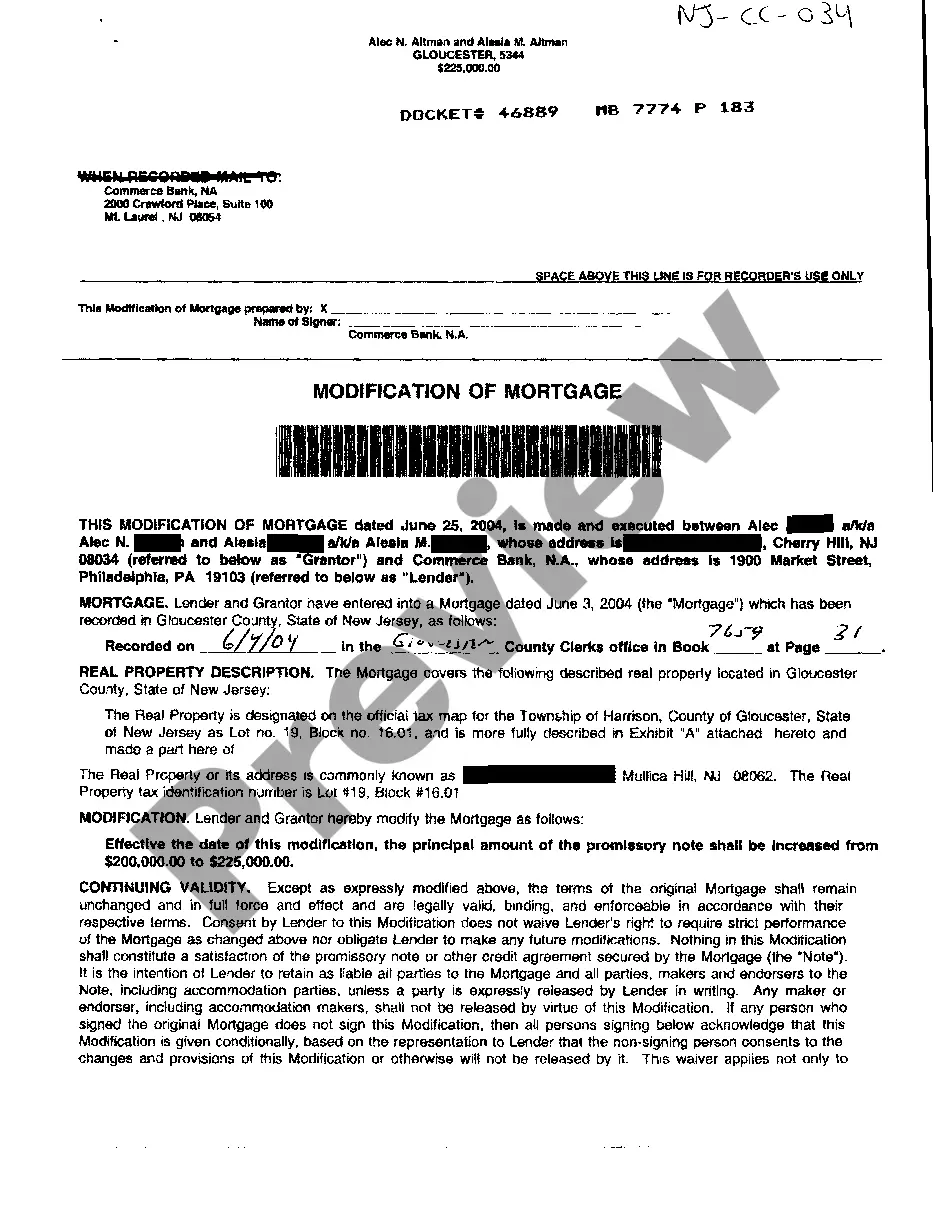

Jersey City, located in New Jersey, offers various types of mortgage modifications designed to assist homeowners facing financial challenges. A mortgage modification is a process by which the terms of an existing mortgage loan are modified to make it more affordable for the borrower. This can help homeowners avoid foreclosure and keep their homes. One type of mortgage modification available in Jersey City is a loan modification. A loan modification involves changing the terms of the loan, such as the interest rate, loan term, or monthly payment, to make it more manageable for the homeowner. It aims to provide a long-term solution for homeowners struggling to meet their mortgage obligations. Another type of mortgage modification available in Jersey City is a principal reduction. In this type of modification, the outstanding loan balance is reduced, often due to the decline in the property's value. A principal reduction can help homeowners who owe more on their mortgages than their homes are worth. Jersey City also offers a government-backed mortgage modification program called the Home Affordable Modification Program (CAMP). CAMP provides eligible homeowners with financial assistance to modify their mortgages and make them more affordable. It includes measures such as interest rate reductions, term extensions, and principal forbearance. Additionally, there are temporary mortgage modifications available in Jersey City, such as forbearance agreements. A forbearance agreement allows homeowners facing temporary financial hardships to pause or reduce their mortgage payments for a specific period. This can provide short-term relief during times of financial difficulty. Mortgage modifications in Jersey City aim to assist homeowners who are struggling to make their mortgage payments and avoid foreclosure. These modifications are designed to provide borrowers with more manageable loan terms and affordable monthly payments, allowing them to keep their homes and regain financial stability. In summary, Jersey City, New Jersey, offers various types of mortgage modifications including loan modifications, principal reduction, government-backed programs like CAMP, and temporary solutions like forbearance agreements. These modifications aim to help homeowners facing financial challenges to stay in their homes and overcome their mortgage difficulties.

Jersey City New Jersey Modification Of Mortgage

Description

How to fill out Jersey City New Jersey Modification Of Mortgage?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person without any law education to draft this sort of papers from scratch, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service offers a huge library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Jersey City New Jersey Modification Of Mortgage or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Jersey City New Jersey Modification Of Mortgage in minutes using our trustworthy service. If you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our platform, make sure to follow these steps before downloading the Jersey City New Jersey Modification Of Mortgage:

- Ensure the template you have chosen is specific to your location considering that the regulations of one state or area do not work for another state or area.

- Review the document and go through a brief outline (if provided) of cases the document can be used for.

- If the form you chosen doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Select the payment gateway and proceed to download the Jersey City New Jersey Modification Of Mortgage once the payment is completed.

You’re all set! Now you can go on and print out the document or fill it out online. If you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.