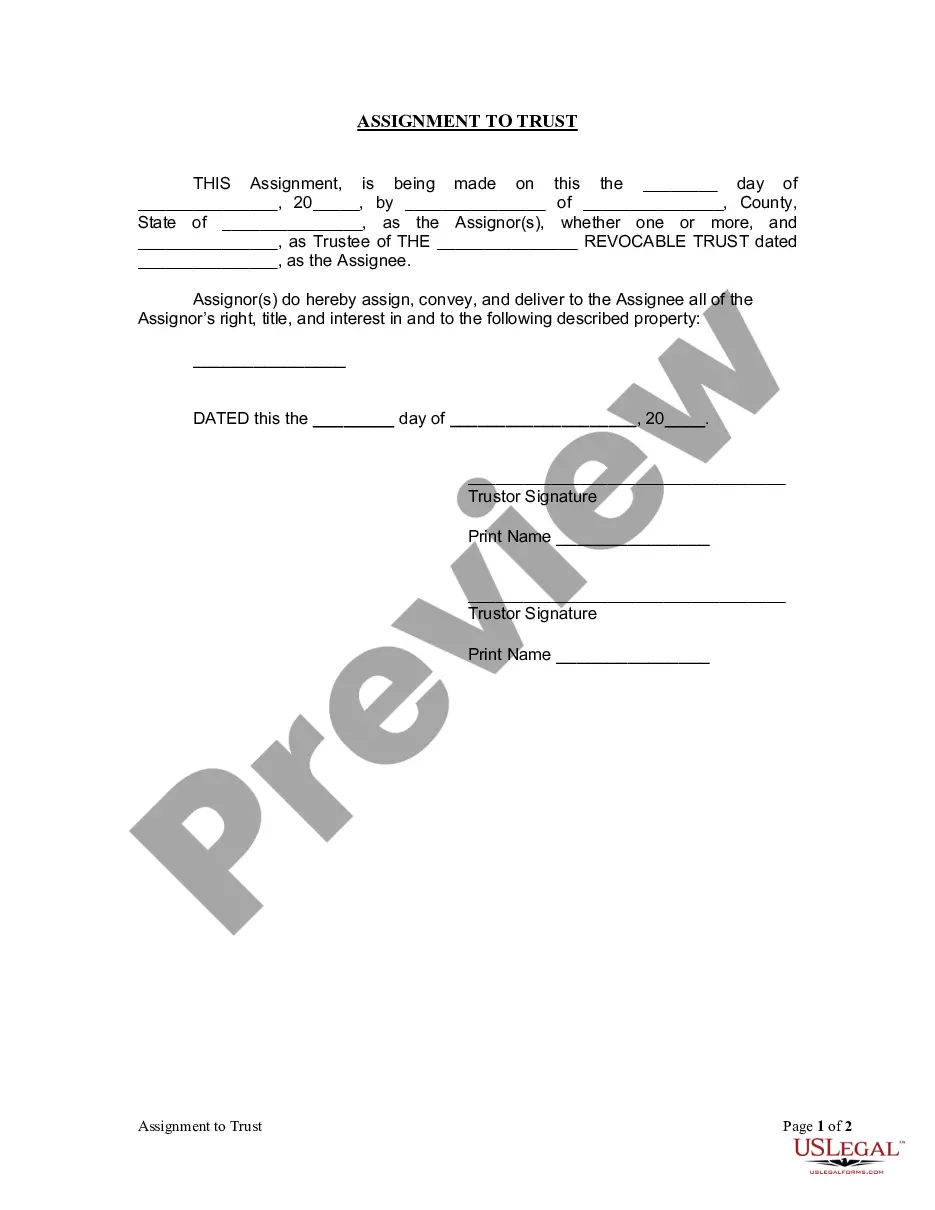

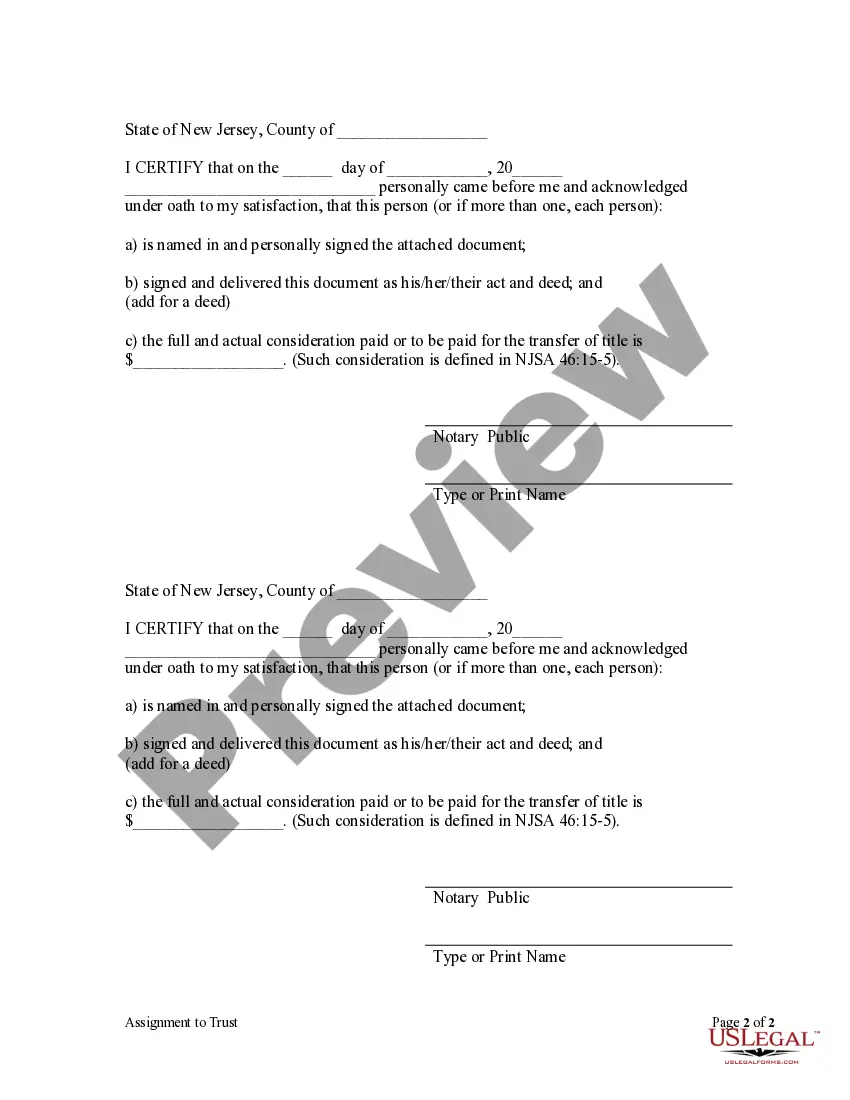

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Paterson New Jersey Assignment to Living Trust

Description

How to fill out New Jersey Assignment To Living Trust?

If you are looking for a pertinent form template, it's unattainable to discover a superior platform than the US Legal Forms website – one of the most extensive collections on the web.

With this collection, you can uncover a vast array of form samples for commercial and personal uses categorized by type and geographic areas, or keywords.

With the top-notch search functionality, obtaining the latest Paterson New Jersey Assignment to Living Trust is as straightforward as 1-2-3.

Complete the payment. Utilize your credit card or PayPal account to finalize the account creation process.

Obtain the template. Choose the format and store it on your device.

- Additionally, the accuracy of every document is validated by a team of professional lawyers who routinely assess the templates on our site and update them based on the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you require to acquire the Paterson New Jersey Assignment to Living Trust is to Log In to your user profile and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure that you have selected the form you require. Review its details and use the Preview option (if available) to examine its content. If it does not satisfy your requirements, employ the Search option at the top of the screen to locate the correct record.

- Verify your choice. Select the Buy now option. Following that, choose your preferred payment plan and supply the necessary information to create an account.

Form popularity

FAQ

Filing a living trust in New Jersey involves several key steps designed to ensure your trust is valid and effective. First, you need to create a trust document that outlines the terms and conditions of the trust. Next, assign your assets to the trust, which can include property, bank accounts, and investments. Utilizing platforms like US Legal Forms can streamline this process by providing you with easy-to-use templates and guidance tailored to the specifics of Paterson, New Jersey Assignment to Living Trust.

An assignment to a trust is a legal process where you transfer ownership of your assets into a trust. This process is crucial for creating an effective estate plan, particularly in Paterson, New Jersey. When you assign assets to your living trust, those assets are managed according to your wishes, ultimately benefiting your heirs without going through probate. This approach provides clarity and efficiency, making estate management smoother.

To put everything in a living trust, you first need to transfer ownership of your assets into the trust. This includes updating titles, deeds, and account names accordingly. You can simplify the process by utilizing US Legal Forms to create a Paterson New Jersey Assignment to Living Trust, ensuring all legal requirements are met, and that your assets are protected and managed as per your wishes.

