Jersey City New Jersey Record Request Form Tax Court: A Comprehensive Guide Introduction: The Jersey City New Jersey Record Request Form Tax Court is a crucial document that enables individuals to request records related to tax court cases in Jersey City, New Jersey. Whether you are an individual seeking information about your own tax case or a legal professional representing a client, understanding the various types of record request forms available and knowing how to navigate the tax court system in Jersey City is essential. In this article, we will delve into the details of the Jersey City New Jersey Record Request Form Tax Court, its different types, and provide relevant information about the process. 1. Overview of the Jersey City Tax Court: The Jersey City Tax Court is a judicial body that handles disputes concerning local tax issues. It deals with cases related to property tax assessments, tax exemptions, and other tax-related matters. When individuals or entities wish to access specific records related to tax court cases, they must utilize the Jersey City New Jersey Record Request Form Tax Court. 2. Types of Jersey City New Jersey Record Request Form Tax Court: a. Individual Record Request Form: This type of record request form is designed for individuals who are seeking records pertaining to their own tax court cases. It requires specific personal details, such as name, address, contact information, and case details, to ensure accurate retrieval of the requested records. b. Legal Representative Record Request Form: Attorneys or legal representatives handling tax court cases on behalf of their clients can use this form. It allows authorized professionals to access the records necessary for case preparation and client representation. The form typically requires both the client's and the attorney's information, along with the case details. c. Public Record Request Form: In certain cases, individuals or organizations may need access to tax court records that are considered public information. This form allows for the retrieval of publicly available records, maintaining transparency in the judicial process. Requesting parties typically need to provide their contact information, reason for the request, and specific details of the records they seek. 3. Filling Out the Jersey City New Jersey Record Request Form Tax Court: To maximize the chances of a successful record request, it is vital to accurately complete the form. Key elements to include are: — Requester's full name, address, phone number, and email. — Type of request form (individual, legal representative, or public) being submitted. — Case-specific information like docket number, tax year, property address, or any other relevant details to ensure precise record retrieval. — Reason for the record request, outlining the purpose behind needing the records to facilitate the evaluation process. 4. Submitting the Request Form: Once the request form is filled out correctly, it can be submitted to the Jersey City Tax Court. The preferred method of submission, such as physical mail, email, or an online portal, may vary depending on the court's guidelines. Paying attention to submission instructions and ensuring all required supporting documentation is included, if applicable, will streamline the process. Conclusion: The Jersey City New Jersey Record Request Form Tax Court is an essential tool for accessing records related to tax court cases in Jersey City, New Jersey. By understanding the different types of request forms available and accurately completing the necessary fields, individuals and legal professionals can gather the information needed for case preparation and representation. It is essential to adhere to the court's submission guidelines to ensure a smooth and successful record request process.

Jersey City New Jersey Record Request Form Tax Court

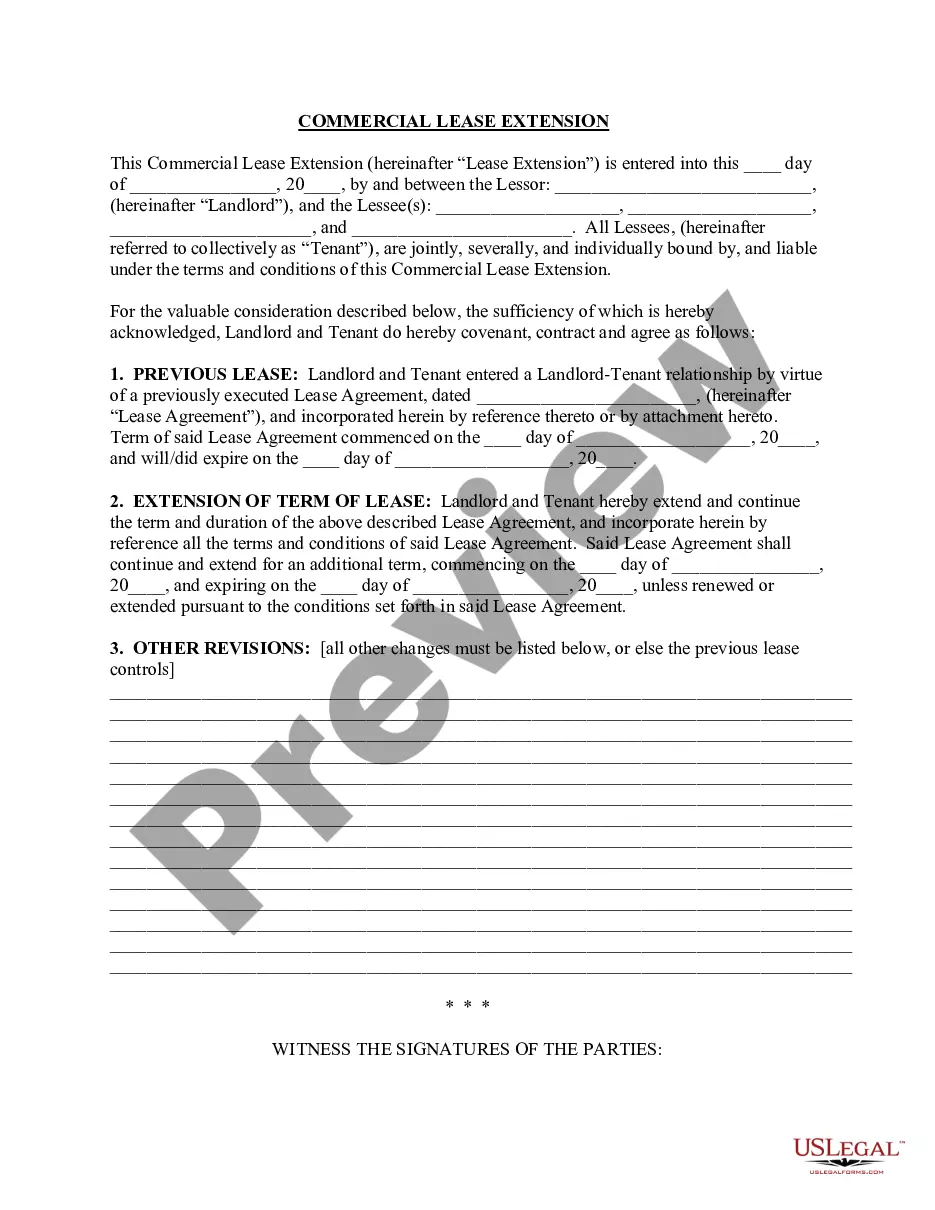

Description

How to fill out Jersey City New Jersey Record Request Form Tax Court?

Are you looking for a trustworthy and inexpensive legal forms provider to buy the Jersey City New Jersey Record Request Form Tax Court? US Legal Forms is your go-to option.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of separate state and county.

To download the document, you need to log in account, locate the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Jersey City New Jersey Record Request Form Tax Court conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the document is intended for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Jersey City New Jersey Record Request Form Tax Court in any provided file format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal paperwork online for good.