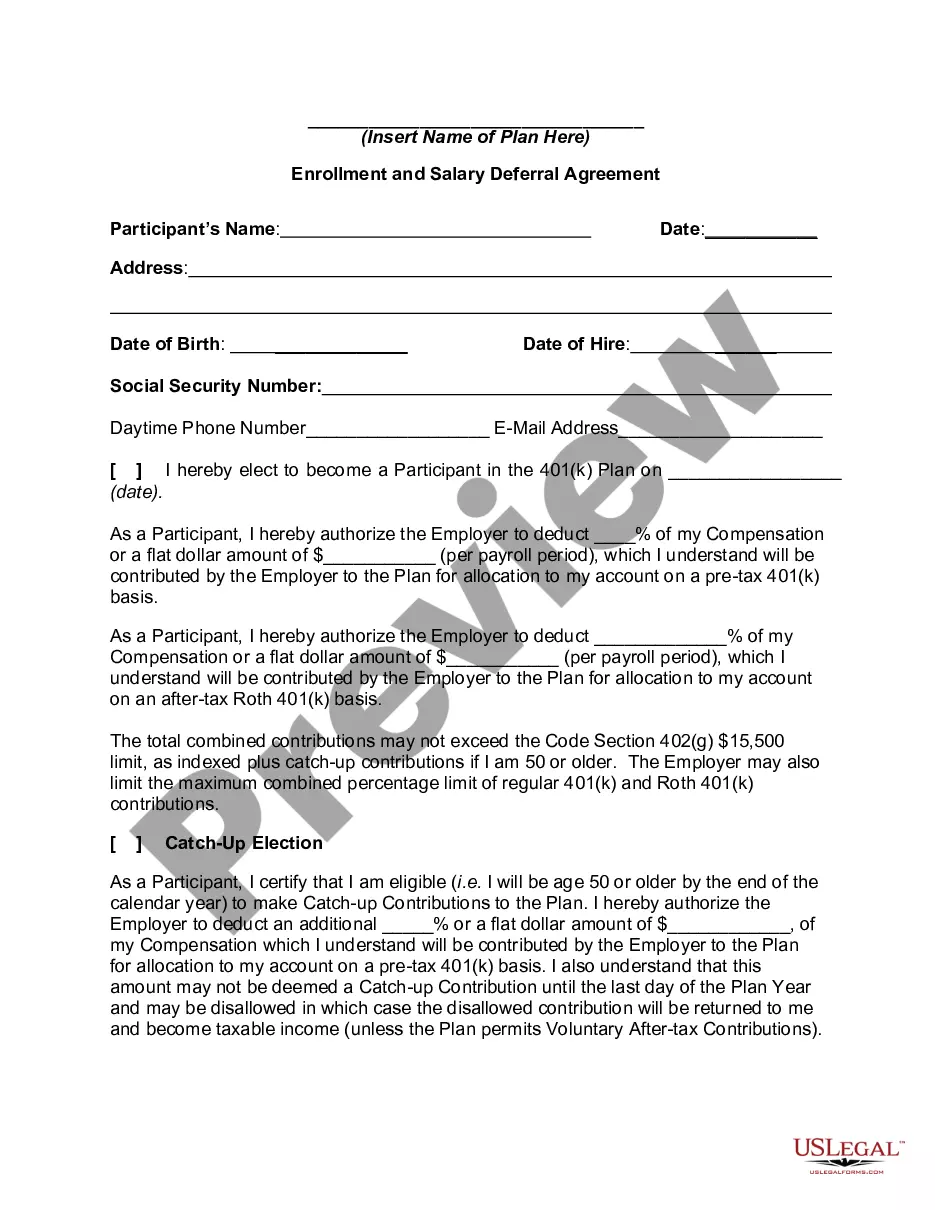

A Paterson New Jersey Living Trust for Husband and Wife with Minor and/or Adult Children is a legal document that allows a couple to ensure the proper management and distribution of their assets during their lifetime and after their passing. This type of trust is specifically designed for married couples residing in Paterson, New Jersey, who have minor and/or adult children. Here are some relevant keywords and variations associated with this topic: 1. Living trust: A legally binding document that outlines the details of asset management and distribution. 2. Paterson, New Jersey: The specific location for which this living trust is tailored. 3. Husband and wife: Refers to a married couple that wants to create a joint living trust. 4. Minor children: Dependents under the legal age, typically under 18 years old, who require specific care and provisions in the trust. 5. Adult children: The offspring of the couple who are no longer minors but may still be named as beneficiaries or trustees. 6. Trustee: A person or entity named in the trust document responsible for managing and distributing the trust assets according to the trust's specifications. 7. Asset management: The process of handling, investing, and safeguarding the assets within the trust. 8. Distribution: The act of transferring the trust assets to the intended beneficiaries as stated in the trust document. 9. Testamentary trust: A type of trust established in a will, which only comes into effect upon the death of the testator. 10. Revocable trust: A trust that can be modified or revoked by the creators during their lifetime. 11. Irrevocable trust: A trust that cannot be modified or revoked once established, providing asset protection and potential tax benefits. 12. Pour-over will: A legal document that works in conjunction with a living trust to ensure any assets not titled in the trust name are transferred to it upon the creator's death. 13. Medical directives: Legal provisions within the living trust that outline healthcare instructions and powers of attorney for the creators. 14. Financial power of attorney: Designates a trusted individual to handle financial matters and make decisions on behalf of the trust creators in the event of their incapacity. 15. Beneficiaries: Individuals or entities named in the trust document who are entitled to receive the assets or income from the trust. It is important to consult with a qualified estate planning attorney in Paterson, New Jersey, to determine the most suitable type of living trust for your specific circumstances and to ensure all legal requirements are met.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Paterson New Jersey Fideicomiso en vida para esposo y esposa con hijos menores o adultos - New Jersey Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Paterson New Jersey Fideicomiso En Vida Para Esposo Y Esposa Con Hijos Menores O Adultos?

If you are searching for a relevant form, it’s extremely hard to choose a more convenient platform than the US Legal Forms website – probably the most extensive online libraries. With this library, you can find thousands of document samples for organization and individual purposes by categories and states, or key phrases. Using our advanced search function, getting the most up-to-date Paterson New Jersey Living Trust for Husband and Wife with Minor and or Adult Children is as elementary as 1-2-3. In addition, the relevance of each record is verified by a team of professional lawyers that regularly check the templates on our platform and update them based on the newest state and county laws.

If you already know about our system and have a registered account, all you need to receive the Paterson New Jersey Living Trust for Husband and Wife with Minor and or Adult Children is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have found the sample you need. Check its explanation and utilize the Preview function (if available) to see its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to discover the appropriate file.

- Confirm your selection. Select the Buy now button. After that, select your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Use your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the file format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the obtained Paterson New Jersey Living Trust for Husband and Wife with Minor and or Adult Children.

Each template you save in your profile does not have an expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you need to have an extra duplicate for modifying or printing, you may come back and save it again whenever you want.

Take advantage of the US Legal Forms professional library to get access to the Paterson New Jersey Living Trust for Husband and Wife with Minor and or Adult Children you were seeking and thousands of other professional and state-specific samples on a single platform!