Jersey City, New Jersey Assignment to Living Trust: A Comprehensive Guide Introduction: The process of assigning assets or properties to a living trust is a crucial aspect of estate planning in Jersey City, New Jersey. By creating a living trust, individuals can ensure the smooth transfer of their wealth to their beneficiaries while avoiding the probate process. This detailed description aims to provide insights into the concept of assignment to living trust in Jersey City and shed light on various types of living trusts. What is a Living Trust? A living trust, also known as an inter vivos trust, is a legal vehicle that enables individuals to transfer their assets into a trust while maintaining control over them during their lifetime. Unlike a will, which goes through probate, a living trust allows for a seamless transfer of assets upon the granter's death, thereby avoiding potential delays and costs associated with probate. Types of Living Trusts in Jersey City, New Jersey: 1. Revocable Living Trust: — A revocable living trust is the most common type chosen by individuals in Jersey City. — It allows thgranteror to modify or terminate the trust during their lifetime. — The assets assigned to a revocable living trust can be easily accessed, sold, or transferred. 2. Irrevocable Living Trust: — Unlike a revocable living trust, an irrevocable trust cannot be altered or terminated without the consent of the beneficiaries. — Assets assigned to an irrevocable living trust are protected from estate taxes and can provide asset protection. — This type of trust is often employed for Medicaid planning or to preserve wealth for future generations. 3. Testamentary Living Trust: — A testamentary living trust is created through a will and becomes effective upon the granter's death. — It allows for more control over the distribution of assets while avoiding probate. — Assets assigned to a testamentary living trust may be subject to probate before being transferred to the trust. 4. Special Needs Trust: — A special needs trust is designed to provide for the financial needs of individuals with disabilities or special needs. — It allows them to retain eligibility for government benefits while still benefiting from the trust. — Assets assigned to a special needs trust can enhance the quality of life for the beneficiary without disqualifying them from essential aid programs. The Assignment Process in Jersey City: 1. Seek Professional Guidance: — Engage the services of a qualified estate planning attorney in Jersey City. — They will assist in evaluating your unique circumstances and determining the most suitable type of living trust. 2. Asset Identification and Evaluation: — Identify assets that you wish to transfer to the living trust, such as real estate, investments, bank accounts, and valuable personal property. — Evaluate and appraise the assets to ensure their accurate value representation within the trust. 3. Drafting and Executing Trust Documents: — Collaborate with your attorney to draft the necessary legal documents, including the trust agreement, assignment documents, and ancillary forms. — Review the documents meticulously and sign them in accordance with New Jersey laws. 4. Assignment and Funding: — Complete the assignment process by transferring ownership of the identified assets to the living trust. — This involves changing titles, ownership deeds, beneficiary designations, and re-registering accounts. Conclusion: Jersey City residents have various options when it comes to assigning assets to living trusts. By carefully considering their goals and consulting with a professional, individuals can choose the most suitable type of living trust to secure their assets and provide for their loved ones. Properly executed assignments to living trusts ensure a smooth transfer of assets, minimize costs, and potentially reduce estate taxes, giving individuals peace of mind for their legacies.

