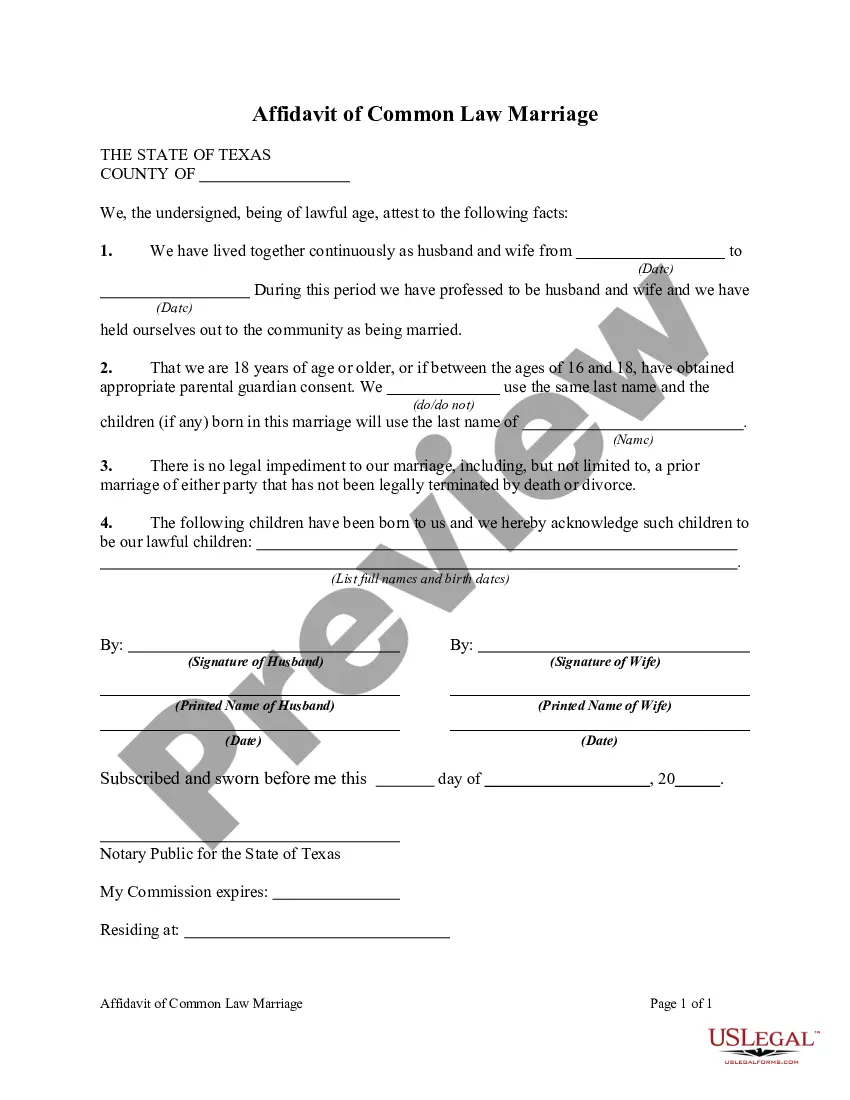

A living trust is an essential legal document that helps individuals in Newark, New Jersey, who are single, divorced, widowed, or widower without children, to manage and distribute their assets and properties during their lifetime and after their passing. This comprehensive guide will provide a detailed description of what a Newark New Jersey Living Trust entails for individuals in these specific circumstances. We will explore the relevant keywords associated with this topic and explain the different types of living trusts available. Keywords: Newark New Jersey Living Trust, living trust for individuals, single individuals living trust, divorced living trust, widowed living trust, widower living trust, living trust for individuals with no children, living trust benefits, asset management, asset distribution, estate planning. Introduction: A living trust is a legal arrangement that allows individuals to dictate how their assets will be managed and distributed both during their lifetime and after their passing. This invaluable tool provides control, privacy, and flexibility in managing one's estate. For individuals in Newark, New Jersey, who are single, divorced, or widowed, and have no children, a living trust becomes all the more important. Benefits of a Newark New Jersey Living Trust for Individual Who is Single, Divorced, or Widow (or Widower) with No Children: 1. Control over Asset Management: A living trust allows individuals to choose how their assets will be managed during their lifetime. This ensures that their wishes are respected and followed, even if they become incapacitated. 2. Privacy: Unlike a will, a living trust is not subject to probate, which is a public process. By avoiding probate, individuals can maintain the utmost privacy regarding the details of their estate and beneficiaries. 3. Flexibility and Revocability: Living trusts provide the flexibility to modify or revoke the trust as circumstances might change. This means individuals can adjust the trust to account for life events such as new relationships, assets, or beneficiaries. 4. Asset Distribution: With a living trust, individuals can specify how their assets should be distributed after their passing. This allows them to provide for loved ones, friends, charities, or any other beneficiaries they choose. Types of Newark New Jersey Living Trust for Individual Who is Single, Divorced, or Widow (or Widower) with No Children: 1. Revocable Living Trust: This is the most common type of living trust. It allows the individual to maintain control and ownership of their assets during their lifetime while designating beneficiaries who will receive the assets upon their passing. This trust can be modified or revoked as desired by the individual. 2. Irrevocable Living Trust: This type of trust permanently transfers ownership and control of the assets to the trust. Once established, the individual can no longer modify or revoke the trust. However, it offers certain tax benefits and protection from creditors. 3. Special Needs Trust: If the individual has a loved one with special needs, a Special Needs Trust can be created within a living trust. This arrangement ensures that the beneficiary receives necessary care and benefits while preserving their eligibility for government assistance. 4. Charitable Remainder Trust: For individuals considering charitable donations, a Charitable Remainder Trust allows them to provide income to themselves or a chosen beneficiary during their lifetime and donate the remaining assets to a charitable organization upon their passing. Conclusion: A Newark New Jersey Living Trust is a critical estate planning tool for single individuals, divorcees, widows, or widowers without children. By establishing a living trust, individuals in these situations can promote asset management, maintain privacy, exercise control, and ensure a smooth distribution of their assets to desired beneficiaries. Whether opting for a revocable or irrevocable trust or considering a special needs or charitable remainder trust, it is essential to consult with a qualified estate planning attorney to tailor the living trust according to specific needs and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Newark New Jersey Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos (o Viudos) sin Hijos - New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

How to fill out Newark New Jersey Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos (o Viudos) Sin Hijos?

Do you need a reliable and inexpensive legal forms provider to get the Newark New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children? US Legal Forms is your go-to option.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Newark New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the form is intended for.

- Restart the search in case the template isn’t good for your legal situation.

Now you can create your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Newark New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children in any available format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal papers online once and for all.