Filling a living trust requires careful attention to detail. Start by gathering all necessary information about your assets and beneficiaries. You will need to designate what property goes into the trust and who will manage it. By using US Legal Forms, you can access templates specifically designed for a Paterson New Jersey Assignment to Living Trust, making the process straightforward and efficient.

To put your house in a trust in New Jersey, start by forming your Paterson New Jersey Assignment to Living Trust. Next, prepare a deed transferring the property to the trust. It is crucial to have the deed properly executed and recorded with the county clerk. Finally, consider consulting with a legal expert or using a platform like US Legal Forms to ensure a seamless process and to address any questions you might have.

Putting your house in a Paterson New Jersey Assignment to Living Trust can have some drawbacks. Firstly, the costs associated with setting up and maintaining the trust may be higher than you expect. Secondly, while it can help avoid probate, it may not protect your assets from creditors. Lastly, you may lose some control over the property, as the trustee will follow the terms of the trust.

Setting up a living trust in New Jersey begins with defining your goals for the trust and identifying the assets you wish to include. You must draft the trust document, outlining the terms and appointing a trustee. Once prepared, you need to fund the trust by transferring assets into it. Using uslegalforms can significantly simplify this process, especially for a Paterson New Jersey Assignment to Living Trust.

A significant downside of a living trust involves the up-front costs and complexities of setting it up. While a living trust avoids probate, it requires careful planning and management, which some may find daunting. Individuals may also encounter issues like losing the ability to control assets if they do not manage their contributions effectively. We recommend understanding these aspects thoroughly, especially in the realm of a Paterson New Jersey Assignment to Living Trust.

To transfer property to a trust in New Jersey, you typically need to execute a deed that names the trust as the new owner. This process involves completing the necessary legal documentation according to New Jersey laws. Additionally, you must record the new deed with the county clerk's office. For a smooth transition, the Paterson New Jersey Assignment to Living Trust can be facilitated using uslegalforms, which provides detailed instructions and templates.

One of the biggest mistakes parents make when establishing a trust fund is failing to properly fund it. Without transferring assets into the trust, the trust cannot serve its purpose. This oversight can lead to complications in estate distribution. To avoid this pitfall in the context of a Paterson New Jersey Assignment to Living Trust, consider consulting professionals who can guide you through the funding process.