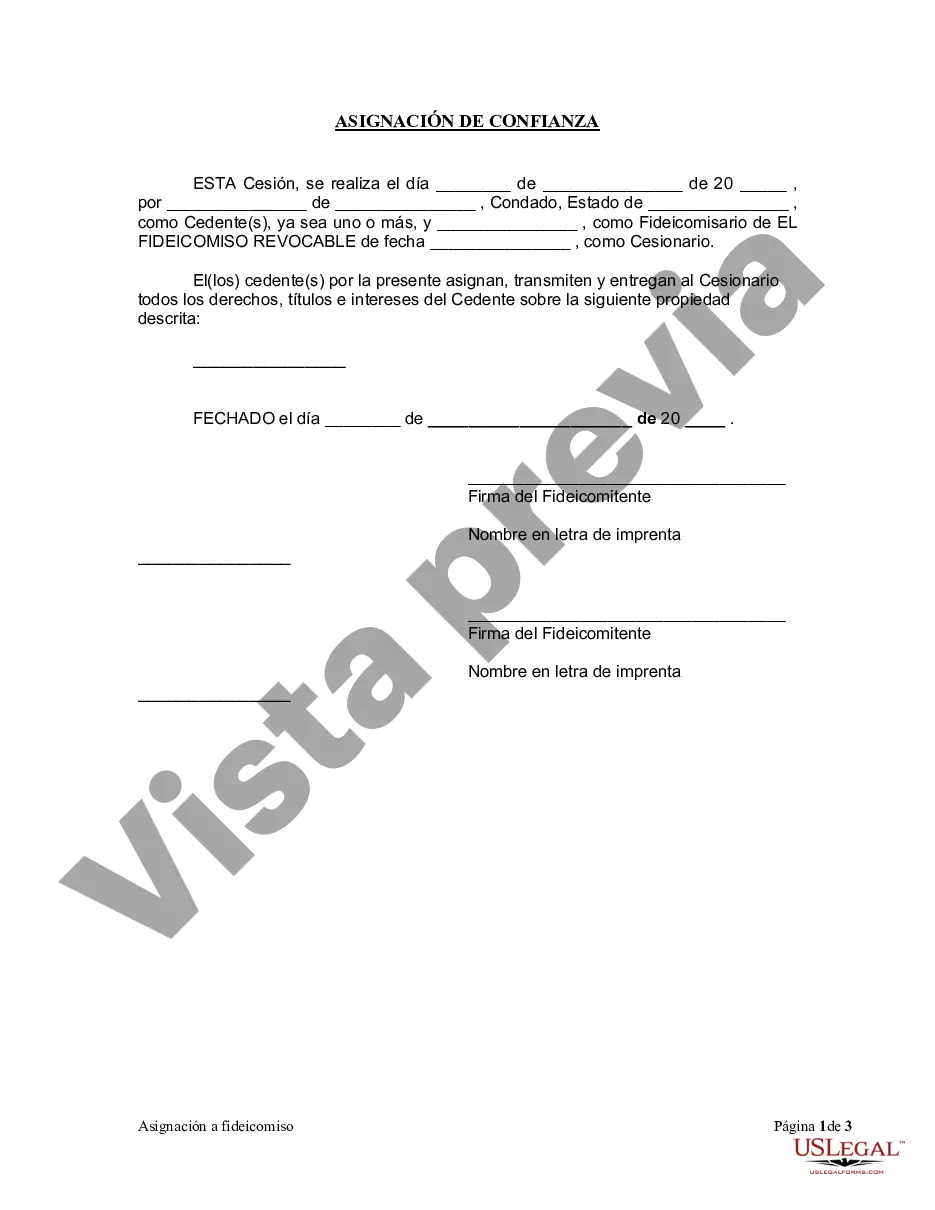

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Jersey City New Jersey Asignación a un fideicomiso en vida - New Jersey Assignment to Living Trust

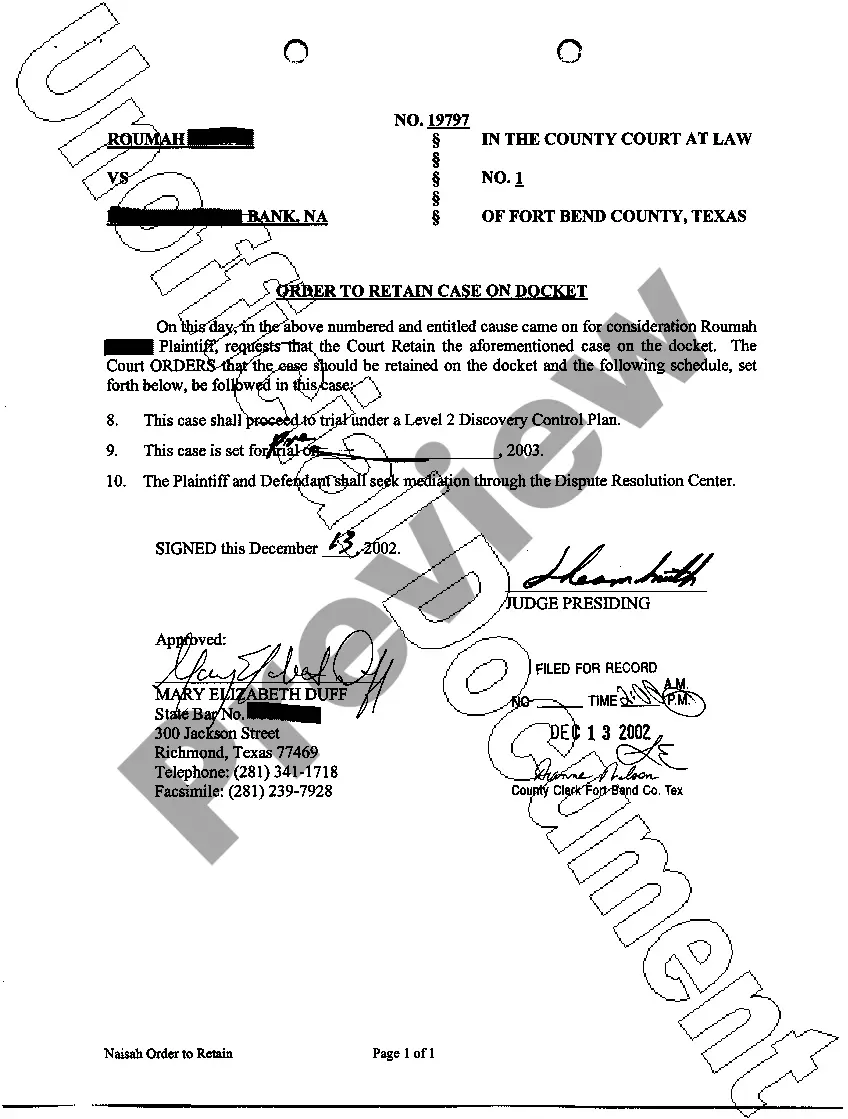

Description

How to fill out Jersey City New Jersey Asignación A Un Fideicomiso En Vida?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, usually, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Jersey City New Jersey Assignment to Living Trust or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Jersey City New Jersey Assignment to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Jersey City New Jersey Assignment to Living Trust is suitable for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!