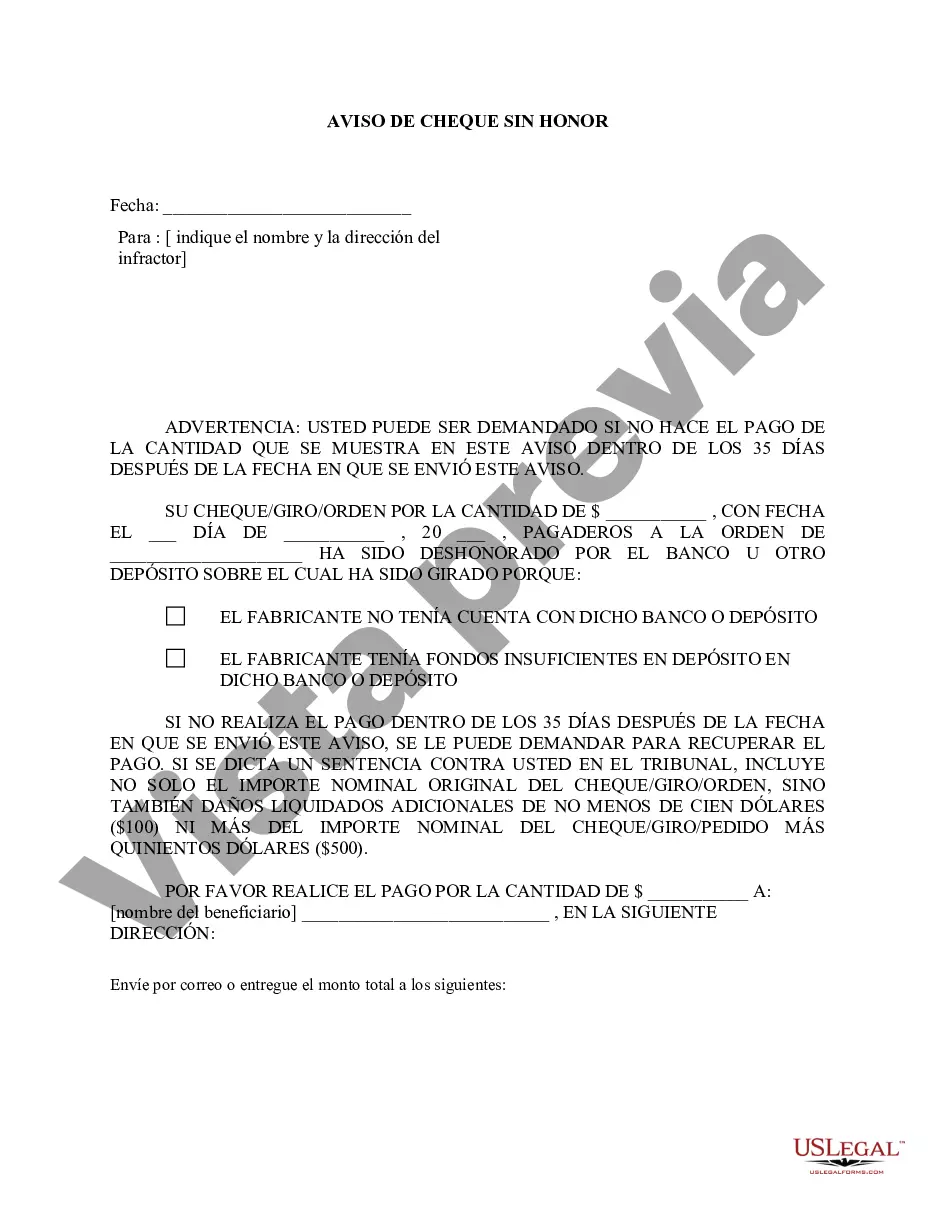

Title: Understanding Elizabeth New Jersey Notice of Dishonored Check — Civil Proceedings Keywords: bad check, bounced check, Elizabeth New Jersey Notice of Dishonored Check, civil proceedings Introduction: In Elizabeth, New Jersey, a Notice of Dishonored Check is a legal document issued to inform individuals that their check has been returned unpaid by the financial institution upon which it was drawn. Such occurrences often result in civil proceedings, where the party affected seeks restitution for the debt incurred. This article will provide a comprehensive overview of the Elizabeth New Jersey Notice of Dishonored Check — Civil proceedings, covering the different types and implications associated with bad or bounced checks. 1. Definition of a Bad Check: A bad check, also known as a dishonored or bounced check, refers to a check that has been returned unpaid by the bank due to insufficient funds, a closed account, or irregularities. It essentially means that the person who issued the check did not have enough money in their account to cover the requested funds. 2. Elizabeth New Jersey Notice of Dishonored Check — Civil Proceedings: When a check is dishonored, the recipient may choose to pursue civil actions to seek restitution for the unpaid amount. The civil proceedings involve filing an Elizabeth New Jersey Notice of Dishonored Check, which serves as a formal notification to the check issuer regarding their unpaid debt. 3. Types of Elizabeth New Jersey Notice of Dishonored Check — Civil Proceedings: a) Civil Demand Letter: A civil demand letter is an initial attempt to recover the amount owed from the check issuer before escalating the matter to a court. The letter typically requests prompt payment to avoid further legal actions. b) Small Claims Court: If the check issuer does not respond to the civil demand letter or fails to make the necessary payment, the recipient may file a small claims court case. In this case, the recipient must prove that the check was issued, dishonored, and that the recipient suffered a financial loss due to the dishonor. c) Superior Court Proceedings: If the amount of the dishonored check exceeds the small claims court's jurisdiction or if the recipient decides to pursue a more extensive legal action, they can file a complaint in the Superior Court of New Jersey. This initiates a formal civil lawsuit to obtain the owed funds. 