclosure can have significant consequences for property owners. The successful bidder at the auction becomes the new owner of the property, and the previous owner loses all rights and interests in the property. Additionally, any outstanding liens or mortgages on the property may also be extinguished through this process. In conclusion, the Jersey City, New Jersey Final Judgment of Tax Sale Certificate Foreclosure is a legal process used to recover unpaid property taxes. It can be initiated through In Rem or In Personal foreclosure, and it ultimately results in the sale of the property to settle the outstanding tax debt.

Free preview

How to fill out Jersey City New Jersey Final Judgment Of Tax Sale Certificate Foreclosure?

If you’ve already used our service before, log in to your account and save the Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Jersey City New Jersey Final Judgment of Tax Sale Certificate Foreclosure. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!