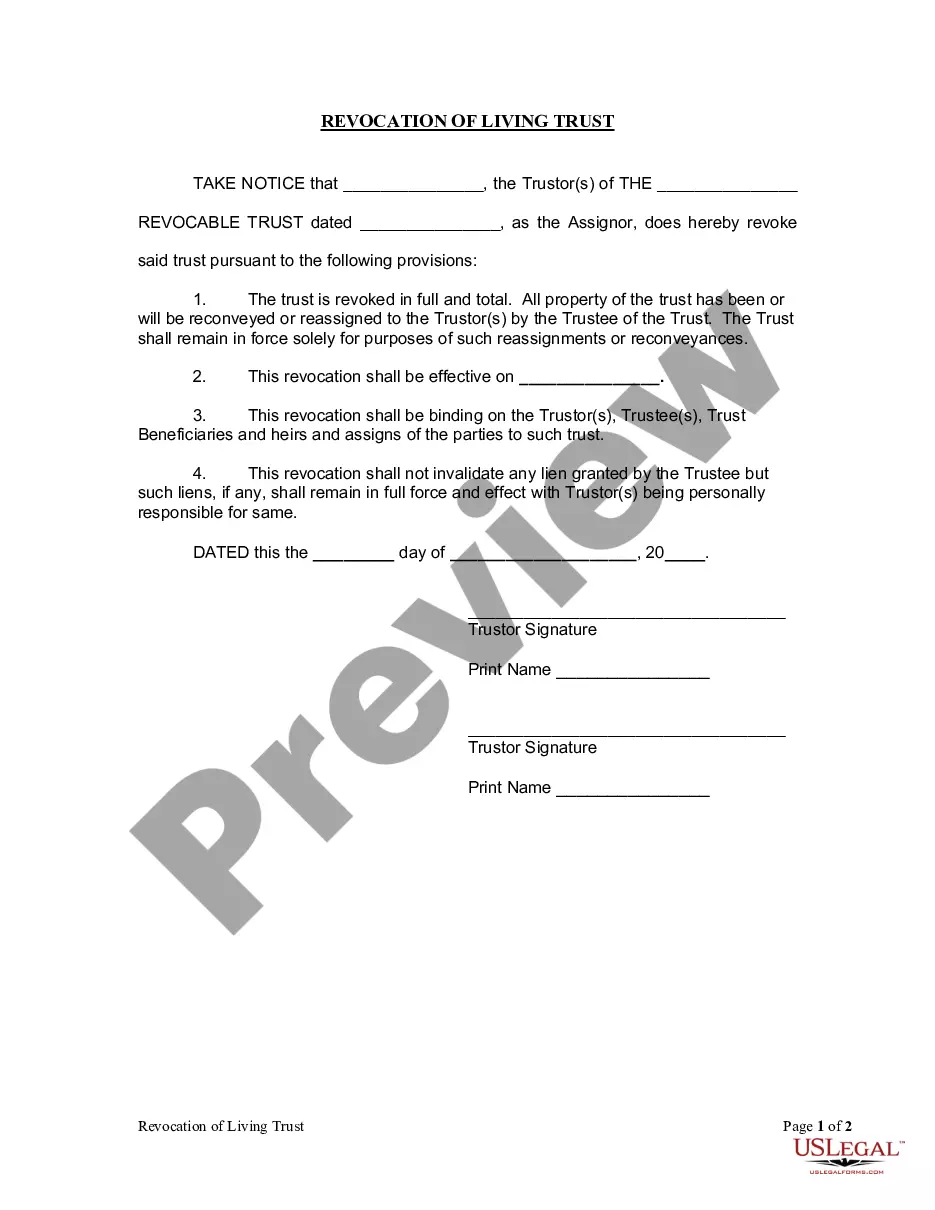

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. It declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Paterson New Jersey Revocation of Living Trust

Description

How to fill out New Jersey Revocation Of Living Trust?

Take advantage of the US Legal Forms and gain immediate access to any form template you require.

Our user-friendly platform, featuring a vast array of document templates, streamlines the process of locating and obtaining practically any document sample you will need.

You can download, fill out, and sign the Paterson New Jersey Revocation of Living Trust within a few minutes instead of spending hours browsing online for an appropriate template.

Utilizing our catalog is an excellent way to enhance the security of your document submissions. Our qualified attorneys consistently evaluate all documents to ensure that the forms are applicable to a specific area and adhere to the latest laws and regulations.

If you have not yet created an account, follow these steps.

- How can you obtain the Paterson New Jersey Revocation of Living Trust.

- If you are a subscriber, simply Log In to your account. The Download button will be visible on all the samples you view.

- Moreover, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

Revoking a trust beneficiary typically requires you to amend the trust document explicitly. This process may involve a written amendment or a completely new trust document. If you're navigating this in Paterson, New Jersey, seeking help from resources focused on the revocation of living trusts can ensure that your wishes are executed correctly.

Revoking a trust can be straightforward if you follow the proper legal steps. Generally, it involves preparing documentation that aligns with state laws. In Paterson, New Jersey, utilizing the services of platforms that specialize in revocation of living trusts can streamline the process and minimize complications.

A trust revocation declaration usually includes a statement indicating the intent to revoke the trust, details of the trust being revoked, and the effective date of the revocation. Sample formats are widely available online. For those in Paterson, New Jersey, using an online platform can simplify the process of drafting a proper revocation declaration.

To remove a beneficiary from a family trust, you typically need to amend the trust document. This involves drafting a formal amendment that states the removal clearly and is signed by the grantor. If you are unsure how to proceed, consulting with a legal expert in Paterson, New Jersey, on the revocation of a living trust can provide clarity.

One common mistake parents make is failing to communicate their intentions with their children. Without clear communication, misunderstandings can arise regarding the purpose and benefits of the trust. Engaging in open discussions and utilizing resources like Paterson New Jersey's revocation of living trust can help ensure everyone understands the setup.

Yes, a beneficiary of a trust can be removed under specific circumstances. The process often requires amendments to the trust document and may necessitate legal guidance. In Paterson, New Jersey, the revocation of a living trust can help clarify or alter beneficiary designations, ensuring your wishes are honored.

To amend a revocable trust in New Jersey, you must create a written amendment that clearly states the changes you wish to make. It is essential to sign and date this amendment, as the trust document itself may specify additional requirements. You can also seek assistance from platforms like US Legal Forms to ensure that your amendment complies with local laws in Paterson, New Jersey, regarding revocation of living trusts. This way, you can ensure that your trust accurately reflects your wishes.

One major disadvantage of revocable living trusts is the lack of asset protection from creditors, as they are still considered part of your estate. Additionally, assets transferred into a trust may not qualify for certain tax benefits. People in Paterson, New Jersey, should also note that establishing a revocation of living trust involves initial costs and continued management responsibilities. Weighing these factors can help you make an informed choice.

You can revoke a revocable trust by creating a written document that states your intention to revoke it. This document must be signed and dated to ensure its validity. In Paterson, New Jersey, it’s important to notify your trustee and any beneficiaries of the revocation of living trust to avoid any confusion. Completing this process properly can help you transition to your new estate planning decisions.

Yes, you can modify a revocable trust at any time while you are alive and competent. This flexibility allows you to make changes in response to your financial situation or family dynamics. In Paterson, New Jersey, the revocation of living trust can involve updating the terms or even the trustee. Just remember to follow proper legal procedures to ensure the changes are valid.