4. Implications of the Elizabeth New Jersey Notice of Dishonored Check — Civil Proceedings: a) Financial Consequences: The dishonored check issuer may be required to pay the original amount owed, any associated costs (including court fees and legal expenses), and potentially additional statutory damages according to New Jersey law. b) Impact on Credit Score: Failure to resolve a dishonored check and subsequent legal proceedings can negatively impact the check issuer's credit score, potentially making it more challenging to secure financing or financial services in the future. c) Legal Penalties: In addition to financial repercussions, dishonoring a check may lead to criminal charges if the issuer's actions are deemed fraudulent or intentional. This could result in fines, probation, or even imprisonment, depending on the severity and circumstances of the offense. Conclusion: Understanding the Elizabeth New Jersey Notice of Dishonored Check — Civil proceedings is crucial for both the recipients of bad checks and those who issued them. Dishonored checks can result in substantial financial and legal consequences. The parties involved should strive to resolve such matters promptly through payment settlement or legal action to avoid further complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Elizabeth New Jersey Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out New Jersey Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Are you in search of a reliable and budget-friendly provider of legal documents to acquire the Elizabeth New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? US Legal Forms is your ultimate choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce process in court, we have you covered. Our site provides over 85,000 current legal document templates for personal and business needs. All templates we offer are not generic and are structured according to the stipulations of particular states and regions.

To obtain the form, you must Log In to your account, locate the necessary form, and click the Download button beside it. Please keep in mind that you can retrieve your previously purchased form templates at any time in the My documents section.

Is this your first time visiting our site? No problem. You can easily create an account, but prior to that, ensure you do the following.

Now you can establish your account. Next, select a subscription plan and proceed with the payment. Once the payment is completed, you can download the Elizabeth New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in any available format. You can return to the website at any moment and download the form again at no cost.

Discovering current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time navigating legal documentation online once and for all.

- Confirm that the Elizabeth New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check aligns with the laws of your state and local area.

- Review the form’s specifics (if available) to understand who and what the form is applicable for.

- Restart the search if the form is not appropriate for your unique situation.